Introduction

Today’s modern, technologically sophisticated economy generates a huge amount of information. This is a mixed blessing for many Americans. They enjoy the prosperity made possible by the more efficient use of resources, and this process is greatly facilitated by effective use of information. They also benefit from access to better and more affordable financial services, all of which depends on companies having the data to effectively measure risk.

Yet at the same time Americans are uneasy that much of their personal financial data is accessible to other people. To a large degree, this concern has translated into restrictions on the private sector. Recent legislation, for instance, requires financial services companies to aggressively disclose their policies on sharing consumer data.

But focusing on private sector access to information is misplaced. Yes, companies should disclose their policies and be punished for fraudulent use of consumer information, but this approach only looks at half of the equation. This incomplete analysis is a mistake because the biggest threat to financial privacy is the federal government.

More specifically, the personal income tax requires individuals to either disclose or make available upon demand almost every shred of their personal financial data to the Internal Revenue Service (IRS). Individuals have to reveal their personal savings, their financial assets, their personal wealth, their profits and losses, and other intimate details of their existence.

Unlike disclosures to the private sector, the provision of information to the government is not a voluntary activity with benefits to both parties. In theory, a consumer freely provides personal data to a credit card company and voluntarily authorizes that company to obtain other personal information in exchange for more affordable credit. Divulging private data to the government, by contrast, is a compulsory activity that will result in the loss of income and/or assets.

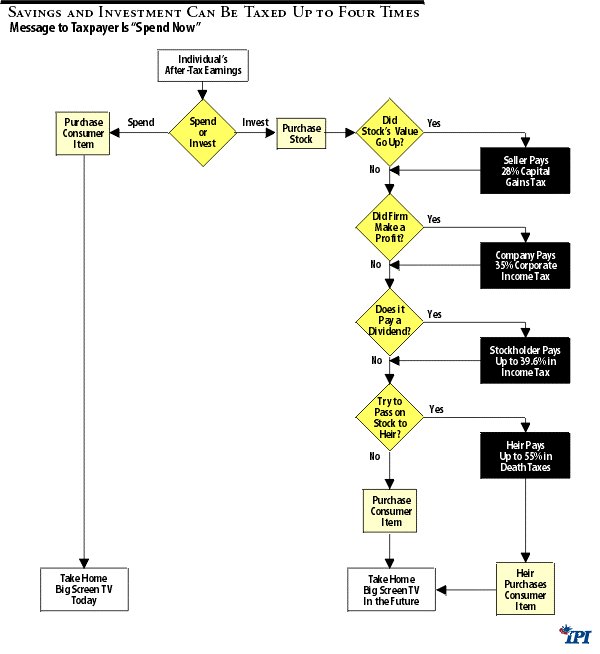

This sweeping assault on privacy might be justifiable if it represented appropriate and necessary enforcement of good tax policy. This is not the case. The loss of financial privacy is caused by the fact that the Internal Revenue Code taxes some forms of income more than one time. Indeed, the combination of the capital gains tax, corporate income tax, personal income tax, and death tax means that some income is taxed as many as four times.

In practical terms, this requires the tax collector to know everything—or at least have the unlimited ability to learn everything—about a taxpayer’s finances. Double-taxing interest income means government must know the amount a taxpayer has saved. Double-taxing capital gains means government must know the assets a taxpayer sells. Double-taxing dividends means government must know the amount of stock a taxpayer owns. Double-taxing at death means government must know everything about a taxpayer’s personal finances.

| Principles of good tax: | |

| Fairness | Tax income at one low rate. This is the principle of treating all individuals equally. One low tax rate ensures that people will not be discriminated against for contributing more to economic growth |

| Neutrality | Tax income only one time. This is the principle of treating all income equally. Taxing income only one time ensures that people will not be discriminated against for saving and investing. |

| Simplicity | Tax income in an uncomplicated fashion. This is the principle of visibility. A simple tax code makes it harder for special interests to sneak special preferences and penalties into the law. |

Yet none of this intrusion would be necessary if government taxed income only one time. The capital gains tax would disappear, as would the death tax. Under almost all tax reform proposals, individual taxpayers would have no need to report dividend or interest income, and overseas income also would be spared.

Economists and other public finance experts support tax reform because of an understandable desire to eliminate the double taxation of savings and investment.1 They argue correctly that the economy will grow faster if there is no longer a bias against capital formation. This paper will examine this issue from a different perspective, however, demonstrating why good tax policy also is a boon for privacy.

Yet better privacy should not be seen just as an unintended fringe benefit of tax reform. The right to keep one’s affairs private is an essential feature of a free and just society. During America’s early years, for instance, tax collectors were not even allowed to enter homes.2 They had to assess a taxpayer’s ability to pay tax by counting windows. In other words, the reduction of government prying is sufficient reason to scrap the Internal Revenue Code.

The Internal Revenue Code vs. Privacy

If a bunch of snoops sat down to design an intrusive tax system, they would have a hard time coming up with something worse than the Internal Revenue Code. In every possible way, today’s tax system requires taxpayers to make unlimited disclosures of information to government. But while it may seem as if the tax code was created to undermine privacy, this is not the case. In almost every instance, the forced disclosure of intimate financial information is the inadvertent—yet inevitable—result of bad tax policy.

| What does the government have an unlimited right to know under the current system? | |||||||||

| Type of Income or Asset | Wages | Interest | Dividends | Sales | Stocks | Bonds | Capital Gains | Assets at Death | Foreign Economic Activity |

|

Current System

|

Yes

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

More specifically, Americans are forced to tell government officials about their private finances largely because the tax code has a misguided definition of income. This sloppy approach results in some income being taxed two or more times, some income being over-stated, and some assets being taxed. That is the bad news. The good news is that tax reform is designed to solve these problems. And since the loss of privacy is a result of bad tax policy, the restoration of privacy is a coincidental consequence of implementing good tax policy.

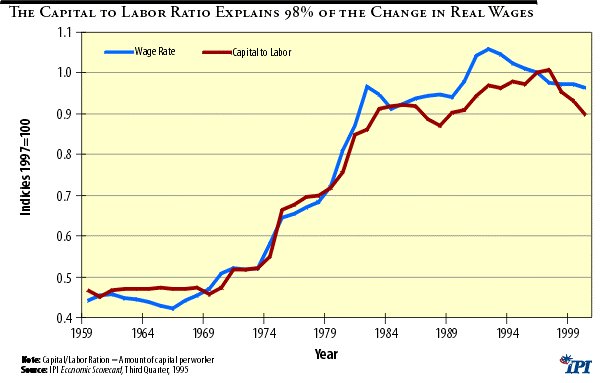

Double taxation of income that is saved and invested is pervasive in the current system. Indeed, a single dollar of income can be subject to as many as four layers of taxation. Economists routinely condemn this bias against capital formation since it has a powerfully negative impact on growth rates, productivity, and wages. Ironically, opponents of tax reform assert that double taxation is needed to ensure that the “rich” pay more taxes. As the accompanying chart illustrates, however, capital formation is closely tied to workers’ wages. Therefore, they are the ones who bear the cost of class-warfare tax policy.

