Introduction

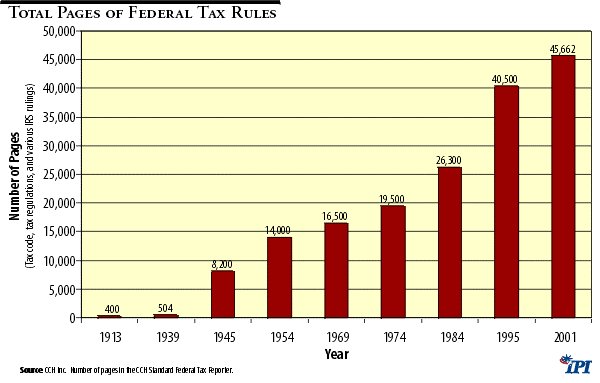

At the beginning of the 20th century, federal taxes accounted for about 3 percent of the nation’s gross domestic product (GDP), and the entire tax code and related regulations filled just a few hundred pages. Today, federal taxes account for 21 percent of GDP, and federal tax rules span 45,662 pages. 1

Each year, Americans spend 6.1 billion hours—more than 3 million person-years—on tax compliance activities such as filling out tax forms, keeping records, and learning tax rules.2 The complexity of the tax system has spawned a huge public and private “ tax industry” to perform administrative, planning, avoidance, and enforcement activities. Those activities represent a pure loss to the economy since they consume resources and human effort that could otherwise create useful goods and services. In addition, tax complexity leads to inequitable treatment of citizens, causes high error rates, promotes evasion, and impedes economic decision making by creating uncertainty.

The chief source of federal tax complexity is the income tax on individuals and corporations. Two-thirds of Americans think the income tax system is “too complex.”3 Treasury Secretary Paul O’Neill called the system an “ abomination.”4 In 1976, president-to-be Jimmy Carter called for “a complete overhaul of our income tax system. I feel it’s a disgrace to the human race.” 5 Since Carter’s attack, the number of pages of federal tax rules has doubled.6

In 1988 Princeton professor David Bradford, a former deputy assistant secretary in the Department of the Treasury, noted “recent experience confirms the tendency of an income tax…to evolve toward ever greater complexity.” 7 Another decade of experience has underscored this reality. There have been 1,916 changes to the tax code in the past five years, and 7,000 changes since 1986.8 The 2001 tax cut law creates 441 separate tax code changes. 9

The good news is that this is a problem that policymakers can do something about. Congress has taken a few small steps to raise the visibility of the tax complexity problem, most recently with the release of a 1,300-page report from the Joint Committee on Taxation (JCT).10 The study cataloged the excessive complexity of federal taxes and proposed more than 100 specific reforms. However, most of the proposals were quite narrow and limited in scope, as was required by the committee’s mandate. 11

Limited simplifications will not be enough. Substantial reform can come only from uprooting the income tax system and replacing it with a consumption-based system, such as the Hall-Rabushka “flat tax,” a national retail sales tax, or a “consumed-income” tax.12 Switching to some version of a consumption-based tax holds the promise of spurring greater economic growth and vastly simplifying the federal tax system.

This study examines the magnitude of federal tax complexity, the costs created by that complexity, the problems inherent in taxing “income,” the advantages of simplifying the tax system through using consumption-based taxes, and some long-term economic trends affecting the tax system.

The Magnitude of Federal Tax Complexity

The Growth of Federal Tax Rules

A century ago, the federal government relied on excise taxes and customs duties for 91 percent of its revenue. As the government grew and sought new sources of revenue, it enacted two income tax systems. The corporate income tax was imposed in 1909, with a 1 percent rate, while the individual income tax was created in 1913, with rates ranging from 1 to 7 percent.13 The income tax began with just 16 pages of tax laws, and the entire federal tax system still had only 500 pages of laws and regulations in the late 1930s. 14 World War II launched the income tax on a trajectory of continual growth, fueled by employer withholding, which started in 1943.

Today, total federal tax rules span 45,662 pages, having more than doubled in length since the 1970s. [See Figure 1] This page count includes the full tax code, tax regulations, and summaries of various Internal Revenue Service (IRS) pronouncements such as letter rulings and technical-advice memoranda.15 The tax code itself runs at least 1.4 million words and has increased in length 51 percent since 1985.16

Figure 1

The growth in tax complexity can also be discerned from other statistics, as summarized in Table 1. For example, the number of different tax forms produced by the IRS increased 23 percent in the past decade, going from 402 to 496. 17 Taxpayer phone calls to the IRS doubled during the 1990s from 56 million to 111 million, even though the number of taxpayers grew only 12 percent.18 Even the growing use of tax preparation software and the 1.5 billion annual hits to the IRS web site have not reduced taxpayer confusion.19

The Tax Industry

The complexity of the tax system has spawned a huge “tax industry” engaged in tax filing, administration, planning, avoidance, enforcement, and other activities. The most visible part of the tax industry is the IRS, with a budget of $9 billion in fiscal 2001. It employs 97,000 people and uses about 74,000 volunteers each year during tax-filing season.20 In addition, there are about 24,000 tax workers in other federal agencies. 21

Table 1

Escalating Income Tax Complexity

| Item and Time Period | Change |

| a) Total pages of federal tax rules, 1984-2001 | Up 74% in 17 years |

| b) Words in federal tax code, 1985-2000 | Up 51% in 15 years |

| c) Words in federal tax regulations, 1985-2000 | Up 58% in 15 years |

| d) Number of IRS tax forms, 1990-2000 | Up 23% in 10 years |

| e) IRS phone queries from taxpayers, 1990-1999 | Up 98% in 9 years |

| f) Percentage of taxpayers using paid tax preparers, 1990-2000 | Up 19% in 10 years |

| g) H&R Block U.S. tax preparation revenues, 1996-2001 | Up 74% in 5 years |

| h) Top 8 accounting firms’ tax revenues, 1996-2001 | Up 112% in 5 years |

| i) Pages in Form 1040 instruction book, 1995-2000 | Up 39% in 5 years |

| j) Time to complete Form 1040 and Schs. A, B, D, 1990-2000 | Up 47% in 10 years |

| k) Number of changed provisions in the tax code since 1986 | 7,000 in 15 years |

| Sources: Author’s calculations based on: a) CCH Inc. tax code, regulations, and IRS rulings, b) Tax Foundation, c) Tax Foundation, d) IRS, e) JCT, f) IRS, g) H&R Block, h) Public Accounting Report, i) NTU, j) NTU, k) CCH Inc. | |

The complexity of the income tax has overwhelmed federal tax workers. Year after year, the IRS answers a large proportion of taxpayer phone queries incorrectly. The most recent government investigation found that IRS workers provided incorrect answers 47 percent of the time.22

Alongside the federal tax bureaucracy, a huge private tax industry of accountants, lawyers, and other workers has developed. Of the 1.6 million accountants in the country, perhaps 30 percent, or 480,000, are in tax practice.23 Of the 1,048,000 attorneys in the country, perhaps 10 percent, or 105,000, are in tax practice.24 Enrolled agents are another group of tax specialists and number at least 35,000.25 There are also uncounted thousands of computer specialists, administrative personnel, and others in the tax industry, as well as tens of thousands of tax workers in state and local governments.26

Total tax industry employment, then, is probably more than 1 million workers. 27 That means there are more workers in the tax industry than there are in the entire motor vehicles and parts industry.28

The following statistics indicate the how rapidly the tax industry has grown:

• Individual Tax Preparation: in 2001, 57 percent of individual tax filers used a paid preparer, up from 48 percent in 1990 and fewer than 20 percent in 1960. 29 About 73 million individual taxpayers use paid preparers, and industry leader H&R Block’s average fee is $112, so basic tax preparation costs individual taxpayers at least $8.2 billion per year.30 Many taxpayers have more complex tax situations and pay thousands of dollars for tax help.

