This Issue Brief examines the proposals that are major contenders for a stimulus package along with their pros and cons. Based on our estimates of the economic payoff versus revenue cost, the report ranks the proposals as to which ones would provide the biggest boost to the U.S. economy.

Why the Economy Has Slowed

Design of a successful stimulus package first requires understanding why the U.S. economy, which had been growing at 4+ percent, started to slow. There is no question that airline disruption, destruction of physical and human capital, shattered confidence and layoffs in the wake of the September 11 terrorist attacks have made conditions worse. But the fact of the matter is that the U.S. economy was already in the doldrums.

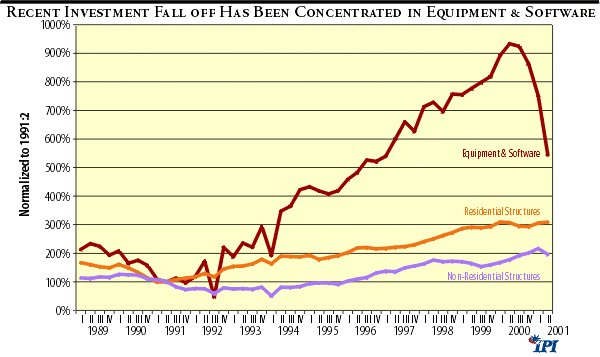

The most pronounced symptom has been a slump in investment that began during the latter half of 2000 and continues today. As Figure 1 shows, the decline has been concentrated in purchases of equipment, particularly high technology. But the investment slowdown was already filtering through other sectors. The economy as a whole grew at an anemic 0.8 percent during the first half of this year. Output of the business sector declined 0.2 percent in the second quarter. 1

Figure 1

Part of the slowdown is due to the monetary roller coaster that traces back to the second half of 1999. To head off liquidity problems in anticipation of Y2K hoarding, the Federal Reserve pumped in money at double-digit rates. As Figure 2 shows, the growth in money base, measured as a six-month moving average, peaked at 22.6 percent in December. That was 3 times (15 percentage points) faster than its average growth rate of 7.8 percent during the 1990s. Once it became clear that financial systems worldwide reached the year 2000 without incident, the Fed began taking money out of the system with a vengeance. By June 2000, money base was growing at a negative 6 percent, 14 percentage points below its average. Money growth has climbed back up to its average only last month.

Figure 2

The excessive pumping in and then draining of reserves helped first inflate then burst the technology bubble. And tight money has certainly discouraged some investment activity. But we believe that fiscal policy has played just as big a role and may have more potential to turn the economy around.

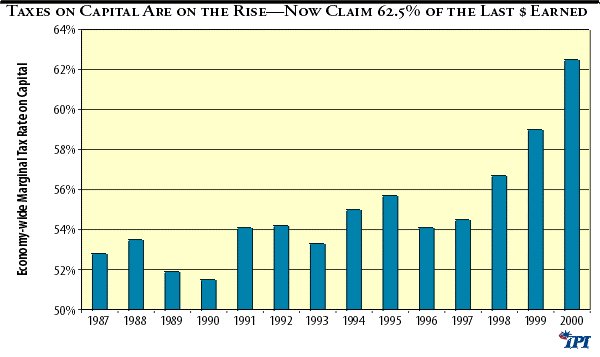

Tight fiscal policy stems primarily from the tax increases enacted during the early 1990s. In an effort to reduce federal deficits, tax bills passed in 1990 and 1993 raised income taxes by, among other things, adding rates of 31%, 36% and 39.6%. As recovery from the last recession gradually picked up steam and real growth pushed people into higher brackets, those tax increases really began to bite. Thanks to gains from the bull market and the wealth created from the technology boom of the 1990s, income from capital has been especially hard hit the last three years. As Figure 3 shows, for the economy as a whole, investors and entrepreneurs, on average, now send 62.5 cents out of every dollar earned on added investment to federal, state and local governments. That is 15 percent higher than the marginal rate in 1995 (54.1%) and 20 percent above the 1989 rate (51.9%). These ever-rising tax rates both raise the cost of capital and reduce returns to savers and investors, thereby limiting expansion of U.S. capital. Less capital, in turn, reduces labor productivity and economic growth overall.

