The country needs a health care reform plan that would replace Obamacare, while increasing access, lowering costs and improving the quality of care—all the things Obamacare was supposed to do but doesn’t. The principles for creating a consumer driven, market-oriented health care plan that would achieve those goals have been around for years, and a number of Republicans have included them in their various reform proposals. Below we highlight 10 steps that would establish a market-oriented health care system.

1. Establish Tax Fairness

About 156 million Americans get their health insurance through an employer.1 The tax system is the primary reason that the employer-based system survives, when almost all other types of insurance are bought and paid for by individuals. Employer money spent on health insurance is excluded from employees’ income. The Office of Management and Budget estimates the tax exclusion costs the federal government about $170 billion in 2012 in lost income tax revenue and another $130 billion in lost payroll tax revenue.2 Redirecting that tax break directly to the individual, rather than having it flow through the employer, could be both budget neutral and would create a level tax playing field.

President George W. Bush proposed ending the tax exclusion and giving everyone a standard deduction: $7,500 for an individual, $15,000 for a family. As a presidential candidate, Senator John McCain proposed giving workers a refundable tax credit: $2,500 for an individual or $5,000 for a family. Either approach would have gone a long way toward implementing tax fairness because everyone, including the self-employed and employees without employer-provided coverage, would get the same break.

2. Expand Consumer Driven Options Like HSAs

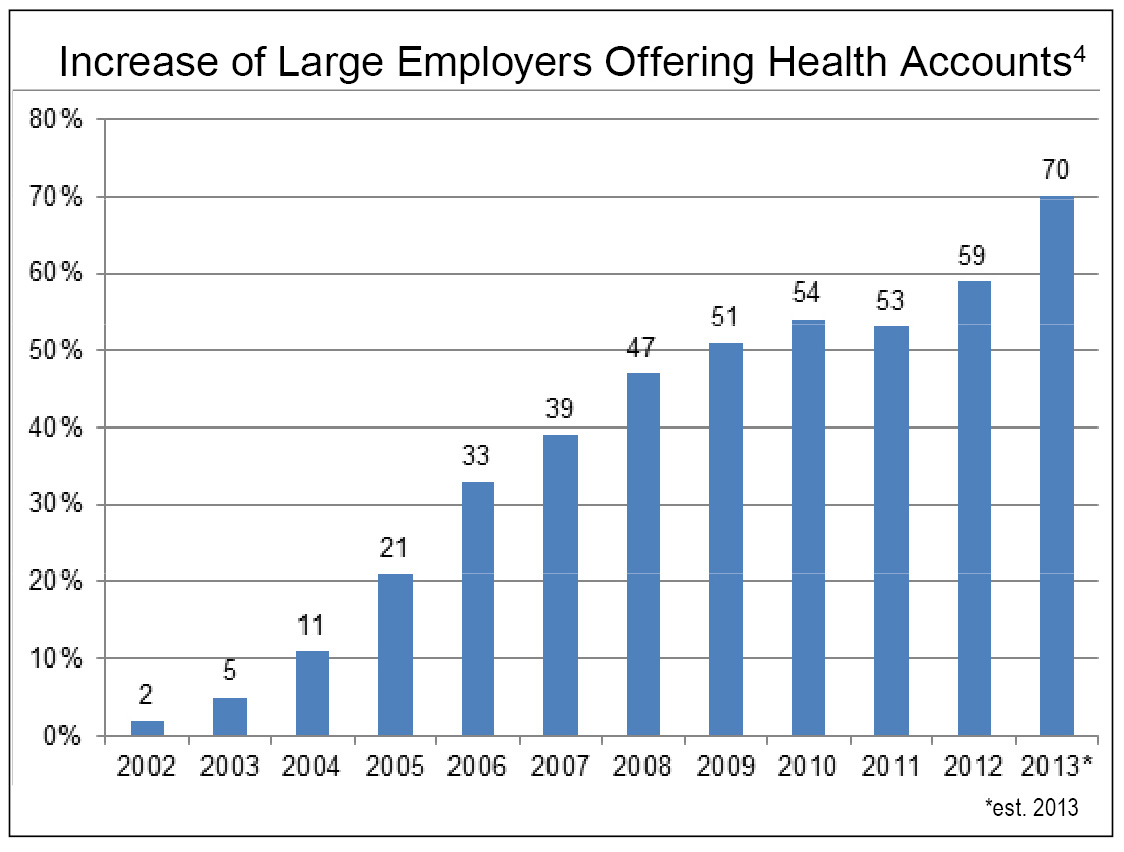

The primary reason Americans spend so much on health care is that comprehensive health insurance insulates them from the cost of care. Health Savings Accounts (HSAs), in combination with a high-deductible health insurance policy to cover major accidents or illnesses, allow workers and their employers to deposit money in a tax-free account owned and controlled by the individual. Patients use their HSA money to pay for allowable small and routine medical care and medications, but they keep it if they don’t use it, giving them a reason to be value-conscious shoppers in the health care marketplace.

