This paper examines the pros and cons of parallel trade, with special attention to the situation in Europe. But it is of significance in the United States given the probable and impending legalisation of re-importation of Canadian drugs into the US.

It begins with an analysis of the relationship between intellectual property rights (IPRs) and parallel trade, reviewing the arguments for and against parallel trade in pharmaceuticals and the various policies of "patent exhaustion" in an international context.

Chapter 2 considers the case of parallel trade in pharmaceuticals, providing several case studies. The objective is to evaluate the welfare effects of parallel trade in a holistic context, evaluating not only the short-term direct effect on prices but also the longer-term impact on research and development, as well as unintended consequences, such as piracy and counterfeiting.

Chapter 3 reviews the policy responses to parallel trade in pharmaceuticals, cases of litigation against companies aiming to counter the impact of re-importation through restrictive contracts, and legislative action supporting parallel trade.

The paper concludes with a review of recent developments, including the problems associated with illegal re-importation of drugs donated to Africa and other unintended consequences. 2

1. Intellectual Property Rights and Parallel Trade

Intellectual property rights (IPRs) are limited rights conferred by the state for certain ideas and expressions — products of the intellect. Examples include patents, which protect inventions, copyright, which protects expressions of ideas (primarily artistic, literary or musical, but also such things as computer code), and trademarks, which protect brands. 3

Patents confer on inventors the right to exclude competitors from producing, selling and distributing their inventions for the duration of the period of protection, which is usually 20 years after filing. Copyright confers a similar right on artists to exclude others from producing, selling or distributing their expressive works for the duration of their life plus 70 years. Meanwhile, trademarks give their owner the right to prevent others from using identical or confusingly similar marks and names on their products. Trademarks are normally renewable perpetually, but may under some circumstances be revoked (e.g. if a product name has become generic). Patents, copyright and trademark are all transferable.

Exhaustion of Intellectual Property Rights

Because IPRs are conferred by the state, their existence is bound by the geographical limits of each state. Many states apply the “principle of national exhaustion”, which means that the IPR holders’ exclusive rights are extinct upon first sale within national borders. It also means that IPR holders may exclude imports of similar IPR-protected goods legally sold in other countries. For example, if CheapMart buys 10,000 pairs of Calvin Klein jeans in Alabama, it can sell them with impunity in Maine and Montana (subject to any restrictions agreed in the contract of sale), but it cannot legally import them into the UK without first obtaining the permission of the owner of the UK trademark on Calvin Klein jeans.

By contrast, international exhaustion terminates rights upon first sale anywhere, and parallel imports may not be excluded. 4 Some have suggested that a global regime of international exhaustion would enhance welfare by enabling consumers everywhere to take advantage of lower prices. 5 Others have argued that a global regime of international exhaustion would lower welfare of many, especially those in poor countries, because it would actually raise prices in those markets to the international average price. 6

To understand why prices would be affected, it is necessary to consider the impact of national exhaustion on the ability of IPR owners to “price discriminate”. Morris et al. (2002) provide the following discussion of price discrimination:

“The word is technical and has no pejorative meaning. It simply indicates that a product is being sold at different (non-marginal cost related) prices. It can be justified on welfare grounds in that it enables firms to offer products at prices that otherwise they would not. If a firm is unable to price discriminate it will set only one price — and that is likely to be higher than the price that many consumers would be willing to pay. Price discrimination is economically desirable where marginal production costs are very low (as in pharmaceuticals) or close to zero (as in the provision of a service such as the ability to cross a river on an already-constructed bridge).

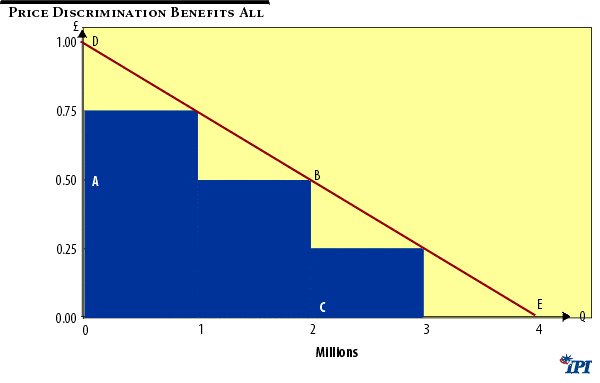

The economic impact of price discrimination can be seen in Figure 1 below. DE represents the demand curve for a medicine. Assume zero marginal production cost. There are three different market segments with differing levels of willingness or ability to pay. These different segments each have the same volume potential, say a million units. The profit maximising price and output level for the firm is to sell 2Q units at 0.5 pounds per unit. Sales and profits (since there are no costs) would be equal to the area ABCO, and provided this area exceeded the expected innovative costs of product development the firm would conduct the R&D and produce and sell the product as described.

Consumers would also receive, ‘free’ as it were, welfare benefits equal to the so-called “consumers’ surplus” triangle ABD.

There are two welfare defects in this situation, however. First, if the innovative costs exceed ABCO ( i.e., 1 million pounds) the product would not be developed, despite the fact that at output level C total welfare (producers’ revenue plus consumers’ surplus) equals ODBC, i.e., 1.5 million pounds. Second, total possible gross consumer welfare is not restricted to ODBC but is equal to the whole area under the demand curve, ODE, i.e., 2 million pounds.

Figure 1

A single uniform price of 0.5 results in a ‘deadweight-loss’ of BCE. But no firm will produce 3 million units to avoid this. To sell these extra units it would have to reduce price to 0.25 and achieve a resulting income of only 0.75 million. The firm would invest up to 2 million pounds in R&D, however, if it could practice price discrimination. This is because, say, it would sell 1 million units to the least price sensitive segment at 0.75; a similar number to the next segment at 0.5; and another 1 million units at 0.25 to the most price conscious market. It would then earn revenues equal to the shaded area in the figure, a number approaching 2 million pounds.

In short, price discrimination enables the firm to service people who otherwise could not afford to purchase its products, it enables it to expand its output beyond the physical level it would select if limited to choosing a uniform, profit maximising price, and since the discriminatory alternative is more profitable, it brings into the firm’s choice set R&D projects which it would otherwise not consider.

Price discrimination thus benefits all. Poorer people less able or unable to pay the normal, uniform profit maximising price gain access they otherwise would not. Today’s medicines, for example, can be made available more cheaply. Producers reap greater profits, increasing incentives for research to develop tomorrow’s medicines more quickly. And a portion of these additional profits comes from the better off who have the most obvious revealed desire to purchas Price discrimination thus benefits all. Poorer people less able or unable to pay the normal, uniform profit maximising price gain access they otherwise would not. Today’s medicines, for example, can be made available more cheaply. Producers reap greater profits, increasing incentives for research to develop tomorrow’s medicines more quickly. And a portion of these additional profits comes from the better off who have the most obvious revealed desire to purchase innovations (as indicated by their willingness to pay) and who tend (sometimes, but not always), to have altruistic feelings toward the poor and less privileged.

The ability to practice price discrimination depends, of course, on the ability to preserve market segments as distinct markets. This requires, in innovative markets, the presence of a degree of exclusivity, usually through the strict enforcement of patents or other forms of IP. In our simple example, with zero marginal costs, competition would drive the price to zero in each segment if there was no intellectual property protection.

By extension, the ability to practice discriminatory pricing also depends on lack of arbitrage or leakage between segments. The firm can only charge the different prices in the segments if it is not possible for a third party to come along and buy cheap in the one segment, and sell dear in another (‘sell dear’ certainly, but at a lower price than the existing firm is currently charging).

So, the truth of the matter is that patent protection combined with price discrimination enables higher rates of economic development through research and development based industry, as well as low-priced essential medicines.

