In just the past three years the federal budget has exploded in size by more than one half trillion dollars. This 108th Congress is spending at a faster pace than any Congress since before Woodstock. Milton Friedman, the revered Nobel Prize winning economist, declares that this unbridled spurt in government spending “is the single greatest deterrent to faster economic growth in the United States today.” Another former Nobel prize economist, James Buchanan worries that by allowing government to grow so rapidly ahead of the pace of the private sector, we are “killing the goose of free enterprise that lays the golden eggs.”

The sudden spurt of government spending and the resulting mountainous budget deficits are all the more unexpected given that they have occurred under a Republican Congress and a Republican president. Under a Republican regime, Washington has enacted the most expensive farm bill, education bill, and Africa foreign aid bill ever and has just passed the largest new federal entitlement program— Medicare prescription drug benefits—since the launching of LBJ’s Great Society.

The fiscal nervous breakdown raises the unavoidable question of whether there is any willpower left on Capitol Hill to restrain the size of the now $2.4 trillion federal enterprise. Is the fight for smaller and smarter government completely futile? After all, Republicans were voted into power precisely because voters lost faith that the Democratic Party was capable of delivering efficient and affordable government. But now the Republicans have metamorphosed into exactly what they replaced—spendaholoics.

The good news is that the fight for cost-efficient government is not futile at all. But we do know now that to win requires a lot more than just changing from the Blue Team, the Democrats, to the Red Team, the Republicans. The whole fiscal game plan is defective needs to be revised. We need a new budgetary weight loss plan. That’s what this study offers: a dietary budget plan that protects the financial future of tomorrow’s taxpayers. Whether the politicians want to take the weight off, is an altogether different question.

Immortality in Washington

Ronald Reagan once quipped that the closest thing to eternal life on this earth is a federal government program. The last two decades of budget policymaking has confirmed that statement to be still sadly accurate. There have been two major efforts to shrink the size and scope of the federal government in recent times. The first was by Ronald Reagan in 1981. The second was by Newt Gingrich and the Republican revolutionaries who seized control of the U.S. House and Senate after the 1994 elections.

Both the Reagan and Gingrich revolutions certainly produced impressive policy victories. Reagan enacted his landmark tax cut and much of his “supply side” economic plan that helped launch a two-decade long era of prosperity. In the mid 1990s the congressional Republicans helped further prod faster economic growth by enacting welfare reform, a balanced budget plan, and a capital gains tax cut.

But the government did not shrink. Many of the federal programs that were placed on the chopping block, ranging from Amtrak subsidies to the National Endowment for the Arts and the Export-Import Bank continue to flourish. For most of what the government was spending money on in 1980, Congress appropriates even more money today—twenty-five years later. The number of federal government programs has expanded by scores. Every federal agency, no matter how antiquated and wasteful, is treated as a politically impenetrable fortress. As such, no more than a dozen or so federal programs were canceled in the early 1980s or during the Contract with America “revolution.”

Most depressing of all, when the Reagan Revolution began, the federal budget was just above $600 billion. Now the budget costs $2.4 trillion.1 Even adjusting for inflation, federal expenditures have more than doubled since the beginning of the Reagan era.

The special interests in Washington have become proficient at forever inventing new programs. But no one has figured out a viable political strategy for getting rid of old ones. Many years ago, the late and distinguished University of Maryland economist Mancur Olson wrote in his classic book The Rise and Decline of Nations that government programs spawn and then empower their own special interest constituencies, which quickly erect a protective political fortress around the agencies they benefit from. The smart and prolific budget reporter Jonathan Rauch of National Journal has called this phenomenon “Demosclerosis.”2

Rauch has noted that no matter how obsolete, inefficient, or counterproductive a federal program might become, there’s very little political incentive to get rid of it, and therefore the federal budget has become a cluttered closet of outdated and money-wasting agencies.

One cannot help but be struck at the difference in operating style between private sector companies and public sector agencies in America over the past two decades. Starting in the mid-1980s, America’s private industries—in computers, energy, autos, steel, pharmaceuticals, financial services, semiconductors, and telecommunications (to name a few)—restructured themselves and began a process of sweating out ineffic One cannot help but be struck at the difference in operating style between private sector companies and public sector agencies in America over the past two decades. Starting in the mid-1980s, America’s private industries—in computers, energy, autos, steel, pharmaceuticals, financial services, semiconductors, and telecommunications (to name a few)—restructured themselves and began a process of sweating out inefficiencies, slashing costs, and raising productivity levels. Productivity levels in the last ten years have risen by 20 percent throughout the business sector, and by more than 25 percent in many key industries.3 The result: the economy posted record growth rates from 1983-2000. U.S. industries are routinely out-competing once-dominant foreign rivals. Over the past 15 years private industry has continually produced more with less.

The only industry that has been immune from this productivity revolution has been government itself. In 1980 there were 20 million manufacturing workers in the U.S., 4 million more than government workers. By 2002 the numbers were reversed, with the number of government workers reaching about 21 million, and manufacturing workers falling below 17 million.4 Most federal agency budgets are two to three times larger (adjusted for inflation) today than 30 years ago, but most Americans believe that public services were better then than now.

What we have in Washington today is a bipartisan fiscal cop-out. No one in Congress or the executive branch has insisted that federal tax dollars be spent judiciously. Here are some recent examples of absurd wastes of federal funds that incite taxpayer outrage, but elicit yawns and inaction from Washington policymakers:

- The General Accounting Office recently found that the Pentagon “has not properly accounted for billions of dollars in basic transactions… DOD reported an estimated $22 billion in disbursements that it has been unable to match with corresponding obligations.”5 In other words, somehow the Pentagon lost track of what happened to the money. Secretary Rumsfeld admits that antiquated business practices cost DOD at least $15 billion every year.6

- A federal audit of the Medicare program discovered that the federal government made $12.5 billion in erroneous payments in FY2001.7

- The U.S. Department of Agriculture provides farmers with operating income of more than $1 million four times the average subsidy that it does to farmers with operating income of less than $50,000. Most farmers receive none of the $50 billion a year doled out in crop subsidies.8

- The food stamp program routinely sends out food vouchers to ineligible families. It’s difficult to estimate the amount of waste here the last couple of years, because the federal government recently loosened the state reporting requirements substantially. In 2000, the last year that estimates were provided, improper food stamp payments cost over $1 billion.9

- The U.S. Department of Commerce spent tens of millions of dollars on Advanced Technology Program grants to just 10 companies from 1990-96. These firms had combined profits of over that period of $31 billion.

- The GAO estimated that $6 out of every $10 spent on Superfund is used for purposes other than toxic waste cleanup.10 The money is spent on bureaucracy, like secretaries, laboratory work, and office expenses. Superfund money is supposed to be spent on cleaning up waste, not creating more of it!

- The U.S. Office of Management and Budget recently discovered that most programs don’t do what they are created to do. According to the OMB performance assessments of 230 programs, 5% of the agencies were rated ineffective and 50.4% of the programs were rated “results not demonstrated.” If programs cannot demonstrate results, why fund them?

- There are six reasons why it is financially and ethically imperative for Congress to demand value for taxpayer dollars and to identify activities that the government no longer should be spending money on:

- Congress has a fiduciary duty to its citizens to provide the highest value for the tax dollars it collects and spends. That is true regardless of whether the budget is in balance, in deficit, or in surplus. Thomas Jefferson once described “economy in government” as one of the first virtues of a good government. To require taxpayers to underwrite wasteful and inefficient government is to cheat them out of their hard-earned tax dollars.

- Demanding better value for our tax dollars is essential to restoring the citizen’s faith in the political system. Americans are withdrawing from the political process because they believe it is futile to try to reform a government that is incapable of change. Our incapacity to end unnecessary federal activities only reinforces that sense of futility.

- There are substantial economic gains from periodically clearing out the deadwood in government. Stamping out waste and inefficiencies in government could save hundreds of billions of dollars a year. These savings can and should be used for reducing the $500+ billion federal deficit, for cutting the excessive federal tax burden now imposed on workers and businesses, and for covering some of the transitional costs to a personal investment alternative to Social Security. In government, a tax dollar saved is a taxpayer dollar earned.