Several studies have demonstrated that HSAs lower health care spending without any negative impact on patients’ health.3 Obamacare reduced the number of allowable HSA expenditures; those restrictions should be reversed to allow the widest possible use of HSAs.

3. Cap the Tax Deduction for Health Insurance

Historically, the health insurance tax break was unlimited, encouraging employees, and especially unions, to try to get the most comprehensive coverage they can get, which has the unintended consequence of increasing health care spending and use. Capping that tax break—as the standard deduction and tax credit would do indirectly—encourages people to choose high-deductible coverage, which would dramatically lower health care utilization and total spending.

4. Provide Help for Low-Income Families

There’s general agreement that there should be some public assistance for low-income families that cannot afford coverage, but what’s the best way?

The standard-deduction approach discussed above doesn’t help if a family pays no income tax—and nearly half of U.S. households pay little or no income tax—but a refundable tax credit would. A family owing, say, $1,000 in income tax would still have $4,000 left over from a $5,000 refundable credit to apply toward health coverage, significantly lowering the family’s effective cost and providing direct help for purchasing coverage.

But while the refundable tax credit serves two purposes—tax fairness and a subsidy for low-income families—tax experts also believe it is more susceptible to fraud.

5. Create a Safety Net for the Uninsurables

One of President Obama’s primary justifications for reforming health insurance was that millions of Americans were being denied coverage because of a preexisting medical condition. But employer-based coverage, Medicare and Medicaid—covering perhaps 260 million total—accept eligible people with a preexisting condition. And 35 states have (or had) state-based high-risk pools to provide coverage for those who couldn’t get it, plus seven states required health insurers to accept all applicants. In other words, while being denied coverage because of a preexisting condition was a real issue for some, the vast majority of Americans could get coverage even with a preexisting condition.

We need to return to the system of high-risk pools that Obamacare is unraveling, with some additional funding and some best-practices to ensure they all work effectively.

6. Privatize Medicare

Republicans have lost their way on Medicare, only proposing to cut benefits and raise taxes. The better solution, which Republicans used to strongly support, is shifting to a system of personal retirement accounts, both for income and health care after retirement. The only real conservative approach is to allow people to put their own money aside during their working years and buy their own coverage in retirement.

7. Give Vets and Medicaid Recipients Vouchers

The only health coverage worse than what we provide for veterans is what we provide for the poor (i.e., Medicaid). Many states have been clamoring for more flexibility with their Medicaid dollars to experiment with different solutions. Washington should give them that flexibility.

We could also build on the Medicare Advantage (MA) program by giving vets and the poor a defined contribution to buy into an MA-type private health plan. More than 25 percent of seniors already choose a similar option under Medicare. Forcing the poor, and especially our vets, to get substandard coverage is shameful; there’s a much easier and better way.

8. Allow Cross-State Health Insurance Purchases

Allowing people to buy health insurance across state lines is a good idea, though it isn’t a panacea. That’s because health insurers selling in one state may not have a network of physicians and hospitals in the state where a consumer wants that policy. But it would work in some states and create more competition in those instances.

9. Push Malpractice Reform

Federal malpractice reform is an important step, but Republicans have been unsuccessful in reforming the malpractice system at the federal level, even when they controlled both Congress and the White House. So states have acted on their own, which has lowered malpractice premiums and attracted doctors to those states.

10. Shrink HHS

The Department of Health and Human Services has 76,000 full-time equivalent employees and an annual budget of more than $900 billion—and the potential for untold mischief.5 Even when the Republican-led House has tried to defund parts of Obamacare, HHS just shifted around millions of dollars within its budget and proceeded largely undeterred. The department’s spending authority should be dramatically cut in future appropriations bills. Partially defunding the beast would help limit the damage it does.

Endnotes

1. Paul D. Fronstin, “Sources of Health Insurance and Characteristics of the Uninsured: Analysis of the March 2013 Current Population Survey,” Employee Benefit Research Institute, September 2013, p. 5. http://www.ebri.org/pdf/briefspdf/EBRI_IB_09-13.No390.Sources.

2. Jeremy Horpedahl and Harrison Searles, “The Tax Exemption of Employer Provided Health Insurance,” Mercatus Center, July 2013. http://mercatus.org/sites/default/files/Horpedahl_TaxExemptEmployerHealthIns_MOP_071813.pdf

3. See, for example, “Skin in the Game: How Consumer-Directed Health Plans Affect the Cost and Use of Health Care,” The Rand Corporation, May 2012. http://mercatus.org/sites/default/files/Horpedahl_TaxExemptEmployerHealthIns_MOP_071813.pdf

4. Performance in an Era of Uncertainty. 17th Annual Towers Watson/national Business Group on Health Survey of Purchasing Value in Health care, 2012. p.30. http://www.changehealthcare.com/downloads/industry/Towers-Watson-NBGH-2012.pdf

5. “Fiscal Year 2014 Budget in Brief,” U.S. Dept. of Health and Human Services, p. 1. http://www.hhs.gov/budget/fy2014/fy-2014-budget-in-brief.pdf