Introduction

Before we can transform our highly burdensome and overwhelmingly complex income tax system to create a flatter, fairer tax system, we must take a hard look at the current tax treatment of health insurance. Unless a careful strategy is developed, the favored tax treatment of employment-based health insurance could well be the Achilles Heel of overall tax reform.

The challenge is worth taking: the tax treatment of employment-based health insurance needs to be modernized for the sake of both tax reform and health reform.

It is no coincidence that the United States offers the highest-quality health care in the world and that, during the twentieth century, it repeatedly has turned its back on government-run health systems. The challenge for the twenty-first century is to modernize policy decisions made nearly 60 years ago that are increasingly out-of-date and out-of-step with today’s economy. To make high-quality health care accessible and affordable for all Americans, the key is tax reform.

Today, the tax code provides a generous but highly invisible subsidy for the health insurance that more than 160 million Americans receive through the workplace. This tax benefit is worth more than $130 billion in tax savings— ;much more valuable than even the mortgage interest deduction—to working Americans and their families.1

Yet this subsidy leaves millions of people behind, especially those at the lower end of the income scale. Furthermore, the subsidy is invisible to those who do receive it, causing another series of distortions in the marketplace for health insurance.

The political battles over a new tax system could run into a brick wall unless strategies are developed for alternatives to these subsidies and people are educated about the need for new ideas. Because people are not well informed about how the current tax subsidy determines the nature of their health insurance, they are particularly susceptible to scare tactics by opponents of tax reform. Opponents have already signaled that they will use the health care issue to try to derail tax reform.

Reforming the tax treatment of health insurance is essential to achieve a more efficient and equitable market for medical services and health insurance in the United States. Correcting the tax distortion would lower the costs of health insurance coverage in both the public and private sectors and thereby allow broader access to quality health care.

The current tax treatment of health insurance is a problem that must be addressed in fundamental tax reform. Freeing up the current tax preferences for employment-based health insurance can lead to an extensive, equitable and personalized market of health coverage for Americans of all income levels.

The Historical Accident of Job-Based Insurance

Early in the 20th Century, the link between health insurance and the workplace began to be established in the United States.2 During and after World War II, employment-based health insurance became more widespread, and the link became much stronger.

Factories were pushed to meet wartime production schedules. Competition for good workers was intense but was hampered by wartime wage controls. Employers found they could compete for scarce workers and boost compensation without running afoul of these controls by offering health insurance as a benefit in lieu of cash wages. In 1943, the Internal Revenue Service ruled that employers’ contributions to group health insurance would not count as taxable income for employees.

That ruling, its codification by Congress in 1954, rising tax rates on middle-class incomes, and the rising demand for health insurance all combined to create a strong incentive for obtaining health insurance through the workplace.

The generous tax preference accorded job-based health insurance is a historical accident that has increased automatically over the decades without legislative authorization or appropriations. It has percolated through the economy for nearly 60 years to become the foundation for a system that provides subsidies to employers. The consequence is clear: working and retired Americans seek health insurance for themselves and their families through their jobs.

But this form of subsidizing health insurance is increasingly out-of-step with our rapidly changing economy and workforce. Because of increased access to communication and information, American workers are more knowledgeable about their needs and health care options. Furthermore, our free-market economy makes such choices crucial to improving the quality and lowering the costs of health care. Employees might well ask why their companies do not offer to pay their mortgages or grocery bills as well. Health insurance has become a job-based perk because of a dated tax policy.

In addition, the subsidies for job-based health insurance are very regressive: current tax law provides generous benefits to those who have higher incomes and receive health insurance through the workplace. Yet it offers little or no assistance to those at the lower end of the income scale. A taxpayer earning $100,000 a year or more gets an annual subsidy worth $2,638 while one earning $15,000 gets only $79 a year in assistance toward the purchase of health insurance.3

What that means is that an executive with a high-paying job gets a generous tax subsidy for health insurance from the taxpayer, while the waitress serving her lunch gets little or no help in purchasing health insurance. Clearly, it is not a system we would have designed if we were starting from scratch. It is a relic of World War II wage controls, and changes are needed.