- If the government is incapable of ending wasteful and obsolete federal programs, it will never have the resources available to solve tomorrow’s problems. Even liberals should endorse eliminating absurd programs like the Agriculture Department’s advertising subsidies to Ocean Spray and Ralston-Purina, because these dollars are unavailable for higher priorities in the future. Our democracy becomes paralyzed by our inability to say “no” to the special interests.

- Many federal activities today do not pass constitutional muster. We no longer ask the question that Congress should ask every day: Where is the constitutional authority for subsidies for the arts, the sugar producers, or the Cowgirl Hall of Fame? Where is Congress authorized to take money from middle-income workers to provide free drug benefits to H. Ross Perot?

- More activities can and should be devolved to state and local governments and in many cases to private charities. Programs like job training, road building, crime fighting, public housing, and school funding are much more appropriately handled by the states and localities. Our founding fathers ingeniously and intentionally established a federal system where most domestic governmental activities would be provided by state and local governments, not the federal government. Welfare reform in the 1990s worked because it relied on the ingenious model of the Founding Fathers. The best welfare, homeless assistance, drug treatment is often serviced by private charities, not governmental entities.

This study offers an antidote to the fiscal sclerosis in Washington that has cultivated waste, neglect, and inefficient use of taxpayer dollars. It is meant to prescribe common sense budget reforms that hopefully will appeal to both fiscally conservative Republicans and Democrats, to the extent they exist anymore in Washington. The plan herein would:

- Reduce the size of government more than half over the next 10 years. Instead of the budget growing to $3.2 trillion by 2013 as scheduled, it would cost $1.6 trillion. This would still leave the United States with the largest government in the world.

- Cut the burden of the federal government from 20% of GDP to less than 10% for the first time since the early 1930s.

- Eliminate more than 300 useless federal agencies.

- Get corporations off the federal dole.

- Preserve a safety net for the lowest income Americans but require work by the able-bodied as a condition for all welfare.

- Use market incentives to give Americans a better deal for Social Security and Medicare.

- Keep the budget in balance for at least the next decade while using asset sale proceeds for debt retirement.

- Offer Americans a large tax cut (of more than $2,000 per family per year) and help pave the way to a simplified and pro-growth federal consumption tax system that would abolish the current IRS tax code.

This plan will require a new culture of fiscal austerity in Washington, but the payoff is huge: a freer and more prosperous America in this new century for our children and grandchildren.

The Triumph of Big Government

In 1995, when Republicans seized the reins of control in Congress, it appeared that the inexorable growth of government would come to a screeching halt. And for a while it did. In 1996, for the first time in years, many federal agencies saw a decline in their annual budgets. There was clearly a new ethic of fiscal restraint, rather than fiscal expansionism. But that ethic was short-lived.

The original “Contract with America” budget in 1995 slated more than 300 programs for termination. Some of these programs were little more than political slush funds for special interest constituencies-such as the Legal Services Corporation, bilingual education funds, and Bill Clinton’s army of $7.27 Americorps “volunteers.” Others—like the TVA and the Rural Electrification Administration—are so antiquated that Barry Goldwater pledged to shut them down some 35 years ago when he ran for President. The price tags and the cobwebs are much bigger now. And most of the others on the list are hopelessly ineffectual: including the Economic Development Administration, Amtrak operating funds, federal transit grants, the Appalachian Regional Commission, and maritime subsidies. In many ways the original Contract with America budget was reminiscent in its audacity of the first Reagan/Stockman budget back in 1981.

Unfortunately most of those programs are still flourishing. A 2000 Cato Institute study entitled “The Living Dead of the Federal Budget,” found that very few programs were actually eliminated and that the combined budgets of programs that were supposed to be eliminated in 1995 was higher, not lower than when the GOP took over Congress. We’ve updated some the calculations from that study through 2003. Here are some examples of the fiscal deterioration:

- The Corporation for National and Community Service (known best as the administrator of President Clinton’s pet-project, AmeriCorps) has seen its budget increase by more than a factor of six, from $81 million to $631 million.11 And typical AmeriCorps employees are overpaid; they make about $12 an hour for minimum-wage tasks.12 Why in the world does a program that is supposed to rely on volunteers have to cost taxpayers close to $1 billion a year?

- Most farm programs were supposed to be phased out entirely with the passage of the Freedom to Farm Act back in 1995, but it turns out that over the past 7 years payments to farmers have reached an all-time high when “emergency funding” is included. And under the latest scheme, concocted by farm-state Republicans and farm-state Democrats alike, the federal taxpayer will now dole out at least $100 billion over the next 6 years to farmers. And the Heritage Foundation has discovered this outrage: many farmers will receive more than $1 million in subsidies over the next 6 to 10 years.13

- Amtrak was supposed to be made financially self-sufficient, meaning that it would no longer require taxpayer subsidies, by 2002. It has made miserable progress toward this goal. In 2000, it only reduced its budget gap by $5 million, leaving it $281 million short of paying its own bills.14 By law, Amtrak’s assets should have been liquidated over a year ago, and the Amtrak Reform Council’s recommendation put into effect. Instead, it continues to operate at a huge expense to taxpayers.

- Runaway entitlement programs created America’s budget crisis, so naturally Congress wants to create new ones. The Medicare prescription drug benefit that Bush requested in his 2004 budget and signed into law just weeks ago was projected to cost $400 billion over the next 10 years—almost double the price tag that Bill Clinton and Al Gore recommended. And yet congressional Democrats are arguing that the Bush plan is too skimpy; they are pushing for a staggering $700 billion plan.15 They may get their wish: Updated cost estimates for the new Medicare prescription drug benefit are already running well over the President’s projection, and not one pill has yet been distributed under the program.

- In 2001, a bill to raise the budget for the Peace Corps by 50 percent over four years passed the House by a margin of 326-90. This prompted a Washington Times headline: “Republicans Retreat from Battle to Shrink the Size of Government.”16

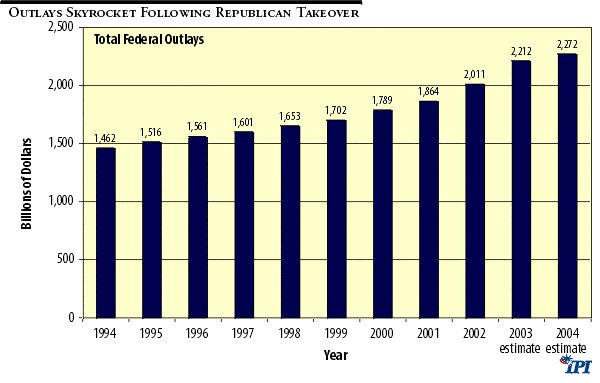

The end result is that after ten budgets designed by the Republican majorities in the House and Senate, the budget is bulkier than ever before. The federal budget in 2003, after adjusting for inflation, will be some $700 billion higher than when the GOP took over the reins of Congress in January 1995. Figure 1 shows the growth of federal appropriations over this period. These have not been lean times for federal agencies.

Figure 1

The five-year spending total of $11.8 trillion planned for 2003-2007 is more money—adjusted for inflation than America spent to fight World Wars I and II, the Civil War, and the Revolutionary War. In fact, in today’s dollars, it is more money than the United States government spent on everything from 1800 to 1960.

Then-Rep. David McIntosh of Indiana concluded that the GOP’s efforts to control spending had become “anemic and an embarrassment.”17 It would appear that the culture of spending in Washington that caused Democrats to finally lose control of Congress in 1994 has spread like a virus to the Republican side of the aisle. Government is growing rapidly again. And the most immediate repercussion of this spending spree has been a budget deficit that may reach $400 billion in 2004. Washington is again colored in red ink.

