Introduction

In recent years, even in the brief era of budget surpluses and supposed fiscal tightfistedness, government in Washington has grown enormously. When Ronald Reagan entered the White House in 1980, his message to voters was plain and simple: big government is the problem, not the solution. At the time, federal spending was at just over $500 billion. Now the budget is $1.85 trillion and by 2002 it will ecclipse $2 trillion. In the 20 years since the Reagan Revolution began, the federal budget has almost quadrupled. Even adjusting for inflation, the federal enterprise is twice as large as it was in 1980. Over the next five years, the federal government is expected to spend more money than was spent on World Wars I and II, the Civil War, and the Revolutionary War—even after adjusting for inflation.1

Historically, the public sector of the U.S. economy was much smaller. The roots of government expansionism date back to the Great Depression and President Franklin Delano Roosevelt’s New Deal in the 1930s. Prior to the 1930s the federal government consumed less than 5 percent of national income except during times of war or national emergency. Today, it takes between 20 and 25 percent. Government at all levels has fattened from 10 percent to 40 percent.

When the United States gained its independence, the founders envisioned a national government with very explicit and restricted responsibilities. The primary responsibility was to protect the national security. In the realm of domestic affairs, the founders foresaw very limited government involvement in the daily lives of its citizens. The founders did not provide for Commerce, Education, or Housing and Urban Development departments. This was not an oversight—they simply never envisioned a national government performing such activities.

The minimal government involvement in the domestic economy they did envision was to be funded and delivered at the state and local levels. And even that involvement was to be restricted by Congress’ authority over interstate commerce, an authority granted by the founders for the purpose of preventing state governments from interfering with transactions between residents of different states.

Over the course of 200 years, the United States has transformed itself from a nation with almost no government presence in the marketplace to one in which the government is the dominant actor in the domestic economy. How this happened is described below.

The Growth Of Government In America: 1800–2000

Three factors account for the twentieth-century growth of government in Washington. The first was the advent of the income tax in 1913. The income tax soon became a revenue-generating machine for Congress, unlike such previous sources of income as tariffs and land sales. The income tax gave politicians and bureaucrats a steady, massive revenue stream to spend on new programs. The maximum rate of the first income tax was 7 percent; within a decade the top tax was 70 percent.

The second force behind the growth of government was war and depression. The three major crises of the 20th century—World War I, the Great Depression, and World War II—each spawned new government powers for the politicians in Washington. When President James Madison once observed that “crisis is the rallying cry of the tyrant,” he showed great foresight. Those who supported a larger role for government in American life seized on the national crisis of the day to argue successfully for more federal spending and taxing authority. They still do, ass seen by the burst in federal spending in the wake of the September 11 terrorist attacks. In his 1987 classic, Crisis and Leviathan, the renowned economic historian Robert Higgs documents the tendency of government officials to exploit crises so as to increase the cost and influence of government.2 Higgs shows that governments rarely contract to their previous size after a war or economic depression.

Consider these examples. Before World War I the top income tax rate was 7 percent. By 1920 it had risen to the once incomprehensible level of 70 percent. The top tax rate never again returned to its original level.

During the Great Depression, the administration of FDR launched the New Deal in an effort to put America and Americans back to work. From 1930 to 1940 federal spending as a share of GDP doubled from 4 to 8 percent of total national output as FDR initiated farm subsidies, public works, jobs programs, unemployment benefits, home mortgage insurance programs, bank regulations, and so on. At the same time, economist John Maynard Keynes preached that in times of large-scale unemployment, lawmakers are morally obligated to borrow and spend money to stimulate the economy. This gave Congress and the FDR White House an intellectual case for funding the federal programs they were eager to create anyway. Of course the truth of the New Deal is that even after this massive infusion of public money, in 1940 the nation was still mired in Depression. Only when the United States went to war with Germany and Japan, conscripting several million Americans and employing millions more in defense industries did the nation regain its industrial might and return to full employment.

During World War II, the administration and Congress expanded federal powers in unprecedented ways. They imposed wage and price controls, re-initiated the draft, instituted income tax withholding, raised taxes to all-time-high levels, and converted private industries into appendages of Uncle Sam’s war effort. Some of these measures, such as income tax withholding, remain in effect today. Higgs points out in Crisis and Leviathan that during the war FDR claimed almost dictatorial powers for the president and Congress. Federal spending soared to about 40 percent of GDP, its highest level ever. It never again would return to its prewar level.

A general pattern thus emerges from each national crisis. The Civil War, World War I, and World War II each enabled a doubling in the size of the ensuing peacetime government. The launching of the New Deal during the Great Depression also doubled the size of the federal government.

Two other factors account for our current massive and expensive government. One is the breakdown of what Cato Institute economist William Niskanen calls America’s “fiscal constitution.”3 The U.S. Constitution imposes strict limits on government activities, wherein the acceptable activities are outlined in Article I, Section 8. The founders limited authority to spend money at the federal level to such activities as national defense, a court system, road building, a post office, and debt repayment. They created only one cabinet agency, the Treasury Department, and provided it with an initial budget of less than $1 million.

For the first 100 years of the nation’s history, the constitutional balance of power ensured scrupulous observance of the defined limits. When Congress tried to assert new spending authority, the president issued a veto or the Supreme Court cited constitutional constraints. It was not until the 1930s and the infamous Roosevelt court-packing scheme that the Supreme Court began to give Congress carte blanche to spend money on domestic welfare programs. Wrongly ruling that Congress was authorized to spend money to “provide for the General Welfare of the citizens,” the Court conferred on federal legislators the near-limitless spending power that Congress continues to flaunt and flex.

The other factor that engorged the federal Leviathan was the concept of entitlements. The modern entitlement state was born in 1933 as the federal government’s first and most expensive income transfer program, Social Security. In the 1960s President Lyndon Baines Johnson launched the Great Society, creating a whole new menu of entitlement programs, among them Medicare, Medicaid, food stamps, public housing, and Aid to Families with Dependent Children (AFDC). Once created these income transfer programs were virtually impossible to restrain. For years, eligibility and benefits were routinely expanded. By 1990 Medicare was about 10 times more expensive than originally forecast. Soon farmers, small businessmen, Fortune 500 companies, minority businessmen, veterans, college students, artists, actors, the unemployed, cities, and even foreign governments were all on one federal dole or another. The entitlement state had become so all-encompassing that seemingly everyone was getting a check from Uncle Sam for some reason or another. Some 20 years ago author Matthew Lesko started writing mega-bestsellers about how to get hundreds of thousands of dollars of free money from Washington, chronicling the thousands of federal programs and agencies that give out money. 4 His books are still bestsellers, and his annoying adds are a fixture on TV. The major result of the Great Society was to breed new political constituencies for big government. There is much truth to the adage t hat a system that robs Peter to pay Paul can always count on Paul’s support.