How the Current System Works Against Workers

Non-taxed, invisible wages

Employment-based health insurance is part of the compensation package many employers provide to their employees in the form of a non-cash wage. What makes health insurance different from cash wages or salary compensation, however, is that workers do not pay taxes on this part of their compensation package.

The tax code offers an exclusion of health insurance costs from taxable income to those who get their health insurance at work. Section 106 of the Internal Revenue Code provides that the value of health benefits need not be counted as part of the taxable income of employees.

This seems like a generous accommodation for the needs of Americans to secure affordable health care. However, it only applies to those who are provided with health coverage through an employer. We have seen how this makes for inequalities in health care assistance. Yet it has further negative consequences.

Hidden wages = lowered income

The value of the health coverage, the tax benefit employees receive, and the costs in forgone wages are largely invisible to workers. An example may prove useful. Take a graphics artist whose salary is $40,000. Her company offers health insurance, but the additional $5,000 cost of the policy covering her family and herself is excluded from her taxable income. The tax code encourages her to believe that her premiums are paid by her employer and are therefore “free.” This illusion persists because her pay stub does not reflect the $5,000 in nontaxable income that she receives in the form of health insurance. (Even if her employer asked her to contribute to the cost of her health insurance premiums, the contribution would represent only a fraction of the full cost of the policy.)

In fact, the employer sees the cost of employing her as $40,000 plus $5,000, or $45,000, plus other benefits and taxes.

The company must write the check for the premium in order for the employee to receive the tax subsidy. The employee therefore never sees the full cost of the health insurance policy, or the cash income that he or she is forgoing in lieu of the insurance policy. The exclusion therefore creates an illusion that the company is providing health insurance as a perk. The tax benefit is invisible as well.

As long as Americans remain under the mistaken illusion that they are getting “free” or heavily subsidized health insurance at work, they will be shielded from the full cost of their health care consumption decisions. They will not understand that their cash compensation is lower because of high health insurance costs. And they will not see the generous tax break they are getting for their job-based health coverage.

The visibility of deductions/the penalty to workers

In addition to the exclusion of health insurance from the taxable income of employees, businesses can take a tax deduction for the cost of this health coverage, as they do for most other forms of employee compensation. They write the check for the health insurance premiums on behalf of their workers, and some pay medical bills directly if they self-insure. Businesses deduct these costs from their earnings since health insurance is part of the total compensation package paid to workers and must be deducted to measure net profits correctly.

While the tax break for health coverage to individuals (its exclusion from taxable income) is invisible, the costs of health coverage to employers are visible. This creates an imbalance that, again, is contrary to the interests of the employee. When deductions are taken, they are visible because the entity receiving the tax deduction must first pay the full cost of the purchase before deducting it from total income. We hear the cries of employers complaining about the rising cost of health insurance because they are paying the bill. Employees may be receiving smaller raises as a result, but this is a consequence of visible costs to an employer and invisible benefits to an employee.

Visibility is one of the core principles stressed as essential to a properly functioning tax system by economists. It was identified by the National Commission on Economic Growth and Tax Reform as an essential principle for tax policy.4 Deductions are visible, but exclusions are invisible and therefore much more likely to cause distortions in the marketplace.

Putting Consumers Back in Control of Their Decisions

Cost efficiency

In a market-based economy, whoever controls the money controls the choices. For several decades, those who have job-based health insurance in America have been under the illusion that someone else pays their bills for medical care. In fact, each of us pays, and we pay more for the perceived luxury of thinking we don’t pay.

Eugene Steuerle of the Urban Institute estimates that the average American family pays about $11,000 a year toward the total $1.2 trillion in American health care expenditures.5 Unfortunately, most of that spending is invisible. The money comes from pre-tax wages used to pay job-based health insurance premiums, from taxes paid to fund federal health programs like Medicare and Medicaid, from cost-shifting among private and public payers, and from other sources.