• H&R Block Revenues: H&R Block is the largest tax preparation firm, with 90,000 workers.31 The company’s tax preparation revenues are up 74 percent in the past five years.32 In addition to H&R Block, there are thousands of smaller practitioners. An IRS tabulation found that 1.1 million different tax preparers had signed individual tax returns in 1997, although some of those may have been unpaid preparers.33

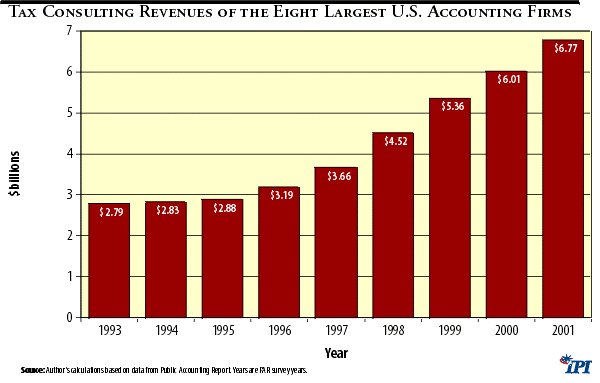

• Business Tax Preparation: Providing tax help to 25 million U.S. businesses is big business. Tax fees generate 29 percent of the revenues of the top 100 accounting firms, led by PricewaterhouseCoopers and Ernst & Young.34 Tax fees have soared in recent years, more than doubling in the past seven years for the top 100 firms, and more than doubling in the past five years for the top 8 firms. [See Figure 2]

Figure 2

Costs of Tax Complexity

It will be of little avail to the people, that the laws are made by men of their own choice, if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood…or undergo such incessant changes that no man who knows what the law is today, can guess what it will be tomorrow.

—James Madison, Federalist no. 62

Compliance Burden

The compliance burden is the total time and money wasted by filling out tax forms, keeping tax records, learning tax rules, and other tax-related chores. The Office of Management and Budget (OMB) estimates that Americans spend 6.1 billion hours, or 3 million person-years, on federal tax compliance each year. 35 With the opportunity cost of compliance equal to $30 per hour, (an OMB estimate), the tax compliance costs of lost time are about $183 billion. 36 Most tax compliance costs are associated with income rather than other taxes. It is estimated that federal income tax compliance costs range from about 10 to 20 percent of income tax revenues.37

Business Compliance Burden

Businesses bear the biggest brunt of tax complexity costs under the income tax. There are currently 700 separate provisions of the tax code that affect individuals but 1,500 provisions affecting businesses.38 At least 55 percent of the income tax compliance burden initially falls on businesses.39

Many large corporations spend more than $10 million per year on tax paperwork. Mobil Corporation once brought their federal tax documents to a congressional hearing to illustrate the magnitude of the compliance burden. Their tax documents ran 6,300 pages and weighed 76 pounds.40 Citigroup’s tax return sometimes exceeds 30,000 pages.41 For small businesses, tax compliance costs can be larger than actual taxes paid.42

The need for business tax simplification is a key reason to pursue major tax reform. All Americans will gain if businesses spend less time buried in tax paperwork and more time creating better products with lower costs.

Enforcement Costs

In addition to facing the basic compliance costs of filing returns, many taxpayers incur costs even after they have filed their returns. Responding to IRS audits, notices, liens, levies, and seizures as well as fighting the IRS in court can cost individuals thousands of dollars and businesses millions of dollars. The IRS assesses about 30 million penalties each year, imposing extra time and monetary costs on taxpayers.43 Because of the complexity of the tax system, many penalties are erroneous. In fact, the high error rate caused the IRS Taxpayer Advocate to identify IRS penalties as one of the most serious taxpayer problems, and penalties are one of the most litigated areas of tax law.44

Errors

In addition to added time and monetary costs, tax complexity causes taxpayers, the IRS, and tax experts to make errors. IRS errors have already been noted: the IRS gives incorrect answers to about half of taxpayer phone inquiries and often assesses erroneous penalties.45 And errors can cost taxpayers money. For example, a new General Accounting Office (GAO) study found that more than half a million taxpayers together lose more than $300 million per year because they take the standard deduction when they should itemize their deductions.46

Other evidence of excessive complexity comes from Money magazine’s annual test of tax experts, who are asked to compute taxes for a hypothetical family. Money’s results consistently show wide variations in experts’ answers thanks to the complexity of the tax laws. In 1998, the 46 experts surveyed came up with 46 different answers; their calculations of taxes owed ranged from $34,240 to $68,912.47

Economic Planning Difficulty

Tax complexity impedes efficient decision-making and results in families and businesses missing opportunities and making poor economic decisions. This decision-making impediment of the tax system has been called “ transactional complexity.”48 For example, the growing number of saving vehicles under the income tax, including numerous individual retirement accounts (IRAs), confuses family financial planning. The wrong saving choice may mean lower returns, less liquidity, and payment of penalties should money need to be withdrawn at the wrong time. Other examples of transactional complexity include the difficulty in figuring out when capital gains should be realized, and the tax implications of choosing a business structure for a new company.

A dramatic example of income tax complexity interfering with economic planning is the recent phenomenon of taxpayers exercising incentive stock options (ISOs) only to be hit unwittingly with large alternative minimum tax (AMT) bills. 49 Many ISO holders are middle-income families working for high-tech firms. When taxpayers exercise ISOs, the difference between the option price and the market price may trigger the AMT, even if the stock is not sold. Many taxpayers have been hit with large AMT tax bills and without enough cash available to pay the IRS. While wealthy taxpayers might have tax advisers helping them, many middle-class families have never even heard of the AMT; still, they face large tax bills they never planned for.

Uncertainty

The income tax system injects at least two types of uncertainty into economic planning. The first is the continual change in tax rules. This complicates long-term economic decisions, such as business investment and retirement planning. Taxpayers have faced a remarkable number of changes in federal tax law in recent decades. Since 1954, more than 500 public laws have made tax code changes.50 The past five years have seen 1,916 changes to the tax code.51 The 2001 $1.35 trillion tax cut law contains 85 major provisions and creates 441 separate changes to the code.52

Each change in tax law sets off changes in tax regulations, requests for IRS guidance, changes to tax forms, and higher error rates. The 2001 tax law adds new wrinkles in uncertainty with multiyear phase-in periods for numerous provisions. Phase-ins create the threat that the rules will be changed— again—before they become effective, but after taxpayers have acted in anticipation of the new rules.

The second way tax complexity creates uncertainty is in confusing taxpayers and the IRS about the effects of current laws—let alone future changes. Discussing costs of corporate tax paperwork, Professor Joel Slemrod of the University of Michigan noted “ even after all this expense, neither the company nor the IRS is completely sure what the correct tax liability really is. Audits, appeals, and litigation can drag on for years.”53 The GAO found that hundreds of tax disputes between the IRS and large corporations remain unsettled for 10 years or more.54 IRS agents have estimated that “about 86 percent of corporate tax disputes were due to different interpretations of the tax laws.”55

In 1992, the IRS estimated that after being audited large corporations owed $142 billion in taxes, but corporations themselves figured they owed just $118 billion.56 Noting this gap, the GAO found that “the difference is substantial and, in large part, attributable to ambiguity and complexity in tax law.” 57 Uncertainty about corporate tax liability has measurable economic effects. One academic study found that tax law complexity decreases the accuracy of Wall Street estimates of company tax rates, which are a key component of bottom-line returns to shareholders.58

Noncompliance

Tax complexity leads to noncompliance with the tax system, whether through confusion or a desire to evade taxes. The General Accounting Office estimates that the government loses about 17 percent of income tax revenues to noncompliance, or about $200 billion annually.59