A neutral, fair tax system would not impose a higher burden on income that is saved and invested than on income that is consumed. Heavy taxation of savings reduces savings. But it also undermines privacy. The current tax code is littered with provisions that force taxpayers to divulge intimate details of their personal finances. There are three types of double taxation, and two of these—taxing income more than once and taxing assets—cause a loss of privacy.

Taxing Income More than Once

“ Double taxation” is a layman’s term to describe features of the tax code that create a bias against income that is saved and invested compared with income that is consumed. As shown below, this bias occurs when income is taxed more than one time between the time it is earned and when it is consumed. The following examples also demonstrate, however, why double taxation has adverse implications for privacy:

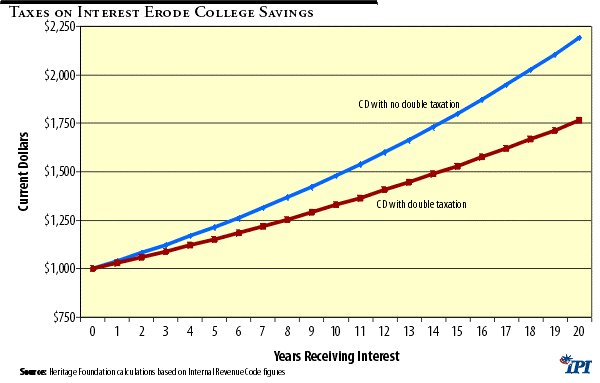

- Tax on interest: An obvious bias in the tax code is the double tax on interest. A taxpayer who spends his after-tax income incurs little or no federal tax liability. The taxpayer who saves and invests the money is not so fortunate. Even though the income was taxed when first earned, any interest generated by that income is subject to an additional tax. The tax is bad for privacy because it means that government must know, or have the ability to demand, all details about a taxpayer’s bank accounts and bond holdings.

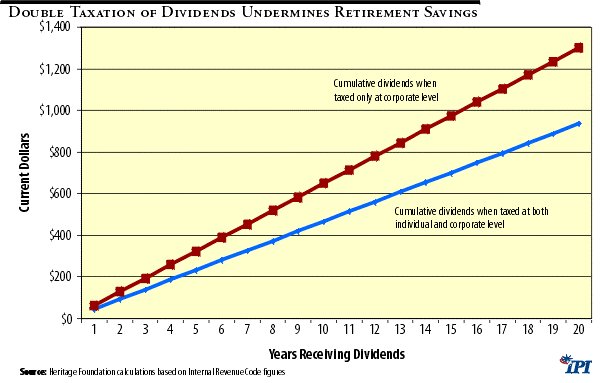

- Dividend tax: Another unambiguous form of double taxation is the treatment of corporate income. When a corporation earns a profit, these earnings are subject to the corporate income tax. But when the remaining after-tax profit is then distributed as dividends to the corporation’s owners (shareholders), the income is subject to another layer of tax. The tax is bad for privacy because it means that government must know, or have the ability to demand, all details about an individual’s financial holdings that generate dividend income.

- Tax on foreign income: “Territorial taxation,” according to which governments only tax the income earned inside their borders, is a principle of good tax policy. It is simple to enforce and it respects sovereignty since governments are not trying to tax activity that takes place in other nations. The Internal Revenue Code, however, imposes tax on the income that individuals and businesses earn abroad. But since that income is taxed already in the country where it is earned, this means that foreign income of U.S. residents is subject to two layers of tax. The tax code attempts to address this inequity by providing a credit for taxes paid to other governments, but this is a grossly inadequate solution. The tax is bad for privacy because it means that government must know, or have the ability to demand, all details about the foreign economic activities of taxpayers.

Taxing Assets and Net Changes in Assets

Another form of double taxation occurs when a taxpayer earns income, pays tax on that income, purchases an asset with the remaining after-tax income, but is then forced to pay an additional layer on those assets. Besides having an undesirable impact on capital formation, the following provisions of the tax code require substantial loss of privacy:

- Death tax: The death tax, technically know as the “estate tax,” requires certain taxpayers to pay a substantial tax on their assets upon death. In theory, the tax is supposed to apply only to “rich” people, but it affects a lot of middle-class homeowners and a significant share of farmers and small-business owners. The tax, which can seize more than 50 percent of a taxpayer’s wealth, imposes a heavy burden on assets that were purchased with after-tax dollars. The tax is bad for privacy because the taxpayer (actually expensive lawyers and/or accountants hired by the taxpayer’s family) must make a complete report on all assets owned at the time of death.

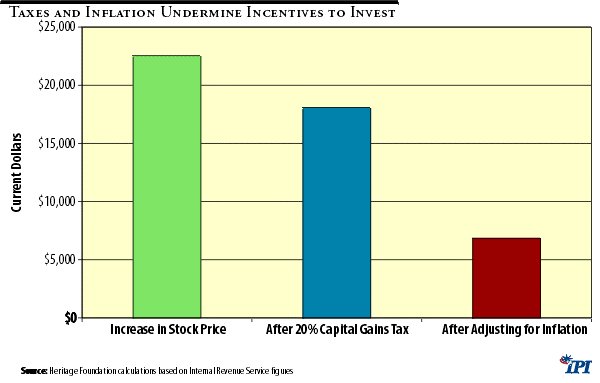

- Capital gains tax: The capital gains tax is a tax on the transfer of assets, with the tax being imposed on the difference between the asset’s sale price and purchase price. This tax occurs if the asset was purchased with after-tax dollars. This tax occurs even though that increase may reflect a future stream of income that will be taxed. This tax even occurs on “gains” that represent nothing more than years of inflation. The capital gains tax is bad tax policy and it should be repealed. But the capital gains tax also is misguided for other reasons. The tax is bad for privacy because it permits the government to know when an asset is purchased, how much it is worth when purchased, how long it is owned, when it is sold, and how much it is worth when sold.