The only way for Americans to get back in control of costs and choices is to get control of the money. When that happens, consumers can choose the doctors and medical care that they, and not an insurance clerk or government bureaucrat, deem necessary. They, not a bureaucrat or employer, will decide what compromises they are or are not willing to make to get medical care and health insurance.

Because medical care, and consequently health insurance, is expensive, some people need help in affording coverage. Changes to the financing system can provide that help by expanding access to health insurance, providing security, maintaining a system envied for the quality of care, and creating new incentives for cost efficiency.

The Ethical Imperative for Increased Efficiency

Over the last several decades, modern medicine has evolved to a point that medical professionals can diagnose life-threatening diseases early enough to provide life-saving therapies. With these advances have come the social questions: who is entitled to medical care and at what price? Today, care is rarely denied to those in critical need of medical treatment. But haphazard access to medical care is expensive, inefficient, and diminishes individual dignity.

The political process has thankfully struggled against and so far rejected a sweeping reform proposal that would address the needs of 280 million Americans through a single government-designed program. No one single solution will ever work. The following proposal could correct some of the distortions caused by flawed federal tax policies by helping those in need with a new form of assistance to purchase health coverage.

Tax Reform Requires Alternative Health Care Solutions

During the last major health care reform debate in the 1990s, Americans consistently said they wanted universal access to health care but just as consistently said they did not want the government bureaucracy that accompanied a centralized government solution. The American people, committed to the imperative of equality, want everyone to have access to the medical care they need, but they want a solution that does not compromise the strength of the health care system or the economy, and does not place an undue burden on individual or government resources.

The convergence of frustration with the tax system and frustration with the health care system may provide a historic opportunity for change. In 1999, the average household paid nearly 40 percent of its income in federal, state, and local taxes. This high tax rate during peacetime and prosperity, coupled with growing disaffection with centralized government, leads many political analysts to believe that the country is ripe for tax reform.

Furthermore, the coincidence of tax reform and health care reform is inevitable if we are to institute a radically different tax structure. A debate over a major simplification of the federal tax system would necessarily draw attention to the generous tax benefit provided for employment-based health insurance. Regardless of how dated and prejudicial this system is, health care could be a political/emotional card played by the opposition to extensive tax reform. It is imperative that advocates of tax reform understand the political volatility of changes to current health care subsidies. For fundamental tax reform to proceed, there needs to first be a viable and equitable alternative to today’s system of health care subsidies.

Coupling tax reform with free-market health reform could finally make a win-win political scenario possible.

A Viable, Equitable and Long-term Solution

Some have advocated extending the exclusion of health insurance from taxable income to the uninsured, but this is not a viable alternative. Under the current tax provisions for health care, there is no way to extend benefits to the uninsured. By definition, the exclusion is only available to those who are able to obtain their health insurance through the workplace; premiums are excluded from their taxable income.

Other initiatives have been and are being considered that would provide incentives through an individual tax deduction. A tax deduction for health insurance would function much like the mortgage interest deduction: people would purchase their own health insurance, then take a deduction on their income tax returns for allowable premiums they have paid.

Congress has already enacted an individually based tax deduction, which is being phased in through 2003. But this deduction is limited to self-employed individuals who purchase their own health insurance. Furthermore, a tax deduction is not effective in reaching the vast majority of the uninsured. Because of the progressive rate structure of the U.S. income tax system, deductions favor middle- and upper-income individuals and families who are most likely already to have health insurance and provide little or no help to those at the lower end of the income scale.

More than 80 percent of the uninsured are working Americans or their dependents. They either can’t afford to purchase health coverage on their own with after-tax dollars, or they can’t afford to pay their share of the premium costs for health insurance their employers may offer.