Pork Is Served Again

The 105th, 106th, 107th, and 108th Congresses have even shown reluctance to eliminate programs with almost no public support or broad-based constituency. Programs falling in this category would include foreign aid, the Department of Energy, and Uncle Sam’s $90 billion a year corporate welfare slush fund.

The reluctance to attack corporate welfare is particularly distressing. Funding corporations only reinforces the public’s general suspicion that the GOP is the party of the rich, the privileged, and the corporate lobbyists. The discredited mercantilist policies of the Commerce and Agriculture Departments are the antithesis of the free market policies Republicans say they espouse. The handouts have merely created a constituency of statist businessmen who have joined forces with the left to lobby for ever expanding government. “If you can’t push AT&T and GE off the dole,” Silicon Valley venture capitalist Tim Draper told the Senate Government Affairs committee in 1997, “how can we ever expect to get farmers, unions, artists, and seniors to give up their subsidies?”

The story of the Department of Education budget is most revealing of all. This was an agency that Republicans had argued in the Reagan years and then after the GOP takeover of Congress in 1994, should be shutdown because it has had no impact on school performance. According to a recent report by Education Week : “federal education spending has not only survived under the Republican Congress, it has grown—by nearly 38 percent since the fiscal 1996 budget.” In 1999 Congress approved a record $33.1 billion for education spending. In 2000 it increased funding by another $6 billion. By 2002, the total reached $55 billion, and this year the Bush budget plan calls for it to rise to a staggering $70 billion by 2007. Once-fiscally conservative Republicans now openly boast of outspending the Democrats on education programs.

Another disturbing trend has been the re-emergence of the very kind of pork barrel spending that minority Republicans for years derided as inexcusably wasteful. In each of the past four years the trend has been toward more obese budgets for pork programs. In 2003, an unprecedented amount of pork was pushed through in a huge omnibus spending bill. The total pork budget for 2003 is a record $22.5 billion for 9,262 parochial projects. Some of the highlights include a DNA study of bears, catfish health, and the International Coffee Organization.18

Congress also saw fit to give tax dollars to the Rock and Roll Hall of Fame, the Baseball Hall of Fame, and the Cowgirl Fall of Fame, prompting spending hawk Jeff Flake of Arizona to comment: “I must confess that after sifting through this bill I am tempted to nominate its authors to a fictional “Pork Barrel Hall of Fame . ” On second thought, I’d better not. They’d probably find a way to fund it.”19

Why It Is So Hard to Cut the Budget

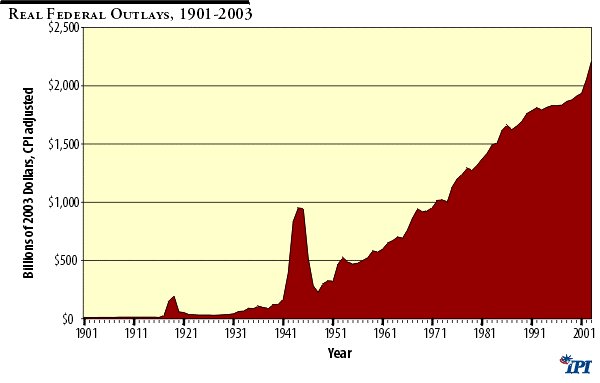

Fiscal conservatives in Congress have made only slight progress in reversing the underlying trend of bigger government in America. Figure 2 below shows the long-term trend of ever-rising federal expenditures. Real federal outlays have climbed from $11 billion in 1900, to $325 billion in 1950, to over $2.2 trillion in 2003. Even as a share of national output, the federal government now takes 20 percent of GDP, up from 15 percent in 1950 and 4 percent in 1930.

Figure 2

Republican control of Congress has done nothing to stop the expansion of government. The Democratic cardinals on Capitol Hill have simply handed over the reins of power to a cast of Republican cardinals. Some analysts conclude from all of this that the goal of limiting government is simply futile—that politicians are giving the voters all the government they want. That’s wrong. By two-to-one margins Americans still say they prefer less government services and lower taxes to more government and higher taxes. Two-thirds of voters consistently say they think their taxes are too high, not too low. The goal is not flawed, but the game plan has been.

The GOP’s policy failures on the budget fall into four categories:

- Since the Penny-Kasich effort in 1993 to eliminate wasteful programs, there hasn’t been a bipartisan effort to cut government spending. Republican budgets have been devised in a purely partisan way that fails to reach out to moderate, “blue dog Democrats,” many of whom are more fiscally conservative than old-bull Republicans. One lesson of the Reagan and Gingrich eras is that cutting even the most unjustifiable programs in Washington is unachievable unless there is bipartisan consensus to do so.

- Would-be budget cutters have failed to recognize that the budget process is still severely biased in favor of spending, rather than cutting. Budget-cutters in Congress have devoted insufficient attention to institutional reforms—to changing the fiscal rules of the game to end the pro-spending tilt.

- Advocates of limited government in Congress need to constantly remind voters of all the bureaucratically inept ways that Washington is spending their money. One of the few GOP stars here is Michigan Republican Pete Hoekstra who publishes a monthly Tale of Bureaucracy with easily digestible news horror stories of how Washington is spending our tax dollars. Hoekstra’s reports show that most federal agencies cannot pass a simply audit—a requirement for all private firms—and that dozens of agencies have tens of billions of tax dollars unaccounted for by the bureau heads. Americans first realized how much waste there was in the Pentagon when federal auditors revealed back in the early 1980s that the Defense Department had spent $300 on hammers and $600 on toilet seats for military aircraft. Voters were outraged at how their tax dollars were being misspent and a political consensus began to emerge that waste in the Pentagon had to be weeded out.

- Budget reduction plans need to be perceived as fair-minded by the voting public . For example, one of the reasons the Republican’s have lost credibility with voters when it comes to budget issues is that the GOP’s budget knife seems to spare some of the worst welfare abusers. Liberals charge that Republicans want to cut school children off the dole, but not the Fortune 500. The Washington Post assessed the budget plans by the Republican majorities by declaring, “Everything seems to get cut—but not corporate welfare.”20

The Payoff from Smaller Government

This study provides the Bush administration and the 108th Congress a detailed budget blueprint for reversing the growth of federal expenditures. It would cut government expenditures in half by 2013. By achieving this goal, the plan would allow Congress to:

- Balance the budget without relying on Social Security surplus money;

- Reduce the size of the federal government from 19 to 10 percent of GDP within 10 years;

- Eliminate some 300 unnecessary and unconstitutional programs;

- Reduce the federal tax burden substantially and in ways that would promote economic growth; and

- Retire some $1 trillion of the national debt.

This comprehensive fiscal plan involves 9 common sense steps to shrinking the size of government:

- Eliminate numerous programs that have either outlived their usefulness or proven their uselessness. A long list of federal programs that should be canceled is offered at the end of this study.

- Privatize federal assets that belong in the private sector and use the proceeds to retire the national debt.

- Devolve a variety of programs to the state and local level. The federal government’s role in transportation, education, housing, and economic development, should be shifted to the state level, just as welfare programs were sent back to state capitols two years ago.

- Restructure federal entitlement programs —most importantly Social Security and Medicare—in ways that will promote cost saving, better performance, and greater reliance on market principles. Most importantly, the government’s role in these areas must be restructured so as to reduce the open-ended entitlement nature of these programs and encourage more personal responsibility while preserving the safety net features.

- End all corporate welfare programs in order to save $100 billion a year.

- Replace all welfare programs with a generous earned income credit that ties public assistance directly to work.

- End welfare for the affluent by eliminating all federal payments to Americans with net assets or incomes of more than $1 million a year.

- Reform the federal budget rule making process so as to eliminate the pro-tax and spend bias in Congress.

- Tie tax cuts and the promise of tax reform to federal spending reductions to build political constituencies for smaller government.

If Congress adopted all of these recommendations, they would generate more than $1 trillion a year in taxpayer savings when fully phased in. Even assuming that half of those savings were used to retire federal debt, this would leave sufficient funds to completely finance the transition to a radically simplified consumption oriented federal tax system with a single tax rate of less than 20 percent. This tax restructuring in turn, would help generate substantially faster economic growth and thus higher living standards for our children.