Making Taxpayers Over-state their Income

There are other provisions of the tax code that are a form of double taxation, but it might be more accurate to state that these are features of the Internal Revenue Code that force taxpayers to over-state their income. Like more traditional forms of double taxation, these provisions are economically misguided. And they certainly impose tremendous compliance costs on taxpayers. Though not on the same level as the provisions listed above, these features of the tax system also have some implications for privacy:

- Alternative minimum tax: The alternative minimum tax (AMT) requires a growing number of taxpayers to calculate their tax liability a second time, according to a different set of rules, and then pay the government the larger of the two amounts. The original theory behind the law was that some high-income taxpayers were making excessive use of deductions. To be sure, some deductions may not be defensible, but this is an issue that should be addressed as part of fundamental reform. The current AMT is a horribly complicated system that imposes high compliance costs on both individual and business taxpayers. This tax is bad for privacy because it forces taxpayers, both individual and business, to divulge more of their financial affairs to the government.

- Depreciation: When a business spends money to build new plants and buy new equipment, those expenditures are a cost of doing business. In calculating its taxable income, a business should be able to subtract those costs (like the costs of employee wages, office supplies, and raw materials) from its total revenue. Unfortunately, the tax code allows only a share of investment costs to be deducted in the year they are incurred. The bulk of the costs cannot be deducted until future years (a process known as depreciation). This significantly increases the tax burden on investment and creates immense paperwork burdens. This tax is bad for privacy because it forces taxpayers to provide the IRS extensive details on the type of investments and the timing of those investments.

Absolute privacy is impossible in a world with taxes. Even the simplest flat tax or sales tax will require people to report some data. The current tax system, however, goes overboard in the other direction. Many features of the Internal Revenue Code, especially those dealing with the double taxation of income that is saved and invested, seemingly are designed to require and/or permit government to know wide-ranging details about a taxpayer’s finances.

To be fair, though, lawmakers have never sought to undermine privacy. All of the provisions discussed above are the result of other motives—especially the desire to impose heavier taxes on the so-called rich. But almost all tax reform plans explicitly reject this approach. And because these tax reform plans are based on the premise that income should not be taxed more than one time, improvements in privacy can be a dramatic side-effect of replacing the Internal Revenue Code.

Defining Income Properly so Savings are not Double-Taxed

Why do economists and other policy makers place so much importance on savings? In large part, this is because investment is widely viewed as a leading determinant of economic growth and it is rather difficult to have investment if there is no savings. While this is a somewhat simple description, every single economic theory—even Marxism—recognizes that capital formation is the key to long-term growth and rising wages.

Consider, for example, why American farmers and factory workers earn more income than their counterparts in Bangladesh. This is not because Americans are smarter or work longer hours. Americans earn more because they produce more, and they produce more because they have modern tools, equipment, and technology—what economists call capital.3 Yet tools, equipment, and technology do not materialize out of thin air. They exist because people have been willing to save and invest.

But many people, including a lot of politicians, do not understand the cause of savings and the impact of taxes on savings. It is not even clear that they can define “savings.”

“Savings” and “investment” are two words that describe the same thing—the decision to postpone consumption today in exchange for the ability to consume in the future. In other words, savings and investment are different sides of the same coin. The only reason that they are sometimes viewed as different is because individuals oftentimes choose to deposit savings in financial intermediaries such as banks, mutual funds, and pension funds. The intermediary, of course, then chooses how to invest the money. But choosing an intermediary does not alter the fact that income that is saved is also income that is invested.

But why do people save? People, after all, generally prefer immediate consumption to future consumption. Part of the answer is that people are cautious and save money for unexpected expenses. Another reason is that income and expenditures do not occur simultaneously, so people deposit income at financial institutions and then draw on those balances.

But these factors account for only a modest amount of savings. The bulk of saving occurs because people are paid to save. More specifically, people save because they will earn a return—or because other people are willing to pay them a return in exchange for the use of their money.4 In other words, people are willing to postpone consumption today because of the expectation that they will be able to consume even more tomorrow.

This is where taxes enter the picture, particularly double taxation. Individuals are willing to save and invest because the return that they earn allows them to increase future consumption. Yet double taxation distorts this decision because double taxation reduces the return earned from income that is saved and invested. This means, of course, that people will have less incentive to save and invest. The accompanying chart illustrates how this process penalizes capital formation.

Taxes are a cost imposed on certain activities, and if the tax is imposed in a discriminatory manner, it will alter behavior. Double taxation increases the cost of savings and investment. In the jargon of economists, this means that there is a bias against future consumption and a bias in favor of current consumption. And because this bias results in less saving, less investment, and less capital formation, double taxation reduces economic growth.

| The Internal Revenue Code vs. Savings and Investment |

| To understand the practical impact of double taxation, consider a taxpayer who has $100 of disposable after-tax income. That taxpayer has a choice: either to spend the income immediately or to defer consumption by investing it. Consuming the money immediately yields $100 of benefit immediately, but investing it would yield a return that could allow the taxpayer to consume, say, $112 a year from now. The decision to invest obviously varies according to individual preferences about the value of consumption today compared with consumption in the future, but let us assume a taxpayer would be willing to give up $100 of consumption today in exchange for $110 of consumption one year later. In this case, of course, the taxpayer chooses to invest. In addition to making the taxpayer better off in the future, this decision also has a desirable impact on the economy by increasing capital. Today’s system of multiple taxation, however, undermines capital formation. Thanks to the combination of the corporate income tax and personal income tax on dividends, the hypothetical taxpayer in the above example may wind up sacrificing $100 of consumption today to gain only $105 in after-tax consumption one year from now. Fewer individuals under this scenario would choose to invest, opting instead for immediate consumption and thereby depriving the economy of their capital. In addition, our mistreated taxpayer might have to pay capital gains and death taxes. Little wonder that so many people simply choose to spend their money. |

This bias against savings and investment should be eliminated. It should be eliminated to improve the economy’s performance. It should be eliminated to boost savings and investment. And it should be eliminated to boost worker productivity and wages. But is also should be eliminated because privacy is a characteristic of a society that respects the individual. To be sure, privacy is not an absolute right, but government policy should not invade privacy without a compelling interest.5 Needless to say, the enforcement of bad tax law does not satisfy that criterion.

The Tax Reform Solution

If the tax code undermines privacy by double-taxing income, the obvious response is to eliminate those provisions of the tax code that cause the problem. This means changing the tax law. Lawmakers can make these changes because they want to eliminate double taxation, or they can make these changes to promote privacy. But they cannot escape the fact that the flaws in the system—particularly the ones caused by the bias against savings and investment—must be repealed.