All of this public sector expansionism, combined with record high taxes, runaway inflation and a government-created energy crisis, brought America to the brink of financial collapse by the late 1970s. A rusting and de-industrializing America was losing in the global marketplace to the Japanese and the Germans. It was rightly described as the greatest economic crisis in America since the Depression. Reagan’s 1980 election victory brought a temporary halt to the growth of government. Reagan cut taxes and slowed the growth of government expenditures but did not reverse the course. By the early 1990s the government actually reached its all-time peak in spending and taxing. Under President Bill Clinton and a Republican Congress, the growth spurt again subsided. Although government spending continued to grow in real terms, federal spending fell from 23 to 19 percent of national output in the 1990s. But this was not because government had grown smaller. Rather, a technology-driven private sector expansion started to shrink the relative size of government.

But the effect did not last long. The war on terrorism has caused the budget to climb back above 20 percent of GDP. By 2010, if not before, the government will really start to explode. The explosion will be driven by demographics as baby boomers retire. The combined, unfunded liability of the two major senior citizen programs, Medicare and Social Security, is well over $15 trillion. In the midst of the war on terrorism and debates over economic stimulus packages, the prospect of contracting government may seem idealistic. Yet this is the critical moment to rein in government, to demand new agency efficiencies and discontinue old extraneous activities. We must eliminate programs and processes that have failed or finished their missions and capture the tens of billions of dollars they would otherwise waste.

Now is also the moment to fix and modernize entitlements. We can redesign the American tax system to promote growth and prosperity and, as financial wizard Pete Peterson has written, “grow up before we grow old.”5 If we do not, we may drive the nation into an economic ditch. We will even increase the likelihood of generational warfare as our children’s taxes are increased to pay for our own lack of fiscal foresight.

CNBC economist Larry Kudlow has noted many times the curious fact that although practically every sector of industry has over the years streamlined production in response to competition, government alone has failed to reduce its inefficiency. He’s right. As taxpayers, Americans have not insisted upon the same degree of excellence and frugality in government that we have, as consumers, demanded of every other industry. Imagine for a moment that we had seen the same productivity gains in our nation’s schools as in the computer industry over the past 25 years. We would be building a nation of Einsteins and Edisons. However, when government fails, all too often we reward incompetence with more money.

Taxes

We start our discussion of government growth with a review of changes in tax burdens and tax policies. As stated above, steady increases in tax revenues have been one of the primary engines of government growth. Revenues drive spending. We learned (or relearned) this lesson in recent years of prosperity when higher tax collections generated large increases in congressional spending—even when Republicans controlled Congress.

Total Taxes

The American Revolution may have been the greatest tax revolt in world history. Yet as a result of the growth of government expenditures described above, taxes are now at levels that would have been inconceivable 200, 100, or even 50 years ago. Today, as a result of federal, state, and local taxes, many middle-income Americans work nearly half of each workday to pay the government. Data from the Tax Foundation in Washington reveals that in 1957 the average two-earner family paid 28 percent of its income in taxes. Today, it pays 38 percent.6

The tax burden is even more clearly expressed by examining taxes paid per household (data shown in 2000 dollars):

• In 1900 total taxes per household were $1,900.

• In 1950 total taxes per household were $11,000.

• In 1999 total taxes per household reached $30,000.

This rising tax burden diminishes workers’ ability to consume and save. It also impedes workers’ incentive to work and employers’ incentive to hire. Taxes drive a wedge between what the worker receives and what the employer pays. These figures do not even include the cost to American individuals and firms that comply with complicated and time-consuming tax laws. By one estimate, Americans spend 5.4 billion hours at an annual cost of $600 billion to the economy just completing the paperwork requirements of federal taxes.7

The Federal Tax Burden

Reliable federal tax data are available back to 1800.8 For the first 100 years of the nation’s existence, taxes were very low. The opposition to high taxes that was deeply ingrained in the colonial spirit also was lasting. Government revenues predominantly came from two sources: revenue tariffs and land sales. The limited sources of revenues for the federal government were a natural restraint on its expenditures. Three events changed that: the 1913 imposition of the income tax; two World Wars, which accustomed the American people to very high tax rates; and the 1933 creation of the Social Security program, with its gradually rising payroll taxes.

Taxes were relatively stable until 1900. It was not until World War II that the federal tax burden rose by about threefold.

• In 1800 per capita federal taxes were $25.

• In 1900 per capita federal taxes were $140.

• In 1950 per capita federal taxes were $1,860.

• In 1999 per capita federal taxes were $6,660

Income Taxes

The tax Americans dread most is the income tax. Until the Sixteenth Amendment was ratified in 1913, the Supreme Court consistently ruled an income tax unconstitutional. No law has contributed more to the growth of government than the imposition of the federal income tax. Today, the Internal Revenue Service (IRS) has broad, sweeping powers to investigate Americans’ activities and finances. Without a search warrant, the IRS can search Americans’ property and financial documents. Without a trial, the IRS can seize Americans’ property.

The income tax burden at the federal level has continually escalated. Figure 1 shows the federal income tax burden per household. The pattern is clear: during periods of war, income taxes are raised, and they are never reduced to prewar levels. Today, the average American household pays almost $10,000 in federal income taxes, double the 1950 burden.

Figure 1

States too have become much more reliant upon income taxes in the past 50 years. Prior to World War II only a handful of states imposed an income tax. Today, only nine states do not, and four of those are reconsidering the matter. Today state and local governments raise about $110 billion per year through income taxes.

• In 1900 state and local governments raised no revenues through income taxes.

• In 1960 state and local governments raised 10 percent of revenues through income taxes.

• In 1992 state and local governments raised 26 percent of revenues through income taxes.

Governments’ increased reliance on income taxes is disturbing. Almost all studies show that these are the taxes most damaging to economic growth, entrepreneurial activity, and employment because they directly impact work and business success. That is, they punish a growing, job-creating economy for its vitality!

The income tax also becomes more complex with each passing year. The original income tax law was 14 pages long and remained under 1,000 pages as late as 1950. Today it has expanded to 11,650 pages. Even the Republican Congress (supposedly devoted to tax simplification) has been unable to halt its growth.

Tax Rates

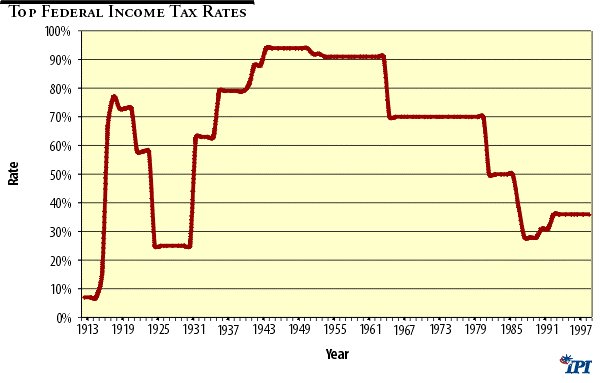

As with tax revenues, tax rates have climbed during the twentieth century. When the first individual income tax was passed in 1913 the rates ranged from 1 to 7 percent. At the time, opponents charged that it would not be long before the rates were raised to the unthinkable level of 10 percent! Supporters countered that this would never happen. Yet as Figure 2 shows:

• By 1916 the top rate had more than doubled to 15 percent.

• By 1917 and the start of World War I the top rate rose to 67 percent.

• In 1944 during World War II the top rate reached 94 percent.

• In the 1950s the top tax rate remained at 91 percent.