Figure 3

Just as fiscal policy has helped create the problem, fiscal policy can provide powerful solutions, provided the stimulus package contains proposals that are effective in promoting growth. Let us now examine the likely contenders.

Likely Contenders for the Stimulus Package

Tax cuts can give the economy a needed boost. While the tax bill passed early last summer focused mainly on individual income taxes, proposals currently under consideration also include tax relief for businesses and for workers. Proposals that have been most often mentioned include:

• Accelerating rate cuts passed earlier this year

• Cutting payroll taxes

• Allowing faster recovery of capital costs, especially through depreciation reform

• Instituting an investment tax credit (ITC) for equipment

• Lowering the corporate income tax rate

• Reducing the tax rate on capital gains tax

• Repealing the alternative minimum tax (AMT).

Some proposals will cost more than others. Others will do the economy more good. Any proposal’s economic effect and revenue cost will depend on how it is structured. Unfortunately, at this stage, proposals are very short on specifics. In the absence of details, we have used simple, generic forms of the proposals to illustrate their relative effectiveness in achieving more economic growth. We have scaled the proposals on depreciation and an ITC along with the corporate, personal and payroll rate cuts so that each costs the same amount of revenue in the “long run,” that is, ten years out. For capital gains and the AMT, we have adapted prior, published policy simulations. We also kept the economic incentives of each tax cut constant throughout the ten-year period.2

Table 1 ranks the generic proposals in terms of our estimates of how much each would add to gross domestic product in per dollar of revenue cost. The estimates used for both GDP and revenue are for the tenth year (2011). The revenue cost is static; that is, it excludes any economic feedback effects that the proposal might generate.

Table 1

Ranking the Tax Proposals: Which Provides the Most Growth?

|

Provision

|

Added GDP per $1 of Tax Cut in 2011

|

| Capital gains |

$10.61

|

| Depreciation Reform |

$9.00

|

| Repeal AMT |

$5.61

|

| ITC for Equipment |

$4.84

|

| Corporate Rate Cut |

$2.76

|

| Speedup 2001 Tax Cuts |

$2.52

|

|

Personal Rate Cuts

|

$2.10

|

|

IRA Expansion

|

$6.97

|

|

Estate & Gift Tax

|

$9.82

|

| Payroll Tax Cut, No Cap |

$0.70

|

| Payroll Tax Cut, Limited |

$0.23

|

| Proposals were scaled to cost the same in 2011 as a one percentage point reduction in the corporate rate. That translated into an ITC of about 1 percent; 20 percent shorter tax lives with some expensing; roughly an 0.8 percent reduction in personal rates; and a 0.7 percent reduction in the payroll tax. Economic effects were estimated using the Fiscal Associates Model. | |

Right now, for every extra dollar of GDP, the federal government collects about 33 cents in taxes. That means the federal government should roughly break even in the long run on any proposal yielding at least $3 in added output per dollar of cost. Proposals yielding $4 of extra GDP for every revenue dollar spent would pick up revenue.

Tax Cuts Aimed at Capital Produce Biggest Economic Benefits

The rankings in Table 1 show that reducing tax rates on capital would have the biggest economic payoff. There are several reasons why. First, the United States is part of the global economy. Capital flows in or out of the U.S. in response to domestic changes in the rate of return. An increase in the U.S. return will cause the domestic capital base to expand until its return is again in balance with the worldwide return. In other words, the supply of capital is very responsive. Second, as just discussed, the current downturn started with a slowdown in investment resulting, in part, from rising tax rates on capital. Third, capital is the more heavily taxed input. At the margin, taxes on capital are roughly 50 percent higher than those on labor.

Two proposals–capital gains and accelerated depreciation–would do the most to reduce the cost of capital and increase its rate of return relative to their revenue cost. Also producing enough growth to outweigh revenue costs over the long run are repeal of the AMT and an ITC for equipment. The last business tax cut on the list—a corporate rate cut—is less effective in terms of generating more growth. Let us look more closely at each one.

Capital gains

Right now, for every extra dollar of GDP, the federal government collects about 33 cents in taxes. That means the federal government should roughly break even in the long run on any proposal yielding at least $3 in added output per dollar of cost. Proposals yielding $4 of extra GDP for every revenue dollar spent would pick up revenue.