Fundamental tax reform offers a way of bypassing special interests. The entire purpose and approach of tax reform—scrapping the Internal Revenue Code and replacing it with a new, simple system—is based on the notion that the tax system should reflect core values and principles. One of the reasons tax reform has so much support among voters is precisely because it is seen as a way of slicing through the Gordian knot of deal-making and back-scratching that created the current system.

| Tax Reform: All at Once or One Step at a Time? |

| Advocates of tax reform must consider an important strategic issue. Should they attempt to solve the problems in the tax code on an incremental basis or should they support a comprehensive reform that will fix all the problems in one fell swoop? This question does not necessarily have a right or wrong answer. The smart strategy probably changes over time depending on the political environment. Nonetheless, there is considerable reason to think that a comprehensive approach is the correct approach today. Fundamental tax reform is a huge undertaking, to be sure, but at least it offers the promise of completely solving almost all of the problems caused by the current tax code. Incremental reform, by contrast, seems to be a perpetual game of one-step-forward, two-steps-back. Lawmakers occasionally will enact a pro-growth tax cut, but these victories are offset by misguided policies. Indeed, this is the approach that has given us the current Internal Revenue Code, a 10,000 page, 7-million word testimony to the power of special interest arm-twisting that relegates values like growth and privacy to the back burner. |

Perhaps most important, at least for purposes of promoting privacy, is the fact that neutrality is one of the three main principles of fundamental tax reform. As discussed earlier, this is the notion that the tax code should not discriminate against income that is saved and invested. This means that all the categories of double taxation in the current tax system would be eliminated. And since the loss of privacy is a consequence of double taxation, a restoration of privacy can be a positive fringe benefit of good tax policy.

Eliminating the bias against income that is saved and invested is a core feature of every major tax reform plan. With just one exception, this means that fundamental tax reform is the solution to an invasive tax code that gives government the right to know every detail about a taxpayer’s financial existence.

The Flat Tax

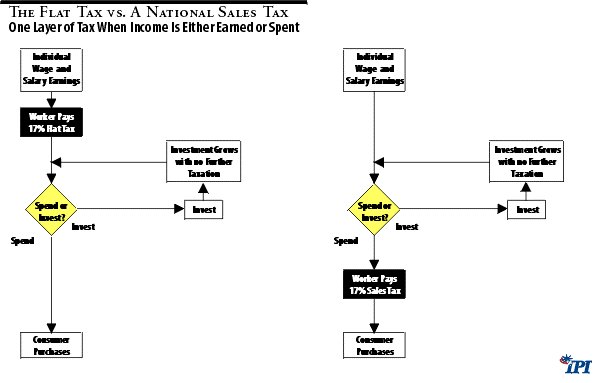

Perhaps the most famous of tax reform plans, the flat tax would scrap the hundreds of forms required by the current system and replace them with two simple postcards.6 Households would file one postcard, and this form would be used to collect taxes on labor income—the wages and salaries people earn. The other postcard would be filed by businesses, and this form would be used to collect taxes on capital income—the interest, dividends and business income people earn.

Like other major tax reform plans, the flat tax would tax income at one low rate. It would not subject any income to double taxation. And it is designed to radically simplify the tax collection process and therefore allow a sweeping reduction of the IRS. It also would dramatically improve the international competitiveness of businesses and entrepreneurs by taxing only income earned in the United States.

In a flat tax system, households directly pay tax only on their wages, salaries, and pensions. As a result, the tax collection agency has no need to track how they use the money that is left after paying that single layer of tax. People can save their take-home pay. They can use it for a vacation. They can buy food, pay the mortgagee, give it to charity, or make investments. There are no tax consequences to these decisions, so government has no interest in knowing how the money is spent.

For all intents and purposes, the flat tax is like an unlimited, back-ended (or Roth) IRA. Unlike conventional IRAs, taxpayers do not deduct the money they put in a Roth IRA. All deposits are after-tax, but all annual earnings and subsequent withdrawals are spared a second layer of tax. Under current rules, of course, Roth IRAs have so many restrictions that taxpayers do not receive any privacy benefit. But if the Roth IRA is made universal, with no age limits, income limits, or deposit limits, the government would have no need to track the money in the accounts and/or how it is invested.

| What does the government have an unlimited right to know under a flat tax? | |||||||||

| Type of Income or Asset | Wages | Interest | Dividends | Sales | Stocks | Bonds | Capital Gains | Assets at Death | Foreign Economic Activity |

|

Flat Tax

|

Yes

|

No

|

No

|

No

|

No

|

No

|

No

|

No

|

No

|

The flat tax, with its universal, back-ended IRA, has enormous implications for privacy. Consider the following types of income and assets and the degree to which these must be disclosed in a flat-tax world:

Wages: The flat tax does allow the government to know peoples’ annual wage and salary income. Like the current system, employers would report that income to the government. Taxpayers would receive <->

W-2 forms and use those forms to complete the simple postcard-sized tax form.

Interest: The government would have no need to track individual savings under a flat tax. Interest income is taxed under a flat tax system, but it is withheld and paid by the financial institution (technically, interest payments are non-deductible, which is the equivalent of having the firm prepay the tax— much as employers prepay most personal income tax via withholding). Individuals therefore would not have to report interest earnings.

Dividends: The government would have no need to track individual stock holdings under a flat tax. Corporate profits are taxed under the flat tax (the corporation is prepaying taxes on behalf of shareholders, much as financial institutions would prepay taxes on interest), but there is not a second layer of tax at the individual level.

Sales: The government would have no need to track sales under a flat tax.

Capital Gains: The government would have no need to track the sale of assets under a flat tax. Any purchases of property, either tangible or financial, would be made with after-tax dollars.

Assets at Death: The government would have no need to track the disposition of assets at death under a flat tax. As long as assets are purchased with after-tax dollars, any tax on the distribution of those assets, either before death or after death, would be double taxation.

Stocks: Since there is no individual tax on dividends, capital gains, or assets at death under a flat tax, the government would have no tax-related reason for knowing the stock holdings of individuals.

Bonds: Since there is no individual tax on interest, capital gains, or assets at death under a flat tax, the government would have no tax-related reason for knowing the bond holdings of individuals.

Foreign Economic Activity: The government does not seek to tax income earned outside the United States under a flat tax, so individuals would not need to divulge foreign income if this reform is enacted.

National Sales Tax

Some have proposed that the income tax be completely abolished and that the federal government instead rely on some form of national sales tax. There are three possible options for this approach: The National Retail Sales Tax, the Fair Tax, and the Value Added Tax (VAT).7 While not identical, these tax reform plans share many common features. They all would tax the value of sales to consumers, and they all would avoid “ cascading”—that is, the final tax on consumers would be the same regardless of how many times the product was sold as it moved from raw material to manufacturer to wholesaler to retailer.

