As conservatives congratulate themselves on ten years of welfare reform, they need to start looking at the larger picture and all that was left undone. The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) addressed only one program in the welfare behemoth, Aid to Families with Dependent Children. The myriad other programs that constitute the welfare state remain untouched. Figures recently reported by the National Center for Health Statistics showing out-of-wedlock births at a record high confirm that, in social terms, we have barely scratched the surface.

Moreover, it is not called the welfare “state” for nothing. For unnoticed by reformers has been a startling development that is far more serious than even the devastating economic effects. This is the quiet metamorphosis of welfare from a simple system of public assistance into nothing less than a miniature penal apparatus, replete with its own system of courts, prosecutors, police, and jails: juvenile and “family” courts, “matrimonial” lawyers, child protective services, domestic violence units, child support enforcement agents, and more. This kafkaesque machinery operates by its own rules, largely outside the constitutional order, and represents the fulfillment of Friedrich von Hayek’s prophecy that socialism would eventually take us down a “road to serfdom.”

The first step in the mission creep transforming public assistance into bureaucratic tyranny was the extension of welfare operations beyond the needy. Having shut the front door to welfare abuse among low-income recipients, reformers have left the back door wide open, with welfare-originated programs quietly expanded to serve the middle class.

The prime example is child support enforcement, which grew directly out of welfare. Despite sanctimonious rhetoric about being “for the children,” the original aim was not to provide for children but to recover welfare costs; no other constitutional justification exists for this federal plainclothes police force. The program was begun exclusively for families on welfare and was to be applied to willfully absent parents who had abandoned their parental responsibilities to their children, leaving them dependent on public assistance to satisfy basic needs.

During the 1980s and 1990s – with no public debate, justification, or explanation – federal enforcement machinery conceived and created to address the minority of children in poverty was expanded (under bureaucratic and feminist pressure) to cover all child support cases, including the vast majority not receiving welfare. Unlike Temporary Assistance to Needy Families and virtually every other welfare program, child support enforcement is not means tested; indeed, there are no limitations or eligibility requirements at all.

This vastly expanded the size of the program and continues to do so by bringing in millions of middle-class divorce cases, for which the system was never intended. Unlike the welfare-related cases, where it is almost impossible to collect from impecunious young inner-city fathers, the divorced fathers have deeper pockets to mine. By padding their roles with millions of middle-class cases, states found they could collect a huge windfall of federal incentive payments at taxpayers’ expense. As Lary Holland and Jason Bottomley write:

The federal guidelines wanted the states to function as a collection agency…from parents who had willfully abandoned their parental responsibilities to their children. The result, however, was different from the intent and has caused the state welfare programs…to collect from willing parents that would ordinarily provide a loving environment for their children absent a court order limiting their involvement. Despite the original intent of the IV-D welfare program, it now provides an incentive for the states to use their courts to produce forcibly absent parents in order to increase the states' IV-D welfare caseload.1

The non-welfare cases now dwarf the welfare cases. Recent figures show that welfare cases, consisting mostly of unmarried parents, account for 17% of all child support cases, and the proportion is shrinking. The remaining 83% of non-welfare cases consist largely of previously married fathers who are usually divorced involuntarily and who generally can be counted on to pay. These non-welfare cases currently account for 92% of the money collected.2

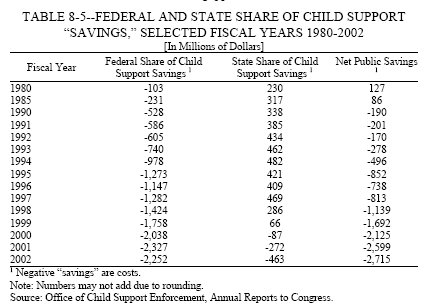

Promoted as a program that would reduce government spending, federal child support enforcement has incurred a continuously increasing deficit. "The overall financial impact of the child support program on taxpayers is negative," the House Ways and Means Committee reports. Taxpayers lost $2.7 billion in 2002.3

This money does not vanish. It ends up in state coffers, for whom it constitutes a lucrative source of revenue. “Most States make a profit on their child support program,” according to Ways and Means, which notes that “States are free to spend this profit in any manner the State sees fit.”4 Federal taxpayers subsidize state government operations through child support, and every fatherless child is an additional source of revenue for state governments.