• During the Reagan years the top marginal rate was chopped to 28 percent.

• Today the top marginal rate is 38.6 percent.

Figure 2

Although the Reagan administration cut tax rates, the government collects more revenue at the lower rates than ever before. For instance, from 1980 to 1992 federal income tax collections rose by roughly $150 billion. Moreover, the share of the income tax burden borne by the richest 10 percent of Americans rose from 48 to 60 percent from 1981 to 1998. Virtually every country in the world today recognizes the economic benefits of lower marginal tax rates in stimulating work and in attracting investment. Every industrialized nation in the world has lower marginal income tax rates today than in 1980.9

Today the United States has the highest estate tax of any major industrialized nation except Japan. The 55 percent top estate tax rate is the highest in the federal IRS tax code.

Payroll Taxes

Another reason the middle class feels so burdened by taxes is that Social Security payroll taxes continue to rise. Figure 3 shows:

• The first Social Security payroll tax rate, in place from 1937 to 1950, was 2 percent.

• By 1970, after the introduction of Medicare and the hospital insurance tax, the payroll tax rate was 9.6 percent.

• By 1980 the rate increased to 12.3 percent.

• By 1990 the rate increased to its current 15.3 percent.

The typical middle-income family now pays a greater share of its income in payroll taxes—including the portion hidden from view as the employer’ s share—than income taxes.10 That is why reducing payroll taxes may be the most effective way to reduce the tax burden on middle- and low-income working families.

Figure 3

Expenditures

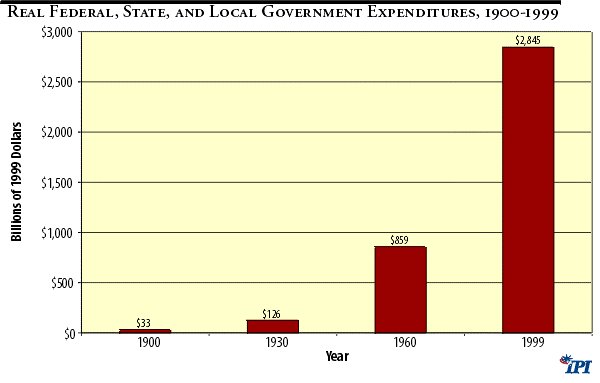

In 1900 government in America was still, by today’s standards, incredibly lean and efficient. At that time total federal, state, and local expenditures were $33 billion. Americans now support a nearly $3 trillion government, an increase in real outlays of more than a hundredfold! [See Figure 4]

Figure 4

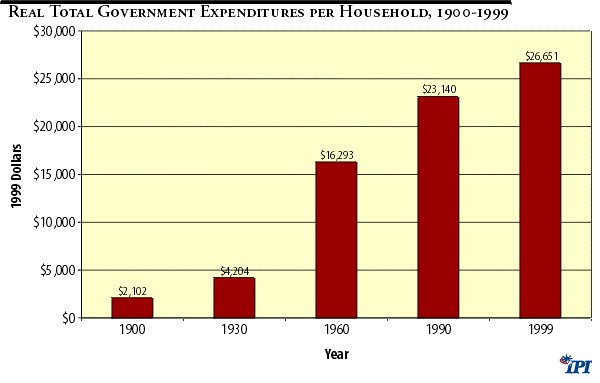

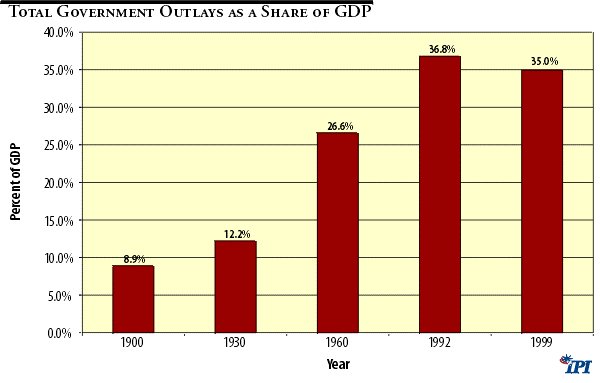

Figure 5 shows that, adjusting for population growth, government spent $2,102 for every household in 1900 and today spends $26,651. Even adjusting for the fact that the economy is much larger today than 50 or 100 years ago, the government as a share of GDP has more than tripled. [See Figure 6]

Figure 5

Figure 6

Federal Outlays

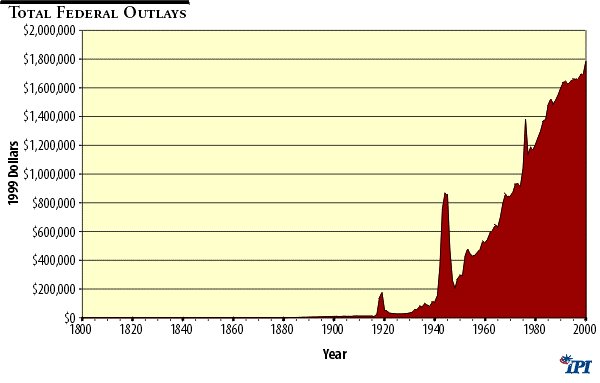

Most of the growth of government has been in Washington at the federal level. Figure 7 shows the expansion of the federal budget from 1800 to 1999. As the steep ascent shows, federal spending has exploded 10,000-fold, with almost all of the increase in the past 40 years. Real federal outlays have climbed from $100 million in 1800 to $155 million in 1850, to $10 billion in 1900, to $300 billion in 1950, to $1,800 billion today.

Figure 7

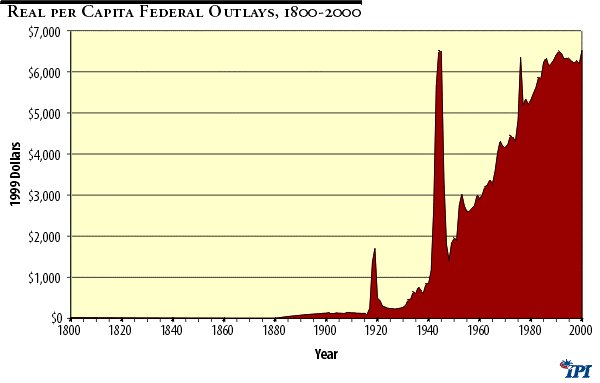

Of course the nation is much larger today than in earlier periods, so one would expect government to be somewhat larger. Figure 8 shows the per capita level of federal spending over time. Even if we adjust for population growth and inflation, federal expenditures have mushroomed.

Figure 8

Bear in mind that this does not include backdoor spending on, for example, mandates and regulations, which are discussed in a later section. If they are included, the federal government’s per person expenditures for the year 2000 exceed $10,000.