Ideally, companies would be able to segment markets precisely according to the willingness to pay of each individual. In practice the costs of attempting such segmentation would be prohibitive, so simpler solutions are employed. These typically entail segmenting markets by country and then segmenting each country according to several categories, such as: private buyers; corporate purchasers; charitable purchasers and government purchasers. But the twist in the tail is the threat of parallel imports, which would undermine the ability to segment markets by country."

The regulation of parallel imports is, then, fundamentally a trade-off between short-run static costs (which accrue because IPRs create market power) and long-run dynamic benefits (which include raising the speed of innovation and marketing of new products).

Exhaustion and Parallel Imports

Exhaustion policies vary internationally: the European Union pursues regional exhaustion, which means that goods, once purchased, may be freely resold within its frontiers, but parallel imports from non-member countries are excluded. Parallel imports (PI) are “goods produced genuinely under protection of a trademark, patent or copyright, placed into circulation in one market, and then imported into a second market without the authorization of the local owner of the intellectual property right”. 7 (Parallel imports do not include counterfeited or pirated goods, although authorising these imports would seem, in some instances, to have facilitated the entry of such products — see Chapter 2.)

In the USA, the first-sale doctrine is employed (i.e. rights are exhausted when purchased outside the vertical distribution chain). Parallel imports of pharmaceuticals are admissible in the USA; in order to block PI, a trademark owner needs to show that imports are not identical in quality to the original products. However, US patent owners are protected from parallel imports in prescription drugs by an explicit right of importation. (As mentioned in the introduction, this situation is currently being challenged as purchasing drugs online or daytrip shopping in Canada and Mexico is becoming increasingly popular pastimes for US senior citizens.)

There have been some signs of a move toward an international policy in exhaustion. For instance, the World Intellectual Property Organisation (WIPO) considers restrictions on parallel imports to be a natural extension of IPR holders’ rights to control vertical markets, i.e. to retain the right of sole distribution of its products within a given territory. 8 But there is currently no legally binding global agreement pertaining to exhaustion of intellectual property.

The closest thing to a global agreement on intellectual property is the Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS), which is governed by the World Trade Organisation. TRIPS provides for minimum IP standards in all WTO member countries. However, it is silent on the issue of exhaustion. 9

The Motives for Parallel Trade

As mentioned above, parallel trade occurs because of a profitable arbitrage situation between national markets where identical goods are available at different prices. The basic incentive for parallel importing appears when the price differential exceeds the costs of transporting and selling goods across borders. The main reasons for price differentials and hence opportunities for arbitrage are the following:

- IPR protection may vary from one country to another, so that a product may remain under patent in one jurisdiction for longer than it is under patent in a neighbouring jurisdiction. In the latter jurisdiction, the product may then be subject to competition from generic suppliers, driving down the price of the branded product.

- Variations in purchasing power, per capita income and preferences affect demand and market size, reflected in price differentials. Also, rebates negotiated by government or donations of medicines can lead to substantial price differences.

- Government regulation of prices.

- Differing inflation rates, which create exchange rate differentials, which, combined with national price controls, may translate into retail price variations.

- Tax rates, notably sales taxes, may motivate differential international pricing to ensure efficient sales.

- The patent holder may develop various marketing and sales strategies with corresponding price differences for selected markets.

In addition to pharmaceuticals (discussed below), parallel trade exists in many industrial sectors. In 1985, the US Department of Commerce reported rising parallel import volumes in 37 product categories, especially trademarked goods such as “Mercedes-Benz sedans, Opium perfume and Nikon cameras”. 10 One study suggested that these imports were due to the rise in the US dollar and that gray imports occurred because parallel importers were able to get a free ride on the authorised distributors’ marketing costs.

The collapse of several Asian currencies in the late 1990s also encouraged parallel imports into the USA, Japan and Europe of construction equipment, computers, automobiles and branded consumer goods. 11

A study by the Economist Intelligence Unit provided some interesting results by comparing retail prices in the EU:

- among 98 products in four EU countries, only 14 were found to be cheaper in the US

- in France, which has never practised international exhaustion, 57 of the 133 products studied had the lowest prices

- whereas the UK, Sweden and Germany (which do practice international exhaustion) had the lowest prices for, respectively, nine,18 and 49 of the 133 products in the sample 12

Based on this evidence, international exhaustion cannot be said to definitively promote lower prices, even when parallel trade is present.

Parallel Trade in Pharmaceuticals

One characteristic of re-importation is that although legal, it is rarely fully accounted for. Within the European Union, re-imports are estimated to represent $3.3 billion in 2001 and forecast to rise to $7.4 billion in 2006, i.e. more than double in volume over the next few years. 13 The same source estimated that re-import penetration amounted to 7% to 8% of the total prescription market in late 2001 and would rise to 10% by 2006. The research-based industry in Europe estimates the income loss to be €5-7 billion ($5.5-$7.6 billion) in 2001. 14

To understand why parallel trade has particularly affected the pharmaceutical industry it is necessary first to understand a little about the industry. Gudmundsson 15 provides an extensive study of the pharmaceutical industry. His argument may be summarised as follows:

An industry protected by patents: Because drug molecules are easy to copy, patents are a necessary and even fundamental condition for development of new drugs. (Some high-tech industries have such high fixed costs that their products may only be copied by a handful of competing firms and with delay; therefore, patent protection becomes in fact less relevant. Some sectors also develop so rapidly that the competitive advantage amounts to being first on the market, which makes patent expiry of little interest.)

A research-intensive industry: Pharmaceutical companies develop and market new products in order to maintain and increase their market share; innovation is accordingly paramount to survival. Research and development costs have risen very rapidly over the past three decades. In 1970, annual R&D expenditure in the US pharmaceutical industry amounted to $600 million, to $9.6 billion in 1991 and to $11.1 billion in 1992. Unfortunately, this rise has not yielded a proportional increase in the number of new drugs: In the 1970s, 30 to 40 new drugs were put on the market each year, compared to 10 to 20 in the 1980s.

A highly regulated industry: The therapeutic nature of pharmaceuticals leads governments to establish strict rules before a new drug is approved for sale. The result is new medicines are delayed in reaching the market and R&D costs increase due to rigorous testing procedures. The flip side of regulations is that health care policies in industrialised countries mean that patients only pay a fraction of real drug costs. This does not encourage doctors, hospitals and patients to seek out the most cost-effective drugs.

A competitive industry: Increasingly, brand-name manufacturers have to tackle competition from generic producers once patents expire. Marketing of generic products may in some cases reduce the prices of branded drugs by at least 50%. In 1992, generic products represented 43% of prescription drugs in the UK.

An industry seeking new markets: Due to saturated and highly regulated markets in the West, the pharmaceutical industry is increasingly searching for new outlets in the newly industrialised countries and in developing countries.

The pharmaceutical industry tends to be considered as a monolith composed of a few multinational companies, but it is easy to distinguish four different kinds of enterprises: 16

- Research-based pharmaceutical and vaccines companies, relying on patent protection to recoup their investments;

- Companies selling branded OTC (over-the-counter) medicines;

- Manufacturers of generic products (selling branded or unbranded versions of off-patent products);

- Companies selling copies of patented products, and in certain cases counterfeit products. Some companies break patent and other laws but some manufacturers of unlicensed copies of on-patent medicines, such as Ranbaxy, Cipla and D r . Reddy’s in India, operate legally because there is currently no patent protection for products in India.

Various figures are cited to justify the patent protection enjoyed by the first category of companies, which invest considerable sums in research and development of new products. The latter is estimated to amount to 15%-20% of revenues. The R&D costs have increased substantially in recent decades; a 2003 study by the Tufts Center for the Study of Drug Development puts the cost of developing and marketing a new pharmaceutical product at approx. $900 million. 17

A Necessary Trade-off: Risk Taking vs. Public Safety

The discussion on the price of new medicines frequently overlooks the regulatory impact; however, a large part of the final cost may be attributed to the number and length of compulsory clinical tests, as well as to the relative efficiency of the authorities in charge of approving new drugs.

