One of liberals’ longstanding excuses for the abysmally slow economic recovery over the past four years is that Republicans stonewalled President Obama’s efforts to prime the stimulus pump.

Had Republicans let Obama be Obama—that is, an even bigger-spending liberal who thinks that economic growth comes from government, not private, spending—the president would have poured in even more money up front, which would have jumpstarted the economy.

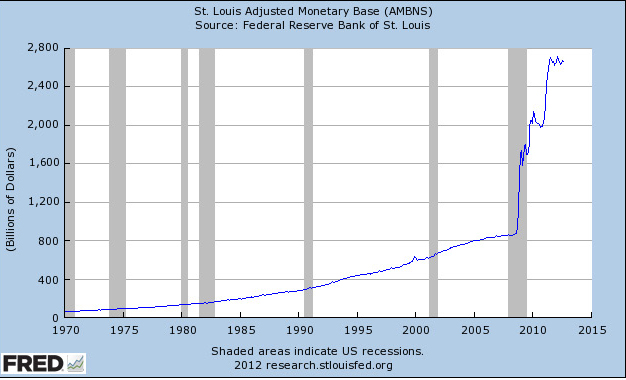

Such comments ignore the Federal Reserve Bank’s role as a printing press. As the accompanying graph clearly indicates, the Fed pumped about $2 trillion into the economy over a span of about two years—and none of it was part of the money Obama and his Democratically controlled Congress handed out.

Note that roughly half of that $2 trillion came after the last recession was officially over. And the Fed’s not done yet, recently announcing its third quantitative easing (QE3)—or what some might call Obama’s biggest super PAC.

But there is a price to pay for easy-money policies: inflation.

Most people today, including many economists, think of inflation as a rise in prices and wages. But as economist Ludwig von Mises pointed out decades ago, the rise in prices and wages is the result of inflation. According to von Mises, inflation is “the increase in the quantity of money and money substitutes,” which is exactly what’s been happening.

Or as the one-time New York Times economic affairs journalist Henry Hazlitt wrote: “Inflation, always and everywhere, is primarily caused by an increase in the supply of money and credit. In fact, inflation is the increase in the supply of money and credit. … The word ‘inflation’ originally applied solely to the quantity of money. It meant that the volume of money was inflated, blown up, overextended.”

We are living in very inflationary times, thanks to the Fed, and some day the bill in the form of very high prices will come due. And only then will most of the public think we have inflation.

September 25, 2012