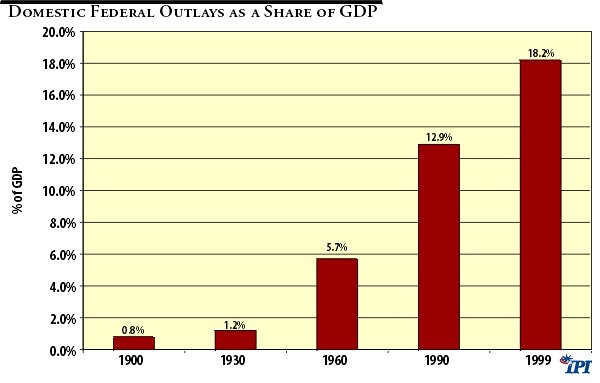

A meaningful way to measure government’s burden on the economy is its spending relative to total economic output.11 One might argue that government spends more money today because the American economy is now much larger. If government is consuming the same proportion of total output in two periods, then the economic burden of paying for its activities is roughly the same, even if its later expenditures are much larger. Unfortunately, federal spending is outpacing economic growth.

• In 1900 the federal government consumed less than 5 percent of total output.

• In 1950 the federal government consumed roughly 15 percent of total output.

• In 1999 the federal government consumed roughly 19 percent of total output.

The Composition of Federal Outlays

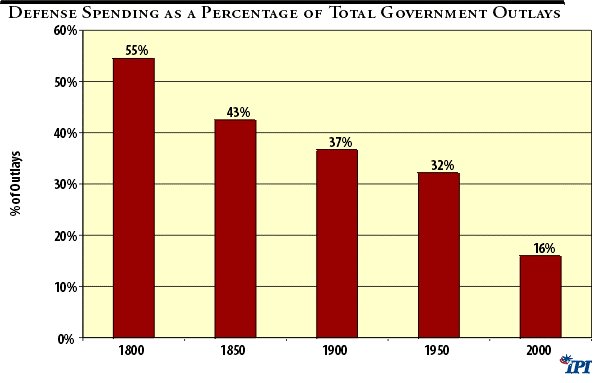

The single most important activity of the federal government is to provide for the national defense. A free nation spends as much as necessary to protect its borders and its citizens. Is the modern-day growth of government on the federal level a result of the Cold War defense buildup? Figure 9 shows that the answer is clearly no. Except for brief periods during wartime, national defense spending has continually shrunk from one-half of the total federal budget in 1800 to one-sixth today.

Figure 9

Figure 10

The inverse of this steady reduction in defense spending as a share of the budget is the expansion of civilian program spending. Figure 10 shows the full extent of the increase in domestic expenditures, highlighting the sharp rise since 1970.

The data powerfully refute the common complaint by special interest groups that favored domestic programs were subject to draconian budget cuts in recent years. Although the Reagan years encouraged modest spending reductions in selected domestic programs, today’s spending in every major domestic area except Interior is at an all-time high. See Appendix Table A1.

Welfare And Transfer Payments: A Nation Entitled

A great challenge in America circa 2001 is to find some member of the public who does not receive a check from the government for one purpose or another. Every week the federal government sends tens of billions to farmers for growing (or not growing) crops, to veterans for health care or retirement, to the unemployed for not working, to those with low incomes for food and shelter, to college students for school, to the elderly for being retired, to the elderly and poor to pay for healthcare, to unwed mothers for childcare, and on and on. Years ago most of these transfer payment programs did not exist. Virtually all of them emerged in the 20th century, yet none can be eliminated or even reformed without howls of protest. In a half-century, we have become a people who regard ourselves as “ entitled” to “benefits” from government.

Federal, state, and local social welfare spending has soared throughout the past 100 years.12 The data series begins in 1900, because prior to that time there were virtually no federal transfers, except for veterans’ benefits, and the only significant state and local transfers were small public aid programs.

• In 1900 the government spent $10 billion on social welfare.

• In 1950 the government spent $130 billion on social welfare.

• In 1995 the government spent $1,010 billion on social welfare.

It is noteworthy that in 1950 these transfer programs constituted roughly 12 percent of the federal budget. Today they consume almost 40 percent. Between 1989 and 1999, real federal expenditures on entitlements grew by $250 billion.

One of the public policy success stories of the last decade was the 1997 enactment of welfare reform. In the previous 10 years some states had experimented with welfare reform, reporting promising results. Today, welfare rolls are down nationwide by more than 40 percent. Even so, welfare remains one of the largest components of the budget. Antipoverty programs are still growing even as public assistance caseloads are falling. Government welfare spending from 1930 to 1995 grew exponentially.

• In 1930 public assistance spending was $11 billion.

• In 1970 public assistance spending was $65 billion.

• In 1995 public assistance spending was up to $254 billion.

Robert Rector of the Heritage Foundation, who has tracked welfare spending since the birth of the Great Society programs in the 1960s, finds that between 1965 and 1995 the government spent $5 trillion on the war on poverty.13 Welfare reform may reduce these costs and enable those seduced by welfare to rebuild their lives. Early reports are encouraging, but it is too early to generalize on results.

Government Employment

Government bureaucracy has grown at a steady pace at the federal, state, and local levels. In the past 20 years private sector union membership has shrunk, while public sector unions now have record membership. The modern-day labor movement mostly consists of teachers and other government employees. Today, the AFL-CIO has more NEA members than Teamsters.14

The U.S. government currently employs 19.5 million civilians, up from 8.5 million in 1960 and 4.5 million in 1940. For the first time ever, in 1992 the U.S. had more civilian public sector employees than manufacturing employees, as shown in Figure 11. Today, nearly 2 million more Americans work for the government than for manufacturers.

Figure 11

With the growth in the number of government workers, America has witnessed a growth in government payrolls.

• In 1940 government spent $7 billion on monthly payroll.

• In 1960 government spent $18 billion on monthly payroll.

• In 1997 government spent $51 billion on monthly payroll.

Government employees receive about 30 to 40 percent higher total compensation than do comparably skilled private sector workers. For example, the average public sector bus driver earns 70 percent more than his private sector counterpart.15 Reliable studies show that postal workers make fully one-third more in salaries and benefits than comparably skilled private sector workers.16 The wage premium paid to government employees has widened rather than narrowed in recent years. A 1992 report by the American Legislative Exchange Council (ALEC) shows:

Average state and local government employee compensation (including wages, salaries, and employee benefits) has been rising more quickly than average private employee compensation for 40 years . . . Average state and local government employee compensation increased by an inflation-adjusted 14.6 percent, or $4,031, in 1989 compared to 1980. For every new dollar of average compensation increase for private sector employees, state and local government employees received more than $4.20.17

As the ALEC study concludes, America’s government workers have become “a protected class.” Jeanne Allen, president of the Center on Education Reform reports that in New York City it can cost up to $200,000 to fire an incompetent teacher.18 This is one of the biggest obstacles to government downsizing and reform.

Regulation

Politicians have become ingenious at achieving their policy objectives without having to spend money or to raise taxes directly. Increasingly they accomplish their goals through regulations or mandates on the private economy. For example, in the last several decades federal regulations have required private businesses to spend money on health, worker training, safety, consumer protection, aid to the disabled, environmental protection, and so on.19 These hidden or backdoor forms of taxation on the consumer and on firms erode economic growth. The invisible cost for regulation may be as high as $4,000 per person.20

Enactment of New Regulations

Tallying the total cost and total number of federal regulations is very difficult. One indirect way to measure the government regulatory burden is by counting the number of pages of regulations that appear in the Federal Register each year. Using this number as an index, the number of new regulations has grown 15-fold since 1935.