Former IRS commissioner Shirley Peterson thinks that confusion plays an important role in noncompliance: “A good part of what we call non-compliance with the tax laws is caused by taxpayers’ lack of understanding of what is required in the first place.”60 The JCT notes that for other taxpayers, “complexity can foster multiple interpretations of the law and aggressive planning opportunities. In addition, taxpayers may consciously choose to ‘play the audit lottery’ by taking a questionable position on their tax returns, in the belief that complexity will shield them from discovery.”61

Inconsistent and ambiguous income tax rules make it difficult for the government to find tax evaders. Consequently, it responds with more audits, more information-reporting requirements, more enforcement activities, more court battles, and ever more regulations. Aggressive tax planning and the resulting responses by the IRS are lucrative for accountants and lawyers, but the country would be better off if tax rules were simple and transparent so that business could spend its energies making good products, not playing cat-and-mouse games with the tax authorities.62

Inequity and Unfairness

Tax code complexity creates unfairness when it exacerbates “horizontal inequities,” which occur when similar families pay different amounts of taxes. As Congress has larded up the income tax code with special preferences, inequities have only increased. For example, tax incentives for education may reward individuals who pay to take classes but not individuals who learn by themselves at home. Such inequities, and the tax complexity they create, have resulted in about 60 percent of Americans thinking that the income tax system is “unfair.”63 As David Bradford has noted, echoing Madison, “A law that can be understood by only a tiny priesthood of lawyers and accountants is naturally subject to popular suspicion.”64

Causes of Income Tax Complexity

The first decision to make when designing a tax system is what base, or economic quantity, to tax. In 1909 and 1913, respectively, the federal government imposed new taxes on corporate and individual income. Initially, tax rates were low and affected very few people, so any concerns about the simplicity or efficiency of the tax base would not have seemed important. 65 But 90 years later, the twin income taxes have morphed into giant revenue machines that together raise $1.3 trillion annually, or 60 percent of total federal receipts.

Unfortunately, the government picked an economically damaging and inherently complex tax base for what became its largest revenue source. The income tax is economically damaging because it distorts crucial decisions in the market economy, such as the trade-off between consumption and saving. The income tax is inherently complex for the reasons discussed in the following sections.

Haig-Simons Income

The Sixteenth Amendment to the U.S. Constitution, enacted in 1913, allowed “taxes on incomes, from whatever source derived” but failed to define how income should be measured. Statutory definitions that followed were just as vague, and there have been legal wrangling and congressional gyrations ever since about the proper base for the income tax.

Academic thought has been dominated by the measure of income named after economists Robert Haig and Henry Simons, who wrote in the 1920s and 1930s. 66 Haig-Simons income is simple to describe in theory: income equals consumption plus the rise in market value of net wealth during a year. That means it includes all forms of labor compensation, such as wages and fringe benefits, and all sources of capital income, such as interest, dividends, and capital gains. It represents all income accrued during a year—whether or not it is received—including the paper value of net capital gains. For example, if a worker had wages of $30,000 that was spent on goods and services and unrealized stock market gains of $10,000, a Haig-Simons tax would have a base of $40,000. Haig-Simons also includes components individuals would not normally think of as income, such as the implicit rent received from owning one’s home and the buildup of wealth in life insurance policies. This is a very expansive measure of income, and our tax system has never come close to fully implementing it.

While Haig-Simons income is simple in the abstract, it is very impractical to tax in the real world. A basic difficulty stems from having to determine the market value of all assets each year in order to measure changes in net worth. In addition, Haig-Simons would require imputing many quantities, such as the phantom income from owning one’s home. Under such a system, taxpayers with little cash flow would face large tax bills they simply could not pay.

Despite the impracticality of using Haig-Simons, it has remained a touchstone for many public finance experts, and it still influences current tax policy. Oddly, a Haig-Simons income tax does not have a strong economic argument in favor of it. In fact, the taxation of a broadly defined income base leads to a bias against saving and investment. For example, the accrual method of taxing capital gains would clearly tax investment twice: a rise in an asset’s projected future returns would lead to an immediate, taxable capital gain; then, the return to the asset would be taxed again as it generated revenues in future years. In addition, Haig-Simons fails to recognize that saving is an expense incurred to earn income; therefore, leading theorists such as Irving Fisher have argued that it is very flawed.67

Without a strong economic rationale, the attraction of a Haig-Simons income tax base seems to stem partly from its theoretical simplicity and partly from the egalitarian impulse to impose a heavy load of taxation on those with high incomes. Since Haig-Simons fully taxes capital income, many people have claimed that it is more equitable than alternatives.68 That claim is of course subjective, and many other people argue that consumption-based taxation is superior to income taxation on fairness grounds, but a discussion of tax fairness is beyond the scope of this paper.69

Falling Back on ad hoc Rules

The impracticality of taxing Haig-Simons income has forced policymakers to fall back on an array of ad hoc rules to implement the federal income tax. Some income is exempt from tax, some income is taxed once, and other income is taxed multiple times. Income may be taxed when earned, when realized, or when received. There is no consistent standard under present tax policy for what constitutes income or when it should be taxed.

Ad hoc rules have multiplied because there is no simple and efficient structure for an income tax. A key problem is the necessity of dealing with inflation, which “wreaks havoc” with income taxes, as David Bradford notes. 70 Inflation distorts many key income tax items, including capital gains, depreciation, and interest.

Dealing with inflation creates a catch-22 of efficiency and complexity problems. If inflation is not specifically dealt with, the result is overtaxation and the distortion of tax rates across different investments. Alternately, fully adjusting the income tax for inflation would require excessive paperwork, or “rule complexity.” As a result, governments usually fall back on ad hoc and approximate fixes for inflation. The problem with ad hoc fixes is that they generate inconsistencies and thus create decision-making difficulties, or “transactional complexities.” 71

A classic example is capital gains taxation. To avoid taxing purely inflationary gains, special rules are needed to adjust for inflation. A full solution would be to allow indexing of the capital gain basis, but that would involve excessive paperwork. Instead, the federal tax system has usually allowed an ad hoc adjustment for inflation in the form of an exemption or a lower tax rate. Such makeshift adjustments provide only a rough solution, and they create tension as taxpayers seek to recharacterize ordinary income as capital gains. Complexity increases as the government drafts extensive rules to prevent taxpayers from unduly taking advantage of the special capital gains rules.

The realization tax treatment of capital gains is another example of the Catch-22 complexity problem.72 A Haig-Simons income tax would tax capital gains on an accrual basis, taxing all net gains at the end of each year. As noted previously, that would be both difficult and unfair since cash-poor taxpayers could not afford to pay taxes on purely paper gains. As a result, federal taxation has fallen back to taxing capital gains upon their realization, or asset sale. But that approach creates transactional complexity as taxpayers seek to optimally time realizations and offset capital gains with losses. Complexity has further increased as the government has created complicated rules to limit taxpayers’ flexibility in dealing with capital gains. Special rules, for example, limit the extent to which capital losses may offset ordinary income, and “wash sale rules” restrict the use of timing techniques to match gains with losses.

Inherent Inconsistency for Deductions

Determining which expenses may be deducted against gross income is another inherently complex area of the tax system. Under the income tax, businesses generally use accrual accounting to measure the tax base of net income or profits. The basic idea is to match revenues with expenses over time to accurately measure net income within each period.73 This is far more difficult than it sounds, especially because there is no agreed-upon definition of net income.

Consider business purchases of buildings and capital equipment. Those assets generate revenues in future years, so it is thought that they should not be simply deducted in the year they are purchased. Rather, they must be depreciated, or deducted against receipts, in future periods based on the decline in their value over time. If depreciation deductions do not accurately track the decline in the asset’s value, the Haig-Simons income tax base will be mismeasured. Since every asset is different, and new types of assets are invented all the time, it is difficult to maintain accurate and simple rules for calculating depreciation.

As is the case with capital gains, inflation creates depreciation distortions for which there are no simple solutions. The current income tax allows accelerated depreciation, which may roughly compensate for inflation, but this ad hoc fix involves complicated rules and can lead to economic distortions. 74 Inflation also causes problems for other tax code provisions that attempt to match revenues and expenses through time, such as inventory accounting.

