The Washington State Legislature has passed a package of executive-request legislation related to health care and prescription drugs. The legislation includes a bill, “Importation of Prescription Drugs from Canadian Wholesalers,” that directs the state Board of Pharmacy to submit a waiver request to the federal Food and Drug Administration to authorize the state of Washington to license Canadian prescription drug wholesalers. This legislation has become law despite a major report released by the Department of Health and Human Services’ (HHS) Task Force on Importation that documented a multitude of cost and safety concerns related to commercial prescription drug importation. The report also confirmed what economists and industry experts have long argued: that drug importation would diminish R&D incentives and eventually lead to fewer new drug therapies.

Reduced R&D spending and fewer new drugs have clear public health costs which must be weighed against the short-run savings in drug spending. This is an issue to be considered by policymakers throughout the nation. But another issue, the economic impact of drug importation, must not be neglected in this debate. Research-intensive regions like California, Massachusetts and Washington have a financial stake in the success of an industry that has been, and will continue to be, a powerful engine for economic growth.

Policymakers in Washington state need to be conscious of the longer-term, far-reaching harmful effects that their well-intentioned, but misguided, drug-importation policies may have on their local citizens, companies and the economy.

Research and Development in the Washington Economy

During the 30-month recession that ended in June 2003, Washington’s economy was among the hardest hit in the nation. During that period, the state economy shed over 115,000 private-sector jobs. 1 One bright spot during this storm was the biopharmaceutical sector. According to the Milken Institute, the biopharmaceutical industry generated over 28,000 jobs in Washington in 2003. Of those, 8,700 people were employed within the industry while the remaining 20,000 were a result of the industry’s powerful multiplier effects. 2 In fact, between 1990 and 2002, industry employment grew at an average annual rate of 10 percent, nearly tripling in size. 3

The state has done an excellent job of fostering a competitive bioscience cluster. Building upon an exceptional academic research base and significant federal funding from the National Institutes of Health, the state has positioned itself as a national leader in the industry.

The value of a thriving bioscience sector has been recognized by a growing number of states. Many have introduced initiatives to strengthen the local industry by providing early-state venture capital, research parks and research laboratories. Yet while some public policy efforts have, on the one hand, sought to strengthen the industry, regulatory and legislative pressures continue to threaten it.

Importation and Price Controls

The argument is often made that drug companies could lower prices and continue to fund the current level of R&D spending. Critics often point toward the industry’s large profit margins as evidence. These critics misunderstand the relationship between R&D spending and prescription drug prices.

One reason that biopharmaceutical firms spend so much on R&D is the prospect of what economists call “monopoly profits” that come with patented products. That doesn’t mean there are no competitors, just that competitors can’t duplicate the patented product. Proposals that remove patent protections or limit the potential monopoly profits thus diminish R&D spending in two ways: First, they lower a firm’s cash flow and thereby limit funds available for R&D, and second, they diminish a firm’s expected rate of return on R&D and thus remove incentives to fund future research efforts.

Another potential impact on the industry is the negative impact on venture capital investment. Most biotechnology companies in Washington are small companies, employing fewer than 100 employees. 4 These firms typically rely quite heavily on venture capital investment to fund research. In 2004, 85 Washington state companies (nine of which were biopharmaceutical firms) raised over $770 million in venture capital, the state’s largest total since the Internet bubble burst in 2001. 5

While it is difficult to estimate the impact of price controls on future venture capital investment, when the Clinton administration threatened to control prices in 1994 and 1995 the growth rate in biotech venture capital investments contracted by 6 percent and 16 percent, respectively. 6 For smaller firms without approved drugs in the market place, this venture capital is the only available source of investment. A contraction of venture capital funding could spell disaster for biotech firms in Washington and across the country.

Economic Impact on the Washington Economy

In September 2004, a study released by the Institute for Policy Innovation (IPI) reported that a price control policy implemented at the federal level could result in a loss of $14.8 billion (in net present value terms) in industrial R&D spending over the first 12 years of price control implementation. The authors further estimated that the failure rate of drugs entering clinical trials, due to economic reasons, would increase by approximately 70 percent and the number of new drugs approved each year would fall from an annual average of 31 to just nine.