• In 1935 there were 4,000 pages in the Federal Register.

• In 1950 there were 12,000 pages in the Federal Register.

• In 1980 pages in the Federal Register peaked at 73,528 under President Carter.

• Ronald Reagan’s antiregulation policies reduced the number of pages to 44,812 in 1986.

• Under George Bush, regulations climbed back to 49,795 pages in 1990.

• Under Bill Clinton, the number of pages jumped to 68,571 in 1998.

Regulation is nothing more than an indirect tax on the economy— specifically on workers and consumers. Several reliable and independent studies have calculated the cost of regulation. These studies find that the growing regulatory burden of the past 25 years has taken a heavy toll on the economy.

Regulations add as much as 33 percent to the cost of building an airplane engine and as much as 95 percent to the price of a new vaccine.21

The costs of regulations often far outweigh the benefits to consumers and workers. For example, according to Resources for the Future, the costs of some of the provisions of the Clean Air Act Amendments of 1990 will outweigh the benefits by a ratio between 2 to 1 and 4 to 1.22

The USDA’s modification of its laboratory animal welfare standards to enhance the “psychological well-being of primates” carries an estimated cost to industry of $3 billion.23

Environmental laws are the largest and fastest-growing areas of economic regulation. Economists Dale Jorgenson of Harvard and Peter Wilcoxen of the University of Texas calculate that the cost of environmental regulation alone “is a long-run reduction of 2.59 percent in the level of the U.S. GNP.”24 This means that in 1990 environmental laws reduced GNP by about $180 billion and contributed to the loss of 4 million jobs. Consider the cost to the private sector of complying with federal environmental regulations through the year 1999.25

• In 1970 the nation spent $25 billion on environmental regulation.

• In 1990 the nation spent $147 billion on environmental regulation.

• In 1999 the nation spent more than $280 billion on environmental regulation.

This is an increase in spending on environmental control from 0.8 percent of GNP in 1970 to between 3 and 4 percent in 2000.

Do these environmental laws provide benefits in terms of increased life expectancy and quality of life? In many cases, the answer is yes, but in too many others no. For example, the Office of Management and Budget (OMB) estimated in 1990 that business would have to spend $5.7 trillion to save one life under an EPA regulation on wood preservatives.26 This was equal to the entire U.S. GNP!

When regulations are cost-inefficient their long-term impact can be precisely the opposite of their intent. The evidence from around the world is that nations with productive and growing economies spend more on environmental protection, worker safety, consumer protection, and health than nations that are poor. Wealthier nations are healthier nations. They can afford to spend more on environmental cleanup and other health concerns. If unwise regulation reduces economic growth, it consumes resources in the society that could be available for environmental, health, and social progress.

Lawyers, Lobbyists, And Trade Associations

Increased litigation that cripples America’s most successful companies is a great danger to our economy. The Justice Department attacks Microsoft and Intel for alleged antitrust violations. States sue the tobacco companies and gun manufacturers for cigarette and gun-related deaths. High-tech companies are sued when their stock prices fall. Chemical companies, drug companies, and fast food chains purveying “unhealthful” meals are threatened with lawsuits as well. A growing army of trial lawyers has prompted all of this litigation. The trial lawyers already impose a multi-billion-dollar toll on the U.S. economy. 27

America is awash in lawyers. In the 1980s more Americans graduated from law school than there were lawyers in Japan. Until about 1960 the ratio of lawyers to population remained fairly constant; since then, the number of lawyers has tripled and the ratio of lawyers to population has more than doubled.

• In 1870 there were 1,100 lawyers per million residents.

• In 1900 there were 1,500 lawyers per million residents.

• In 1960 there were 1,200 lawyers per million residents.

• In 1990 there were 3,100 lawyers per million residents.

• In 1998 there were 3,515 lawyers per million residents.

Not surprisingly, Washington has more than twice as many lawyers per resident as other large U.S. cities. As government at the federal and state levels has grown and the money at stake in legislative battles has increased, the resources devoted to lobbying and influence peddling have multiplied. One 1996 study by the Cato Institute shows that the local economies of state capitals and Washington, D.C., are growing much faster in population, income, and jobs than the rest of the nation.28

Other statistics reveal a similar upward trend in lobbying activities. For example:

• In 1956 approximately 4,900 national trade associations had a presence in Washington. Today 23,000 do.

• In 1960 some 365 individuals were paid to lobby the Senate. Today 40,100 (400 for every Senator) crowd the Capitol’s corridors.

• In 1970, the American Association of Retired Persons (AARP), one of the most politically powerful special interest groups in America, had 2 million members. Today its membership exceeds 30 million.

Measurements Of The Total Cost Of Government

In this study we have documented government growth using a wide range of measures. When we combine all the costs of public sector activity—taxes, spending, borrowing, regulation, mandates, and litigation—we find that government now consumes almost 50 percent of our nation’s total output.

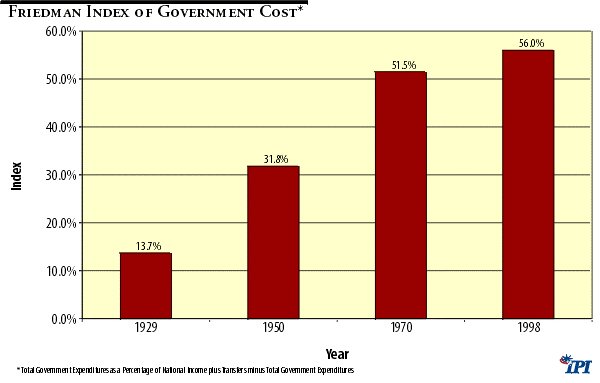

Nobel laureate Milton Friedman proposes an alternative method of computing the real cost of government. Friedman suggests that the real cost is the ratio of government resources to private resources.29 The GDP, says Friedman, is a poor measure of real wealth producing output because it includes as one major component government spending. But government spending does not often add to national welfare and in many instances subtracts from it. For example, Friedman shows that all of the expenditures of the Food and Drug Administration (FDA) with respect to regulating new drugs, vaccines, and medical devices cause more—not fewer—deaths. This is because the FDA often delays for years the introduction of lifesaving drugs for cancer, heart disease, and other killer diseases. Tens of thousands of Americans may die while the FDA keeps a breakthrough lifesaving drug off the market.

Using the Friedman index, Figure 12 below shows that government swallows up more than half of all resources in American society today—four times what it took in 1929:

Figure 12

One additional measure of the total cost of government to Americans is an index developed by economist Lawrence Kotlikoff of Boston University and the National Bureau of Economic Research (NBER).30 Kotlikoff measures the amount of income that Americans pay in taxes over their entire work lives. The Kotlikoff index starts with Americans born in 1900, moves up through children born today, then projects into the future. Kotlikoff’s chilling findings:

• A child born in 1900 (for most readers, our grandparents) paid 23.6 percent of his income in taxes over his or her lifetime.

• A child born between 1930 and 1940 (for most readers, our parents) the lifetime tax burden was 31 percent.

• For those born in 1960 (baby boomers), the lifetime tax burden is 35 percent.

