Governments should have strategic reserves for the same reason families keep a spare tire or an emergency fund: not because it’s exciting, but because it’s useful when something goes wrong.

Governments should have strategic reserves for the same reason families keep a spare tire or an emergency fund: not because it’s exciting, but because it’s useful when something goes wrong.

A real strategic reserve exists for a concrete, predictable reason: The thing you’re stockpiling is something you must be able to access in an emergency. Petroleum reserves hedge oil supply shocks. Medical stockpiles hedge shortages of critical supplies. Even foreign-currency reserves hedge a very specific risk: paying foreign-currency liabilities when markets seize up.

Bitcoin matches none of those use cases. There are no sovereign liabilities denominated in bitcoin, which means there’s no obvious emergency for which “having bitcoin on hand” is the solution. Reserves should be built around the liabilities and risks you’re trying to hedge — and bitcoin’s volatility tends to amplify risk rather than reduce it.

If you want an asset to be there in a crisis, it helps if it doesn’t routinely plunge 50 percent at the worst possible time.

Some proponents argue bitcoin is “digital gold” and will shore up dollar dominance. But that argument collapses the moment you ask the practical question: What liability does bitcoin help the United States pay? What emergency does it solve? We do not run a bitcoin-denominated economy.

In other words, a government bitcoin “reserve” is really government chasing fads and making highly speculative bets with taxpayer dollars. And gambling with taxpayer dollars is not a legitimate function of government.

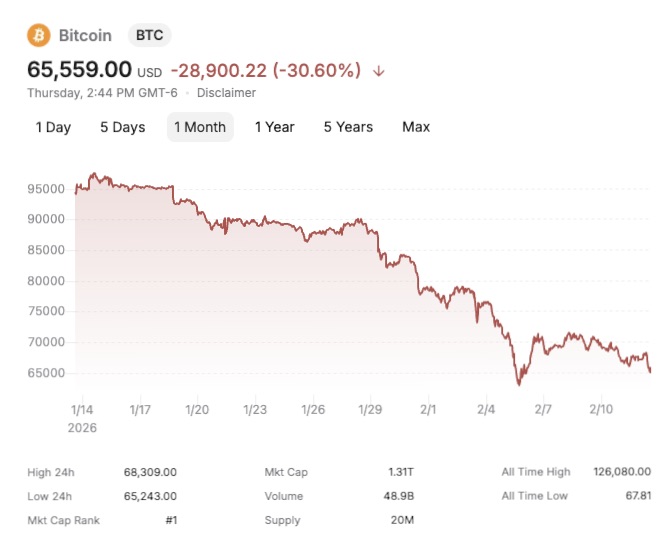

In late 2025, Texas seeded its new bitcoin reserve fund with $5 million, buying bitcoin at a market price of $91,336. Less than two months later, that initial purchase has lost more than 28 percent of its value. Was that a good use of taxpayer dollars?

Of course, governments buying massive quantities of bitcoin would drive up the price, creating a windfall for existing holders. That’s undoubtedly why some crypto bros are pushing the idea — but that’s cronyism and wealth transfer, not sound strategy.

If a government comes into possession of bitcoin through forfeiture, it should be disposed of transparently and applied to legitimate public priorities. Locking it away indefinitely under an executive order that declares it must not be sold is the opposite of sober stewardship.

America’s strength is not that Washington is a better speculator than the market. It’s that we have the rule of law, deep capital markets, and an innovation economy that doesn’t require the federal government to run a hedge fund.