The costs and benefits of the development of new medicines are germane when considering an optimal equilibrium between the incentives granted to innovative companies and the simultaneously urgent needs of speedy approval of new medicines and legitimate safety concerns. However, the incentives governing regulators and inventors are largely different. The former risks dismissal by his superiors, and potentially even criminal action, if a drug is approved and subsequently proves damaging; but he will receive none of the benefits from a rapid approval of a new drug. The cost of delays in the regulatory pipeline are borne by industry and ultimately by consumers.

During the 1960s, regulatory policies in the US became more severe than regulations in the United Kingdom. A 1976 study 18 shows that the impact of the US regulations significantly delayed the arrival of new drugs on the market: From 1950 to 1961, the number of new drugs on the American market was on average 56 per year; between 1962 and 1976 it had fallen to 17 per year. Grabowski also found that this reduction was much greater in the US than in the UK, France or West Germany during the same period.

Another study19 examined the effect of the new regulations on research opportunities in the US and the UK. The authors assumed that factors unrelated to regulation would reduce the research intensity in both countries, but that for reasons linked to regulation this reduction would be greater in the US. The results showed that between 1960-61 and 1966-70 research productivity dropped six-fold as compared to three-fold in the UK. The study also confirmed that the concomitant decline in profitability induced US pharmaceutical companies to relocate their research abroad. The percentage of total research investments overseas increased from 9.9% in 1972 to 15.4% in 1974. 20

Because of stricter regulations in the USA, American pharmaceutical companies thus decided to shift their research efforts and sales to overseas markets. Grabowski notes that, on average, new regulations doubled the development and marketing costs for new drugs. Peltzman states that the net cost of regulation introduced in 1962 amounted to $250 to $350 million, or 6% of total drug sales (in 1974). 21 The impact of the regulations was wider felt: during the period 1961-73, only 9% of new drugs were first marketed on the US market. 22 It is reasonable to conclude that regulations may thus be held partly responsible for the phenomenon of concentration in the US pharmaceutical industry.

Considering the theoretical consumer benefits of a strict approach to approval of new drugs, one might surmise that US policy would prove superior. In fact, Wardell 23 has shown that for nine different therapeutic categories, the number of new drugs launched on the UK market between 1962 and 1971 was 50% higher than in the US, without registering a higher proportion of serious accidents.

Parallel Trade (Re-importation) in Practice

How does parallel trade work? Several actors are involved: First, the parallel importer chooses a source country, such as Greece, where the target product has a low price relative to the same product sold by the original manufacturer (or a licensee) in the import country, e.g. Finland. The target product is in most cases a new, innovative medicine offering a high price differential and therefore a high profit margin in the import country. According to one report, a margin below 15% is very unlikely to be worthwhile for a parallel trader. 24 Other factors determining the choice of target product are the patient population, formulation, transport, re-labelling and storage requirements.

The parallel importer, generally a small independent wholesaling firm, must then repackage the product, sometimes replace labels and add new notices in the language of the importing country. Apart from the EU regulations, the parallel importer has to conform to national regulations, i.e. the relevant government agency has to give its permission for sale of the re-imported product. The latter must also be identical to the drug registered in the importing country. In order to establish that there is no undermining of quality, the competent authority in the import country will contact its counterpart in the exporting country to receive documentation on the product in question. In some countries, there is also a specific authority governing prices on pharmaceutical products, including re-imported products.

The parallel importer buys chiefly from retail vendors in other EU countries. The retailers in turn make their purchases either directly from the original manufacturers or from licensed resellers. In most European countries, there are several retailers that work mainly on a regional basis.

Other actors, who are not directly involved in parallel trade, may nevertheless influence the conditions under which re-importation takes place. These include physicians who may or may not choose re-imported medicines when they make prescriptions. Similarly, pharmacists may have incentives to promote re-imported products over alternatives. Finally, consumers have their own reasons for discriminating between parallel imported pharmaceuticals and products from licensed providers.

Prescription drugs are also, generally, contingent on some form of insurance scheme where the government is one influential partner. In this respect, the insurer has an incentive to make sure that expenditure is not higher than absolutely necessary and therefore to steer consumption toward cheaper alternatives when available.

Parallel traders are subject to obtaining a product license, the requirements being an issue for national legislation:

- The re-importer must meet the standards for pharmaceutical companies.

- The re-importer has to obtain a license for parallel trade, although he may reference the marketing authorization of the original manufacturer .

- The re-importer must show that the imported product is identical to the version existing on the national market .

2. Case Studies

This chapter contains a review of re-importation in the European Union, the US and Canada. The impact of parallel trade in the latter category remains modest, but recent legal and economic trends point to a considerable development potential. As world trade is expected to increase dramatically in the next few decades, the conditions for re-importation will be affected.

The European Union

In the EU, the legal foundation of parallel trade (or parallel distribution) is found in Articles 30 and 36 of the Treaty of Rome, which authorise the free movement of goods and confer the right to control the import of goods by national governments, provided the products are not harmful or pose a threat to the public. A second, equally important support within the EU legal framework is the Trademark Directive (1989), which upholds the principle of international exhaustion of intellectual property rights. However, exhaustion will not apply where there are “legitimate reasons” for a trademark owner to oppose further commercialisation of the goods “especially where the condition of the goods is changed or impaired after they have been put on the market”. In 1999, the European Court of Justice added that a trademark owner may not hinder the sale of a re-imported product carrying his trademark if its original packaging has been modified in a way that is objectively necessary to permit its sale in the importing member country. 25

Parallel trade occurs when a trading firm buys IP-protected goods (such as prescription drugs) in one country (e.g. Spain) and imports them to another, for instance Germany or the Netherlands. This procedure necessitates no formal permission from the original rights holder (the patent owner), as the European Union is legally a single market. From the outset, the European Court of Justice has declared that, in the context of patented goods, the free circulation of goods takes precedence over intellectual property rights. The various cases that have been brought before the Court are concerned with alternative strategies to protect IPRs, such as dual pricing, supply restrictions, packaging and trademark infringement. 26

Total pharmaceutical production in Europe in 2001 amounted to € 130 billion ($140 billion) and an estimated € 138 billion ($150 billion) in 2002. The industry employed approximately 560,000 people in 2002 of which 82,500 were in research and development.

The European share of the world pharmaceutical market declined from 32% to 22% over the past decade; the US share increased from 31% to 43%. Similarly, in 1990 major European research-based companies spent 73% of their global R&D expenditure in the EU, but only 59% in 1999. On average, European countries spend 8% of GDP on health care compared to about 14% in the US. 27

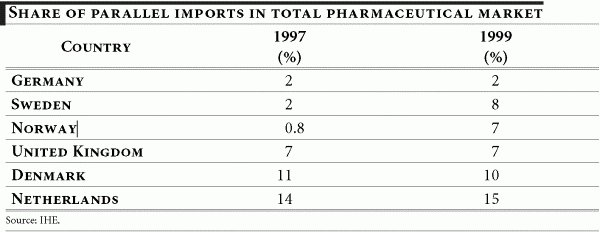

Parallel trade in pharmaceuticals in Europe first appeared in the early 1970s, primarily in Germany, the Netherlands and the United Kingdom. Today these countries — along with Norway, Denmark and Sweden — continue to account for the highest proportion of parallel imports in the pharmaceutical market.

According to various estimates, more than 10% of prescription drugs in Europe are re-imported. The recourse to parallel trade is expected to intensify, as governments and public health services increasingly seek ways to curb health expenditure. The rise in re-imported medicines may to a large extent, be attributed to the incentives for their use given to hospitals, physicians, pharmacists and patients.