Tax deductions, either above or below the line, will be of little or no help to families with incomes under $25,000—the most likely to be uninsured. Due to the combined effects of the standard deduction, personal exemptions, and child tax credit, these families often pay no federal income taxes. Even a full deduction would mean a savings of only 15 percent off the cost of health insurance—far too little to be of help to the uninsured.

Proposals for a national sales tax, which would tax consumption expenditures, include a rebate of taxes paid on necessities. These necessities, which could include health care, would escape taxation up to a capped limit. In both flat tax and sales tax proposals, the personal exemption could be increased to provide additional benefits to lower-income individuals and families for the purchase of health insurance.

The Health Policy Consensus Group has proposed a solution that is supported by political leaders on both sides of the aisle.6 It is a subsidy for health care that provides a tax cut and targets those who currently do not have health insurance. It would give individuals more choice as to where and how they obtain medical care, and could create new incentives for a competitive, consumer-driven market for health insurance and medical services.

The Health Policy Consensus Group’s proposal would offer (instead of deductions and exclusions) a refundable tax credit for the purchase of health insurance. The tax credit would be a direct subtraction from taxes owed. If taxpayers owe less than the credit for which they are eligible, they can claim the difference as a refundable subsidy. A refundable tax credit would not only give families meaningful help in purchasing private health insurance, it would also help ease the transition toward tax reform.

It should be emphasized that tax credits are not a permanent solution. They are an incremental step toward a system of subsidies that would help eliminate many of the current distortions, give more workers access to health care, and allow a simpler, more efficient system of taxation. The new tax credit subsidies would be visible to the recipients, empowering them to make decisions about how to obtain the best value for their health insurance dollar in a competitive marketplace. This is a vision for the future, one that will be not achieved without legislative change.

Tax Credits Are an Essential Move In the Right Direction

Even with the generous $130 billion subsidy for job-based health insurance, more than 40 million people are without coverage at some point during the year because they don’t receive or can’t afford the health insurance offered by their employers.

Tax credits are an interim solution to move toward greater fairness. It may seem odd to discuss the merits of tax credits while pushing for a simpler, fairer, flatter tax system. In fact, enacting tax credits to obtain private health insurance actually puts in place a system of subsidies that will make the transition to overall tax reform much easier.

Tax credits also are a good start because they could eventually be substituted by straightforward subsidies. By providing a refundable tax credit worth, for example, $1,000 for individuals and $2,000 for families, the credit could be turned into a direct subsidy or an expansion of the basic personal exemption. This transition will remain more difficult to do as long as the subsidy for private health insurance is expressed as a deduction or exclusion from income, with the subsidy varying depending on how much is spent on health coverage.

In making a direct subsidy through a tax credit, the expenditure moves to the spending side of the budget (where it belongs) rather than being run through the tax code with all of its complexity and confusion. The key to this new refundable tax credit system is that individuals know they have a specific subsidy for health insurance qualified in dollars rather than in an open entitlement to benefits. In the new system, consumers—not government bureaucrats, politicians, or human resource directors—decide how the money will be spent.

This change would provide a measure of equity missing from the current system. Equally important, the subsidy would go directly to the individual to make the health care arrangements that best suit his or her needs and shrink the role of government in micromanaging the health care system.

President George Bush has embraced the concept of tax credits as the centerpiece of his initiative to assist the uninsured in obtaining coverage. The alternative proposed by those on the political left would lure more and more of the uninsured into existing government-run health programs like Medicare and Medicaid. Tax credits are a step toward individual ownership of health insurance, selected in a competitive, private marketplace.

Moving Toward Real Insurance: the Benefits of a Tax Credit

Employment

The incentives would be targeted directly to individuals regardless of their employment status, unlike the current system of subsidies for job-based insurance.

Under this new system, individuals and families would not be required to give up their health coverage when they lose or change jobs, any more than they would be required to refinance their mortgage or get new auto or life insurance when they get a new job. Tax credits would answer many of the questions raised in the health care reform debate: security, portability, eliminating job-lock, providing broader access to coverage, and creating incentives for cost control, to name a few.