Some taxpayers assume that the flat tax and a national sales tax are radically different ways to fund the federal government. This is understandable, since one tax is collected from the paycheck and the other is collected at the cash register. By almost every standard, however, the flat tax and a national sales tax represent two sides of the same coin. The flat tax is imposed on income when it is earned and the sales tax is imposed on income when it is spent.

The common features of the flat tax and national sales tax are:

- A single flat rate. Under both plans, income is taxed at one low rate.8

- No bias against savings and investment. The flat tax explicitly avoids any double taxation of income that is saved and invested. The sales tax avoids any double taxation by exempting wholesale purchases.

- Equality. Either the flat tax or sales tax would change the code so that all taxpayers—and all income—are treated the same under the law.

- Simplicity. With more than 1,000 forms, publications, and notices, the current IRS has become a nightmare of complexity that requires 8 billion pieces of paper each year. The flat tax requires only two forms, which would be filed once each year, while the sales tax requires only one form, which would be filed monthly.

- Territoriality. Both the flat tax and sales tax respect fiscal sovereignty by taxing only economic activity inside America’s borders.

All versions of the national sales tax improve the privacy rights of taxpayers. Sales taxes, by their very nature, do not require individual taxpayers to divulge any information on income and assets to the IRS. Consider the following types of income and assets and the degree to which these must be disclosed in a sales tax world:

| What does the government have an unlimited right to know under a national sales tax? | |||||||||

| Type of Income or Asset | Wages | Interest | Dividends | Sales | Stocks | Bonds | Capital Gains | Assets at Death | Foreign Economic Activity |

|

National Sales Tax

|

No

|

No

|

No

|

Yes

|

No

|

No

|

No

|

No

|

Yes

|

Wages: The government would have no need to track individual wage and salary income under a national sales tax.9

Interest: The government would have no need to track individual savings under a sales tax since there is no tax on interest.

Dividends: The government would have no need to track individual stock holdings under a sales tax. There would be no tax on dividends and no corporate income tax.

Sales: The government would track sales if the income tax was replaced by a national sales tax, but the compliance burden would fall on sellers instead of buyers.

Capital Gains: The government would have no need to track the transfer of assets under a sales tax.

Assets at Death: The government would have no need to track the disposition of assets at death under a sales tax.

Stocks: Since there is no tax on dividends, capital gains, or assets at death under a sales tax, the government would have no tax-related reason for knowing the stock holdings of individuals.

Bonds: Since there is no tax on interest, capital gains, or assets at death under a sales tax, the government would have no tax-related reason for knowing the bond holdings of individuals.

Foreign Economic Activity: Purchases of goods made overseas would be taxable, so consumers would have to divulge those purchases when returning to the United States.

Inflow-Outflow Tax

The least well known of the major tax reform plans is the inflow-outflow tax. Sometimes called the single-rate USA tax10 and sometimes called the Ture tax,11 this reform plan would junk the current system and replace it with an unlimited traditional (or front-ended) IRA. Like the flat tax, the inflow-outflow would tax income only one time, and the tax would be imposed at one low rate.

For all intents and purposes, the inflow-outflow tax is a version of the flat tax—with two noteworthy differences. The first difference is that the traditional flat tax has an unlimited back-ended IRA and the inflow-outflow tax has an unlimited front-ended IRA. This means that taxpayers would be able to fully deduct all forms of savings under the inflow-outflow tax, but they would pay a tax on all withdrawals, including both interest and principal.

Another way of describing the difference is that the inflow-outflow tax exempts all new savings from tax, but all forms of dis-saving—including borrowing—would be taxable. The flat tax uses the opposite approach. Saving is not deductible, but there is no tax on dis-saving. While these two plans sound like dramatically different approaches, front-ended and back-ended IRAs provide the same level of protection against double taxation.

The other difference between the inflow-outflow tax and the flat tax is the impact on privacy. While the inflow-outflow tax would yield similar economic benefits, the impact on privacy would be muted. In short, politicians must keep track of the money flowing into a front-ended IRA so they can grab their share when withdrawals are made. To be sure, this does not require the same level of invasiveness as the current system, but it does mean that financial privacy is not a significant benefit of the inflow-outflow tax.

| What does the government have an unlimited right to know under an inflow-outflow tax? | |||||||||

| Type of Income or Asset | Wages | Interest | Dividends | Sales | Stocks | Bonds | Capital Gains | Assets at Death | Foreign Economic Activity |

|

Inflow Outflow Tax

|

Yes

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

Yes

|

No

|

No

|

Wages: The inflow-outflow tax does allow the government to know peoples’ annual wage and salary income. Like the current system, employers would report that income to the government. Taxpayers would receive W-2 forms and use those forms to complete their tax return.

Interest: The government would track individual savings under an inflow-outflow tax, including the interest income generated by the front-ended IRA. Individuals would not have to report that income, however, until withdrawals were made.

Dividends: The government would track individual investments under an inflow-outflow tax, including the dividend income generated by the front-ended IRA. Individuals would not have to report that income, however, until withdrawals were made.

Sales: The government would have no need to track sales under an inflow-outflow tax.

Capital Gains: The government would track asset ownership under an inflow-outflow tax, including the capital gains generated by the front-ended IRA. Individuals would not have to report those gains, however, until withdrawals were made.

Assets at Death: The government would have no need to track the disposition of assets at death under an inflow-outflow tax, other than to levy a tax on any assets that are withdrawn.

Stocks: The government would track individual stock ownership under an inflow-outflow tax. Individuals would not have to report those holdings, however, unless the stock is sold and the money is withdrawn from the front-ended IRA.

Bonds: The government would track individual bond ownership under an inflow-outflow tax. Individuals would not have to report those holdings, however, unless the bond is sold and the money is withdrawn from the front-ended IRA.

Foreign Economic Activity: The government does not seek to tax income earned outside the United States under an inflow-outflow tax, so individuals would not need to divulge foreign income if this reform is enacted.

Why Privacy Matters

The current tax code is a Byzantine contraption that requires 753 forms and instructions12 and 280 publications and notices.13 And that is just what is available on the IRS website. This avalanche of paperwork is a direct result of a complex tax code, and the complex tax code exists because lawmakers neglect principles of sound tax policy.