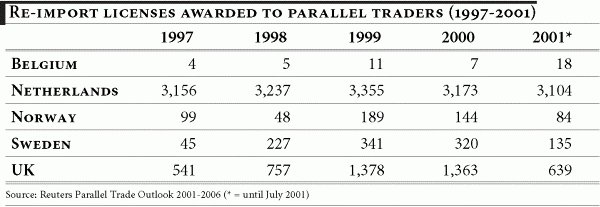

Table 2

Pricing and Re-import Licensing

Pricing and pricing transparency are paramount for evaluating the impact of parallel trade. The EU Directive 89/105 requires national governments practising price controls to publish their pricing policy. Compliance makes it possible to verify that medicines are priced in a reasonable manner. Government pricing will determine the conditions under which parallel traders may intervene to exploit the price differential.

In the EU, a parallel trader needs to obtain a Parallel Import Product License (PIPL), issued by national agencies or by the European Medicines Evaluation Agency (EMEA, established in 1995). The number of PIPLs has increased substantially in recent years. The European Association of Euro-Pharmaceutical Companies (EAEPC) 28 actively promotes the increase of parallel import licenses, with the goal of promoting free movement of medicines within the EU.

The EAEPC is thus at odds with the European Federation of Pharmaceutical Industries and Associations (EFPIA) 29 and the International Federation of Pharmaceutical Manufacturers Association (IFPMA) 30 , which endeavour to uphold the research-based pharmaceutical companies’ efforts to defend product patents and trademarks. Whereas the former sees itself as a partner in the efforts to complete and consolidate the EU market in terms of free trade, the latter view this approach as fundamentally detrimental to intellectual property rights.

An obvious goal for pharmaceutical companies in Europe would be to obtain, ideally, free pricing for their products and thus the option of price discrimination, i.e. setting prices according to purchasing power in each market segment. This would also usher in a truly single market. However, a single pricing policy is unlikely in the short term, as it would mean repealing national price controls. It also does not make much sense as long as national governments retain the control over healthcare and reimbursement policies. Therefore, as one observer remarks, “it tackles the symptom - parallel trade — rather than the malady itself — market distortion”. 31

It should be stressed that pricing works both ways: in response to parallel trade, research-based companies endeavour to create a price corridor (a 5% to 10% price band around the price set by manufacturers). In the absence of a uniform pricing policy in the European Union, this could work to stave off parallel traders. However, taking into account national regulations on drug prices, which will not be abolished within the foreseeable future, uniform pricing within Europe is not likely to be on the short-term political agenda of the EU.

The advent of the Euro currency has reduced exchange rate differentials and hence improved price transparency within the current 12 members of the European Monetary Union (EMU). However, re-importers may still enjoy exceptional profit margins in for instance the UK and Sweden, which retain national currencies.

An important initiative on pricing occurred in late 2000 when the EU Commissioners Liikanen and Byrne set up the High Level Group on Innovation and Provision of Medicines. Its report was submitted to the European Commission president in May 2002. Analyzing the report, a recent document 32 focuses on its Recommendation 6:

That the Commission and Member States should secure the principle that a Member State’s authority to regulate prices in the EU should extend only to those medicines purchased by, or reimbursed by, the State. Full competition should be allowed for medicines not reimbursed by State systems or medicines sold into private markets.

While apparently innocent, this statement represents a major step toward creating a European free market in pharmaceuticals. This would improve the competitiveness of the European industry and thus improve price transparency and consumer benefits. The major benefit of the recommendation is to distinguish between reimbursed drugs (imposed by healthcare providers and largely financed by government) and drugs that are not reimbursed and which therefore should be subject to market pricing.

As pointed out in the CNE White Paper, this recommendation offers a win-win situation: While granting member states continued control over national health care, it opens the way for the creation of an embryonic free market in pharmaceuticals. This would also bring the internal market of medicines in line with competitive conditions applied elsewhere. Finally, it would help eliminate some of the distortions from parallel traders.

In the following section, a summary of policy issues and the impact of parallel trade in a selection of countries are discussed.

Germany: Europe’s Largest Market

As the biggest pharmaceutical market in the European Union by volume and value (and the third largest market worldwide), Germany is a prime target for parallel trade. This has been exacerbated by recent policy initiatives to substitute re-imported products and generics for brand names.

Parallel trade has grown exponentially since 2000 following the enactment of a law requiring pharmacists to replace brand names with re-imported drugs when the latter are at least 10% cheaper. Between 1998 and 2001, the parallel trade more than trebled, from 260 to more than 800 million euros. The market share of re-imported drugs increased from 1.8% in 1998 to 5.8% in January 2002. 33 German parallel traders also enjoy considerable support from legislators in achieving such growth. A law introduced in 2001 makes it mandatory for pharmacists to supply low-priced alternatives (re-imported products or generics) whenever possible. This substitution practice forces pharmacies to have a minimum sales quota of re-imports of 5.5% in 2002, increasing to 7% in 2003.

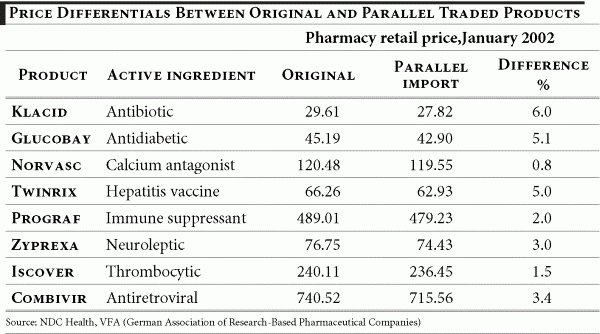

As noted by the German association of research-based pharmaceutical companies, “no other business enjoys such a guaranteed sales increase.” 34 Whereas one of the explicit policy goals in promoting parallel imports is lower prices (at least 10% cheaper than branded products) recent data show that the price differential between originals and parallel traded products has shrunk substantially. A study of eight products, representing around 17% of re-imports shows that in no single example was the 10% target reached: The largest difference was 6% and for half of the products in the sample the difference was only 3% or less. To the extent that price comparisons are possible over the last three years, price hikes for parallel imports exceed those of original products.

Table 3

As the public sector increasingly experiences a lack of funding and lower quality in services, patients are turning to private alternatives. The German system is two-speed, i.e. privately insured patients and patients insured by the public regime receive different treatment and pay accordingly. In an attempt to boost recourse to public healthcare, the government decided in 2002 to increase the minimum income required of consumers to be eligible for private health insurance.

Parallel trade in Germany is forecast to increase, accounting for $3.6 billion or 9% penetration by 2006. Prospects for re-importation are positive, despite recent developments where the largest importer Kohl-Pharma was indirectly involved in the illicit re-importation of medicines destined for Africa. Price-reduced AIDS medicines from GlaxoSmithKline were sent off only to reappear on the European market. 35

Despite resistance from pharmacists, re-import substitution is an important policy instrument for cost containment. In the early 1990s, a series of government decisions aimed at curbing the cost of prescription drugs yielded an 11% drop in sales. Meanwhile, because of these budgetary measures, two major generic producers (Ratiopharm and Hexal) doubled their market share to 20% of the total. 36

The issue of conflicting goals between government policy and pharmaceutical companies may be further illustrated by the recent case where the German government decided to cut drug prices. 37 This followed a 2002 agreement where major pharmaceutical companies had donated € 200 million to the German public health-insurance system, while receiving a guarantee that legislators would not modify current pricing for the next two years. But in November 2002, the government announced it would cut prices by 6% in 2003. Officials claim that the deal was made on the understanding that companies would keep their own prices under control. Instead, the German government claims that companies have increased the price of many drugs outside its control, thus contributing to a 15% rise in prescription drug costs over the last two years. Pharmaceutical companies have reacted by reconsidering or cancelling investment plans in Germany. 38

The UK: A Champion of Parallel Trade

It is estimated that 90% of UK pharmacists source products through parallel trade. According to the Consumers’ Association, this would save the National Health System (NHS) approximately £80 million a year. The United Kingdom is indeed a major destination for re-imports in Europe with an estimated drug expenditure of $8.4 billion in 2000. One source indicated that by late 2002, 20% of all UK prescriptions would be re-imports. 39

There is no direct pricing control for pharmaceuticals, but the government has introduced several measures destined to cut prices. One peculiar feature of the UK situation is that of the pharmacist “claw back” system: This means that the NHS claims back around 9% of pharmacist revenues, whether parallel imported products are sold or not. In other words, the cheaper the price of the product (notably re-imports) the greater the profit for the pharmacist — profitability rises with the proportion of re-imported products sold. This translates into substantial savings for the public health system; in fact, the lion’s share of this amount accrues to the pharmacists (the estimated total being in excess of € 164 million ($175 million) between 2001 and 2002). 40 An important additional aspect is that the parallel trade remains unregulated; therefore, substantial potential tax revenues are not accounted for in the general balance when the savings of parallel trade are estimated.