Equality

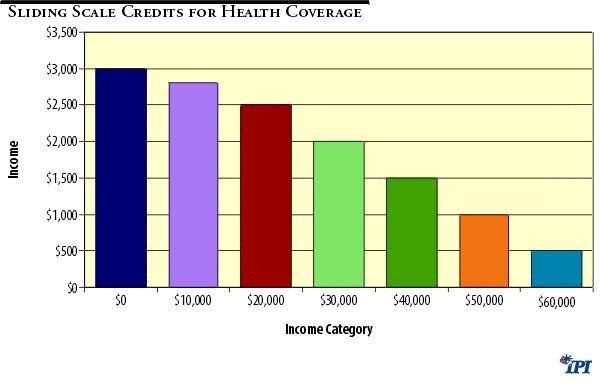

A system of credits or vouchers could be available without regard to income. Or the subsidies could be provided on a sliding income scale, as represented in the chart below (Figure 1). This system would provide a specific amount of money to each individual and family in certain income classes toward the purchase of health insurance. This would be more difficult to administer than a flat credit system but could have more political appeal.

Figure 1

As one option of expanding coverage, those eligible for the credit but who choose not to purchase their own health insurance policy would default into an insurance pool. The money saved from the subsidy they did not use could pay for their participation in the insurance pool, such as a state-based high-risk pool, or a private program of all companies participating in the insurance program. The coverage would be purchased for them from the public funds saved because the person did not claim the credit available to him or her.

Instead of having most of the subsidy going to the wealthiest Americans, as it does today, new subsidies could be allocated to those at the lower end of the economic scale who are less likely to be able to purchase health insurance on their own. If the full cost of the health insurance policy were visible, consumers would make better decisions in the allocation of these resources. For example, many more people would see the benefit and value of purchasing catastrophic coverage that is real insurance: protecting them against the cost of large medical bills.

Efficiency

Some consumers would see the value of purchasing a relatively inexpensive health insurance policy that protects them against the costs of major accidents or illnesses. They could use the premium savings from this less costly “ catastrophic insurance” to pay for routine medical bills out-of-pocket or to establish Medical Savings Accounts. Others may prefer to purchase a straight Health Maintenance Organization contract to provide predictable access to routine and catastrophic care. Giving people choices would allow a more diverse and complex market to evolve that would cater to the individual needs of consumers and provide a broader range of choices.

Surely the cost of a health insurance plan that protects against high-cost medical bills would be much more economical than a policy in which virtually every bill is run through insurance. Imagine, for example, an automobile insurance policy that ran every repair bill through insurance. Consumers understand that this would be expensive and inefficient, so most opt instead for the higher deductible policies that keep premiums lower. The same principle works for health insurance.

Efforts to expand government control and regulation of heath care ignore the real case we should be making for health coverage: the social responsibility involving the costs of catastrophic medical expenses should be distinguished from individual preferences and needs for routine medical care. That is, it is the responsibility of individuals to have catastrophic health coverage so they do not subject others to the cost of routine medical bills—especially those that the injured or ill person could have afforded. Unfortunately, the large part of these private expenses becomes a burden on taxpayers through public programs.

“Health insurance” that pays all medical bills after a deductible of a few hundred dollars isn’t insurance at all; it is a pre-payment plan for medical bills. Individuals may choose to purchase this type of coverage, but it is an individual choice that should neither be rewarded nor restricted by the federal government. Instead of attempting to require everyone to fit into the same package, people can tailor the package to fit their individual and family needs.

Future Goals of the Tax Credit

The ideal plan would provide individuals and families with the security of owning their own health insurance. Direct subsidies, in the form of tax credits or vouchers, would simplify the tax code and provide individuals and families the help they need in purchasing health coverage.