At a more fundamental level, the current concept of taxing income creates the intractable problem of determining which expenses should be deducted immediately and which should be capitalized. Purchases that are capitalized are deducted over future years using the special rules for depreciation, amortization, and inventory. In theory, any asset that produces benefits in future years should be capitalized, but the tax code contains no consistently followed principle of capitalization. A lack of consistency has resulted in many battles between the IRS and taxpayers.75 The Supreme Court has noted the ambiguity: “If one really takes seriously the concept of a capital expenditure as anything that yields income, actual or imputed, beyond the period . . . in which the expenditure is made, the result will be to force the capitalization of virtually every business expense.” 76 For example, advertising costs may be immediately deducted under current rules. But most advertising produces benefits in future years. In theory, then, advertising costs should be amortized rather than immediately deducted.

Congress has, though, followed no consistent policy on capitalization. For example, in one attempt to properly measure Haig-Simons income, Congress burdened entrepreneurs by requiring amortization over five years of costs associated with starting a new business. It decided that start-up costs create value in future time periods and thus should not be immediately deducted. On the other hand, Congress has decided that research and development expenses may be immediately deducted, even though R&D clearly generates benefits over future years.

Inconsistency regarding deductions has also created complexity under the individual income tax. In an effort to broaden the tax base, for example, Congress eliminated the personal interest deduction in 1986. Since mortgage interest remained deductible, however, home equity loans developed to essentially allow people who own homes to continue to deduct personal interest.

Such income tax inconsistencies create administrative and enforcement problems. The government must create complicated “anti-abuse” rules to counter the natural tendency of taxpayers to reorganize their affairs to seek out tax preferences. Also, there is a continual call for IRS guidance from taxpayers and tax accountants because, with no generally followed principles, it is not clear what the law requires in each specific situation.

Inconsistency Breeds Instability

The ad hoc and inconsistent rules of the income tax have been a major source of instability in the federal tax system. Policymakers have gyrated between broader and narrower tax bases, with saving and investment provisions as the main battleground. Proponents of broadening the base use Haig-Simons income as the touchstone. Others, concerned about the economic damage caused by taxing broad-based income, favor removing excess taxes from personal saving and business investment. Removing taxes from saving and investment moves the system toward a consumption-based tax. Table 2 illustrates some of the gyrations taken by Congress as it has changed policy direction on saving and investment provisions in recent decades. 77

Table 2

The Gyrating Income Tax Base: Changing Rules for Saving and Investment

| Broad-Based Income is Taxed | Exceptions are Created | Exceptions are Restricted | Restrictions are Liberalized |

| Income tax is imposed, resulting in heavy tax burden on saving and investment | Harm from income tax is recognized and exceptions are made | Exceptions are restricted in effort to “broaden the base” | Restrictions are liberalized as their disincentive effects are recognized |

| Personal Saving | Capital gains treatment changed 25 times since 1922. Rate reduced in 1978 and 1981 | Capital gains rate increased in 1986 | Capital gains rate reduced in 1997 |

| Creation of individual and employer-based saving/pension plans | Restrictions on eligibility, contribution limits, early withdrawals, distributions, etc. | Liberalization in 1996, 1997, 2001. Creation of SIMPLE plans with fewer rules | |

| IRAs liberalized in 1981 | IRAs restricted in 1986 | IRAs liberalized in 1997, 2001 | |

| Business Investment | Depreciation liberalized in 1962, 1971, 1981 | Depreciation deductions pared back in 1982, 1984, 1986 | Calls to liberalize depreciation for high-tech and other assets |

| Investment tax credit (ITC) on and off since 1962 | ITC eliminated in 1986 | ||

| Business incentives in general | Corporate alternative minimum tax (AMT) limits business incentives | JCT, ABA, AICPA, and others call for AMT repeal | |

| Small business incentives, such as expensing capital purchases | Small business incentives are restricted and denied to larger firms | Small business expensing liberalized in 1996 | |

| Source: Author’s compilation. | |||

Congress has changed the treatment of long-term capital gains 25 times since it first treated gains separately from ordinary income in 1922.78 Another example of unstable policy is the investment tax credit (ITC), which was adopted in 1962, repealed in the late 1960s, reinstated and then increased in the 1970s, and repealed in 1986.79 Similarly, since accelerated depreciation was introduced in 1954, depreciation rules have changed every decade or so.80

Various major tax acts have embraced opposing tax base philosophies. The tax laws of 1969 and 1976 generally moved toward a Haig-Simons income tax base, but the 1978 tax law that followed moved back toward a consumption base.81 The Economic Recovery Tax Act of 1981 then moved the system much further toward a consumption base. It liberalized depreciation deductions, expanded IRAs, and lowered the capital gains tax rate. Congress changed course in 1982 and 1984, scaling back the liberalized depreciation of the 1981 law and reducing the ITC.

The wide-ranging Tax Reform Act of 1986 (TRA86) substantially expanded the tax base toward the Haig-Simons ideal. IRA provisions were cut back, the capital gains tax rate was raised, depreciation deductions were further restricted, the ITC was eliminated, and the individual and corporate AMTs were beefed up. TRA86 also created some of the most complex parts of the income tax code, including the new rules for the AMT and inventory accounting. So while TRA86 cut marginal tax rates, the broadening of the tax base toward Haig-Simons has been widely criticized for its complexity and anti-saving effects.

After TRA86, Congress realized its overreach and began slowly moving the tax system back toward a consumption base. Capital gains tax rates were lowered once again in 1997. Small business expensing for capital purchases was modestly liberalized in 1996. And rules for retirement saving plans were liberalized in 1996, 1997, and 2001.

Tax instability, though, can cause large gyrations in business investment and economic growth. This was dramatically illustrated with the recession that hit the real estate industry after TRA86. Before 1986, favorable tax provisions and economic factors, such as high inflation, led to a construction boom in shopping centers, commercial office space, and apartment buildings. Tax-induced investment was also flowing into obscure tax shelters, such as mink farms and buffalo raising.82

In casting a wide net to discourage tax shelter activity and broaden the tax base, TRA86 made numerous changes that together sent the real estate industry into a tailspin.83 First, the capital gains rate was increased from 20 to 28 percent— important because a substantial share of real estate returns are in the form of gains. Second, depreciation lives for real estate were lengthened, thus pushing up effective tax rates on investment. Commercial property, which had been written off over 19 years before TRA86, was to be written off over 31.5 years, and later, 39 years. Third, new passive loss limitation rules were introduced for real estate. These rules restricted even active investors in real estate from deducting real estate losses against other (non-passive) income sources.

These changes led to a dramatic drop in real estate prices and sucked investment out of the industry by the late 1980s. For example, apartment building construction fell more than 25 percent in the years following TRA86. 84 The real estate collapse in turn created loan defaults at savings and loan institutions and commercial banks that held substantial real estate assets, thus causing many to fail. There is continuing debate about which pre- or post-TRA86 tax rules make the most sense for real estate. But a broader message from the episode is that continual change in tax rules can create widespread damage to affected industries and the broader economy.

Income Tax Damage and Band-Aid Fixes

A key cause of the gyration of the tax system is that high tax rates imposed on an income base cause substantial economic damage, particularly to saving and investment. In response to the damage, there are continuing demands for Congress to carve out exceptions. For small businesses, Congress carved out an exception to the complex and costly depreciation rules by allowing immediate deduction, or “expensing,” of the first $24,000 of capital investment.85

Congress has recognized that full income taxation of individuals’ personal saving would be destructive. In response, it has carved out dozens of preferential provisions for saving, including 401(k)s, numerous IRAs, and other vehicles. With the income tax, Congress takes as its starting position that saving should be fully taxed, but numerous and complicated exceptions to the rule should then be carved out. This is a much more complex approach than starting with the general rule that saving should not be taxed, as would be the case under a consumption-based tax system.86

The current approach causes great instability, as shown in Table 2. Congress creates tax preferences, determines that the preferences should not be used “too much,” and then restricts them. The negative effects of restrictions, in turn, lead to calls for liberalizing the restrictions.