The United Kingdom has higher drug pricing than most other members of the European Union and is therefore a major parallel importer of cheaper medicines, mainly from southern Europe. Licenses granted for parallel imports went from 426 in 1995 to 1,363 in 2000 and applications keep coming in faster than licenses are issued. 41 The UK is forecast to have the third highest penetration of re-imports (11%) after the Netherlands and Denmark in 2001. Parallel trade volume increased by 38% in 2001 and an estimated 20% at the end of 2002. The Association of British Pharmaceutical Industries puts the loss of income at £ 1 billion per year ($1.66 billion). 42 As the UK remains outside of the Euro, there are substantial profits to be made from exchange rate differentials. This factor is expected to remain the chief driver for re-importation growth.

The Medicines Control Agency (MCA), established in 1989, is the main authority for controlling medicines in the UK. However, the agency seems to pay little attention to the complaints from major pharmaceutical companies concerning breaches of regulations, such as repackaging rules (parallel traders are obliged to submit the modified trade dress to the original manufacturer). 43

Sweden: A Strong Newcomer

The first re-import license in Sweden was granted in 1996 and the first parallel traded product appeared on the market in early 1997 (the anti-ulcer medicine Losec). The number of PIPLs increased exponentially in 1998-2000, but decreased in 2001 as the market expanded. In 2000, parallel imports included 137 products and 8.6% of total pharmaceutical sales (or SEK 1.7 billion). 44

Interestingly, until 1996 Sweden granted patent protection only on pharmaceuticals for the manufacturing process and for the product itself. According to one author, Sweden could thus develop its industry by chiefly copying foreign products, which enabled the country to eventually acquire the necessary resources to produce its own medicines with an added therapeutic value. 45

There are currently 10 parallel trading companies in Sweden, sourcing products mainly from southern Europe. Pricing is the chief determinant for the decision to import, but according to the IHE survey of parallel traders, reliable delivery is almost as important. Swedish parallel traders deliver exclusively to the government-owned pharmacies and compete on the basis of price, packaging and delivery guarantees.

AstraZeneca is the producer most affected by parallel trade since it produces half the products re-imported into Sweden. This means products already manufactured in Sweden are those mainly re-imported into the country. In many cases, these are products that have a higher price in Sweden than in other European countries. Indeed, in the case of certain products the original manufacturer has lost almost all of its domestic sales due to parallel imports. 46

This may have far-reaching consequences for the employees in the concerned company, as pointed out in the IHE survey: When most of the sales are represented by re-imports, employees lose the incentive to market and provide information about the product as the benefits accrue mainly to the parallel trader.

From a regulatory point of view, there is a clear difference between original manufacturers and parallel traders: The Swedish authority (Läkemedelsverket) governing pharmaceutical products accepts foreign labels on parallel imports, although this has led to complaints from pharmacists. Secondly, the authority asks higher fees from direct importers than from parallel traders, which are also exempt from the safety requirements applied to the original producers. This constitutes an important safety concern, as re-imported products may not be recalled as easily as regularly supplied medicines that enjoy secure tracking through distribution protocols. From a regulatory point of view, there is a clear difference between original manufacturers and parallel traders: the Swedish authority (Läkemedelsverket) governing pharmaceutical products accepts foreign labels on parallel imports, although this has led to complaints from pharmacists. Secondly, the authority asks higher fees from direct importers than from parallel traders, which are also exempt from the safety requirements applied to the original producers. This constitutes an important safety concern, as re-imported products may not be recalled as easily as regularly supplied medicines that enjoy secure tracking through distribution protocols.

Producers consider, unsurprisingly, that parallel trade should be banned as long as the pricing of medicine is regulated: If pricing were free, the research-based companies would be able to counter the parallel traders by adjusting their prices accordingly. In Sweden, a pharmaceutical firm may not increase a price that has been set, which means that companies take good care before cutting prices. The alternative would be refusing to supply a country, which does not accept the price demanded by the manufacturer. So far, this strategy has not been used, but the producers think this may prove necessary in order to restrict parallel trade. 47

The Netherlands

The Netherlands probably has the highest penetration of parallel imports in the EU in 2001: 15% of the total market, forecast at 16% in 2006 (or $1 billion). As underlined by one source, the country also benefits from the proximity to Belgium, which allows both for cheap imports and a minimum need for repackaging because of the languages being similar. 48

There is also the danger that illegal imports of medicines will be sold at a large discount or given away to developing countries, but subsequently smuggled back into Europe. In October 2002, the Dutch customs dismantled a network of illegal importation of antiretroviral drugs, manufactured by GlaxoSmithKline, representing an amount of €15 million ($17 million). After having been shipped to Africa, the drugs returned to the Netherlands by means of a Dutch importer.

France

Due to relatively low drug prices, France is essentially a parallel exporter of medicines to other EU countries. Prices are close to the European average, although more than 20% lower than in the UK and Germany, and more than 30% above Spanish prices. By comparison, an identical drug will be sold at € 10 in France, € 7.5 in Spain and Portugal and at € 12 in the UK and Germany. 49

France has the highest consumption of medicines in Europe. As noted by one study, in 1992 the average Frenchman spent $136 on drugs whereas in the UK per capita drug expenditure amounted to $65, “without the latter being twice more likely to die than the former”. 50

Like all other EU countries, the French government has attempted to curb the rise in healthcare spending (9.5% of GDP in 2000) at several occasions, so far unsuccessfully. The Raffarin government has increased its use of generic products as a key component of its efforts to reduce the deficit in the social security budget. (Spending on pharmaceutical products represented 1.92% of GDP in 2000, which puts France in second position after the USA.) 51 In exchange, the government has proposed that pharmaceutical companies be free to set their own prices for innovative drugs. This initiative is welcome as it will contribute to speeding up the actual marketing of new products. Generally, innovations tend to arrive on the French market several months after their introduction in other EU countries; the additional delay estimated by the Health Ministry is 70 days. France is the laggard in Europe: On average a new product takes a year to reach the market, compared to a month in Germany.

The French pharmaceutical industry has lost its competitive edge in terms of innovation: it went from number two worldwide in 1970 to number seven in 1995. Due to the system of guaranteed prices, research and development progressively lost its importance, inducing firms to invest more resources into existing products. As one commentator summarized the situation, “we lived in extraordinary comfort in an extremely closed-up market. The system of social protection amounted to protecting the industry.” 52

This situation is likely to change as the government proposes to remove 650 drugs from the list of reimbursed medicines. For generic products, the refund would be based on the cheapest generic; this price would be set by law and for each class of generics. At the same time, the government plans to fight parallel imports by fixing prices close to the European average price level for new products. The EU average would be used to set retail prices, and the difference between the old and the new price would be paid to the Sécurité Sociale by the pharmaceutical company (the current French prices being 15% below the European average). 53

The EU Council Draft Regulation (30 Oct. 2002) and the French response

A report by the French government was published in February 2003 in response to the EU draft regulation aimed at avoiding “trade diversion into the European Union of certain key medicines”. 54

Although nominally a part of the current French government’s policy for health care reform, it puts forward a number of proposals that show a close understanding of the delicate balance between safeguarding intellectual property and the need to find ways to expand access to vital medicines in developing countries. If adopted by the French minister of foreign trade, it could become a formal proposal to the EU. Whereas the number of revealed frauds is limited, the report underlines the potential threat of re-imports.