Tax Cuts Aimed at Capital Produce Biggest Economic Benefits

The rankings in Table 1 show that reducing tax rates on capital would have the biggest economic payoff. There are several reasons why. First, the United States is part of the global economy. Capital flows in or out of the U.S. in response to domestic changes in the rate of return. An increase in the U.S. return will cause the domestic capital base to expand until its return is again in balance with the worldwide return. In other words, the supply of capital is very responsive. Second, as just discussed, the current downturn started with a slowdown in investment resulting, in part, from rising tax rates on capital. Third, capital is the more heavily taxed input. At the margin, taxes on capital are roughly 50 percent higher than those on labor.

Two proposals–capital gains and accelerated depreciation–would do the most to reduce the cost of capital and increase its rate of return relative to their revenue cost. Also producing enough growth to outweigh revenue costs over the long run are repeal of the AMT and an ITC for equipment. The last business tax cut on the list—a corporate rate cut—is less effective in terms of generating more growth. Let us look more closely at each one.

Capital gains

Long run, lowering the capital gains tax rate would add more than $10 in output to our nation’s economy for every dollar the government gives up in revenue.3 Our generic proposal essentially assumes a lowering of the top cap gains rate from 20 percent to 15 percent.

Hist Long run, lowering the capital gains tax rate would add more than $10 in output to our nation’s economy for every dollar the government gives up in revenue.3 Our generic proposal essentially assumes a lowering of the top cap gains rate from 20 percent to 15 percent.

Historically, cuts in the capital gains tax have induced investors to engage in more buying and selling of stock than otherwise. These added transactions have led to higher realizations of capital gains and, therefore, higher revenue. Conversely, increases in capital gains taxes have led to lower realizations and less revenue pickup than government forecasters expected. In 1986, government forecasters predicted that realizations would continue to increase on the basis of prior trend. Following elimination of the 60% exclusion in 1986, capital gains realizations dropped 60 percent, virtually offsetting the supposed static revenue gain.4 When the top capital gains rate was lowered from 28% to 20% in 1997, government estimators maintained the cut would lose revenue by 2000. Instead, realizations and tax collections more than doubled in response to the 30 percent drop in the cap gains rate.5

Another argument recently heard against cutting capital gains taxes is that doing so would trigger a stock sell-off, further depressing financial markets. The problem with this line of reasoning is that a lower tax on capital gains raises investor return from holding an asset. The only way lowering capital gains taxes could cause a sell off in the stock market is if investors are willing to sell a now-higher valued asset for less. In the unlikely event that there would be such sellers, there would be plenty of buyers willing to purchase the stock at a bargain.

Capital gains, however, by itself, is not enough to get the economy going again. Despite its high return per revenue dollar, the simple fact is that lowering cap gains taxes do not have much static revenue loss. Last year, total capital gains revenues were running about $80 billion. The static loss from lowering the rate from 20 percent to 15 percent would amount to only $40 billion over ten years.

Accelerating depreciation

Current law requires that most purchases of plant and equipment be written off over a number of years. These depreciation deductions are set by law and vary for different assets. For example, computers must be written off over five years and most factory-floor machinery over seven years. The longer the business is required to postpone the deduction, the less the deduction is worth and the greater the tax cost associated with the purchase.

While there are any number of ways to accelerate depreciation, our generic proposal assumes about 20 percent shorter lives for most equipment and expensing for some high-tech assets. Long run, this faster write-off for purchases of equipment would yield $9 in extra GDP per revenue dollar. The reason for the high payoff is that to receive the tax cut a business must purchase an asset, which constitutes new investment.

Figure 4

Accelerated depreciation does not cost much revenue because total depreciation deductions do not increase but are simply moved closer to the time when expenses are incurred. As Figure 4 shows, half of the ten-year revenue cost for faster depreciation is concentrated in the first three years. After that, the annual revenue cost declines and eventually approaches zero. In contrast, the revenue costs of other tax cuts like rate reduction or an ITC start out small but grow over time.