Choices in the Information Age

As the Unites States leads the world to the information age, people have greater access to more and more information about health care options. Government cannot and should not stop this information explosion, and it cannot and should not stop people from seeking the medical services they need to promote and maintain their own health.

In a true free-market system, costs would be controlled, not by government restrictions, but by individual consumers seeking the best value for their premium dollars in a competitive marketplace. Those who have information to compare can make choices, and informed choices drive the market to restructure. All consumers benefit from this free-market dynamic.

Subsidies to individuals to make their own health care arrangements would inject new vitality into the market for individually purchased health insurance. Because more than four-fifths of Americans get their health coverage either through the workplace or through government programs, the market for individual health insurance is not nearly as vibrant as it could or should be. The individual market also has been suffocated by a plethora of state mandates and regulation. Targeting subsidies to individuals to purchase their own health insurance would revitalize this market for individual health insurance and force sellers to cater to the needs of consumers rather than to large, depersonalized purchasers like employers or government.

Local Health Care

Incentives could be established to encourage local initiatives and volunteer activities, which are historically the most successful ways of problem solving.

A redesigned health care subsidy could encourage medical care providers, hospitals, and groups to implement programs and medical treatment that specifically address the needs of underserved populations. A special commission could be established to investigate the most effective local programs and find out what makes them work, and an information clearinghouse could facilitate duplication of the best programs.

The challenge for the federal government is to stay out of the way of creative local initiatives while setting up a climate in which more of them can flourish. These programs will succeed only if they are encouraged by incentives, not driven by federal mandates, controls, and red tape.

Federal incentive and state enforcement

The primary responsibilities of government would be structuring incentives properly to encourage people to take responsibility for themselves as much as possible, and for seeing that the private marketplace lives up to its commitments to consumers.

State governments have both the experience and the infrastructure to provide contract enforcement. They can best offer protection to assure consumers that the coverage they have purchased is the coverage that is provided.

Options for Individually Targeted Subsidies

Many of the reforms to the health care system we advocate are based upon ideas that return power to consumers by giving them more control over their own resources. The idea of individually targeted subsidies can provide help for the uninsured as well as for those eligible for the State Children’s Health Insurance Program, Medicare, or Medicaid.

Health care is too personal to be dictated by the federal government. That is true for everyone, rich or poor. Those relying on public assistance should not be subject to restrictive entitlement programs, and existing subsidy programs could be improved to supplement the federal tax credits. For example, many of those in the lowest income categories already qualify for Medicaid or the State Children’s Health Insurance Program (SCHIP). These allocations could be provided to individuals in the form of vouchers for the purchase of private health insurance. Here are some options for giving individuals more control over choices and spending for existing programs:

- Medicare subscribers: Medicare subscribers would be allowed a one-time option of keeping their private health insurance when they turn 65 and receive, instead of the current monthly Medicare payment, a contribution toward their private insurance.

- Medicaid beneficiaries: Those who currently receive Medicaid assistance would be eligible for a direct subsidy to cover the cost of privately offered coverage. Therefore, the poor and lower-income individuals would have access to good, private medical care and catastrophic coverage, just like everyone else.

- SCHIP beneficiaries: Children and the parents of children in lower- and middle-income categories who qualify for SCHIP coverage could receive the benefit in the form of a refundable tax credit or voucher that would allow them to obtain private health insurance, either at work or through a new alliance or organization that they may choose.

In a reformed system, tax credits could be directed to individuals for the purchase of health insurance on a sliding income scale. While it would add some complexity, the subsidies could provide more generous assistance to those in lower income categories, with reduced subsidies as the recipient’s income rises.

The National Bi-Partisan Commission on the Future of Medicare recommends a system for Medicare that would provide direct subsidies to individuals for the purchase of health insurance. Instead of the current Medicare entitlement to a limited set of medical benefits, beneficiaries would receive a monetary allocation, often referred to as “premium support,” that they could use toward the purchase of competing private health plans.