Making The Numbers Add Up

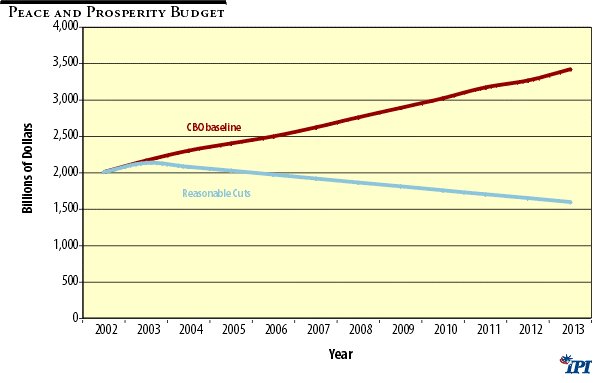

The Congressional Budget Office estimates that between 2003 and 2013 the federal budget will increase by about $1.2 trillion—from $2.2 trillion to $3.4 trillion.

But why? Why should the budget be on an automatic pilot switch that expands the federal enterprise by more than $100 billion every year without forethought or debate? Given that we are now living in an era of relative peace and prosperity, there is no essential economic or equity rationale for the budget to be rising at all. In fact, throughout many previous post-war periods in American history, the federal budget contracted, it didn’t grow. For example, in the 1940s and early 1950s, outlays were fairly stable and declined in some years. Outlays declined significantly after World War I and the Civil War But why? Why should the budget be on an automatic pilot switch that expands the federal enterprise by more than $100 billion every year without forethought or debate? Given that we are now living in an era of relative peace and prosperity, there is no essential economic or equity rationale for the budget to be rising at all. In fact, throughout many previous post-war periods in American history, the federal budget contracted, it didn’t grow. For example, in the 1940s and early 1950s, outlays were fairly stable and declined in some years. Outlays declined significantly after World War I and the Civil War.

There is another reason why it would be reasonable to expect that the federal budget should be shrinking over the next 10 years. We are now in the benign phase of the demographic cycle with the huge 75 million plus baby boomer generation now at the peak of their earnings years and with very few new retirees entering Social Security and Medicare. The baby boomers won’t start retiring until next decade. This gives us 10 years to grow the economy and husband our resources at the federal level to prepare for the fiscal tidal wave we know is heading our way.

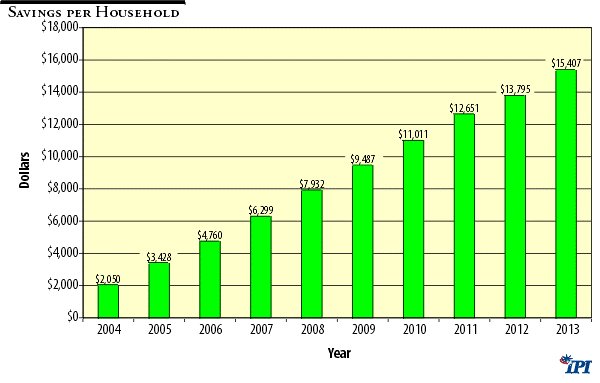

In Figure 3, I show the expenditure path for a reasonable pro-taxpayer federal budget plan. Note in Figure 4 that after a few years the taxpayer dividends from this new budget path start to grow to enormous proportions. Under this budget plan, by 2013 the federal tax bite could be cut in half. The savings per household would be about $75,000 from 2004-2013 under this revised budget plan. This plan, by the way, not only clears the way for a new tax system, but also reserves savings for converting Social Security into a totally private IRA type system.

Figure 3

Figure 4

The Putting Taxpayers First Plan

Step 1. Eliminate unnecessary and wasteful programs.

The federal budget now consists of several thousand line item agencies, bureaus, offices, and grant programs. Yet, as mentioned previously over the past 20 years very few of these programs have actually ceased operation. In fact, since 1996 not a single federal program of any fiscal consequence has actually been eliminated. Not one. No matter how outmoded, inefficient, duplicative, or even counterproductive a federal program is, the cnstituents who benefit from the spending create a lobbying fortress to protect their cash cow from the budget sword. For this reason, the $2 trillion federal government appears to be the only institution in America immune from this competitive restructuring.

As much as $200 billion a year is spent on domestic programs that have been identified as candidates for termination by such independent agencies as the Congressional Budget Office, the General Accounting Office, the Grace Commission, the bipartisan Penny-Kasich spending reduction program, and even by President Clinton himself in the budget submissions during his two terms in offi As much as $200 billion a year is spent on domestic programs that have been identified as candidates for termination by such independent agencies as the Congressional Budget Office, the General Accounting Office, the Grace Commission, the bipartisan Penny-Kasich spending reduction program, and even by President Clinton himself in the budget submissions during his two terms in office. They survive not because they serve any national interest, but rather because of political or parochial considerations.

The list of obsolete agencies along with their latest budgets is shown in the appendix.

There is value, also, in reassessing whether some of the cabinet agencies that have been created over the past 50 years are really necessary. The 1995 budget resolution crafted by then House Budget Committee chairman John Kasich would have terminated 300 programs and would have closed down the Departments of Education, Energy, and Commerce. Unfortunately, Congress retreated from the plan. But Kasich was right, these 3 agencies in particular serve almost no overriding public interest. The U.S. Department of Education’s funding over the past 25 years has actually been negatively associated with test scores and school performance. That is to say, the more the federal government spends on education, the less kids learn in school. The Department of Energy has mainly worked since its inception in the late 1970s to try to keep oil and electricity prices high for consumers. It has also wasted tens of billions of taxpayer dollars on alternative fuel projects (beginning with the mega-flop Synthetic Fuels Corporation of the late 1970s), almost all of which have been commercial busts. Finally, the Commerce Department is really the Department of Corporate Welfare. The party in charge of the White House has typically converted the Commerce Department into a fundraising arm of the party committee, as its primary function has been to milk industry groups of campaign contributions. (Remember Ron Brown, for example.)

How can unnecessary federal programs be eliminated given that they have survived for so long against prolonged attacks? Here are a few suggested strategies:

1. Start with the easy targets. Many programs have almost no constituency outside of Washington, D.C. and thus should be relatively painless to zero out. Virtually all of the foreign aid programs within the State Department, for example could be zeroed out without any public complaint whatsoever. Programs that incite public hostility, such as Bilingual Education and the IMF, also should be targeted for immediate elimination.

2. Approve Clinton’s spending cuts. Clinton’s budgets were notoriously lean in the spending reduction department, but they did call for the elimination or substantial funding reductions in low priority programs with annual savings of nearly $10 billion a year. These include:

- Wastewater treatment grants

- Nuclear reactor R&D

- HUD special purpose grants

- Small Business Administration grants and loans

- Impact Aid

- Uranium enrichment programs

- Selected student loan programs

- International security assistance

- Appalachian Regional Commission

3. Target programs that primarily benefit affluent groups who could pay for these programs themselves. Many federal domestic programs primarily benefit Americans with above average incomes. Much of the money spent on the National Endowment for the Arts finances operas and art exhibits in affluent areas and serving a wealthy clientele. The beneficiaries can afford to pay for these programs themselves, if they have value.

4. Eliminate defense pork. The nonpartisan General Accounting Office has identified more than $5 billion in “nondefense” pork spending in the Pentagon budget. The list of high-priority “national defense” programs stuffed inside the defense budget includes $3 million for urban youth programs, $9 million for the World Cup soccer tournament, $57 million for AIDS research, $100 million for breast cancer research, and $10 million for U.S.-Japan management training.