A direct consequence is the systemic abuse of privacy in the tax code. Taxpayers can be forced to provide almost unlimited information about their assets to the IRS. According to 1998 IRS data, 67 million taxpayers had to divulge interest income, 32 million had to divulge dividend income, and 22 million had to divulge their capital gains.14 None of this would be necessary in most tax reform plans. The 4 million taxpayers who will file estate and gift tax returns suffer the greatest invasion of privacy, and every tax reform plan will end their misery.15

Privacy is not an absolute right. Law enforcement officials, for instance, can obtain approval to thoroughly investigate a suspect’s financial affairs. Privacy rights also can be voluntarily waived. Consumers applying for credit cards give financial institutions the authority to review their credit reports. A taxpayer may volunteer to divulge information on assets when applying for a government program. A family will unveil its financial affairs in exchange for a home loan.

These examples have a common thread. With the exception of criminals, people voluntarily choose to provide personal information because they expect a benefit in return. This is not true of the tax code. The IRS demands detailed data in order to take money away from people. There is no benefit to the taxpayer.

Perhaps more importantly, there is no benefit to the economy. As assault on financial privacy could be justified if it served an important purpose. One need only think back to September 11 to understand that there are instances when government has a legitimate need to thoroughly probe peoples’ personal and financial affairs. But the tax code does not pass this test. As discussed above, all of the provisions that undermine financial privacy are the unambiguous result of bad tax policy. Fix these flaws in the tax code and financial privacy—along with economic growth—is the result.

International Tax Harmonization and The Threat To Privacy

The Internal Revenue Service is not the real problem. It is merely the agency charged with enforcing bad tax law. Tax reform solves this problem by replacing bad law with good law. Yet this may never happen if international bureaucracies are allowed to rewrite the rules of international commerce and taxation.

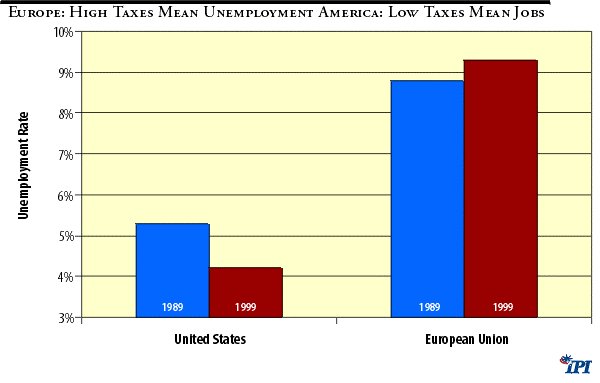

The Organization for Economic Cooperation and Development (OECD), the European Union (EU), and the United Nations (UN) want to give high-tax governments the power to tax income earned in low-tax countries.16 To achieve this goal, these bureaucracies are demanding that low-tax governments emasculate their financial privacy laws and report the financial affairs of foreign investors. If this happens, taxpayers from high-tax nations no longer would be able to reduce their tax burden by shifting their investments to low-tax jurisdictions. In effect, a high-tax government like France would have the power and information needed to impose French tax rates on income earned outside France.

This policy, known as “information exchange,” would be a blow to privacy. Governments around the world would be collecting and sharing private information on personal investments. Information exchange also would be a deathblow to tax reform. As discussed above, tax reform is based on several principles, including the principle that income should not be taxed more than one time and the principle that governments should not tax income earned outside their borders.

The international “harmful tax competition” campaign, by contrast, is based on a fundamentally different ideology. The entire initiative is designed for the purpose of helping high-tax governments double-tax income that is saved and invested—even if that income is earned in another country.

The OECD and Fiscal Imperialism

The OECD is the lead sponsor of the anti-tax-competition effort. The Paris-based bureaucracy is comprised of 30 industrialized economies, most of which are high-tax European welfare states. Politicians from these nations think it is unfair when low-tax countries lure away savings, investment, and entrepreneurship. In an effort to eliminate the pressure of having to compete, they have directed the OECD to undermine the process of tax competition.

The OECD has identified 41 jurisdictions around the world as “tax havens.” These are jurisdictions that have both strong financial privacy laws and low levels of tax. The OECD wants its member nations to be able to tax income that is earned by their residents in these low-tax countries, so the organization is demanding that these low-tax jurisdictions change their laws in order to help foreign governments identify those earnings.

Specifically, these market-based economies are being asked to provide private financial data to OECD member nations. If the low-tax countries do not agree to this “information exchange” policy, the OECD will declare that they are “uncooperative” and ask member nations to subject them to financial protectionism.

Implications for Privacy

The OECD’s proposal is a drastic step, one that undermines the common law principle that bank secrecy is an implicit part of the contract between banker and client.17 Financial privacy historically has been viewed as “an essential safeguard of the citizen against the power of dictatorship.”18 Indeed, the famous Swiss laws regarding banking secrecy were significantly strengthened in 1934 after Adolf Hitler took control in Germany.19

Advocates of the OECD agenda claim that people no longer need to worry about individual freedom and government oppression. Yet the United Nations recently stated, “For much of the twentieth century, governments around the world spied on their citizens to maintain political control. Political freedom can depend on the ability to hide purely personal information from a government.”20

But bank secrecy laws do more than just protect privacy. They also provide systematic benefits to a country’s financial institutions. The OECD even admits this point: “Customers would be unlikely to entrust their money and financial affairs to banks if the confidentiality of their dealings with banks could not be ensured.”21 As a result, bank secrecy laws can help stimulate a vibrant financial services industry.22

Finally, privacy also makes it harder for criminals to select victims.23 Many citizens, particularly those from the developing world, want confidentiality so they are less likely to be targeted for kidnapping and other violent crimes.24 The ability to have private offshore accounts also enables people to protect themselves from financial instability and expropriation.25

Those benefits could soon disappear if governments get carte blanche access to personal financial information.26 And the ability to snoop would not be limited by national borders. Tax collectors would have “a license to inspect any bank account anywhere.”27 This is why the OECD is demanding that low-tax nations sign agreements that would give foreign tax collectors the right to rummage through accounts in search of tax revenue.28

The Money Laundering Red Herring

The OECD wants to force financial institutions and other businesses in all countries to divulge information about law-abiding customers to the government. In effect, opponents of tax competition want to internationalize the controversial “know-your-customer” regulations that compel U.S. banks to spy on their customers. Indeed, these requirements would be extended to other professional service providers.29

The organizations that back these types of initiatives argue that privacy must be curtailed in order to detect criminal violations and stop money laundering. Yet all nations with bank secrecy laws have provisions to suspend that privacy in cases of universally recognized crimes like terrorism, murder, and drug running.30 Indeed, so-called tax havens often have mutual legal assistance treaties with the United States to streamline this type of cooperation.