In addition to penalties and interest on arrearages, states profit through incentive payments based on the amount collected, as well as receiving 66% of operating costs and 90% of computer costs.5 (When two states collaborate, both states qualify for the incentive payment as if each state had collected 100% of the money.) Federal outlays of almost $3.5 billion in 2002 allowed Ohio to collect $228 million and California to collect over $640 million.6 “There is a $200 million per year profit motive driving this system” in Michigan alone, attorney Michael Tindall points out. “It dances at the string of federal money.” 7

To collect these funds states must channel child support payments through their criminal enforcement machinery, criminalizing divorced parents and allowing the government to claim its perennial crackdowns are increasing collections despite the federal program operating at a consistent loss. In January 2000, HHS Secretary Donna Shalala announced that “the federal and state child support enforcement program broke new records in nationwide collections in fiscal year 1999, reaching $15.5 billion, nearly doubling the amount collected in 1992.” 8 Yet these figures are not what they appear.

In simple accounting terms, the General Accounting Office (GAO), which accepts at face value all the official HHS assumptions and data for what is “legally owed but unpaid,” found that as a percentage of what it claims is owed, child support collections actually decreased during this period. “In fiscal year 1996, collections represented 21% of the total amount due but dropped to 17% of the total due in fiscal year 2000,” writes GAO. “As a result, the amount owed at the end of the period is greater than the amount owed at the beginning of the period.” 9

Yet there is a more fundamental and much more consequential sense in which HHS’s claims of success are smoke-and-mirrors.

The ambiguity is “collections.” When we hear of collections through enforcement agencies we assume it involves arrearages or targets those who do not otherwise pay and whose compliance must be “enforced.” Yet in 1992 most child support was still being paid directly from one parent to the other, without accounting by the state. Criminal enforcement methods were limited mostly to the low-income welfare cases for which it was originally created. Increasingly since then, however, all child support payments – including current ones – have been routed through criminal enforcement programs by automatic wage withholding and other coercive measures which presume criminality. Low-income welfare-related cases (where collection is difficult) have remained steady, while non-welfare cases (where compliance is high) continue to increase.10 The “increase” in collections was achieved not by collecting the alleged arrearages built up by poor fathers already in the criminal collection system but by bringing more employed middle-class fathers, who faithfully pay, into it.11

Federal auditors have pointed out that federal child support enforcement has been diverted from its original purpose of serving a welfare constituency to serve as a collection agency for the affluent, with “about 45% reported incomes exceeding 200% of the poverty level and 27% reported incomes exceeding 300%”: “The rate at which child support services are being subsidized appear inappropriate for a population that Congress may not have originally envisioned serving.”12 Federal taxpayers are funding government collection machinery comprising some 100 public services – including wage-withholding, caseworkers, help desk workers, county attorneys, monthly invoicing, tracking debits and credits, asset seizure, free court costs, and a plethora of collection and enforcement services – not for public welfare cases but for what are supposed to be private civil divorce cases, where private remedies are available.13

One enforcement agency director openly acknowledged that the Clinton administration was twisting what had originally been a welfare-designed system to an entitlement serving the affluent in order to encourage profiteering by state governments. Testifying before Congress, Leslie Frye, Chief of California’s Office of Child Support, acknowledged that the administration moved “far beyond the Congressional intent” in developing an incentive system that “in fact encourages states to recruit middle-class families, never dependent on public assistance and never likely to be so, into their programs in order to maximize federal child support incentives.” Concerned that California could lose out under the new formula, Frye lays out the incentive structure with startling candor:

…the proposal also changes the way collections are counted for incentive purposes in a manner that is contrary to the principles underlying the PRWORA and that will lead to financial pressures on states to expand their Child Support Enforcement Programs to encompass all cases in the state, including those families who have never had to interact with government in order to pay or receive child support. Indeed, those states which already have near-universal government programs for child support will receive huge windfalls of incentives under the proposal, while states which historically concentrated on poor and near-poor families will lose federal incentive revenue, compared to the current system.