5. Require independent audits of all federal agencies . As mentioned earlier, about half of all federal agencies cannot pass a basic audit that all businesses must undertake. This is financial malfeasance, which makes the Enron problems look like child’s play. An August U.S. General Accounting Office report indicates that taxpayers are being defrauded of billions of dollars by ineptitude, mismanagement, and fraud at government agencies. For example, 45% of school lunch payments are erroneous. Medicare had an error rate in 2001 of 6.3% in payments (believe it or not, that was an improvement from previous years), thus bilking taxpayers of $13.3 billion. Rep. Jeff Flake has proposed common sense legislation to require all agencies to go through an independent audit. Any agency that does not pass the audit would be ineligible for a budget increase in future years until it can get its books in order and demonstrate that it is spending money efficaciously.

Step 2. Privatize Federal assets and use the proceeds for debt retirement

The United States government is bleeding red ink even though it is the wealthiest entity on the planet. The federal government owns almost one-quarter of all the land in the United States—and under the Clinton administration millions of additional acres has been seized out west by Uncle Sam. Yet only a tiny fraction of the vast federal land holdings are of environmental or historical significance. Moreover, time and again, the federal government has proven itself to be a miserable and negligent custodian of the acreage it does own. The Department of the Interior’s Let It Burn policies, for example, have destroyed hundreds of thousands of land and millions of trees. These fires destroy not only economic value, but also endanger health, safety, and the environment.21 The value of federal land holdings is clearly in the trillions of dollars.

The market value of oil lands alone is estimated to be roughly $450 billion. Government also owns tens of billions of dollars of other assets, including mineral stockpiles, buildings, and other physical capital. Most of those assets are not put to productive use and thus yield little or no return to taxpayers. Some of the federal activities that should be transferred to private ownership include:

- Federal lands that are not environmentally sensitive,

- Federal oil reserves,

- Certain Amtrak routes,

- The Corporation for Public Broadcasting,

- The $300 billion federal loan portfolio,

- The federal helium reserve,

- Public housing units,

- Federal dams,

- The Naval Petroleum Reserve and the strategic petroleum reserve, and

- The remaining broadcast spectrum.

Congress should begin a campaign to privatize those and other unneeded federal assets with a goal of raising $50 billion a year. The funds raised from asset sales should be dedicated to retiring the national debt and reducing federal interest payments.

Step 3. Devolve federal education, transportation and health and welfare programs to the states.

Our federalist system is based on the sound principle that states should be “laboratories of democracy” and that through competition, experimentation and innovation states would learn from one another and adopt best policy practices. This was the type of governmental system our founding fathers envisioned for the United States. The too-often forgotten and neglected 10th amendment of the U.S. Constitution grants all authority not specifically designated to the federal government to the “states and the people.”

There are 3 areas in particular that the federal government ought to devolve down to the states: education, transportation, and welfare.

Education

U.S. education policy has been the primary responsibility of the states and localities for at least 150 years. In fact, the word “education” is nowhere to be found in the U.S. Constitution. School funding was never envisioned as a congressional responsibility.

Efforts to end the federal role in education, which began on a widespread scale in the late 1970s, have been undermined by the left’s effective response that to cut federal education funding is an assault against America’s public schools and the children who attend them.

But there is almost no factual basis for this attack. Federal funding of the schools has not had any measurable impact on student achievement. In fact, the evidence suggests that the school system in America produced better results before the federal government intervened into education policy. There are signs that the federal money is more of a hindrance than a help to improving schools. Despite the fact that the federal government still only accounts for about 10 percent of school funding, well over half of the most expensive regulations imposed on schools are generated in Washington, D.C., not at the state and local levels.

In any case, Washington now spends $60 billion a year and there is little support in Congress for retreating from that level of support. In fact, the cost of these programs is expected to increase by another $11 billion over the next five years at the insistence of the Republicans in Congress. The best solution would be to abolish this spending, cut taxes commensurately, and let the states deal with the consequences. But realistically the best we could hope for is a policy alternative that is “pro-education” but at the same time returns much of the funding responsibility for the schools to the states, cities, and local school districts.

Toward this end, Congress should end all federal education spending programs and divert $40 billion a year to funding a universal education tax credit. This $1,000 tax credit should be made available to all individuals. For families with school-aged children, the credit should be refundable, meaning that every family would be eligible. For families without children, the credit could be counted against donations to scholarship programs to allow lower income children to select better schools. These funds could be used for tuition, tutoring, and purchasing school supplies. Toward this end, Congress should end all federal education spending programs and divert $40 billion a year to funding a universal education tax credit. This $1,000 tax credit should be made available to all individuals. For families with school-aged children, the credit should be refundable, meaning that every family would be eligible. For families without children, the credit could be counted against donations to scholarship programs to allow lower income children to select better schools. These funds could be used for tuition, tutoring, and purchasing school supplies.

The plan could be expanded to allow businesses to qualify for a $5,000 education tax credit. The credit would offset up to $5,000 of funds that the business donated to school scholarship programs.

This approach would remove federal direct interference with schools, but would enhance the principle of increasing parental choice in education. There is compelling evidence that support for such an education tax credit system is far more popular with voters than a voucher program, which uses direct government money for private and even religious schools. A tax credit program incites few of those “separation of church and state” objections.

The education tax credit is also generally consistent with the goals of tax reform. Any consumption based tax system must regard educational expenditures as at least part investment, which should be ideally exempt from tax.

Transportation

The original rationale for the U.S. Department of Transportation was to build the interstate highway system. That was a legitimate federal function, since all U.S. citizens benefit from a coordinated network of interstate highways. But the interstate highway system was completed almost 20 years ago. The vast majority of DOT funds are now spent on non-interstate highways, local roads, and urban transit systems. It makes no sense to collect the federal gasoline tax, send it to Washington, D.C., pass it through a federal bureaucratic maze at DOT with 50,000 workers, and then send it back to the states where the funds originated.

In transportation policy, the federal government has become a costly and meddlesome middleman. Until 1996, states were forced to comply with a federal 55 mile an hour speed limit in order to get back their gas tax revenues from Washington. It was the federal government that mandated airbags. Federal highway funds come with other federal strings that inflate construction costs: the Davis-Bacon Act (requiring union wages on federal highway projects); minority set-aside programs; and buy-America provisions. These add about 30 percent to the cost of federal construction projects and thus contribute to the decay of America’s public infrastructure.

Moreover, increasingly Congress uses the DOT budget as a pot of money to deliver pork barrel projects that states would rarely fund if they were spending their taxpayers’ own money. No single bill exemplified this GOP infatuation with pork more than the 1998 highway bill. This six-year, $214 billion bill drafted by House Transportation Committee Chairman Bud Shuster was the most expensive public works bill in American history. To my knowledge, no bill in the history of Congress has contained so many special projects for members. The bill was crammed with some 1,500 Moreover, increasingly Congress uses the DOT budget as a pot of money to deliver pork barrel projects that states would rarely fund if they were spending their taxpayers’ own money. No single bill exemplified this GOP infatuation with pork more than the 1998 highway bill. This six-year, $214 billion bill drafted by House Transportation Committee Chairman Bud Shuster was the most expensive public works bill in American history. To my knowledge, no bill in the history of Congress has contained so many special projects for members. The bill was crammed with some 1,500 white elephant transportation “demonstration” projects—for bicycle paths, bus museums, parking garages, university research grants, and even $16 million to pay for artwork in the Los Angeles subway. That was ten times more pork projects than in the Democrats’ highway bill that Ronald Reagan vetoed a decade ago. It passed overwhelmingly in both houses.

Table 1

Earmarked Demonstration Projects in Highway Bills

Year | # of Projects | Cost (Millions $) |

1982 | 10 | 386 |

1987 | 152 | 1,300 |

1991 | 539 | 6,200 |

1998 | 1,500 | 9,000 |

| Source : U.S. General Accounting Office data. | ||

Closing down the DOT and repealing the 18.4-cent federal gasoline tax could end all of this inefficiency and redundancy. States could then raise the gas tax themselves (as much as they wish) to pay for whatever road building and repair is needed. By eliminating the cost of the federal bureaucracy in Washington, construction and maintenance costs for highways, bridge and transit systems will fall. Many governors have endorsed this idea as consistent with federalism and the Tenth Amendment.