For personal saving vehicles, Congress has created a complicated patchwork of rules for eligibility, contribution limits, withdrawal requirements, and “ nondiscrimination” requirements designed to broaden plan coverage. Employer-based plans are also subject to complex regulations under the Employee Retirement Income Security Act of 1974 (ERISA). The JCT notes that major areas of employer pension law have changed nearly every year since the early 1980s, and the changes often create such a large backlog of regulations that employers are frequently unsure of how to comply.87

The complexity of tax laws makes saving vehicles less efficient than they should be, and leads to inequitable treatment of individuals. The complex rules and limitations reduce the pro-saving benefits that saving vehicles might otherwise have, defeating their purpose. In addition, the results are inequitable since different individuals have access to different plans, and some purposes, such as retirement, receive favorable saving treatment while others do not.

Congress sometimes realizes that the complexity it creates has gone too far. It then creates new rules to skirt the existing complex rules. For example, as the complexity of employer-based pension plans has increased, firms, particularly smaller ones, have dropped pension coverage. In response, Congress created SIMPLE retirement plans. Available to firms with 100 or fewer employees, SIMPLE loosens some employer requirements. Simplified employee pensions (SEPs), are another congressional attempt to create a simpler retirement saving vehicle.

The 1996 tax law that created SIMPLEs included 32 other law changes under the heading “Pension Simplification Provisions.” The recently passed $1.35 trillion tax cut includes 64 separate provisions changing the rules for tax-favored saving plans.88 Wouldn’t it be much better to exempt personal saving from taxation altogether? This would hugely simplify financial planning and eliminate the need for Congress to pick and choose which forms of saving to favor. In fact, this would be the treatment of saving under a consumption-based tax, as discussed further below.

The Income Tax Fosters Social Engineering

In recent decades, the income tax system has become a popular tool for social engineering through though government policy. “Social engineering” through the tax code may be defined as using tax exemptions, deductions, credits, and other preferences to promote particular activities that policymakers believe need special treatment. For example, there are eight different education incentives under the income tax, each with separate rules and beneficiaries.89

While individual policymakers often support particular preferences, nearly everyone agrees that the overall effect of multiple preferences is a Swiss cheese tax code that is complex and sows taxpayer confusion. Some of the political dynamics that lead to social engineering are unavoidable in any tax system. After all, tax code preferences usually have easily identifiable beneficiaries, but the costs of complexity are more diffuse and less visible.

Nonetheless, because the federal income tax follows no consistent principles, it is ripe for loophole-seeking lobbying and advocacy for special tax breaks to favored groups. Inconsistent treatment begets further inconsistent treatment. And, as noted, the economic damage caused by taxing income in the first place creates unending calls for special exceptions.

By contrast, a consumption base provides a more consistent starting point for a tax system that could substantially reduce social engineering. Consider the complexity of personal saving provisions under the income tax. A consumption-based tax would eliminate all special rules for the taxation of personal saving and thus preempt a major channel for promoting favored activities. For example, five of the eight provisions for education in the 2001 tax law relate to either saving or interest and would therefore be automatically nullified under a consumption tax. Certainly, Congress could continue favoring some activities under a consumption tax, but removing saving and investment from the tax base would narrow the options for special tax preferences.

A major tax reform could also reduce social engineering if it reduced overall tax rates and levels. High taxes cause taxpayer pain, thus raising demands that Congress provide piecemeal relief. For example, the earned income tax credit (EITC) was created and later expanded to offset the heavy burden of payroll taxes that Congress imposes. The EITC is so complicated that it has a 25 percent filer error rate and requires a special $145 million annual outlay for IRS compliance.90 Reducing overall tax levels would reduce the demands to complicate the tax code with such special preferences.

The Simplification Advantages of Consumption-Based Taxes

Nearly all of the major tax reform plans introduced in recent years would replace the individual and corporate income taxes with a consumption-based tax. In addition to the economic growth benefits of such a reform, David Bradford notes that a consumption-based tax would have “vastly simpler implementation” than the income tax.91

Dramatic simplification gains could be achieved, for example, under a “ flat tax” based on the design of Robert Hall and Alvin Rabushka of the Hoover Institution. The leading flat tax proposal of this design is House Majority Leader Dick Armey’s (R-Tex.) H.R. 1040 introduced in the 107 th Congress. According to the Tax Foundation, replacement of the income tax with a flat tax would reduce tax compliance costs by 94 percent.92 Tax compliance expert Joel Slemrod more conservatively estimates that the flat tax would cut compliance costs by 50 percent.93 A study by the American Institute of Certified Public Accountants (AICPA) found that the flat tax would be “a massive simplification that would eliminate much of the complexity that plagues the current system.”94

Dramatic simplification gains could also be achieved under a national retail sales tax. Rep. Billy Tauzin (R-La.) has proposed the National Retail Sales Act, which would replace the individual and corporate income taxes, and the estate tax, with a retail sales tax set at 15 percent. Rep. John Linder’s (R-Ga.) H.R. 2525 introduced in the 107th Congress would take this approach one step further and replace income taxes and federal payroll taxes with a 23-percent retail sales tax called the “ FairTax.”95

According to the Tax Foundation, replacing the individual and corporate income taxes with a retail sales tax would reduce compliance costs by 95 percent. The big advantage with this approach is that individuals would be free from dealing with a federal tax authority, as federal taxes would be collected from the business sector through retail sales transactions.

A third type of consumption-based tax proposal adopts the consumed-income approach to individual taxation. Under this approach, individuals are allowed an up-front deduction for amounts saved, but are taxed when savings are withdrawn for consumption. Rep. Phil English (R-Pa.) takes this approach in H.R. 86, introduced in the 107th Congress, which is a simplified “USA” tax.96 The USA tax replaces the income tax with a consumed-income tax at the individual level and a cash-flow tax at the business level.

The Institute for Research on the Economics of Taxation (IRET) has suggested yet another approach.97 The IRET plan would eliminate business-level taxation altogether and adopt a comprehensive consumed-income tax at the individual level. Eliminating business-level taxation would make the federal taxes more visible to individuals. It would also greatly simplify the system, because business taxation has very high compliance costs and accounts for a large share of the economic distortions created by the tax system.

To simplify the discussion, the following sections focus primarily on the simplification advantages of the flat tax over the income tax. Many of the points, though, could be generalized to other consumption-based tax plans. All the consumption-based tax reform plans, for example, would eliminate the current income tax complexities of depreciation accounting and capital gains taxation.

The Flat Tax

A number of misconceptions surround the Hall-Rabushka flat tax.98 First, it is often mistakenly assumed that the flat rate structure of this tax is the source of its simplification benefits. While a flat rate structure does create some simplification, the main advantage of a flat rate is that the economic disincentive effects of the current tax system are reduced.99 The second misconception is that the flat tax is just a simpler version of the current income tax. In fact, the flat tax is a consumption-based tax, although it is collected like the income tax from both individuals and businesses. 100 Indeed, the consumption base of the flat tax is the key to its simplification benefits.

Flat taxes, retail sales taxes, and value-added taxes (VATs) are all consumption-based taxes, but are administered and collected by different methods. Sales taxes are collected at the final retail stage in the economy, whereas VATs are collected at each stage of production leading up to final retail sales. A sales tax with a 10 percent rate raises the same amount of government revenue as a VAT with a 10 percent rate, but the sales tax is more visible to consumers.