In other words, the administration was stretching congressional intent (and already questionable constitutional authority) to allow profiteering by states. The changes pressured states to expand their programs: “By recruiting ‘never welfare’ families into the IV-D program, we too could benefit from earning incentives on collections for middle class families, which generally are easier to make and higher than collections for poor families,” Frye pointed out. “From a public policy point of view, however, we think this is wrong. We believe that Congress did not contemplate…creating a universal Child Support Enforcement Program.”14 It is difficult not to conclude that the policy changes had little to do with improving the efficiency of collections, since collection could not and did not improve; indeed, as Frye points out, states that worked to improve their welfare collections, no matter how effectively, could not help but lose in the competition with states that simply increased their collection accounts by bringing in more affluent payers: “Mixing the issue of removing the limit on ‘never welfare’ collections with the performance-based incentive system skews the results so that some states, notably those with near-universal child support programs, would receive more incentives for poorer performance, while states with greater proportions of welfare or former welfare families in their caseloads may not ever be able to earn incentives at the current rate, no matter how well they perform.” The purpose of the changes, as Frye suggests, is simply to expand the size of the federal machinery far beyond what Congress intended.

At least three serious adverse results proceed from this transformation of the welfare system:

- Cost to taxpayers

- Subsidy on family breakup and fatherless children

- Criminalization of parents

Cost to Taxpayers

As noted, child support enforcement was originally justified and federalized to save taxpayers’ money by recovering welfare costs. Yet it has incurred a steadily increasing deficit, amounting to $2.7 billion in 2002. “Even amidst cutbacks by the federal government for entitlement block grants and restrictions on the use federal incentive dollars as matching funds, the states’ standing remains to gain billions in funding by including more and more of the middle-class in their welfare programs.” 15

Yet this is only the surface, ignoring indirect administrative and other costs. Arguably this abuse may be costing taxpayers (federal, state, and local) tens of billions of dollars annually. Assistant HHS Secretary Wade Horn argues that most of the $47 billion spending in his department is necessitated by broken homes and fatherless children.16 Further, given the social costs Dr. Horn and others have demonstrated to be connected with fatherless homes – including crime, truancy, drug abuse, unwed teen pregnancy, and more – it is reasonable to see tens of billions of dollars expended in law enforcement and education programs as among the costs. Most strikingly, the law enforcement and criminal justice systems are diverted from their original purpose of protecting society from violent criminals to criminalizing non-violent parents and keeping them apart from their children.

Subsidy on Family Breakup and Fatherless Homes

Child support is usually justified as providing for fatherless children. Yet there are indications that it serves as a taxpayer-funded subsidy on such children, providing an incentive for both mothers and states to remove more children from their fathers. How welfare has exercised this effect on low-income communities has been well known for decades. Child support creates a similar same effect on the middle class.

Because of IV-D funding, states must designate an active, present parent as "absent," even when both parents are fit, willing, and able to care for their children. These incentives drive courts to rule that a child’s “best interest” is to have limited contact with one parent in order to conform to the Title IV-D model of custodial and non-custodial instead of two custodial parents.