If closing the DOT is not politically viable, another option would be to limit the DOT to financing only interstate transportation projects. This way, states would maintain the authority to implement these programs, eliminating a large amount of the bureaucratic waste in the current system.

Welfare Reform – Finishing the Job

Thirty-five years ago, when President Lyndon Johnson launched the “War on Poverty,” he declared: “the days of the dole are numbered.” We have now surpassed day 10,000. Over this period, some $5 trillion has been spent on this war—more in current dollars than the cost of fighting World War II.

The federal government, along with the states and cities, spend an estimated $300 billion per year on anti-poverty programs. That is almost three times the amount that would be needed to lift every poor family to above the poverty level. Still, the poverty rate in the United States remains extremely high and is no lower than when the avalanche of spending to prevent it began. As Charles Murray of the American Enterprise Institute emphasizes, “The tragedy of the welfare state is not how much it costs, but how little it has bought.” The system does not work well for either the poor or the taxpayer.

The welfare state is fundamentally flawed because it rewards bad behavior—illegitimacy and family break-up—and discourages good behavior—work, marriage, and individual responsibility. A 1996 Cato Institute study originated in Texas by David Hartman and James Coder and written by Michael Tanner and me shows that welfare benefits are so high for the non-working, and taxes are so high for the working poor, that a typical female-head of household on welfare and receiving public housing would have to find a job in most states that pays total benefits of $8.50 an hour to compensate for the loss of welfare benefits.22 By not working, the poor are not lazy—they simply are responding to the monetary incentives that the welfare state has created.

The 104th Congress enacted a major welfare reform bill that took several positive steps in ending the welfare state. The primary cash assistance program—Temporary Aid to Needy Families (TANF), which used to be called AFDC – is now run by the states. The entitlement feature of the program has been ended in favor of an annual appropriated block grant. The bill also technically requires work after two years of assistance—but it remains to be seen whether the work requirements will be enforced and, more importantly, whether the new system will discourage illegitimacy and entry into the welfare system in the first place. Welfare caseloads have fallen by 57% in the states si The 104th Congress enacted a major welfare reform bill that took several positive steps in ending the welfare state. The primary cash assistance program—Temporary Aid to Needy Families (TANF), which used to be called AFDC – is now run by the states. The entitlement feature of the program has been ended in favor of an annual appropriated block grant. The bill also technically requires work after two years of assistance—but it remains to be seen whether the work requirements will be enforced and, more importantly, whether the new system will discourage illegitimacy and entry into the welfare system in the first place. Welfare caseloads have fallen by 57% in the states since the 1995 bill was enacted.23 Congress should finish the job by ending the TANF block grant and leaving the funding to the states and private sector as well.

Congress must also recognize that TANF is just one small brick in the modern welfare empire. In Washington there are now more than 60 means tested programs to help the poor. Three of the most expensive “anti-poverty” programs are Medicaid, food stamps, and public housing. As with TANF, they should now be returned to the states and to the fullest extent possible, private charities.

Devolving these remaining welfare programs to the states would be advantageous for several reasons. First, it would allow states full flexibility in serving as innovators and laboratories to devise welfare programs that provide a basic safety net without rewarding destructive behavior. State governments have already begun to experiment with promising reforms in welfare. The most ambitious of those experiments, designed to get people off welfare and into jobs, have been adopted in Wisconsin, under then-Governor Tommy Thompson, and in Michigan under John Engler. Devolution of welfare to the states would help quickly sort out approaches that work from those that do not. It would also end the federal government’s meddlesome middleman role in welfare. In many cases it stymies reform, as when Washington recently denied a waiver for the state of Texas to privatize welfare agencies. Second, interstate competition would force states to control bureaucratic costs, hold down benefit levels, and impose meaningful restrictions on eligibility—all things Washington has failed to do. Third, states are more likely to see the role of government as one of augmenting successful private charitable support systems, rather than supplanting them.

Step 4. Replace all federal anti-poverty spending programs with a more generous Earned Income Credit that requires work as a condition of federal income assistance.

If welfare cannot be fully devolved to the states, a second-best option is to completely abolish all forms of welfare for able-bodied recipients—AFDC, food stamps, public housing, Medicaid, SSI, etc.—and use part of the savings to expand the earned income credit (EIC). Created back in 1975, the EIC gives low-income workers a cash supplement to their paychecks.

Here’s how it works. Suppose a low-income mother of two children owed $500 in income tax but qualified for a $2,000 tax credit under the EIC. She would pay no income taxes and get a check for the $1,500 difference. She could spend that money any way she chose.

In 2000 the EIC provided some 55 million recipients with $25 billion, according to government statistics. In 2000 the EIC provided some 55 million recipients with $25 billion, according to government statistics.24 The amount of the tax credit depends on the income, number of people in the family and other factors. In 2002 the EIC was modestly expanded—the benefit is now up to $4,140 for a family with two or more children and $2,506 for families with only one child, and families can make more than $30,000 and still be eligible for some money. 25 Under this proposal the EIC would be made more generous. For example, the maximum EIC could be raised to $6,000 for a family with two children and with at least one parent working 40 hours a week.

Let’s be clear: this is welfare. The program redistributes money from those who pay income taxes to those who don’t. However, you might call it welfare with dignity, since recipients, rather than the government, determine how the money is spent. Many conservative Republicans hate the EIC. Republicans have consistently tried to cut back on the program since 1995. Those efforts have been misguided. The EIC has one huge advantage over almost all other welfare programs: the aid is tied directly to work. Most other welfare programs require that the recipient not work.

Another advantage of the EIC is that it is less bureaucratic than other welfare programs, which require huge agencies of personnel to provide and monitor the aid. For example, the food stamp program cost $14 billion in 2000, plus another $4 billion for administration.26 The federal government also doled out about $29 billion in housing benefits in 2000.27 The working poor could probably get better housing at a lower cost if they simply had cash to pay the rent, and could choose their own housing.

Opponents of an expanded EIC complain that if you simply give low-income people cash, they will use the money irresponsibly: to buy drugs, liquor, or lottery tickets, rather than food for their family. Alas there is truth to that complaint. Many families are on welfare today because of the dysfunctional behavior of one or both parents. But for these families, this problem of misspending government aid already exists with the current plethora of welfare programs. There’s a thriving black market for food stamps in most urban cities, where welfare recipients trade food stamps and welfare payments to feed an addiction or other irresponsible behavior that harms blameless victims: their children.

The EIC is also riddled with fraud. Fraudulent claims for the EIC cost taxpayers billions of dollars a year as ineligible clients sign up for the free payments. But the point here is that with all its flaws, the EIC is still the welfare program that works best. It has the smallest moral hazard problem, because it requires work. Any government-run welfare program will have some degree of fraud and will impose negative incentive effects on recipients. The EIC is least susceptible to these problems.

The proposal is not really new. Nobel laureate Milton Friedman, in his 1979 best seller Free to Choose and his 1962 book Capitalism and Freedom , proposed what he called a “Negative Income Tax,” the intent of which was to replace welfare with an incentive to work by providing a federal cash supplement to low-income workers even if they paid no taxes. Friedman’s Negative Income Tax proposal is very similar to the EIC.

But there is one large condition attached to the expansion of the EIC: it must be a replacement, not an add-on to the existing and uncoordinated array of welfare state programs. Special care also needs to be made that marginal tax rates are not dramatically raised for working families who fall just outside the EIC income limit.

Expanding the EIC — conditioned upon ending certain welfare programs — would meet liberals’ desire to provide more cash assistance to low-income families. It would also reduce the size of government by blending other bureaucratic welfare programs into the EIC.

The best welfare program in America is a good paying job. Unlike almost all other welfare assistance which is predicated on the recipient not working—the EIC only goes to those who do work. It has the added benefit that it does not require a large welfare industry to deliver the benefits. Welfare providers have been the primary beneficiary and advocate of federal welfare programs.