As it turns out, the flat tax is structured very similarly as one type of VAT. The key difference is that under a subtraction-method VAT, businesses do not take a deduction for wages, thus effectively taxing wages at the business level. By contrast, the flat tax would allow companies to deduct wages, but it then would tax wages at the individual level. The economic effect is the same, but this treatment makes the flat tax more visible to individuals

To sum up, the flat taxes, value-added taxes, and retail sales taxes are economically very similar, but they are administered and collected differently. 101 Because of the similar bases of these taxes, they would share many of the same simplification benefits that are discussed below.

Individual and Business Taxes Simplified

The basic difference between an income tax and a consumption tax lies in the treatment of saving and investment. For individuals, consumption-based taxes can treat saving under rules similar either to those that govern either regular IRAs or those that govern Roth IRAs. In the first case, saving is initially deducted, and later withdrawals are included in the tax base. This is the approach taken by consumed-income tax reform proposals, such as the one proposed by IRET.

In the second case, no deduction is given for saving initially, but returns are not taxed. The flat tax adopts the Roth IRA treatment of saving.102 Under the flat tax, dividends, interest, and capital gains are not taxed at the individual level and do not need to be reported to the IRS. This would greatly ease paperwork headaches for taxpayers, especially in comparison with complying with the current complicated rules for tax-favored saving vehicles. This structure would also dispense with the need for businesses and the IRS to keep track of over half a billion Form 1099s and other information-reporting documents each year.103

For businesses, the flat tax would vastly simplify some of the most complex areas of the tax code, including accounting for capital purchases and inventories. Simplification would occur because consumption-based taxes use cash-flow accounting in place of accrual accounting, which is generally used under the current income tax.104 Accrual accounting requires that firms accurately match revenues and expenses each year to measure net income and to capitalize the expenses that create future benefits. Such timing of income and expense recognition under the income tax is a key source of complexity.

Because consumption taxes do not measure broad-based income, they do not require the complexities of accrual accounting. Instead, under cash-flow accounting businesses would simply deduct materials, inventories, equipment, and structures immediately upon purchase. The purchase price of a $1 pencil would be deducted just as the purchase price of a $10 million machine. David Bradford notes “income accounting is more difficult than cash-flow accounting. That difficulty is responsible for much of the complexity in the current income tax system.”105

Complexities Eliminated under a Consumption-Based Tax

A 1995 survey asked 315 corporate tax directors to rank the most complex parts of the corporate income tax.106 Of the 10 most complex parts, 4 dealt with “timing” issues inherent to measuring income, such as depreciation, and 4 dealt with international tax issues. The other two items were the AMT and “instability in the tax code.” Nearly all of those sources of complexity would be eliminated or greatly reduced under a consumption-based tax.107 Similarly, most complex features of the individual income tax would be eliminated under a consumption-based tax such as the flat tax.

The first section of Table 3 notes complex tax provisions that would be automatically eliminated under the flat tax and generally would be eliminated under other consumption-based tax proposals. The major items in this part are discussed separately below. The rest of the table gives tax complexities that could remain under nearly any tax system. The second column lists the complexities that could be eliminated by the specific design of a tax reform plan. The third column lists the complexities that would remain under the flat tax or other consumption-based tax designs.

Table 3

Complexities Eliminated and Not Eliminated Under a Consumption-Based Flat Tax

| Complexities Eliminated Automatically |

| Personal savings income. No taxation of interest, dividends, and capital gains at individual level. No need to track more than half a billion 1099s and other forms |

| Capital gains. Special treatment eliminated at business and individual levels. Gets rid of multiple tax rates and holding periods, timing of realizations, matching gains with losses, calculating basis, etc |

| Interest. Interest income and expense complications eliminated, such as muni-bond preference, "tracing rules," "original issue discount," etc. |

| Savings vehicles. Plethora of savings vehicles eliminated including 401(k)s, numerous IRAs, etc. Most complex business pension issues disappear. |

| Depreciation. Complex and distortionary accounting rules for capital purchases eliminated. |

| Inventory. Complex accounting rules for business inventory eliminated. |

| Inflation. Measurement problems and distortions caused by inflation eliminated for depreciation, inventory, interest, capital gains, etc. |

| Other business complexities. Capitalization issues, and most issues related to timing of income and deductions, are eliminated. |

| International tax rules. Taxing businesses on a territorial basis would eliminate some of the most complex aspects of business taxation, such the foreign tax credit, subpart F, etc. |

| Business structure. Uniform business taxation would replace "C" and "S" corporations, LLCs, sole proprietorships, and partnerships. Merger and acquisition accounting greatly simplified. |

| Social engineering of capital income. For example, 8 of 20 income tax phase-outs that relate to capital income disappear. And the 5 of 8 education preferences that relate to interest or savings disappear |

| Complexities That Must be Eliminated by Design |

| Multiple tax rates |

| Family status adjustments, such as the child tax credit |

| Earned income tax credit |

| Charitable contribution tax preferences |

| Health care tax preferences |

| Home ownership tax preferences |

| Education tax preferences |

| Complexities Not Eliminated |

| Transfer pricing issues for multinational corporations remain under flat tax |

| Defining taxable consumption vs. non-taxable savings/investment |

| Defining financial flows vs. non-financial flows |

| Defining financial services businesses vs. other businesses |

| Defining taxable vs. tax-exempt activities |

| Source: Author's compilation. |

Capital Gains

Complaints about the difficulty of taxing capital gains have been voiced since the beginning of the income tax, and capital gains “are generally credited with a high proportion of the [tax] law’s bulk and complexity.” 108 There are currently 17 different tax rates that may be applied to capital gains, and the current IRS Schedule D for reporting capital gains is 54 lines long. It’s scheduled to grow even longer in 2002.109

Capital gains taxation comes into play in individual stock and bond ownership, mutual fund ownership, real estate taxation, and corporate and partnership taxation. Capital gains taxpayers must deal with multiple tax rates, multiple holding periods, the timing of realizations, strategies for netting gains and losses, different ways of calculating cost basis, limitations on deducting capital losses, loss carryovers, “wash-sale rules” to prevent loss sales and repurchases, and many other issues.

Most of this complexity is unavoidable under an income tax because capital gains cannot be widely taxed on an accrual basis as suggested by Haig-Simons income theory. As a result, the government has fallen back on taxing gains when realized. Unfortunately, “elaborate rules to define and limit capital gains are inevitable in an income tax based on realization.”110 Taxing gains on realization, combined with preferential capital gains rates, stimulates numerous tax-planning efforts, such as recharacterizing ordinary income as capital gains.

While taxpayers take great efforts to minimize their tax bills, government busily churns out rules and regulations to prevent “abuse” of the ambiguities in the capital gains apparatus. For example, rules denying capital gains treatment to businesses that try to characterize regular business receipts as gains are an area of continuing complexity. It is often difficult to draw distinct lines between assets sold as a part of regular business sales, which are taxed as ordinary income, and assets sold by “investors” for “speculation,” which are taxed as capital gains.111

There is no need for all this complexity. The flat tax would eliminate capital gains taxation for both individuals and businesses.112 Eliminating capital gains taxation would eliminate all the special tax rates and other rules as well as extensive tax avoidance efforts.

Personal Saving

Americans interested in saving a portion of their current income to support themselves in later years face an enormously complex array of tax rules. Different rules come into play for ordinary income, capital gains, 401(k)s, Keoghs, SIMPLEs, SEPs, IRAs, traditional pension plans, insurance company annuities, tax-exempt bonds, and other saving vehicles. A search of Amazon.com finds three books—one 258 pages long—to help families figure out how just one vehicle, the Roth IRA, works.

Each investment option has separate rules regarding eligibility, income limits, maximum contributions, required distributions, withdrawal limitations, penalties, rollovers, and other items.113 Any of those rules can create confusion for individuals trying to plan for their future. For example, the American Bar Association (ABA) recently noted that the “minimum distribution requirements are among the most complex in the code,” and yet Congress expects millions of families to figure them out.114

Employers likewise face heavy burdens with the administrative complexity of tax rules for pension plans. The JCT notes that “the federal laws and regulations governing employer-provided retirement benefits are recognized as among the most complex sets of rules applicable to any area of the tax law.”115 The proliferation of new types of plans makes it difficult for businesses just to figure out which option they want for their employees.