Moreover, by postponing deductions for capital purchases, government forces business to give it an interest-free loan. The fact that government can borrow at a lower rate than business further mutes the revenue loss relative to the gains to business. As the example in the sidebar shows, shortening the life of a 7-year asset to five years would save business 40 percent more than it would cost government.

|

Value of Depreciation Deductions

Business vs. Government The value of depreciation deductions differs from the perspective of business and government. Under current law, the cost recovery schedules for a 5-year and 7-year asset are as follows:

Shortening the life of a 7-year asset to five years would raise the NPV of deductions to business by 5.2 percentage points (77.3%-72.1%) and by 3.7 percentage points for government (85.3%-81.6%). In other words, shortening lives would save business 40 percent more than it would cost government (5.2/3.7). |

||||||||||||||||||||||||||||||||||||||||||||||

The alternative minimum tax (AMT) is supposed to make sure that individuals and businesses pay their “fair share” of taxes.6 In fact, the AMT is an expensive and inefficient way to deal with perceived or real equity problems of the current income tax. The AMT raises marginal tax rates, particularly on capital income, and has very high compliance costs. As serious as these problems are, perhaps the biggest drawback in the current economic climate is the fact that the AMT hits hardest when the economy is weakest. The AMT is procyclical.

Repeal of the AMT would yield $5.61 in added GDP for every dollar of revenue cost. Helping check the static revenue loss is a credit for AMT taxes paid applied against future taxes. Just like capital gains, because the total cost of the AMT is small, the potential benefit from this tax cut is limited.

ITC for Equipment

Like the three previous proposals, the ITC would reduce the cost of capital and increase its return. However, the ITC also would be an additional tax offset, raising revenue costs. Long run, an investment tax credit of about one percent for equipment would return $4.84 for every dollar of revenue cost.

The ITC may be the most efficient short-term fix, but only if business perceives it as the long-run fix. Unfortunately, that probably would not be the case given the ITC’s spotty history. A 7% ITC was put in place in 1962 as part of the Kennedy administration’s package to get the economy going and then repealed in 1969 as part of a major overhaul of the tax code. A 10% ITC was re-instituted in 1981 only to be rescinded in 1986.

There are other problems with the ITC. Its impact is not uniform because it is worth more for shorter than longer-lived assets. The ITC also can raise controversy on equity grounds because, unless carefully crafted, an ITC plus tax depreciation can be better than expensing.

Corporate Rate Cut

Lowering the corporate rate from the current 35% to 34% would yield $2.76 in added GDP per dollar of revenue cost. Its payoff is limited for two reasons. First, the rate cut applies only to corporate capital, about 70 percent of the U.S. capital base. Excluded would be the many small businesses and partnerships that are not incorporated.

Second, unlike faster depreciation or the ITC, there is no guarantee that the rate cut would help finance only new investment. Companies that have no plans to add plant and equipment would receive the tax cut just as expanding businesses would. In lieu of investment, companies might decide to use the tax cut to strengthen their balance sheets by repaying debt or buying back stock. The fact that the rate cut applies to both old and new corporate capital dampens its growth effect while raising the revenue cost.

Accelerating this year’s rate cuts

“The Economic Growth and Tax Relief Reconciliation Act of 2001”(H.R. 1836) was enacted earlier this year. Less than 10 percent of the $1.35 billion in tax cuts over the next decade is slated for fiscal years 2001 and 2002. Much of this short-term relief was mailed out to taxpayers this summer and fall as a tax rebate for the new 10-percent, income tax rate bracket. The evidence so far is that the rebate has not had the anticipated stimulus effect on consumption. One estimate suggests that less than 20 percent is being spent.

The rest of H.R.1836’s tax relief primarily comes in the form of reductions in existing marginal income tax rates, gradual elimination of the estate tax, and expansion of IRAs and other retirement saving vehicles. All these changes will enhance economic efficiency by reducing taxes at the margin. The rate cuts will lower taxes on income from both capital and labor. The IRA and estate tax provisions will lower taxes on capital income.

As now structured, much of the tax cut occurs after 2005. To give the economy a greater boost in the short run, policy makers are considering moving forward at least some of H.R.1836’s remaining tax cuts. There are no specifics on how the tax cuts would be accelerated, however. For purposes of the ranking exercise, we assumed that personal rates would be reduced by 0.8 percent across the board. Because the revenue costs are low relative to the other proposals, the IRA and estate tax provisions were estimated to contribute about 10 percent of the total GDP pickup for the package.7

Speeding up the entire package of tax cuts would produce $2.52 in economic benefits for every dollar of revenue. Much of the economic benefits in the bill come from improved incentives to save and invest contained in the IRA and estate tax provisions. Restricting the speed up to the rate cuts only would lower the payoff to $2.10.