• A child born in the future will pay up to 60 percent of his or her lifetime earnings in taxes.

The explanation for this extraordinary increase in the cost of government is that entitlement spending, particularly for the elderly, will explode as the 60 million baby boomers enter their retirement years. Kotlikoff believes that our failure to trim these entitlements today is a tragic case of generational inequity. I call it fiscal child abuse.

The Trade-Off: Government Growth Versus Economic Growth

Skeptics might argue that the United States is a rich nation and that big government has not had an observable negative effect on American prosperity. Some even argue that government’s increased presence in American life facilitates the nation’s rapid economic growth. Yet the evidence here and abroad does not support this conclusion. Economic freedom (i.e., the absence of a large government sector) and economic growth are highly correlated.31 Similarly, economic freedom is highly correlated with health and welfare, as measured by life expectancy.32

A recent study by economists Richard Vedder and Lowell Gallaway of Ohio University finds that periods of government expansionism (both in spending and regulating) tend to be periods of slow or negative economic growth.33 No one knows for certain when government begins to deter income growth and output expansion. One study by Thomas Dye of Florida State University suggests that the output-maximizing level of government is less than 20 percent of GDP. 34 In any case, if 10 percent of the nation’s resources were transferred from the government to the private sector, bringing government’s share of national income down from 35 to 25 percent, economic growth almost certainly would be enhanced.

Could we realize the goal of 25 percent without dismantling vital or popular federal programs and without harming the economy? It is instructive to note that as recently as the early 1960s government in America was consuming just below 25 percent of GDP. The 1950s and early 1960s were years of great economic resurgence in America. Many Americans look back on the 1950s as a period of postwar prosperity and social tranquility. Only in the last 40 years, particularly from the mid-1960s through the early-1980s, has government grown to 35 percent of the total national economy. Almost all of this growth has been in income redistribution programs, and almost all of the government growth was at the federal level. See Table 1 on the changing composition of federal spending since 1960.

Table 1

Composition of the Federal Budget, 1960–2000 (Percent of Total Budget)

|

Year

|

|||||

|

1960

|

1970

|

1980

|

1990

|

2000

|

|

| National defense |

52%

|

42%

|

23%

|

24%

|

16%

|

| Education, training, employment, and social services |

1%

|

4%

|

5%

|

3%

|

4%

|

| Medicare |

0%

|

3%

|

5%

|

8%

|

11%

|

| Income security |

8%

|

8%

|

14%

|

11%

|

14%

|

| Transportation |

5%

|

4%

|

4%

|

2%

|

3%

|

The federal education budget has mushroomed with almost no sign that the $200 billion spent from 1978 to 2000 has improved education quality. None the less, Congress is preparing to double the education budget over the next 5 years.

Table 1 also shows defense spending has fallen dramatically, with ample signs of deterioration in military readiness and America’s counter-terrorism capabilities. In the wake of the Great Society’s failure, the case for returning to a leaner, more traditional government is powerful.

The components of government spending have changed dramatically. The core services of government were originally the military, transportation, the courts, police, veterans, parks, public health, and education. In 1902 about 3 out of every 4 dollars spent by government went for these essential public services. By 1960 that percentage had fallen to about 2 out of every 3 dollars. Today only about 1 out of every 3 dollars go to the core activities of government; the rest go toward social programs and income redistribution activities—the biggest of course being Social Security, Medicare, and welfare payments. These expenditures provide little economic benefit and may erode incentives to work, invest, and save.

How Government Growth Erodes National Greatness

Government is bigger and costlier than most voters desire. When government is involved in so many activities, it is unlikely to do well at its essential tasks: educating children, keeping American neighborhoods safe, protecting national security, and providing basic municipal services. As highlighted above, at the start of this century, almost 8 of every 10 dollars spent by the public sector went for the essential services of the government. Today, less than 4 of 10 dollars spent are devoted to the highest-priority activities.

More government means less personal freedom. As economist Walter Williams of George Mason University has noted, if the government can lay claim to half of the fruits of our labor, then we are truly at most half free as Americans. 35 Government is, in the memorable words of President George Washington, “a fearsome master.” Government can and should be a force for good. But U.S. history—with slavery, Jim Crow laws, and segregation—and world history—most recently with Nazism and Communism—should have taught us that unchecked government can be a force for evil.

So how is it that we as Americans have permitted it to grow beyond its optimal size and constitutional boundaries? The late economist Mancur Olson of the University of Maryland provides one explanation. Olson notes in his pioneering book, The Rise and Decline of Nations, that special interest groups often come to dominate the political process and drown out the voice of the average voter.36 This has happened in Europe, where powerful unions have rendered once-rich nations uncompetitive.

Further, the political process heavily favors incumbents over challengers. At least four-fifths of all Political Action Committee (PAC) money is funneled to incumbents. The incumbency advantage in elections makes it very difficult for voters to effect political change through the ballot box.

How The Tax System Fuels The Growth Of Government

The federal tax system has had a large, indirect impact on the relentless growth of federal expenditures over recent decades. In fact, the tax system seems designed to minimize public opposition to government growth. Several characteristics of the federal tax system contribute to the high cost of government.

First, the tax system camouflages from voters the real burden of paying for government.37 Many Americans never see the total they pay for government through withholding taxes, business taxes on working and consuming, and employer taxes. The withholding tax was put in place during World War II to minimize public opposition to paying higher taxes as government got more expensive. One legislator famously declared that withholding taxes would allow the federal government to pluck from the ducks the maximum number of feathers with the minimum number of squawks. The corporate income tax is also a hidden form of taxation. Businesses do not pay taxes; they collect them from their shareholders, customers, and workers. The corporate tax simply camouflages the tax burden American families bear. The worst example of a hidden tax is the employer share of the payroll tax. The money is extracted from the worker’ s paycheck, but he never sees it being taken away, and it does not even appear as a deduction on his pay stub. Self-employed Americans pay both the employer and employee share of the payroll tax and know only too well the real bite of the Federal Insurance Contributions Act (FICA).

Another way the tax code contributes to government growth is through real income bracket creep.38 Real income bracket creep is a result of the progressive rate structure of the income tax system. During times of economic growth, Americans’ tax burdens rise at a faster rate than their incomes because the income gains are taxed at a higher marginal tax rate than their average tax rate. More and more Americans move into the 28, 31, and 36 percent tax brackets over time, which increases their annual taxes. Between 1995 and 2000 taxes rose from 18 to 21.5 percent of GDP, even though they were not formally legislated. The explanation for the higher tax is bracket creep.

The tax burden also falls increasingly on the wealthy, which leaves many Americans feeling that taxes are not excessive. Between 1980 and 2000 the share of taxes shouldered by the wealthiest 1 percent rose from 25 to 33 percent. Meanwhile, the total federal income tax burden borne by Americans with incomes below the median family income has shrunk from 9 to 6 percent. We are moving inexorably toward a system in which a small portion of the American public has to carry a very large part of the cost. If we relieve an ever larger share of Americans from the burden of paying at least some share of the cost of government, they doubtless will demand more and more of this “free good.” Karl Marx once warned that democracies would sow the seeds of their own destruction once the populace realized they could vote themselves more and more from the public purse and pass the costs on to others. Our tax code is moving us in that direction.