The report identifies four major problems that confirm the importance of the issues already discussed above:

- In view of the illnesses involved, the threats of re-imports will be greater for the products not covered by the EU regulation; therefore, the provisions may aggravate the problems it aims at solving.

- The countries in the draft regulation, e.g. India and China, may in fact suffer from gaining access to cheap medicines, insofar as they have growing pharmaceutical industries. Conversely, these countries have been known to insufficiently enforce intellectual property rights.

- The report suggests marking the packaging of medicines destined for developing countries in order to avoid product diversion (i.e. diversion of medicines back to the exporting markets); but this very initiative may actually facilitate parallel trade and fraud; it would be more useful to mark the medicines themselves and not the packaging, both for delivery to developing countries and from south to north.

- Pricing: two solutions were suggested. The first would mean that the retail price would not be more than 20% above the average producer price charged by the manufacturer on the OECD markets. The second proposal entails a price corresponding to the manufacturing costs, plus a maximum markup of 10% (subject to control and approval by an independent auditor designated jointly by the manufacturer and the European Commission).

The report subsequently presents 10 proposals which, if agreed to by the French minister, could constitute the country’s reply to the EU draft regulation.

EU Enlargement Toward the East

The future inclusion of 10 states55 situated in Central and Eastern Europe will provide an additional challenge to the EU single market as the new members offer several conditions for parallel trade: trademark regulations, considerable price differentials and in some cases lack of patent protection in the future member countries.

An attempt has been made to limit parallel trade through the inclusion in the accession treaty of a regulatory ban, i.e. the EU will refuse to grant re-import licenses for drugs which do not enjoy patent protection in the new member countries. The Czech Republic, Estonia, Hungary, Slovenia and Cyprus have accepted this provision, whereas Poland has not. As the latter has an important pharmaceutical industry and enjoys low prices, it is expected to become a prominent source of parallel trade.

The USA: A High Potential for Parallel Trade

Being practically the last free market for drugs in the world, as well as the largest market, the US pharmaceutical industry is a potentially enormous target for parallel traders.

On 31 July 2002, the Senate approved a bill (S. 812) that, along with its main provisions dealing with speeding the entry of generic drugs to market, included an amendment to allow pharmacists and wholesalers to re-import prescription drugs from Canada to the U.S. However, the bill also required the secretary of Health and Human Services to certify that the legislation would pose no public safety risk in order for it to be implemented. It also required the HHS secretary Tommy Thompson to certify that drug reimportation from Canada would result in “a significant reduction” in the cost of prescription drugs to consumers.

In fact, it was very unlikely that Secretary Thompson would issue such certifications, given that he had refused to do so in 2001, after a somewhat similar reimportation measure had passed Congress and was enacted into law in October 2000. The Bush administration thus confirmed the decision made by the Clinton administration in July 2001, and congressional efforts to enact revised versions of reimportation authority ceased during the last Congress. 56 However, the HR Bill 2427 which would authorize re-importation of prescription drugs from Canada and Europe, was expected to pass in late July 2003. 57

Authorizing parallel imports may open the door to fake products. In March 2003, a Florida state agency discovered counterfeit drug traffic thought to involve more than 50 wholesalers selling drugs which are either counterfeit or obtained fraudulently. According to the report, the number of criminal wholesale drug cases has increased from practically zero to more than 50 since 1999. 58

Canada: Exporting Price Controls

As a country with substantial regulations and price caps on pharmaceuticals, Canada has major potential for expanding parallel trade in North America in coming years, provided the US authorities remain tolerant of the increasing “medical tourism” from senior citizens.

In late January 2003, GlaxoSmithKline (GSK) decided to suspend its exports to Canada, a move that drew the ire of US citizens who had grown accustomed to buying their drugs cheaply from the 80 online pharmacies in Canada, or by making day trips across the border. In reaction, they launched a boycott against the GSK non-prescription products, “Tums Down to Glaxo”. On 13 February 2003, members of Congress introduced a bill to “preserve the access to safe and affordable Canadian medicines”. The sponsor, Rep. Bernard Sanders (Vermont) has even financed trips by coach to Canada for this purpose. In late February 2003, Sen. Feingold (Wisconsin) introduced a bill, proposing to deny tax breaks for pharmaceutical companies that reduce their supplies to Canada.

Eli Lilly also notified its Canadian wholesalers that any sales to Canada-based pharmacies reselling to the US would amount to a breach of contract. 59 In early April 2003, AstraZeneca followed suit by announcing delivery restrictions to Canada. 60

After some hesitation, the US Food and Drug administration decided to step in, warning US companies that they are liable under civil and criminal law for making re-importation of drugs from Canada possible. (Legally, only a drug manufacturer and its wholesalers may import medications.) The FDA has been careful not to target US consumers who still enjoy the right to bring small quantities of medicine into the country for personal use.

The growth of Canadian online pharmacies is believed to produce shortages for Canadian consumers, as US citizens have reportedly begun to organize “Tupperware” sales parties with representatives of Canadian pharmacies. 61 The number of Internet pharmacies in Manitoba alone rose from 30 to 51 in the first quarter of 2003; more than half of Canada’s 80 online pharmacies are based in this province, some of them filling 2,000 drug orders a day. 62

Summary Remarks

Numerous studies are available on the impact of parallel trade, yet any attempt to substantiate claims on the costs and benefits of the phenomenon is bound to stumble on the lack of empirical data. To the author’s knowledge, no expert analysis currently available advances solid proof of the welfare effects of parallel trade in either direction.

Although empirical studies have found that drug prices subject to competition from parallel imports tend to increase less than those of other products, the impact of re-importation is not clear cut enough to confidently make policy recommendations on economic grounds, neither for a global ban on parallel imports, nor for a global regime of exhaustion of intellectual property rights. 63 Econometric analysis (cf. Ganslandt and Maskus) concludes that rents to parallel importers (or adjacent costs) may well exceed the consumer gains in form of lower prices. Similarly, the IHE study concludes that parallel trade in pharmaceuticals may give incentive to both price increases and reductions in different markets, but that on balance consumer benefits (price savings) may well be outweighed in some cases by the extra costs incurred by pharmacies and profits made by parallel importers. 64 In concluding his study for the WIPO, Maskus remarks that “modified restraints” on parallel trade in pharmaceuticals “are in the global interest”. 65

The OECD synthesis report 66 makes no recommendations, but lists four reasons explaining why policy decisions on parallel trade remain contingent on national considerations. The degree of competition determines to a great extent the welfare effects of exhaustion policies. Second, changes in re-importation policies may modify the behaviour of private actors which then influences the extent of parallel trade and its effects on global welfare. Third, should bans on parallel imports prove conducive to welfare, this does not per se constitute a policy recommendation; other instruments may prove superior in achieving this goal. Fourth, policy hinges on various factors and determining the impact of parallel trade needs to take into account more and better data.

Although the OECD report draws on numerous studies, it only cites a few of them to discuss the net outcome of parallel trade. It should be underlined that the report is concerned with parallel trade in a variety of sectors and not confined to pharmaceuticals. Indeed, a major source of information is the 1999 NERA study 67 commissioned by the EC. This survey explicitly excludes the pharmaceutical industry due to the specific nature of its products and the ensuing regulatory problems. However, this study deals parenthetically with the pharmaceutical industry by stating that trademark holders in the EU could be disadvantaged by re-importation, but equally disadvantaged by parallel exports from the EU.