Tax relief for lower income taxpayers

Also mentioned as a candidate for the stimulus is tax relief for lower income taxpayers. Because many lower-income Americans already pay no federal income tax, payroll tax relief is a likely choice.

Payroll tax cuts, however, would generate the smallest economic payoff. The reason is that the supply of labor is nowhere near as responsive as capital to changes in its return after taxes, which limits its economic effect.8 A 0.7 percent reduction in the Social Security and Medicare rate for all workers would yield an extra $0.70 in GDP per revenue dollar.

There is a possibility that the payroll tax relief would be limited to lower-wage workers. As President Bush said during last year’s campaign, limitations and phase-outs of tax cuts, as with the Earned Income Credit, in themselves produce high marginal rates that hurt growth. That is why capping the rate cut drops the economic payoff to $0.23.

Conclusion

The estimates presented here are based on our economic model and the assumptions we made about the nature of the proposals. Changing the proposal specifications or using other models would likely produce different estimates and could even alter the ranking. That said, evaluating the growth potential of proposed policy changes should be a standard part of the analysis that the Joint Tax Committee, Treasury, the Congressional Budget Office and other government agencies provide to policy makers. These agencies for years have resisted incorporating economic effects into revenue and budget estimates. That resistance, however, should not extend to at least ranking competing proposals as to their relative merits.

With these caveats in mind, proposals that reduce marginal tax rates on income from capital would do more to promote growth than cuts aimed at labor. Not only is capital considerably more responsive to changes in its return, its tax rate, which is about 50 percent higher than labor, has accelerated in recent years and contributed to the continuing slowdown in investment.

Of the likely contenders for the stimulus package, a cut in the capital gains rate and shortening of tax lives for depreciation produce the most economic benefits per revenue dollar. Depreciation reform is especially powerful because it is totally aimed at new investment. Moreover, unlike other cuts such as an ITC or rate reduction, depreciation reform would save business more than it would cost government.

Endnotes

1. For more on the decline in investment and the economic slowdown, see Aldona and Gary Robbins’ National Review Online Financial columns “Purse-onal Issues”(August 23, 2001) and “Fiscal Footing (September 18, 2001) at www.nationalreview.com/nrof_robbins/robbins082301.shtml and www.nationalreview.com/nrof_robbins/robbins0921801.shtml.

2. Proposals were scaled to cost the same in 2011 as a one percentage point reduction in the corporate rate. That translated into an ITC of about 1 percent ; 20 percent shorter tax lives with some expensing; roughly a 0.8 percent reduction in personal rates; and a 0.7 percent reduction in the payroll tax.

3. We adapted some of our prior, published capital gains estimates for purposes of the ranking table. For example, see Gary and Aldona Robbins, Putting Capital Back to Work for America, Institute for Policy Innovation, Tax Action Analysis, Policy Report No. 124, May 1994.

4. Gary and Aldona Robbins, “Reducing Capital Gains Tax Rates,” IPI Issue Brief, February 1995.

5. Congressional Budget Office, The Budget and Economic Outlook: Fiscal Years 2002- 2011, January 2000, Table 3–6.

6. For more on the AMT see Gary and Aldona Robbins, Complicating the Federal Tax Code: A Look at the Alternative Minimum Tax (AMT), Institute for Policy Innovation, TaxAction Analysis, Policy Report No. 145, March 1998.

7. See Gary and Aldona Robbins, The Fiscal Plans of Al Gore and George Bush: A Comparison, IPI Issue Brief, September 26, 2000 for our previous estimates of the Bush tax cut that were adapted for this exercise.

8. Labor’s response to a change in the after-tax wage rate is called the elasticity of labor supply. This elasticity is the percentage change in the amount of labor supplied in response to a percentage change in the after-tax wage rate. The consensus estimate of labor elasticity for primary workers is around 0.1 while that for secondary workers is closer to 1.0. The weighted average labor responsiveness for the U.S. labor force as a whole is between 0.3 and 0.4.