Nine million Federal workers, dependents, and retirees already utilize a similar system that has worked efficiently and effectively for decades. It is an excellent model for seniors and an important change to inject incentive-based cost controls into the Medicare system, which is heading for bankruptcy if it is not changed. The premium support model of Medicare reform is gaining momentum on Capitol Hill and has been supported by President Bush.

Time for Change

The changes that are needed in the health sector will come not through the collective solutions that have been attempted again and again in this century to expand government control of the health system. Rather, they will come through solutions that focus on individual authority, competition, diversity, and freedom of choice that will drive the economy in the twenty-first century.

The goal is to expand freedom by limiting the role of government in the health sector, which is, by the number of pages of regulation governing it, the most heavily regulated sector of the U.S. economy. In order to restore competition and freedom for patients and doctors, we must begin to move away from a system that would bring more and more Americans under the authority of politicians and government regulators in directing health care. Limiting the role of government will expand freedom and promote individual responsibility, competition, and diversity.

In making the case for tax reform, higher-income individuals receiving generous subsidies for health insurance may be willing to trade some of these subsidies for a flatter, lower tax rate. This could actually help balance the demographic tables that would otherwise show higher-income people gaining more through a flatter tax system.

Implementing new subsidies for health insurance now through tax credits would make a transition to a new system easier in the long run. As part of a tax reform initiative, explicit, capped subsidies for health insurance could easily be converted into credits or expanded personal exemptions, available only to those who use the funds to purchase health insurance.

Ultimately, the road to health care reform will run through tax reform. The invisible and regressive tax break for health insurance will be brought to light when the country debates a major overhaul of the tax code. As a result, the route to the health care reform that has eluded policymakers for decades may very well be through a simpler, fairer, and flatter tax system.

Endnotes

1. John Sheils, Paul Hogan, and Randall Haught. “Health Insurance and Taxes: The Impact of Proposed Changes in Current Federal Policy,” Policy Study published by the National Coalition on Health Care, October 18, 1999. Washington, D.C.

2. The description and history of the tax treatment of health insurance are taken from “A Vision for Consumer-Driven Health Care Reform” by the Health Policy Consensus Group, published by the Galen Institute, Alexandria, VA, October, 1999.

3. Ibid. Sheils, et al.

4. A New Tax System for the 21st Century, Unleashing America’s Potential: A pro-growth, pro-family tax system for the 21st century, Report of the National Commission on Economic Growth and Tax Reform, January 1996.

5. C. Eugene Steuerle, Ph.D. and Gordon B.T. Mermin , “A Better Study for Health Insurance,” in Empowering Health Care Consumers through Tax Reform, ed. Grace-Marie Arnett (Ann Arbor: University of Michigan Press, 1999), p. 71.

6. The Health Policy Consensus Group was formed in 1993. It is a network of health policy experts, including researchers from the major market-oriented think tanks, who meet regularly to produce statements, hold conferences, and provide policy advice to policymakers and opinion leaders about ideas for free-market health reform.

About the Author

Grace-Marie Turner is president of the Galen Institute, which promotes public education on tax and health policy issues. She speaks and writes extensively on public policy issues, with a focus on the impact of health insurance taxation on major tax reform initiatives. She also is a founding member of the Health Policy Consensus Group, which serves as a forum for analysts from the major market-oriented think tanks to analyze and develop health and tax policy recommendations.

In 1995-96, she served as executive director of the 14-member National Commission on Economic Growth and Tax Reform, chaired by Jack Kemp. Subsequently, she was senior policy adviser to presidential candidate Steve Forbes. From 1996-97, she was vice president for information marketing at the Heritage Foundation in Washington, D.C., where she developed and implemented strategies to reach new and broader audiences with research, publications, and programs. She also had the responsibility of overseeing Heritage’s award-winning web site.

For 12 years, Ms. Turner was president of Arnett & Co., a health policy analysis and communications firm in Washington, D.C., that she founded in 1984.