It should also be noted that an increase in parallel trade does not mean an automatic increase in the trade balance, e.g. products from a firm based in the United States, which are exported to the European Union and then re-exported to for instance Japan, will be registered on both sides of the trade ledger.

In summary, the net effect of parallel trade may not be established empirically, be it for pharmaceuticals or for other products. However, other factors are of interest for judging the impact of parallel imports.

3. Policy Issues and Recent Debates

The discussion on parallel trade has been fuelled by several recent cases brought to the European Court of Justice (ECJ) and its Court of First Instance (CFI). Below the reader will find a summary account of the various cases that will give jurisprudence further weight and, presumably, set the stage for the future treatment of parallel trade within the European Union.

The key cases cited are still waiting to be resolved, however; even isolated facts brought up by the court will have an incidence on the relationship between pharmaceutical companies, parallel traders and relevant authorities. Indeed, the arguments give a good picture of the necessary tradeoffs, while leaving the detailed enforcement essentially to national jurisdictions. There is an undoubted paradox created within the European Union through the existence of a supposedly single market which, in fact, suffers from the lingering national price controls on pharmaceuticals.

As far as the pharmaceutical industry is concerned, major challenges to parallel trade involve supply restrictions, dual pricing and trademark infringement.

Cases of Litigation

1 - Supply Restrictions: The case of Bayer

In October 2000, the European Court of Justice delivered its judgment on the case where Bayer had imposed supply restrictions in order to prevent parallel imports. The ECJ established that these restrictions did not contravene European competition rules as long as these were not adopted pursuant to a concurrence of wills between the manufacturer and domestic suppliers and did not amount to an abuse of dominant position.

The case dates back to 1991 when Bayer was first accused of limiting supplies of its anti-hypertensive drug Adalat in France and Spain. As prices for Adalat were lower in the latter countries, demand trebled suddenly which resulted in considerable parallel trade from France and Spain to the UK. Bayer reacted by introducing a policy of supplies corresponding to previous levels, allowing for a 10% increase compared to this level. The European Commission responded by claiming this policy reflected a tacit agreement between Bayer and its wholesalers with the aim of restricting exports from Spain or France.

The European Commission first fined Bayer €3 million ($3.4 million) for infringement of EU competition rules. This was later overruled by the Court of First Instance, which dismissed the contention of an export ban as unfounded; no such evidence could be found, nor of any intention by wholesalers to adopt Bayer’s anti-parallel trade policy. The CFI observed that re-imports continued on a smaller scale after Bayer introduced its policy, and established that a non-dominant company should enjoy the freedom to lay down its activities as it sees fit, “providing [...] there is no concurrence of wills between him and his wholesalers”, even if the aim is to prevent parallel importers. 68

Also, the court observed that the Commission’s proposition of extending competition rules would lead to the paradoxical situation where a refusal to sell would be penalised more severely (based on Art. 81 of the EC Treaty on restrictive agreements) than with regard to Art. 82 (abuse of dominant position). A refusal to supply is prohibited under Art. 82 only if it constitutes an abuse. In conclusion, the Court remarks that:

“[n]or, finally, can the Commission rely in support of its argument upon its conviction, which is, moreover, devoid of all foundation, that parallel imports will in the long term bring about the harmonisation of the price of medicinal products. The same applies to its claim that ‘it is not acceptable for parallel imports to be hindered so that pharmaceutical undertakings may impose excessive rates in countries not applying any price control in order to compensate for lower profits in Member States which intervene more on prices.” 69

However, the Commission has appealed and is supported by the German Association of Importers of Pharmaceuticals (BAI) and the European Association of Euro-Pharmaceutical Companies (EAEPC). The Commission argues that the court has departed from earlier case law by adopting too strict an interpretation notably of the term “export ban”. The case could take several years to resolve, but in the meantime it should be noted that this is a first significant, preliminary victory in terms of opposing parallel trade on legal grounds.

More recently, GlaxoSmithKline has been criticised for threatening to cut short its supplies to Canadian wholesalers and retailers (see Chapter 2). US legislation does not allow for imports from Canada, but increasingly US citizens take advantage of the possibilities offered by day trips and mail order firms. 70

2 - Dual Pricing: The Case of GlaxoWellcome (GSK)

While Bayer was under investigation for supply restrictions, Glaxo Wellcome (now part of the merged GlaxoSmithKline) was also targeted by the European Commission for having signed an agreement with wholesalers in Spain. The dual pricing scheme involved on one hand the maximum price set by the Spanish government for products sold in Spain, and on the other a higher price in case the products were destined for export. Glaxo also notified the Commission about this arrangement and thus escaped the fines, which are otherwise imposed in case of breach of antitrust rules.

Nevertheless, the Commission decided that Glaxo’s sales conditions did indeed amount to an export ban and that there was no increase in technical progress, nor any improvement in production or consumer benefits. Furthermore, the EC said there was no causality between parallel trade and reduced research and development efforts. The Commission banned the dual pricing scheme in May 2001 and maintains that Glaxo’s policy contravenes EU competition rules. The company has appealed the Commission’s decision to the Court of First Instance.

3 - Trademark Infringement

Repackaging or re-labelling is necessary for parallel trade in order to comply with regulations and to make it possible to re-export medicines from, for example, Greece to Sweden.

Manufacturers have attacked these practices repeatedly, arguing that this is an example of trademark infringement. As early as 1978, the European Court of Justice ruled that a trademark holder could not stop a parallel trader from reaffixing the trademark, provided the latter could show that it had not adversely affected the original condition of the product. Manufacturers have attacked these practices repeatedly, arguing that this is an example of trademark infringement. As early as 1978, the European Court of Justice ruled that a trademark holder could not stop a parallel trader from reaffixing the trademark, provided the latter could show that it had not adversely affected the original condition of the product. 71 Modifying the packaging is only allowed when “necessary” to permit sale in the importing member country. But parallel traders maintain that they are entitled to make any change to packaging that could enhance sales, as long as the actual contents of the product remain unchanged.

Repackaging necessarily affects the appearance of the original product’s trade dress (the manufacturer’s packaging and logo) and hence the product image. Interfering with the trade dress therefore affects the value and the goodwill of the trademark. However, a trademark owner may not hinder tampering with its trade dress if this is necessary for the parallel importer to market the product in the country of import.

In February 2000, the High Court of England asked the European Court of Justice to resolve two important questions of principle: 1) The meaning and effect of the rule of necessity; 2) The relationship between the specific subject matter and the essential function of the trademark rights and the rule of necessity.

The court’s case law establishes the guidelines to interpret the concept of necessity: Interference with trademark rights by a parallel importer is only permitted if it is objectively necessary, i.e. “if the rules or practices in the importing Member State prevent the product from being marketed in that Member State in the original packaging [...]”. The Court therefore concludes that it is for the national jurisdictions to establish whether this applies in each case. 72

On a more general level, it should be stressed that trademarks are in fact a matter of trust: The customer buys not only a brand that he knows, but also the pledge of quality and a number of properties incorporated in the trademark and to which he has become accustomed. Therefore, trademark infringement should not be regarded exclusively as a technicality involving the trade dress and whether or not a product may be repackaged. The brand recognition which trademarks establish is about a fundamental relationship of confidence between buyer and seller.

Recent Policy Developments

- “Intellectual property protection is key to bringing forward new medicines, vaccines and diagnostics urgently needed for the health of the world’s poorest people.”

- “There is a near absence of innovation for diseases that affect people in developing countries. It is an illusion to think that this market failure will be remedied through the IP system.”