Finally, by imposing so many different taxes, fees, and levies, the federal tax system seems designed to prevent Americans from calculating how much they pay in a week, month or year. Some taxes, like the 100-year-old telephone tax, escape consumers’ notice but bring the federal government billions every year.

What is needed is a flat rate consumption tax. A flat rate tax could swiftly and dramatically reverse the trend toward government growth. How? First, such a tax would stimulate investment, saving, and economic growth, reducing the need for the federal government to subsidize welfare or public services that citizens can pay for directly. Second, a single uniform tax rate would mitigate the arguments that pit rich against poor, since all Americans would face the same rate on items they choose to buy. One likely outcome would be citizen solidarity against tax increases and for reduced government spending to lower the uniform tax rate; another would be the disappearance of any motivation for politicians to seek support by pitting the financial interests of one group against those of another.

Third, a flat consumption tax with minimal deductions and loopholes and with no tax withholding would be almost totally transparent. Americans would pay the tax either at the cash register or on a postcard tax return. The national consumption tax would also consolidate all taxes and allow Americans to reexamine levels of taxation. They would probably reconsider the ways tax monies are used and whether the government gives them their money’s worth.

Finally, a consumption tax would radically reduce the compliance costs of the tax system. These compliance costs—estimated at $125 billion a year— are in and of themselves a “tax” on American workers.39

In sum, a radical overhaul of the federal tax system would be the most productive fiscal move the 107th Congress could make. A tax system visible to those who pay, fair and uniform in its imposition, simple to comply with, and designed to reward economically productive activities can reinvigorate the American tradition of individual freedom and governmental restraint. At the same time, a single rate national consumption tax could raise U.S. living standards over the long term by at least 10 to 20 percent, according to Dale Jorgenson, Dean of Harvard University’s School of Economics.40

Conclusion

The United States is the envy of the rest of the world today, in part because we allow more personal and economic freedom than any other nation. The United States developed rapidly over these past two centuries because we found the proper balance between freedom and order. Most nations are now trying to emulate the American model. France, Germany and Japan have cut tax rates to compete more successfully with American firms. The danger is that if we do not reduce the size of government, and if we do not overhaul our tax system, other nations may not just catch us, they may surpass us.

Endnotes

1. The standard sources used in this report include: U.S. Department of Commerce, Historical Statistics of the United States, Colonial Times to 1970 (Washington, DC: Government Printing Office, 1975); Advisory Commission on Intergovernmental Relations, Significant Features of Fiscal Federalism, 1992; and Office of Management and Budget, Budget of the United States Government, Fiscal Year 1983, Historical Tables.

2. Robert Higgs, Crisis and Leviathan: Critical Episodes in the Growth of American Government (New York: Oxford University Press, 1987).

3. William A. Niskanen, “The Case for a New Fiscal Constitution,” Journal of Economic Perspectives, vol. 6, Spring 1992.

4. Getting Yours: The Complete Guide to Government Money (New York, 1982) and Information U.S.A. (New York, 1983).

5. Peter G. Peterson, Will America Grow Up Before It Grows Old?: How the Coming Social Security Crisis Threatens You, Your Family, and Your Country (New York, 1996).

6. Tax Foundation, “New Study Profiles Total Tax Burden of Median American Family,” March 9, 2000. URL: http://www.taxfoundation.org/prmedianfamily.html.

7. James L. Payne, “Unhappy Returns: The $600 Billion Tax Rip-Off,” Policy Review, Winter 1992, pp. 18–22.

8. See Bruce R. Bartlett, Reaganomics: Supply Side Economics In Action (Westport, Conn., 1980); Gerald W. Scully, “Tax Rates, Tax Revenues and Economic Growth,” National Center for Policy Analysis, 1991; and Ronald Utt and William Orzechowski, “International Perspectives on Economic Growth,” Cato Institute Policy Report, July/August 1985.

9. A chart showing the reduction in tax rates internationally is contained in Stephen Moore, “Why America Does Not Need New Taxes,” Heritage Foundation Backgrounder, 1989.

10. Aldona Robbins and Gary Robbins, “Cutting Social Security Taxes: Honest Reform or Sleight-of-Hand?” Institute for Policy Innovation, February 1990.

11. See Stephen Moore, “How Much Government Can America Afford?” Institute for Policy Innovation, 1991.

12. Social welfare spending includes all forms of cash and noncash public assistance, health care, Social Security, veterans’ benefits, and assorted other transfer payment programs.

13. Robert Rector, “The Paradox of Poverty: How We Spent $3.5 Trillion without Changing the Poverty Rate,” Heritage Foundation, Heritage Lecture No. 410, 1992.

14. Mark de Bernardo, “Public Sector Sees Organized Labor Boom,” Wall Street Journal, December 18, 1986.

15. Wendell Cox and Jean Love, “False Dreams and Broken Promises: The Wasteful Federal Investment in Urban Transit,” Cato Institute Policy Analysis, 1991.

16. Jeffrey Perloft and Michael Wachter, “Wage Comparability in the U.S. Postal Service,” Industrial Labor Relations Review, October 1984, pp. 26–35.

17. Wendell Cox and Samuel Brunelli, “America’s Protected Class,” American Legislative Exchange Council, February 1992, pp. 3–4.

18. Rachel Flick, “How Unions Stole the Big Apple,” Reader’s Digest, January 1992, pp. 39–44. See also Jeanne Allen, Handbook for School Reform, published by the Center on Education Reform. URL: http://edreform.com/handbook/srhtoc.htm.

19. Jonathan Rauch, “The Regulatory President,” National Journal, November 30, 1991, pp. 2902–05.

20. Alan Reynolds, “Cruel Costs of the 1991 Minimum Wage,” Wall Street Journal, July 7, 1992. Melinda Warren and James Lis, “Regulatory Standstill: Analysis of the 1993 Federal Budget,” Center for the Study of American Business, Occasional Paper 105, 1992.

21. William Dafter, “Bush’s Regulatory Build-Up,” Heritage Foundation Backgrounder, 1992.

22. Paul Pormey, “Economics and the Clean Air Act,” Journal of Economic Perspectives, Fall 1990, pp. 173–81.

23. Matthew Kibbe, “Regulatory Nightmares: The Costly, the Deadly, and the Just Plain Stupid,” U.S. Chamber of Commerce, 1992.

24. Dale W. Jorgenson and Peter J. Wilcoxen, “Environmental Regulation and U.S. Economic Growth,” Rand Journal of Economics, Summer 1990, pp. 314–40.

25. U.S. Environmental Protection Agency, Environmental Investments: The Cost of a Clean Environment, December 1990.

26. “Environmentalism Run Riot,” The Economist, August 8, 1992, p. 11.

27. Jonathan Rauch, “The Parasite Economy,” The National Journal, April 25, 1992, pp. 980–85.

28. Richard K. Vedder, “Capital Crimes: Political Centers as Parasite Economies,” Cato Institute Policy Analysis no. 250: February 28, 1996.

