A growing economy creates jobs, raises living standards, maintains global competitiveness, and thus engenders positive attitudes and optimism about the future.

While many policymakers seem intent on focusing on either economic stimulus or austerity, IPI believes that the economy can grow consistently and at higher rates than we’ve experienced in the last decade, and we reject the idea that economic growth contains within itself the seeds of its own demise through inflation, the business cycle, and erroneous Phillips Curve assumptions. Therefore, economic growth should be elected officials’ primary policy goal at the federal, state and local levels, and it’s the organizing principle of our policy work at IPI.

Whatever limitations may exist on economic growth, they should not be self-imposed through counterproductive tax policy, overbearing regulations, ill-conceived monetary policy, trade protectionism, or hostility toward skilled and ambitious immigration.

The Era of Big Government is Back

Election returns show that big government is back, and with so many people depending on it, it may be here to stay.

The Texas vs. California Election

The presidential election will tell us a lot about whether Americans want the country to look more like California or Texas.

The Coming Entitlements Cliff

Who's the Best Candidate for the Technology Industry?

What is driving the tech boom is an entrepreneurial, can-do spirit, relentless innovation, and in many of the most dynamic areas, a light-touch regulatory approach, not the occupant of the White House.

The 'Health Care Fiscal Cliff' Could Take The Economy Down

The US is not only facing a fiscal cliff, but also an entitlements cliff and, thanks to ObamaCare, a health care cliff. Those three cliffs aren't separate; they're intertwined. Go over one and we will be pulled over the other two.

Economic Growth Is Job #1

The incoming president and Congress must take immediate steps to stimulate real economic growth, which will make pursuing the rest of their agenda and solving our other problems possible, and easier.

A Nation of Nation Builders

Both President Obama and Governor Romney want to do some nation building: Obama at home, and Romney abroad. Both are potentially costly ideas without much hope for success.

Of Course It Can Work

The reason Obama and Biden are convinced Romney’s tax plan cannot work is that having failed themselves to grow the economy, they are defining economic growth out of the equation.

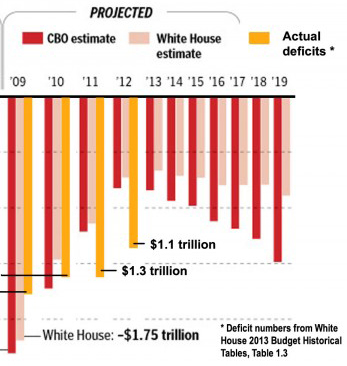

One Graph Tells the Whole, Sorry Economic Story

Listen to those who defend President Obama's economic record and then take a look at the graph, which undermines virtually every claim.

Tonight's Debate: Will Romney Step Up to Plate With Bold Solutions?

While conservative pundits and GOP strategists have encouraged Gov. Romney to be bold in tonight's first debate against President Obama and not play "small-ball," IPI experts are available to discuss whether or not the Republican candidate indeed stepped up to the plate.