The issue of affordable AIDS drugs for African and Asian nations through compulsory licensing and generic substitution would require a separate report. It only has relevance for the problem of parallel trade insofar as the latter has been used to ship discounted medicines to African countries, and, more generally, exceptions to IP rights are often invoked as a means to resolve major health crises. Where a compulsory license is required in both the importing and exporting countries (a situation which arises when the drug is patented in both countries), the WTO text of 24 November 2002 says that these countries “are not required to provide double remuneration to the right holder”. Developing countries would like the importing country only to provide compensation to patent holders, based on affordability. But pharmaceutical companies ask to seek compensation from both countries. 73

In late 2002, the debate on access to medicines in developing countries heated up considerably. After imposing substantial subsidies for the agriculture and steel business, the US government further angered its European partners by making reservations in the WTO negotiations on health, refusing the compromise agreement which would allow members to override patents on pharmaceuticals destined for public health emergencies, such as HIV/AIDS, malaria, tuberculosis and other epidemics. This refusal was repeated on 18 February 2003.

The United States then demanded a limitation on generic exports for diseases defined in paragraph 1 of the Doha Declaration (i.e. AIDS, malaria and tuberculosis). Developing countries and health activists countered by referring to the general goal of the Doha agreement, meaning that TRIPS should promote access to medicines for all.

Generics: Are Copies as Good as the Original?

Increasing the recourse to generics is a recurrent argument in the discussion on improving the access to medicines in developing countries. However, “generics” is a term that covers a large array of products, ranging from brand extensions to unauthorized copies of registered trademarks.

A generic medicine is a product using the name of the active ingredient (e.g. aspirin, which used to be a trademark). Once the patent for a given product expires, anyone is free to manufacture it. Many brand names also continue to be sold in generic trade dress after patent expiry and most major manufacturers have their own generic product operations, which enable them to capitalize on their trademarks. 74 However, it is important to remember that in terms of patent protection, generic products are not all equivalent. Producing a copy of a product whose patent has expired is a legitimate business. But generic products are also sometimes copies of protected medicines that are being produced without licensing.

In view of recent policy initiatives aimed at health care reform (i.e. essentially curbing spending within the public health system), there seems to be a natural coalition of interests forming between governments and providers of generic medicines and parallel importers alike. The latter enjoy the role of allies to explicit policy concerns (reduced costs) and defenders of the consumer (lower-priced medicines). This is a curious stance, as numerous studies show that increased recourse to both parallel imports and generic products amount not so much to consumer or government savings as to increased profits for pharmacists and producers. 75

Recently, the use of generics has been noted in the public policy debate for several reasons. First, Western governments consider generic substitution an efficient instrument for reducing health care costs by stipulating their use in prescriptions over brand names. Second, developing countries such as Brazil and India have built up a large industry in generic pharmaceutical products. But, as underlined by two World Bank economists, an international agreement on generics would not solve Africa’s problems, as insufficient infrastructure and lack of medical personnel “are greater barriers than the cost of pills”. 76

The DEFEND Proposal

A proposal for wider access is the one put forward by three economists.77 The DEFEND proposal (Developing Economies’ Fund for Essential New Drugs) aims at establishing a new international organization to “purchase the license rights for designated areas and distribute the drugs at low cost with a required co-payment from local governments. Furthermore, governments would restrict parallel trade to support desirable price discrimination”. 78

The proposal is an attempt to reconcile the needs to provide cheap drugs to developing countries while giving the necessary concessions to the pharmaceutical companies involved. Whereas the authors cite increased assistance from developed countries as a primary source of financing, the expected cost would still be between $8 billion and $12 billion per annum.

The authors also present an arguable case, asserting that “the cost of giving patients access to existing drugs has to be separated from the incentives for pharmaceutical companies to improve and develop new drugs. Second, the financial incentives to invent new drugs for the world’s least developed countries must be subsidized by the industrialized countries”. 79 But the authors also admit that “assuming that all HIV-positive individuals in sub-Saharan Africa were treated with a typical AIDS cocktail therapy (Crixivan, AZT and 3TC) bought at US prices, the total expenditure for these drugs would be more than total GDP in the sub-Saharan countries put together”. 80

Notwithstanding the annual costs of the proposal (allegedly “an extremely effective use of foreign aid” Notwithstanding the annual costs of the proposal (allegedly “an extremely effective use of foreign aid” 81 ), the inherent logic suggests that foreign aid in the past has been largely efficient in eradicating poverty and disease. It may be objected that, in view of the sums spent in the past 50 years through government aid to developing countries, this is not the case. As the development economist Lord Peter Bauer once remarked, “lack of money is not the cause of poverty, it is poverty”.

Other multilateral initiatives include the $ 2.2 billion granted to the Global Fund to Fight AIDS, tuberculosis and malaria, which has issued its first checks for programs in Ghana, Haiti and Tanzania; But the second round of projects will effectively exhaust the Fund’s resources; at the least, a further $ 6.3 billion are needed over the next two years. 82 This may be compared to the $ 2.8 billion granted for health funding by the Gates Foundation, and an additional pledge of $ 275 million by Abbott, Bristol-Myers Squibb, Merck and Pfizer for treating HIV/AIDS in developing countries. 83 84

Toward Voluntary Licensing?

Clearly, the considerable acrimony between pharmaceutical companies and activist groups has led to harsh exchanges, but little rapprochement as the stalemate in the WTO negotiations on essential drugs has shown. This may change if the recent example of cooperation between Pharmacia and the non-profit organization International Dispensary Association (IDA) proves successful. 85 In late January 2003, Pharmacia launched its pilot programme for granting voluntary licenses for its AIDS drug Transcriptor (delavirdine) to manufacturers of generic medicines. 86 The IDA would be in charge of selecting the generics companies that conform to its quality standards.

The arrangement means that the patent holder awards a non-exclusive license to generics producers to sell cheap copies of urgently needed drugs in poor countries in exchange for a royalty. A company may choose any product for which it holds a patent for out-licensing, but it is relevant only for medicines protected by patent, and not applicable where patents either do not exist or have already expired. As underlined by the authors of the project, “the point of out-licensing is to strengthen price competition in poor countries [...] with no specific ceiling on the number of generic manufacturers who obtain licenses”. 87 The generic licensees would not have to be located in developing countries, but could be anywhere in the world provided the license is granted on condition that the producer supplies products only to Africa. This would increase the downward pressure on prices and improve access to medicines. 88

There are several advantages: Generics companies could compete on price, but would not have the right to compete with the patent owner in developed countries. This would help to maintain market segmentation, preserve incentives for research and development, while promoting access to medicines for poor countries. Unlike compulsory licensing (i.e. expropriation of patents) out-licenses proceed from a voluntary agreement where patent holders and generics manufacturers work together. Out-licensing would also avoid the risk of parallel trading of medicines which have been donated to developing countries, and then diverted back to the donor countries by stipulating that the generic version be of a different shape and colour from the original product. 89

The Case of South Africa

In 2001, 39 pharmaceutical companies brought an action against the South African government concerning the constitutional status of the Medicines and Related Substances Control Amendment Act. 90 The reason was the SA government’s decision to re-import HIV/AIDS drugs. However, yielding to substantial pressure from international public opinion, the research-based companies dropped the claim in April 2001.

The issue of access to antiretroviral drugs and patents restates the question of protection of intellectual property rights versus the need for essential medicines in developing countries. Currently 25 million Africans are living with AIDS and the number is rising. In South Africa alone, 5 million people (11% of the population) carry the AIDS virus. Antiretroviral treatment costs about Rd 850 ($110) per month, which is too high an expense for most patients. 91 The decision to allow parallel imports and generic versions of ARV medicine is therefore understandable, although for a long time the government dragged its feet on recognizing the real extent of the epidemic. But as even parallel imports remain expensive, there is also a growing market of illegal imports, e.g. of the GSK antiretroviral Combivir or (previously) the Pfizer drug Biozole. 92 Whereas it may be argued that generic imports and parallel trade are conducive to lower prices, this will only contribute to improving public health “to the extent that sanitary and administrative conditions are such that effective distribution of medicines is possible”. 93