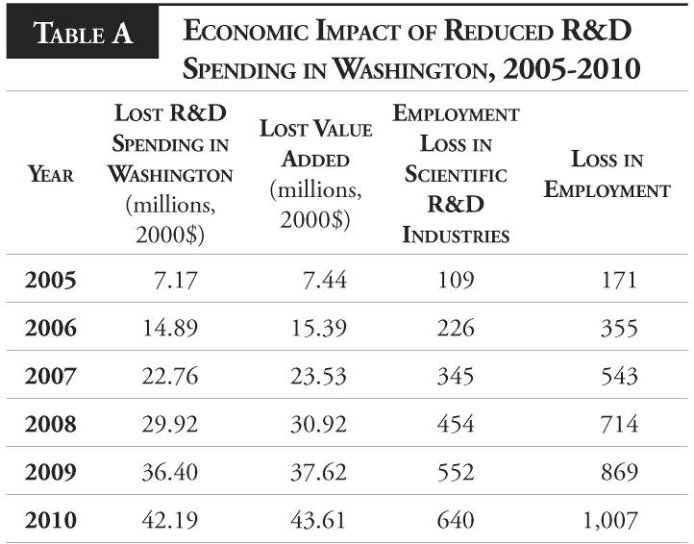

Washington, which benefited from over $496 million in bioscience R&D in 2001, would be among the hardest hit states in the nation. We estimate that within the first five years the state would lose over $100 million in private R&D spending. Table A below illustrates the annual loss in R&D spending and its consequent economic impacts.

Although there are varied methods of measuring economic impacts, the idea is straightforward. Initial spending in an economy has a “ripple” effect whose influence flows through to other sectors and households in the region. In essence, the initial spending in one sector brings about further spending in other sectors. This process creates new income and employment as it reverberates through the business community. Depending on the size of the initial impact, these ancillary effects can be quite large. For example, Boeing’s contribution to the Greater Seattle economy extends far beyond its initial outlay in wages and purchases.

In other words, each expenditure has what economists call a “multiplier” effect that represents the recycling of money and income in an economy. By determining the multiplier for each category of expenditures, it is possible to simulate the initial spending and trace its influence through an economy. By measuring the change in economic indicators (employment, for instance), we can calculate the ultimate economic impact.

The economic contribution of R&D spending in Washington consists of three types of impacts: direct, indirect and induced.

- The direct impact represents the economic impact directly attributable to the biotech firms: local purchases and employee compensation. For instance, in the pharmaceutical or biotech industries this may take the form of spending on legal services to secure patents. This spending creates income and employment directly for the industry’s vendors (legal services in this case).

- The indirect impact represents the spending done by other businesses supplying the goods and services demanded by the industry. For instance, the spending done by a local law firm as a result of being hired by a biotech firm creates employment and income for the law firms’ vendors.

- Finally, the induced impact refers to the income and employment created as a result of the spending done by the employees of the biotech industry, its intermediate suppliers and their vendors. Restaurants, real estate agents, gasoline stations, etc., all benefit from the local spending done by employees.

Using the IMPLAN model to describe commodity flows through the Washington economy, we estimate the annual impact on the state economy as a result of the abandoned R&D spending.

We measure the economic impact using value-added as a measure of local economic activity; it represents the economic activity that ultimately sticks in the Washington economy. Included in value-added is employees’ wages, proprietors’ income, indirect business taxes and corporate profit.

The loss of R&D investment in Washington has overarching effects on the state’s economy. The cumulative loss in employment for the period 2005-2010 is 1,007 jobs, many of these (640) in high-paying research positions. The lost R&D spending further results in a cumulative loss of $43.6 million in regional value-added.

While these figures are not large relative to the entire Washington economy, it is quite significant in the bioscience industries which Washington and other states are taking such pains to promote. It must be remembered, however, that such policies may not provide the desired savings on drug spending. The HHS Task Force on Prescription Drug Importation recently reported that:

“Total savings to drug buyers from legalized commercial importation would be one to two percent of total drug spending and much less than international price comparisons might suggest. The savings going directly to individuals would be less than one percent of total spending. Most of the savings would likely go to third party payers, such as insurance companies and HMOs.” 7

There thus remains the distinct possibility that policy makers harm a vibrant local industry while failing to provide meaningful relief to consumers.

