More Good News on State Taxes

States that have a low flat rate or no state income tax are seeing significant revenue growth.

Taxing Wealth Is Taxing Work

President Biden's effort to punish the wealthy with higher taxes reveals, yet again, that he doesn't understand either wealth or tax rates.

A Better Way to Pay for Roads

It’s time to start talking about phasing out fuel taxes and phasing in usage taxes. It simply makes sense that those who put the most stress on our transportation infrastructure and who profit from the roads have a proportional share in paying for them.

Constitutions Matter for Tax Rates

One benefit of a flat tax is that legislators can't stick it to high-income individuals and corporations without sticking it to everyone.

Does Higher Pay to Legislators Lead to Better Governance?

States that pay their legislators the most get, in return, higher taxes, more regulations and terrible governance.

'I Want High-Income Earners to Stay'

New York City Mayor Eric Adams learns a lesson: Increasing taxes on the rich is the best way to ensure NYC loses revenue.

Tighten the Earned Income Tax Credit

The Earned Income Tax Credit was created to encourage work. But its "refundable tax credit" has turned it into a massive welfare program that punishes those who work and earn too much.

The Bad News from Taxachusetts

Massachusetts demonstrated its opposition to high taxes in 1773. But by ending its flat income tax rate, the Bay State has abandoned its heritage.

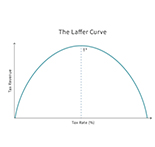

California's Laffer Curve

California proves the Laffer Curve works by demonstrating that the Golden State's high tax policies don't work.

Tax Competition Works

Tax competition works, which is why high-tax states don't like it.

.jpg)