Requiring reports on the financial activities of everyone, by contrast, will undermine law enforcement by overwhelming officials with a blizzard of paperwork. In effect, these laws create a haystack and then ask government investigators to find a needle. A far better approach is to target resources on the identification, investigation, and prosecution of actual criminals. In other words, policymakers should ask whether the costs and benefits of money laundering laws justify monitoring “all aspects of their nationals’ private lives, interfering totally in their privacy—although real criminals will always find ways of bypassing detection systems.”31

The OECD is trying to radically alter international tax policy, and doing so in a way that would cripple financial privacy.32 Tax reform will be a casualty of this effort if it succeeds, and individuals around the world will suffer a significant loss of liberty.33 As one government official from a low-tax regime warned, “This is a utopian world, where you computerize everything and everyone has access to it.”34

Implications for Tax Reform and American Competitiveness

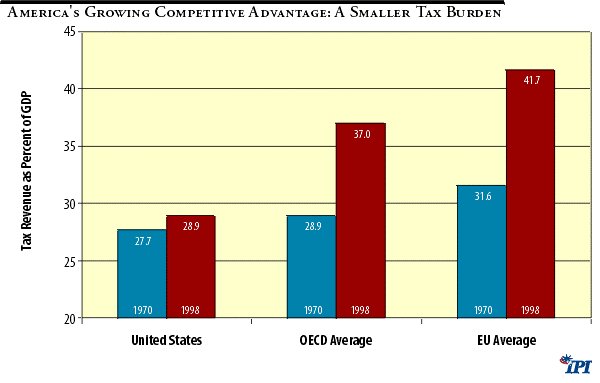

The OECD agenda is contrary to America’s interests. The United States is a low-tax country and a haven for foreign investment. In large part because of our attractive tax and privacy laws, foreigners have invested more than $9 trillion in the U.S. economy.35 And if President Bush continues his efforts to reduce tax rates and eliminate the death tax, America is going to become an even more effective competitor in the world economy. It would therefore be self-defeating for the United States to support the OECD’s attack on tax competition.

If the OECD agenda is approved, U.S. lawmakers will face pressure to adjust American laws so that Europe’s welfare states can track down the money that overburdened European taxpayers bring to America. Financial institutions could be forced into the role of vassal tax collectors for foreign governments.

It certainly means that tax reform would be very unlikely. The flat tax and sales tax are territorial systems. Yet the OECD and other international bureaucracies believe that territorial taxation—the common sense notion that governments only tax economic activity inside their borders—is a form of “harmful” competition. The flat tax and sales tax eliminate double taxation, but the OECD initiative is designed to help governments discriminate against income that is saved and invested.

The Big Picture

Tax reform is a way of boosting economic growth. Lower tax rates will improve incentives to work, save, and invest. The elimination of special preferences and penalties will encourage people to invest resources for wealth maximization instead of tax minimization. Simplification will free up resources that are being wasted to comply with a convoluted tax code. Territorial taxation will make American companies much more competitive in the global economy.

Tax reform means higher income, better jobs, and improved living standards for the American people. Policy makers should not need any additional reasons to junk the Internal Revenue Code. There are several desirable tax reform plans on the table. The time has come to pick one of these proposals.

If lawmakers still are skeptical, there are other reasons why tax reform is a good idea. Privacy may be the most important of these secondary considerations. Eliminating the double taxation of income that is saved and invested creates a huge opportunity to get government out of the business of spying on the private finances of law-abiding Americans. Every tax reform would reduce the amount of personal information that the government has to know. And the two major plans—the flat tax and the national sales tax—eliminate any tax-related reason for the IRS to know an individual’s financial assets.

The beauty of tax reform is that good tax policy yields fringe benefits. Privacy is one of those benefits, but it is not the only one. Two others include:

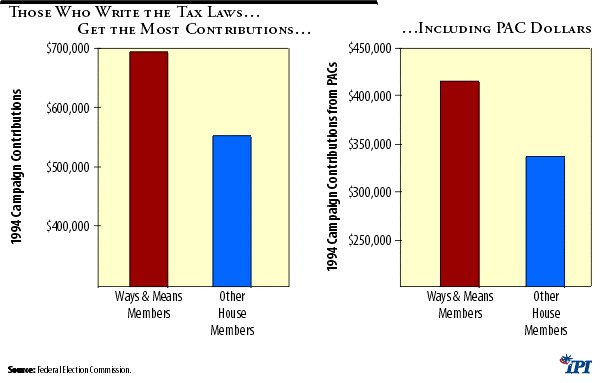

- A reduction in political corruption : There is a powerful relationship between the number of lobbyists and the number of words in the tax code. This symbolizes the ability of special-interest groups to manipulate the tax code with social engineering and backdoor industrial policy. Every time politicians get to pick winners and losers, they also get to shake down an industry or a voting bloc for campaign contributions and political support. Replacing the tax code with a simple and fair system like the flat tax would turn the tax-writing committees from cash cows into harmless oversight bodies.

- More honesty in fiscal policy: A disturbing new development in fiscal policy is the use of the tax code for income redistribution. More specifically, politicians always have used the tax system to punish successful taxpayers. Indeed, that is the main purpose, along with the desire to get more money to spend, for high tax rates and double taxation. But politicians have now started to hand out money via the tax system. “Refundable” provisions like the “earned income credit” are a way of transferring money to people who do not pay taxes. Fundamental tax reform would eliminate these welfare programs from the tax code and force politicians to put them back on the spending side of the ledger where they belong.

Conclusion

Policy makers should protect financial privacy. That is why tax reform is a way of killing two birds with one stone. Replacing the Internal Revenue Code with a flat tax or sales tax would boost growth, increase jobs, and improve living standards. But tax reform also could eliminate any tax-related reason for the government to track the financial holdings of law-abiding people.

To some extent, this is a civil liberties issue and a human rights issue. The right to be left alone is particularly important in a modern economy because of the huge amounts of information that now are available. The more information the government collects, the greater the chance that the information will be abused—either by misguided politicians or clever hackers.

Tax reform is particularly important because it may be the best way of thwarting the anti-tax-competition initiatives being pushed by Europe’s welfare states. Information exchange and other tax harmonization initiatives are predicated on the view that governments should collect and share private financial data. These policies not only are a threat to privacy, but they also undermine America’s competitive advantage in the global economy and they could compromise our fiscal sovereignty. Replacing today’s complicated tax system with one of the tax reforms discussed above would help short-circuit international bureaucracies and preserve tax competition as a liberalizing force in the world economy.

The United States should have a tax system worthy of a great nation. Tax reform plans like the flat tax and sales tax fulfill that promise. They treat people equally and remove barriers to upward mobility. Tax reform is a way of returning privacy and control to the American people.