29. See Milton Friedman, Why Government is the Problem (Stanford, 1993).

30. Laurence J. Kotlikoff, NBER Working Paper Series #6684, “The A-K Model—Its Past, Present and Future” (Cambridge, 1998) URL: http://www.nber.org/papers/w6684.

31. Simon Kuznets, “Two Centuries of Economic Growth: Reflections on U.S. Experience,” American Economic Review, Vol. 67, 1977.

32. Daniel Landau, “Government Expenditure and Economic Growth in Developed Countries, 1952–76,” Public Choice, Vol. 47, 1985, pp. 459–477.

33. Lowell Galloway and Richard Vedder, The Impact of the Welfare State on the American Economy , Joint Economic Committee Study, December 1995.

34. “Taxing Spending and Economic Growth in the American States,” Journal of Politics 42: 1085–1107.

35. “Prosperity and Freedom,” April 5, 2000. TownHall.com Commentary. URL: http://www.townhall.com/columnists/walterwilliams/ww000405.shtml.

36. The Rise and Decline of Nations (New Haven, 1982).

37. Gary Robbins and Aldona Robbins, “Capital, Taxes and Growth,” National Center for Policy Analysis, Policy Report No. 169, 1992.

38. Gerald Scully, ‘The Hidden Growth Tax in the United States,” Working Paper, University of Texas, Dallas, 1991.

39. J. Scott Moody, Tax Foundation Background Paper #35: “The Cost of Complying with the U.S. Federal Income Tax.” November 2000.

40. “The Economic Impact of Taxing Consumption,” Dale W. Jorgenson, Ph.D., Harvard University, Testimony before the Ways and Means Committee, March 27, 1996. “The Economic Impact of Fundamental Tax Reform,” Dale W. Jorgenson, Testimony before the House Ways and Means Committee, June 6, 1995.

Appendix

Table A1

Outlays by department: 1962–2001 (millions of 1999 dollars)

| Department or other unit |

Year

|

% Increase, 1962-1999

|

Annual Growth, 1962-1999

|

||||

|

1962

|

1970

|

1980

|

1990

|

1999

|

|||

| Legislative Branch |

$1,083

|

$1,515

|

$2,473

|

$2,855

|

$2,609

|

141%

|

3.8%

|

| The Judiciary |

$315

|

$571

|

$1,145

|

$2,097

|

$3,790

|

1103%

|

29.8%

|

| Agriculture |

$35,564

|

$36,103

|

$70,273

|

$58,614

|

$62,834

|

77%

|

2.1%

|

| Commerce |

$1,188

|

$3,339

|

$6,321

|

$4,757

|

$5,036

|

324%

|

8.8%

|

| Defense-Military |

$276,856

|

$343,876

|

$264,469

|

$369,115

|

$261,380

|

-6%

|

-0.2%

|

| Education |

$4,508

|

$19,717

|

$29,519

|

$29,264

|

$32,436

|

620%

|

16.7%

|

| Energy |

$15,221

|

$10,270

|

$14,669

|

$15,394

|

$16,048

|

5%

|

0.1%

|

| Health and Human Services |

$19,497

|

$74,665

|

$137,889

|

$223,606

|

$359,701

|

1745%

|

47.2%

|

| Housing and Urban Development |

$4,564

|

$10,438

|

$25,727

|

$25,690

|

$32,734

|

617%

|

16.7%

|

| Interior |

$3,348

|

$4,665

|

$9,034

|

$7,420

|

$7,815

|

133%

|

3.6%

|

| Justice |

$1,652

|

$2,751

|

$5,335

|

$8,289

|

$18,317

|

1009%

|

27.3%

|

| Labor |

$21,624

|

$21,313

|

$59,616

|

$32,121

|

$32,461

|

50%

|

1.4%

|

| State |

$2,525

|

$2,837

|

$4,812

|

$6,117

|

$6,456

|

156%

|

4.2%

|

| Transportation |

$22,862

|

$28,858

|

$40,004

|

$36,497

|

$41,829

|

83%

|

2.2%

|

| Treasury |

$47,293

|

$82,730

|

$154,683

|

$325,060

|

$386,698

|

718%

|

19.4%

|

| Veterans Affairs |

$30,983

|

$37,133

|

$42,701

|

$36,940

|

$43,168

|

39%

|

1.1%

|

| Corps of Engineers |

$5,215

|

$5,013

|

$6,501

|

$4,234

|

$4,191

|

-20%

|

-0.5%

|

| Other Defense-Civil Programs |

$5,282

|

$12,764

|

$24,164

|

$27,633

|

$32,014

|

506%

|

13.7%

|

| Environmental Protection Agency |

$387

|

$1,648

|

$11,319

|

$6,507

|

$6,750

|

1644%

|

44.4%

|

| Executive Office of the President |

$66

|

$124

|

$194

|

$201

|

$417

|

532%

|

14.4%

|

| Federal Emergency Management Administration |

$740

|

$820

|

$2,493

|

$2,781

|

$4,039

|

446%

|

12.0%

|

| General Services Administration |

$2,110

|

$2,275

|

$552

|

-$118

|

-$46

|

-102%

|

-2.8%

|

| International Assistance Programs |

$17,519

|

$11,395

|

$15,651

|

$12,848

|

$10,059

|

-43%

|

-1.2%

|

| National Aeronautics and Space Administration |

$6,945

|

$16,103

|

$10,018

|

$15,833

|

$13,664

|

97%

|

2.6%

|

| National Science Foundation |

$1,011

|

$1,991

|

$1,842

|

$2,341

|

$3,283

|

225%

|

6.1%

|

| Office of Personnel Management |

$5,619

|

$11,382

|

$30,416

|

$40,699

|

$47,515

|

746%

|

20.2%

|

| Small Business Administration |

$1,271

|

$1,086

|

$4,093

|

$882

|

$57

|

-96%

|

-2.6%

|

| Social Security Administration (On-budget) |

$0

|

$2,013

|

$16,400

|

$23,117

|

$40,575

|

N/A

|

N/A

|

| Social Security Administration (Off-budget) |

$79,365

|

$127,948

|

$238,125

|

$312,099

|

$379,213

|

378%

|

10.2%

|

| Other Independent Agencies (On-budget) |

$12,613

|

$18,296

|

$28,012

|

$87,489

|

$6,054

|

-52%

|

-1.4%

|

| Other Independent Agencies (Off-budget) |

$0

|

$0

|

$0

|

$2,071

|

$1,021

|

N/A

|

N/A

|

| Allowances |

$0

|

$0

|

$0

|

$0

|

$0

|

0%

|

0.0%

|

| Undistributed offsetting receipts |

$37,055

|

$53,936

|

$64,622

|

$126,025

|

$159,078

|

329%

|

8.9%

|

| (On-budget) |

$32,475

|

$44,472

|

$57,465

|

$98,562

|

$99,622

|

207%

|

5.6%

|

| (Off-budget) |

$4,586

|

$9,464

|

$7,158

|

$27,462

|

$59,456

|

1196%

|

32.3%

|

| Total outlays |

$590,171

|

$839,695

|

$1,193,832

|

$1,596,431

|

$1,703,040

|

189%

|

5.1%

|