The complexity of those saving plans is self-defeating in many ways. Individuals do not save as much as they might, because complex minimum distribution and other rules limit the attractiveness of employer-provided plans. Thanks to restrictions on withdrawals, those plans reduce family liquidity compared with regular taxable saving. High administrative expenses for those plans reduce net returns to saving. And the tax and ERISA rules for employer-based pension plans have gotten so complex that many firms have dropped those plans altogether, particularly defined-benefit plans.

All this complexity is an artifact of the income tax. Consumption taxes would exempt personal saving from taxation. Not only would this be massively simpler, it would free Congress from picking and choosing which forms of saving should be specially favored. Retirement and education saving are the current favorites among federal politicians, but families have other saving goals, such as saving for a new car or for possible leaner times ahead. It would be much simpler, fairer, and more efficient for individuals themselves, not the federal government, to choose the form and purpose of their saving.

The flat tax exempts from personal taxation the returns to saving, including dividends, interest, and capital gains. It works essentially like an unlimited Roth IRA but without any of the Roth IRA rules. This would greatly simplify family financial planning. Families could receive all the benefits of the current hodge-podge of accounts, but with none of the complexity and none of the continual rule changes. Individuals could save in whatever type of asset they see fit, withdraw the money any time they want, for any purpose they choose, and enjoy the full gross return to saving.

Depreciation and Amortization

Business investment in buildings and equipment generates a stream of future revenues as products produced with the assets are sold in the marketplace. The income tax is supposed to measure broad-based income in each period by matching revenues against depreciation deductions taken to recover the cost of assets. In income tax theory, depreciation deductions should closely track an asset’s actual decay or obsolescence over time.116

In practice, the depreciation system falls far short of measuring depreciation properly. Rough approximations in the tax code place assets in different classes to determine how fast they are depreciated.117 The current asset classification system is very out of date; it is based in part on a 1959 Treasury study.118 As a result, the treatment of new technologies, such as computers, is often wrong and results in those assets being overtaxed. But even up-to-date depreciation schedules would be wrong because inflation makes it extremely difficult to measure depreciation accurately.

The depreciation system has many complex features: assets must be placed in one of eight “tax life” categories to determine the period over which deductions are taken; various mathematical formulas calculate the deduction amounts; complicated rules determine when assets are considered to be placed in service; if partly depreciated assets are sold, complex “depreciation recapture” rules come into play to deny capital gains treatment for a portion of the gain; and many assets are unique and thus raise difficult questions as to appropriate treatment.

Similarly, complex issues arise about intangible assets, such as patents and trademarks. When such assets are purchased, they must be amortized to recover their cost over time. Harvey Rosen, a leading public finance expert, notes that the “intractable complexities” related to intangible assets are “unavoidable if the base of the tax is income.” He discusses one real-life example from professional baseball:

If you buy a baseball team, part of what you are buying is the contracts of the players. The tax authorities have ruled that the component of the acquisition cost that is attributable to player contracts is a depreciable asset . . . on the other hand, other components of the value of the franchise, such as television contracts, are not depreciable. Predictably, club owners are locked into a perpetual battle with the IRS over the value of the player-component of acquisition costs.119

This example highlights a key problem with the income tax: there is inherent ambiguity and inconsistency regarding the capitalization of assets. As a result, there are frequent battles between the IRS and taxpayers over which items are capital purchases and which are regular expenses that may be deducted immediately. The JCT notes “despite guidance provided by the IRS and decisions reached by courts, distinguishing a capital expenditure from a current expense continues to be uncertain and a source of significant disputes.”120 In fact, capitalization is one of the most litigated parts of the tax code. 121 In recent years, the IRS has exacerbated the problem by aggressively forcing companies to capitalize all kinds of expenses that it unilaterally decides yield long-term benefits.122

The flat tax would eliminate the complexity of depreciation and amortization, and the nonstop battles over capitalization. All business purchases would be treated the same way and immediately deducted. Assets would not need to be separated into various depreciation classes, so it wouldn’t matter if Congress didn’t get around to updating them in 40 years, as is currently the case. The rules under the flat tax would be simple and durable over the long term.

Congress has already recognized the excessive complexity and inefficiency of depreciation accounting—but only for small businesses. Small businesses may deduct the first $24,000 of capital purchases each year. The flat tax would give all businesses a huge simplicity benefit that only very small businesses enjoy today.

Inventory Accounting

Under the income tax, businesses with inventories may not simply deduct the costs of materials purchased for production, or of finished goods held for sale. Rather, those inventory expenses must be capitalized and deducted only when products are sold. The idea is to match revenues and expenses so as to accurately measure income in each period, the same principle behind the depreciation rules.

Like the depreciation rules, the complex inventory rules create economic distortions because of the effects of inflation. And both the tax rules for inventory and the tax rules for depreciation differ from the rules used for regular financial accounting. As a result, businesses must keep two sets of books.

The tax rules for inventory accounting have become even more complex in recent years. In particular, the “uniform inventory capitalization” rules enacted in TRA86 are “extraordinarily complex,” according to the ABA. 123 These rules deny deductions for a range of indirect costs, such as interest expenses, which are related to inventories. The JCT has similarly called the rules “complex and burdensome” and proposed some reforms.124

Under the flat tax, all materials purchased would be immediately deducted. That would put an end to the complex inventory rules under tax law and end a major source of disputes between business taxpayers and the IRS.

Alternative Minimum Tax

The corporate and individual AMTs are complex income tax systems that operate alongside ordinary income taxes. There is broad agreement that these ill-conceived parallel tax systems should be repealed. For example, the Joint Committee on Taxation, the American Bar Association, and the American Institute of Certified Public Accounts have all recommended the repeal of the AMT. 125 Former IRS national taxpayer advocate Val Oveson called the AMT “ absolutely, asininely stupid.”126 Under current projections, 36 million taxpayers will be subject to the “ asinine” individual AMT by 2010 unless Congress acts to repeal it. 127

The AMTs are too extensive a topic to cover in this paper. However, of particular relevance is that the two AMTs were originally supported in an attempt to better measure “income” under the income tax. For corporations, that meant using the AMT to produce more consistent marginal tax rates across industries. For individuals, that meant using the AMT to produce more consistent tax rates across families with similar incomes.

Consumption-based taxes can easily achieve consistent and neutral tax rates across industries and across families with similar consumption levels. There would be no need for the AMTs under the flat tax; they could be eliminated.

Taxing Multinational Corporations

The rapidly growing integration of the United States into the world economy is raising questions about the viability of the current “worldwide” system of federal income taxation. Under this system, the foreign earnings of U.S. businesses are subject to U.S. taxation. U.S companies operate more than 24,000 foreign affiliates in Europe, Asia, and elsewhere.128

U.S. corporations set up foreign affiliates to more easily penetrate foreign markets and to stay competitive by tapping into foreign business and technological know-how. This has been a successful strategy as about one-third of the global sales of the largest 500 U.S. corporations are from foreign affiliates.129 Most U.S. foreign affiliates are in high-income countries, such as Germany and France, where they pay tax to foreign governments, typically at high rates.

The U.S. income tax is assessed on foreign business income when it is repatriated to the United States, but a tax credit is provided to roughly prevent double taxation. This is the general rule, but there is a large hodge-podge of special and often inconsistent rules for different industries and types of investments. In fact, there are at least six overlapping sets of “anti-deferral” rules such as the Subpart F rules, which break the general rule of not taxing foreign profits until repatriation.130 This lack of consistently followed principles has led to complexity, instability, tax avoidance efforts, and loophole-closing Band-Aids applied by the government.