The ultimate goal should be to make the EIC generous enough so that it could replace all other welfare programs. Instead of having 70 safety net programs, as we now do, let’s consolidate down to just one. Why should liberals accept this welfare reform? Because in exchange, conservatives should be willing to insure that any family with an adult working 40 hours a week has enough cash income to pay for food, adequate housing, plus health insurance for the workers and their children, and basic child care. This plan is the most affordable and efficient one we can think of to dramatically cut the number of families with children lacking health insurance.

Step 5. Use market-based incentive structures to fix federal entitlement programs.

No plan to downsize the federal government and reduce its costs can possibly succeed if there is not a strategy for reining in entitlement spending. Federal entitlements now account for well over half of the budget, and these income transfer programs are by far the fastest growth areas of the federal budget. For years, Congress has treated entitlements as if they were on automatic pilot and their costs were beyond legislative control. Not surprisingly, these programs began in the 1970s to grow well beyond original expectations. For example, the price tag for Medicare was originally predicted to be about 1/6th what it costs today.

Cutting the benefit structure of these programs has proven to be politically suicidal for elected officials. This is why Social Security, for example, is often referred to as the “third rail of American politics.” If a politician touches it, he will die. This means that a new approach to entitlement reform is needed, one that will restructure these programs using market mechanisms in order to give better service and returns to the Americans who benefit. In this section I discuss reform options for the 3 largest entitlements: Social Security, Medicare, and Medicaid.

Social Security

Social Security is now running a $175 billion annual surplus of payroll taxes collected over payments made to senior citizens—and it’s projected to grow to over $300 billion by 2013.28 This situation will change, of course, when the 80 million baby boomers start to retire and start to depend on Social Security checks as a primary means of financial assistance. In the longer run, the financial situation of Social Security is very gloomy—the program is set to begin running cash deficits in 2018, and the long-term, 75-year unfunded liability is more than $25 trillion.29 That massive liability, like a second national debt, will need to be paid by our children and grandchildren unless we change the program today.

The private investment account solution to Social Security has been discussed at great length in other publications, so I will not dwell on the merits of this proposal. I will simply make the point that the average young American today could get a 2 to 3 times higher pension benefit from an IRA type account than by sending their dollars into the Social Security Administration for “safe” keeping. If the average American with earnings of $40,000 a year were permitted to put 10% of those funds into an IRA (Currently the FICA tax taxes 15%), then that $4,000 a year investment at a 6% interest rate would allow that American to retire with a nest egg of more than $1 million.

To get started, Congress ought to devote the entire Social Security surplus amount to private investment accounts. This would allow about 3 to 4 percentage points of the payroll tax to be placed in a retirement account. Eventually, this “foot in the door approach” to private retirement accounts would become so popular that the entire system could be privatized.

This plan would have two practical advantages over the current financing. First, it would prevent Congress from spending the Social Security surplus as it did throughout most of the 1980s and 1990s. Second, it would create the infrastructure and financial rewards of a personal account system, thus facilitating their expansion in the future.

In Table 2 below I show how much of the payroll tax could be diverted into personal accounts without running a deficit in the pay-as-you-go financing of the system. Eventually Congress should use general fund surpluses from budget cuts, to help finance the transition to a private investment option as well. The goal is to get the entire payroll tax diverted into Americans’ individual accounts. This private system pre-funds Americans’ retirement and ensures the financial solvency of Social Security for generations to come.

Table 2

CBO Projections: Payroll Tax and Social Security Surplus

2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | Total | |

| Social Insurance Taxes | 710 | 753 | 795 | 842 | 888 | 933 | 978 | 1,025 | 1,073 | 1,123 | 1,177 | 9,587 |

| Social Security Surplus | 162 | 164 | 179 | 199 | 219 | 237 | 255 | 273 | 289 | 304 | 317 | 2,436 |

| Percent | 22% | 23% | 24% | 25% | 26% | 26% | 27% | 28% | 28% | 28% | 28% | 26% |

| Source : Congressional Budget Office, “Budget and Economic Outlook: 2004–2013,” January 2003, URL: http://www.cbo.gov/showdoc.cfm?index=4032&sequence=2 | ||||||||||||

Health Care

Without question the largest trouble spot in the budget over the next 20 years will be health care programs. The CBO recently estimated that the net present value of Medicare’s unfunded liability has skyrocketed to $6.1 according to the latest Trustees Report.31 (This is like a third national debt.) And this liability will only continue to grow under current polices. By 2006 Medicare and Medicaid alone will cost $600 billion, consuming about 20 percent of the budget. When the baby boomers start to retire, costs will really begin to explode. By 2040 the Congressional Budget Office expects Medicare and Medicaid costs to double from 4 to 8 percent of GDP. Yet, Congress and the White House continue to bow to pressure from the senior citizen lobby to make Medicare more generous and more widely available to a greater share of the population. As Senator Phil Gramm put it: “If your mother is on the Titanic and the ship is sinking, the last thing on earth you want to be preoccupied with is getting more passengers on board.”32

Revamping Medicare and Medicaid won’t be easy to do politically. Republicans in the 104th Congress stepped on a hornet’s nest when they proposed relatively modest cost saving reforms of Medicare. The tragedy of the GOP misadventure with Medicare in 1995 and 1996 is that Gingrich and company took the heat for trying to fix the program, but they endorsed solutions that did not fundamentally scale back the program in ways that would have gradually reduced senior citizens’ reliance on government for health care. Since then, Republicans and Democrats have gingerly nibbled around the edges of the problem.

Medicare

There are a number of common sense reforms to Medicare and the health care system in general that could substantially reduce the escalating annual costs of the Medicare system. These include: 1) converting Medicare into a means-tested catastrophic insurance program; 2) changing the tax treatment of health care so that more Americans can participate in cost-saving Health Savings Account (HSA) programs; and 3) raising gradually the retirement age for Medicare.

1. Converting Medicare into a catastrophic coverage program . The long-term goal for Medicare should be to convert what is now an unjustifiably generous, first-dollar-coverage prepaid health plan for seniors into a catastrophic insurance “safety net” program. The Part B deductible for Medicare (physicians’ costs) is currently an absurdly low $100. If that deductible had been indexed to medical inflation since the program was created 30 years ago, the deductible would be $400 today. The deductible for Part A (hospital stays) is $792, but most seniors have Medigap insurance to cover the deductible and other co-payments, so their out-of-pocket costs are often negligible.

The way to convert Medicare into a catastrophic coverage plan is to raise the Part A and B deductibles over time. Seniors should be responsible for covering routine medical expenses by either paying out of pocket or purchasing Medigap insurance. (Ideally, when health savings accounts are made available to all workers, seniors too should be permitted to create tax-free accounts for expenses up to $3,000.) The goal for Medicare should be to lift the combined deductible to $4,000 as quickly as possible—and then index that premium to the growth of wages.

One way to make this restructuring of Medicare politically salable is by income testing the deductible. For example, the combined payments under Part A and Part B of Medicare could first be set at 2.5 percent of adjusted gross income (AGI) and then increased 1 percentage point each year for five years. Thus, beginning in 2008, the deductible would be 7.5 percent of AGI, the same rate that the tax code now allows individuals. Payments above the deductible, in most cases, would be fixed payments to the patient per illness or accident. A senior with an income above $40,000 would pay a total deductible of $3,000. Seniors would have security in that they would be protected from the cost of major illnesses or extended hospital stays. And a basic inequity in the health care system would be redressed. Mostly nonworking senior citizens—the wealthiest age group in America—would no longer receive a Cadillac health insurance plan paid for out of the paychecks of relatively lower income working Americans.

2. Change the Tax Treatment of Health Insurance to Encourage HSAs . Congress should change the tax treatment of health insurance to allow tax-free health savings accounts (HSAs) as a way to reduce the inflation in private and public health care. Congress must act quickly to make HSAs widely available, because the left is working frantically to try to socialize the health care system in the U.S. and the advocates of government run health care understand that HSAs are incompatible with a one-size fits all program.