Conclusions

The biopharmaceutical industry has, and continues to be, a promising engine for economic growth in Washington. The high earnings within the industry and powerful employment effects have made it a valuable contributor to the region. Yet its future success remains vulnerable to regulatory and legislative pressures. As a home to some of the nation’s leading pharmaceutical firms, Washington benefits from hundreds of millions of dollars in industrial R&D investment annually. In the process, thousands of high-paying jobs are created and new, innovative drugs are developed. Price control or importation policies, designed to constrain prescription drug prices will, in the process, damper the incentive for the industry to engage in expensive and risky drug development. The result will be fewer new drug developments and fewer high-paying jobs in research-intensive states, like Washington. It is incumbent on policy makers to weigh these adverse effects against the desired, yet potentially elusive, savings that drug importation might provide.

Appendix: The IMPLAN Model

The IMPLAN economic impact modeling system is a product of Minnesota IMPLAN Group, Inc.

IMPLAN provides regional industry multipliers, which enable the user to provide detailed analyses of the direct, indirect and induced economic impacts on the local economy of a change in final demand for certain industries.

IMPLAN multipliers are designed to model a variety of scenarios and are traditionally used to model a shock to a regional economy. Examples of uses of the model include opening or closing military bases, new energy facilities, new sports stadiums, opening or closing manufacturing plants and airport or port facilities. All these scenarios are modeled by estimating changes in final demand by industry and entering them into the IMPLAN model for the region.

Any systematic analysis of economic impacts must account for the inter-industry relationships within a region. IMPLAN, accounts for inter-industry relationships through the use of a regional transaction table that is algebraically manipulated to produce a set of regional multipliers.

IMPLAN captures the direct effects of changes in final demand and local purchases made by local companies as a result of this increase in final demand. Because IMPLAN is based on regional industry multipliers it will also capture the ancillary effects arising from the income earned from the local companies’ input purchases.

IMPLAN is based on a national transaction table that is regionally adjusted through the use of Regional Purchase Coefficients (RPC). RPCs represent the portion of local demand purchased from local producers. Once the transaction table is regionalized, a coefficient matrix is derived by dividing each industry column by the column total. This coefficient matrix is also called the A matrix. Through the algebraic manipulation performed below the regional multipliers are derived:

X = (I -A)-1 Y ,

Where

X = Industry output,

I = Identity matrix,

A = A matrix,

Y = Final Demand.

This analysis accounts for changes in Y, in the form of R&D spending. For the purposes of this study, the IMPLAN model is used to determine how the loss in R&D spending translates into value added and employment losses throughout the economy.

Endnotes

- Brad Wong, “Economy adding jobs, but unemployment rate rose in December,” Seattle Post-Intelligencer, January 19, 2005.

- Ross DeVol, Perry Wong, Armen Bedroussian, Lorna Wallace, Junghoon Ki, Daniela Murphy and Rob Koeppin, “Biopharmaceutical Industry Contributions to State and U.S. Economies,” Milken Institute, October 2004(b).

- Robert A. Chase, “The Biotechnology and Medical Device Industry in Washington State: An Economic Analysis,” Washington Biotechnology & Biomedical Association, December 2002.

- Ibid, page 18.

- John Cook, “Venture Capital: State ranked in top 5 in venture capital funding for 2004,” Seattle Post-Intelligencer, January 21, 2005.

- David M. McIntosh, “Drug Importation: A Prescription to Put Biotech on Life Support,” Washington Legal Foundation, Legal Backgrounder, Vol. 19, No. 15, June 11, 2004.

- Health and Human Services Task Force on Drug Importation, “Report on Prescription Drug Importation,” Department of Health and Human Services, December 2004, page 65.

This study was prepared for the Institute for Policy Innovation by the Beacon Hill Institute at Suffolk University, Boston, MA.

About the Institute for Policy Innovation

The Institute for Policy Innovation (IPI) is a nonprofit, non-partisan educational organization founded in 1987. IPI’s purposes are to conduct research, aid development, and widely promote innovative and nonpartisan solutions to today’s public policy problems. IPI is a public foundation, and is supported wholly by contributions from individuals, businesses, and other non-profit foundations. IPI neither solicits nor accepts contributions from any government agency.

IPI’s focus is on developing new approaches to governing that harness the strengths of individual choice, limited government, and free markets. IPI emphasizes getting its studies into the hands of the press and policy makers so that the ideas they contain can be applied to the challenges facing us today.

About Washington Policy Center

Washington Policy Center is an independent, non-partisan, research and education organization located in Seattle Washington, that publishes studies, sponsors events and conferences and educates citizens on public policy issues facing the region. For more information, visit www.washingtonpolicy.org