Many facets of the U.S. international tax system are complex: foreign income and domestic income are measured differently; foreign assets and domestic assets have different depreciation rules; detailed rules are required to convert foreign currency earnings into dollars; financial services face numerous special rules on foreign earnings; different levels of foreign affiliate ownership face different tax treatment; some foreign income is taxed when repatriated, other income is taxed when earned; different types of foreign income are placed in nine different “baskets” with separate foreign tax credit limitations; special rules allocate certain expenses between domestic and foreign-source income; and so on.

The overall result of these rules is to greatly complicate business planning. These worldwide tax rules raise little if any added revenue for the U.S. government, however, because the government provides a credit to roughly offset foreign taxes paid. Glenn Hubbard, chairman of the Council of Economic Advisers, and James Hines have in the past concluded that “the present U.S. system of taxing multinationals’ income may be raising little U.S. tax revenue, while stimulating a host of tax-motivated financial transactions.”131

There have been repeated calls for simplifying the international tax rules. For example, the ABA has called for reform, noting, “These rules may never be truly simple, but actions can be taken to temper the extraordinary complexity of the current regime.”132 It is true that these rules may never be simple under a worldwide income tax system, but they can be greatly simplified by replacing the income tax with a consumption tax.

Consumption-based taxes, including the flat tax, would eliminate most international tax rules because they are “territorial” taxes, which do not tax the foreign operations of U.S. businesses.133 Although all major consumption-based tax proposals are territorial, they would treat U.S. imports and exports differently. In particular, a national retail sales tax would tax imports and exempt exports from U.S. taxation. By contrast, the flat tax would tax firms on their export sales but allow deductions for foreign inputs to production.134

Most economists think these differences would not be economically important, but they would create new issues in tax administration. In particular, under the flat tax U.S. firms would still have incentives to use “transfer pricing” to shift their tax base to low-tax countries, thus requiring the IRS to continue monitoring such activity.135 On the other hand, the low rate of the flat tax along with its other features would increase the role of the United States as a tax haven. In a 1998 study, the U.S. International Trade Commission concluded that a consumption-based tax would, on net, attract greater foreign investment to the United States and encourage U.S. firms to increase capital investment here rather than abroad. 136

Business Structure

Under the income tax, companies may take a variety of legal forms—sole proprietorship, partnership, LLC, S corporation, and C corporation—each with different income tax implications. This patchwork has created tax complexity and economic inefficiency. In theory, reforms within the income tax system could simplify this business framework. But the 90-year history of the income tax has shown the tendency for this web of business structures to grow more complex over time. Recent decades have witnessed the rapid growth of S corporations and LLCs in response to the tax disadvantages of regular C corporations.137

The flat tax would treat all business activity equally and eliminate special forms of business organization.138 David Bradford notes “uniform treatment of all businesses, whether corporate or in other form, automatically deals with a vast array of complex issues that are intractable under present law.”139 It would also bring greater efficiency, as different investments would return the same after-tax returns no matter which business structure the investment took.

As a side benefit, this simpler organization of business would take most complex tax planning issues out of business restructurings such as mergers and acquisitions. According to the tax guide publisher, CCH, Inc., the income tax rules governing business reorganizations are “immensely complicated” with an “alphabet soup” of at least seven different methods of reorganization.140 Some of the current tax implications of restructuring include whether capital gains are triggered and the value of depreciation deductions afterward. These “notoriously complex” tax rules for business restructuring “ would become almost entirely obsolete” under the flat tax, according to the AICPA.141

Financial Transactions

“The present law tax treatment of financial instruments is governed by a patchwork of statutory rules located throughout the Code,” notes the JCT. 142 This is no coincidence; it is inherent in the income tax, due to the lack of clear and consistent principles defining the tax base.

The inconsistencies of capital gains taxation have already been noted. The taxation of interest is also complex. For example, interest expenses receive a range of different treatments under the income tax. Interest on personal consumer debt and interest on debt used to purchase tax-exempt municipal bonds is not deductible. But mortgage interest is deductible, as is investment interest and normal business interest. Under current rules, at least 10 types of interest are subject to special deduction limitations.143 Tax accountants “have bemoaned the inordinate complexity” of interest expenses, which “have become far more complex” since TRA86. 144

Such inconsistencies lead taxpayers to arbitrage of different tax code provisions to lower their tax burden. The government responds with complex rules to limit such “abuse,” and taxpayers invent new methods to get around the rules.145 For example, because only some types of interest are deductible, “ interest-tracing” rules are required to draw lines between different types of interest. These rules are “complex and subject to manipulation,” according to the JCT.146 A well-known example of interest arbitrage is the increase in home equity loans in recent years to get around TRA86’s disallowance of personal interest deductions. Tax rules subsequently limit the deductibility of interest on home equity loans.

Congress could try to tax financial flows on a more comprehensive and consistent Haig-Simons income basis. But as tax attorney Sheldon Pollack notes, some of the most complex parts of the tax code stem from attempts to tax on a Haig-Simons basis.147 One attempt is the original issue discount, or OID, rules for bond interest. OID rules require interest income to be imputed and taxed when accrued, not when actually received by taxpayers. Pollack notes that these rules add an “extraordinary and unprecedented level of complexity into the tax laws,” requiring sophisticated computer software to figure out how much tax is owed. The OID regulations are 441 pages long.148

A flat tax would eliminate most of these intractable problems because it generally disregards financial flows at both the individual and business level. Under a flat tax, individuals would not deal with financial flows at all, as they would be taxed only on wage and pension income. Nonfinancial businesses would also not deal with financial income or expense items. Interest, dividends, and capital gains income would not be included in business taxable receipts, nor would interest expenses be deductible.

However, financial businesses, such as banks, would require special rules under a consumption-based tax and they pose a challenge to any tax system.149 The tax base is difficult to measure for financial businesses, since the value of financial services, such as account administration costs, are often hidden in margins between borrowing and lending rates. One solution would be to exclude financial businesses from a consumption tax, as is the case under most state retail sales taxes and VATs in foreign countries.150 A number of other options have been discussed for taxing financial businesses under a consumption tax entailing varying levels of complexity.151

Some Complexities Not Eliminated

While a consumption base is a much simpler starting point for a tax system, some areas of complexity would remain. And, no doubt, under a new tax system various loopholes would arise that would need to be plugged with additional rules. However, many areas in which a consumption tax would need special rules are already problem areas under the income tax (see Table 3).

Under a consumption tax, as under an income tax, there are problems of accurately defining taxable “consumption” versus deductible “ investment.” A good example is the purchase of a computer for home use. If it is mainly used for playing games it should be taxable as consumption, but if it is used for a home business it should be deductible as investment (or depreciable under the income tax).152 Another example is expenditures for education, which may be viewed as either consumption or investment.

Fringe benefit issues also would continue to pose challenges as they do under the income tax. Today, many fringe benefits are tax-free and many efforts are expended to engineer employee compensation to fit into this tax-free window. Under the flat tax, fringes would be taxed at the business level by denying currently-allowable deductions. But problems may still arise when valuing fringe benefits and separating them from normal business expenses. For example, a company tennis court might be considered a taxable fringe benefit and denied as a business deduction, or it might be treated as a deductible business expense.

Defining financial flows under a flat tax would require special rules. Financial flows, which are generally not in the tax base, would need to be separated from nonfinancial flows. For example, U.S. businesses selling to foreign firms would have an incentive to redefine regular sales receipts as financial income in order to escape U.S. tax.153 Special rules would be required to prevent this sort of tax avoidance and evasion.

Complexities Eliminated by Design

The second and third sections of Table 3 list some areas of tax complexity that stem from policymakers’ efforts to practice social engineering through the tax code. Any tax system may be subject to these sorts of complexities. For example, Congress would still be able to subsidize education under a consumption-based tax: a retail sales tax could exempt tuition from taxation, while a flat tax could provide wage credits for tuition.