Endnotes

1. For a detailed discussion on this issue, see Steve Entin’s paper from the Road Map to Tax Reform series, “Fixing the Saving Problem: How the Tax System Depresses Saving, and What to do About It,” Institute for Policy Innovation, Policy Report No. 156 (May 16, 2001).

2. Charles Adams, For Good and Evil: The Impact of Taxes on the Course of Civilization (New York: Madison Books, 1993).

3. There are, of course, other factors that determine growth. Property rights and the rule-of-law, for instance, are critically important for economic development and capital formation. For more information, see The 2001 Index of Economic Freedom, ed. Gerald P. O’Driscoll, Jr., et al. (The Heritage Foundation and Dow Jones & Company, Inc., 2001).

4. Economists refer to this return as interest, but that term in the economics literature refers to any income generated by savings, not just payments to bank deposits and bondholders.

5. Privacy for tax purposes does not mean privacy for non-tax purposes. Governments would be able to access information on assets and income for criminal and civil investigations.

6. Leading supporters of the flat tax include House Majority Leader Dick Armey (R-TX), Senator Richard Shelby (R-AL), and magazine publisher Steve Forbes. The flat tax is based on a proposal put forward by Stanford economists Alvin Rabushka and Robert Hall.

7. The national retail sales tax, often associated with Representative Billy Tauzin (R-LA), would replace the income tax with a tax on all final retail sales. The Fair Tax, championed by Representative John Linder (R-GA), would replace the income and payroll tax with a tax on all final retail sales. The VAT, which has no support in the U.S. Congress, would replace the income tax with a tax on the “value added” to a product at each stage of the production process. The net effect of all these taxes would be the same as a single tax on the end product.

8. The tax rate would depend on several factors, including 1) whether lawmakers want to collect as much money from the new system as they collect from the old system, 2) how much faster the economy grows following tax reform (more jobs and higher incomes translate into additional revenue for the government), and 3) the amount of protection for lower-income taxpayers (households receive a generous exemption under the flat tax and a universal rebate under the sales tax).

9. There may be other reasons for the government to obtain this data, including: 1) calculation of Social Security taxes and/or benefits, and 2) determination of eligibility for various government programs.

10. The Unlimited Savings Account (USA) tax was sponsored by Senators Sam Nunn (D-GA) and Pete Domenici (R-NM) and enjoyed some attention in the early 1990s.

11. The late Norm Ture served under Ronald Reagan at the Treasury Department and was President of the Institute for Research for the Economics of Taxation.

12. “Forms and Instructions,” Internal Revenue Service, 2002. http://www.irs.gov/forms_pubs/forms.html.

13. “Publications and Notices,” idem. http://www.irs.gov/forms_pubs/pubs.html.

14. “Table 1—Individual Income Tax Returns: Selected Income and Tax Items for Specified Tax Years, 1980–1999,” FedWorld, 2001. http://ftp.fedworld.gov/pub/irs-soi/99in01si.xls

15. “Table 22—Selected Returns and Forms Filed or To Be Filed by Type During Specified Calendar Years, 1975–2001,” FedWorld, 2001. http://ftp.fedworld.gov/pub/irs-soi/01a122sr.xls

16. The OECD agenda can be seen in “Towards Global Tax Co-operation: Progress in Identifying and Eliminating Harmful Tax Practices,” OECD, 2000. http://www.oecd.org/daf/fa/harm_tax/Report_En.pdf. The EU agenda can be seen in “Savings tax proposal: frequently asked questions,” The European Union Online Memo 01/266 (18 July 2001) http://europa.eu.in t/comm/taxation_customs/publications/official_doc/IP/ip011026/memo01266_en.pdf, and the UN agenda can be seen in “High-level international intergovernmental consideration of financing for development,” Agenda item 101 of the United Nations General Assembly Fifty-fifth Session (26 June 2001) http://www.un.org/esa/ffd/a55–1000.pdf.

17. Improving Access to Bank Information for Tax Purposes, OECD Committee on Fiscal affairs (OECD, 2000).

18. Christopher Adams, “Nowhere to Hide,” The Financial Times, June 26, 2000.

19. Maurice Aubert, Swiss Banking Secrecy (Geneva: Schellenberg & Haissly, 1997).

20. United Nations, “Financial Havens, Banking Secrecy, and Money Laundering,” 1998. https:// www.imolin.org/finhaeng.htm.

21. OECD, Improving Access.

22. Ibid.

23. UN, “Financial Havens.”

24. Testimony of Amy Elliot before the Permanent Subcommittee on Investigations of the Committee on Governmental Affairs, U.S. Senate, November 9, 1999.

25. Testimony of Antonio Giraldi before the Permanent Subcommittee on Investigations of the Committee on Governmental Affairs, U.S. Senate, November 10, 1999.

26. Harmful Tax Competition: An Emerging Global Issue (OECD, 1998).

27. Graham Mather, Tax Competition and the OECD (London: European Financial Forum, 2000).

28. OECD, “Towards Global Tax Co-operation.”

29. Patrick Moulette, “Money Laundering: Staying Ahead of the Latest Trends,” OECD Observer, April 2000.

30. For more information, see Daniel J. Mitchell, “Money Laundering Bill Should Target Criminals, Not Low Taxes,” Backgrounder No. 1492, the Heritage Foundation, October 16, 2001. http://www.heritage.org/library/backgrounder/bg1492.html.

31. Jacques Rossier, “The Future of Financial Privacy in the Age of Digital Money,” Remarks at Geneva Financial Center Conference, September 8, 1999. http://www.geneva-finance.ch/e/conference.htm.

32. OECD, Improving Access.

33. Bruce Zagaris, The Assault on Low Tax Jurisdictions: A Call for Balance and Debate, European Financial Forum (EFF, 1999).

34. Astrid Wendtlandt, “Offshore Centres Reject EU Plan to Share Information,” The Financial Times, July 25, 2000.

35. Harlan W. King, “The International Investment Position of the United States at Yearend 2000,” Survey of Current Business , U.S. Department of Commerce, July 2001.

About the Author

Dan Mitchell, Ph.D., is the McKenna senior fellow in political economy at The Heritage Foundation. A former advisor on budgetary and tax matters to the Senate Finance Committee, Mitchell’s by-line can be found regularly in such national publications as The Wall Street Journal and Investor’s Business Daily. He is a frequent guest on radio and television and a popular speaker on the lecture circuit. Prior to joining The Heritage Foundation in 1990, Mitchell was Director of Tax and Budget Policy for Citizens for a Sound Economy. He holds a Ph.D. in Economics from George Mason University and master’s and bachelor’s degrees in economics from the University of Georgia.