We have 30 years of experience that has taught us that a larger direct federal role in health care will almost certainly have three effects: (1) it will send medical costs soaring for everyone; (2) it will lead to a deterioration in the quality of care that Americans have access to; and (3) it will bust the federal budget.

Probably the only viable defense against a national health insurance system—under which all Americans are required to purchase uniform insurance directly or via the government and people with healthy lifestyles are forced to subsidize those with unhealthy lifestyles—is to make tax-free HSAs widely available as quickly as possible. The Kennedy-Kassebaum law enacted in 1996 provided for a limited Medical Savings Account (MSA) pilot project and the MSA’s are extremely popular with workers. This promising option should be made available to all individuals and businesses that wish to participate.

3. Raise the Eligibility Age for Medicare . Rather than allow younger workers to “buy-in to Medicare,” as was proposed by the Clinton administration, Congress should move in the opposite direction by gradually raising the age of eligibility for Medicare to 71. Beginning in 2001 the age of eligibility should be lifted by three months per year for the next 24 years. That would mean that the age at which one would receive Medicare benefits would be 66 in 2004, 67 in 2008, 68 in 2012, until the retirement age reached 71 in 2024. Workers could still retire at 65 but with a reduced benefit.

Due to a quirk in current law, the Social Security retirement age is scheduled to rise over time, but not that of Medicare. Without question, any increase in the retirement age for Social Security should apply to Medicare as well.

Medicaid

Perhaps no federal welfare program is more wasteful and inefficient than Medicaid. In 2000 there were about 15 million children and 13 million adults who used Medicaid essentially as a health insurance program. Together these two groups — about 28.6 million people — cost the program about $30 billion.

The EIC expansion option should be offered as a replacement for Medicaid. If we include the $9 billion a year that is given to hospitals that provide care to a disproportionate number of low-income families, the EIC could provide about $1,150 per person, or about $3,450 per family of three. With $1,150-per-person, most families would be able to buy a health insurance policy on the private market in most areas of the country. Under this plan, the poor would get better ca The EIC expansion option should be offered as a replacement for Medicaid. If we include the $9 billion a year that is given to hospitals that provide care to a disproportionate number of low-income families, the EIC could provide about $1,150 per person, or about $3,450 per family of three. With $1,150-per-person, most families would be able to buy a health insurance policy on the private market in most areas of the country. Under this plan, the poor would get better care, and the cost to taxpayers would probably shrink if poor families shopped around for the best health plan for their needs—which probably would not include first dollar insurance coverage.

Step 6. Abolish all Corporate Welfare

America’s most costly welfare recipients today are Fortune 500 companies.33 In 2002 Uncle Sam doled out about $93 billion in taxpayer subsidies.34

These welfare payments come in every conceivable shape and size. Including government grants, contracts, cut rate insurance, loans, and loan guarantees, there are roughly 125 such business subsidy programs in the federal budget and they can be found in virtually every cabinet agency of the government—including the Defense Department

If Congress were to eliminate all corporate spending subsidies, the savings would be large enough to entirely eliminate the capital gains tax. This is four times more money than is raised each year by the death tax. Eliminating either of those anti-growth taxes would do far more to benefit American industry and U.S. global competitiveness than asking Congress to pick industrial winners and losers. Then Democratic Senator Bill Bradley’s attack against the corporate welfare state was accurate: “The best way to allocate resources in America is through a market mechanism. Tax and direct-spending corporate subsidies impede the market’s functioning for non-economic, special interest reasons.”35

One perverse, but predictable outcome of a corporate welfare state is that industry begins to view Congress, rather than consumers, as their real customers. Firms begin to produce for government, not the market. Corporate welfare, notes Wall Street financier Theodore J. Forstmann, has led to the emergence of the “statist businessman in America.”36 The statist businessman is “a conservator, not a creator; a caretaker, not a risk taker; an argument against capitalism even though he is not a capitalist at all.”37

Business subsidies are often defended on the premise that they correct distortions in the marketplace. In reality, the major effect of corporate subsidies is to divert credit and capital to politically well-connected firms at the expense of their less politically influential rivals. This is precisely what Japan has found during its economic collapse over the past decade. In Japan the myth of industrial policy as a competitiveness strategy has led to a 67 percent reduction in the value of Japanese stock market since 1991.

It is also argued that corporate subsidies are necessary so that U.S. firms can compete with their subsidized rivals in other nations. But more than 90 percent of American businesses manage to stay in business without ever receiving government grants, loan guarantees, insurance, or airplane seats on Commerce Department trade missions around the globe. But they pay higher taxes, which lowers their competitiveness, to support those businesses that do.

There is no evidence that the government can direct capital funds more effectively than the $100 billion a year venture capital industry or private money managers. Decades of historical experience prove that government agencies have a much less successful track record than do private money managers of correctly selecting winners. Example: the average delinquency rate is almost three times higher for government loan programs (8 percent) than for commercial lenders (3 percent).38 The Small Business Administration delinquency rates reached over 20 percent in the 1980s; the Farmers Home Administration delinquency rate has approached 50 percent.39 The Federal Housing Administration’s default rate is 8 percent versus a 3 percent industry-wide average for private mortgage insurers.

Given that there are more than 1 million small and large businesses in the U.S. today, the subsidies approach to prosperity is utterly futile. The only effective way to enhance the competitiveness and productivity of American industry is to create a level playing field, which minimizes government interference in the marketplace and substantially reduces tax rates and regulatory burdens.

In Washington there seems to be a mighty fine line between too big to fail and too big to succeed. Recently the federal government attacked Microsoft, perhaps America’s most innovative and profitable high-technology corporation in decades. Congress spent hundreds of millions of dollars trying to prop up the firm’s less efficient computer industry rivals. Had the government succeeded in its quest to knock Microsoft from its lofty perch, no doubt it would have had a taxpayer-funded safety net waiting to cushion its fall.

We now have an unhealthy policy regime in Washington through which federal regulatory and anti-trust policies are increasingly geared toward punishing success, while federal corporate welfare policies increasingly reward the losers.

The main villain in corporate welfare is government spending, not tax deductions. To the extent the tax code contains unjustified tax favors carved out for specific industries or firms, the loopholes should be closed in conjunction with an overall reform or elimination of the income tax.

Even though both Congress and now the Bush White House have pledged to shrink the corporate safety net, those promises are largely unfulfilled. In 1recent years, corporate welfare spending actually rose slight Even though both Congress and now the Bush White House have pledged to shrink the corporate safety net, those promises are largely unfulfilled. In 1recent years, corporate welfare spending actually rose slightly. Clearly, the strategies used in the past to combat the corporate welfare state have yielded disappointing results for taxpayers.

Here are concrete steps Congress should take to shrink the corporate welfare state:

1. Congress should immediately enact a budget rescission bill, perhaps entitled “The Corporate Welfare Elimination Act,” terminating a minimum of 40-50 business subsidy programs and closing down the Departments of Commerce and Energy. Savings of at least $200 billion over six years should be targeted. The bill should be crafted in a bipartisan fashion by identifying those programs that have been recommended for extinction by groups such as the Cato Institute, the Heritage Foundation, the Progressive Policy Institute, and even in some cases the Nader group Essential Information. Across the ideological spectrum, there is widespread support for reducing these subsidies. Spending programs included in this rescission should include, but not be restricted to:

- The Small Business Administration

- The Advanced Technology Program

- Forest Service Road Building

- Federal Housing Admin. subsidies to mortgage lenders

- The Agriculture Marketing Promotion Program

- Manufacturing Extension Program

- National Technical and Information Administration

- International Trade Administration

- Department of Energy R & D funding

- The Maritime Administration

- Overseas Private Investment Corp. (OPIC)

- Agriculture Research Service

- Minority Business Development Administration.

- The Export Import Bank

- Economic Development Administration

2. Form a Corporate Welfare Elimination Commission—modeled after the Military Base-Closing Commission of 1995 . This Commission should be given the charter to identify at least $50 billion a year of corporate subsidies for termination. Congress should then be required to vote up or down on the entire package.