Further, child support creates an economic incentive for mothers (who file most divorces) to break up their families. Robert Willis calculates that child support levels exceeding the cost of raising children creates “an incentive for divorce by the custodial mother.” His analysis indicates that only between one-fifth and one-third of child support payments are actually used for the children; the rest is profit for the custodial parent. “We believe that this recent entitlement,” write two other scholars, “…has led to the destruction of families by creating financial incentives to divorce [and] the prevention of families by creating financial incentives not to marry upon conceiving of a child.”17 This simply extends well-established findings that increased welfare payments result in increased divorce.18 In this case, however, a dimension of law enforcement is added, which becomes effectively a system of federal divorce enforcement. " Enforcement…is the critical variable in the choice dilemma because it represents a greater surety in the assessment of the probability of attaining rewards," write Folse and Varela-Alvarez. "Strong enforcement, while it is an agreed upon societal goal to protect children, may, in fact, lead to class-based micro-level decisions that lead to the unintended consequence of increasing the likelihood of divorce."19 In other words, a mother can escape the uncertainties, vicissitudes, and compromises inherent to life shared with a working husband by divorcing, whereupon she acquires the police as a private collection agency who will force him, at the point of a gun if necessary, to pay her the family income that she then controls alone. At a time when the government is creating new federal programs ostensibly to strengthen marriage, it is operating a program that is working directly contrary to that aim. Bryce Christensen points to “evidence of the linkage between aggressive child-support policies and the erosion of wedlock.” “Because the politicians who have framed such [child support] policies have done nothing to reinforce the social ideal of keeping children in intact families," he explains, "they have – however unintentionally – actually reduced the likelihood that a growing number of children will enjoy the tremendous economic, social, and psychological benefits which the realization of that ideal can bring.”20

This has created an administrative regime where child support is no longer primarily a system of requiring men to take responsibility for the offspring they have sired and then abandoned, as the public has been led to believe; overwhelmingly child support is now a system whereby “a father is forced to finance the filching of his own children.”21 “By allowing a faithless wife to keep her children and a sizable portion of her former spouse’s income,” writes Christensen, “current child-support laws have combined with no-fault jurisprudence to convert wedlock into snare for many guiltless men.” 22

Criminalization of Parents

To collect federal incentive payments, states must channel all child support payments through their criminal enforcement machinery – not just delinquent payments but current payments, thus subjecting law-abiding citizens to criminal enforcement measures. Private domestic relations matters are being unnecessarily criminalized even when there is no support problem and the non-custodial parent pays consistently. State agencies place all divorced people in the criminal machinery regardless of need or circumstance, because the more clients in the program, the more federal funding the agency receives.

Though most of these fathers were actively involved in raising their children – indeed, they often clamor for more time with them – these fathers had to be designated as “absent” in order to fit into the welfare model, with the unstated stigma that they had “abandoned” their children when clearly they had done no such thing.

The federal funding also supplies an added incentive both to make guidelines as onerous as possible and to squeeze every dollar from every parent available (as well as to turn as many parents as possible into obligors by providing financial incentives for mothers to divorce). “From 1989 to 1998,” writes Georgia assistant district attorney William Akins, “the federal government provided welfare and collection incentive funds to the states based on the gross amount of the total child support payments recovered from non-custodial parents, thus creating a corresponding incentive to establish support obligations as high as possible without regard to appropriateness of amount.”23 This has led to what Robert Seidenberg describes as “a windfall of income for middle-class and upper-middle-class divorced women.”24 Thus the impossible burdens that plunder and criminalize otherwise law-abiding parents and the heavy-handed criminal enforcement measures against plainly innocent people that are now too becoming conspicuous to ignore.

Amid the near-hysteria that has been generated on the subject of unpaid child support and “deadbeat dads,” the fact remains that no such problem has ever been demonstrated. While it is obligatory, when offering the mildest criticism of the child support system, to state that "some" fathers no doubt do fail to provide for their children, there is simply no scientific evidence that there is or ever has been a widespread problem of fathers abandoning their children and not paying child support. No government or academic study has ever documented such a problem. Prior to the creation of the federal Office of Child Support Enforcement (OCSE) and throughout its 31-year history, no study has ever been conducted on the reason for its existence. Indeed, several federally funded studies have come to the conclusion that no such problem exists, and a full-scale government-sponsored study was cancelled by OCSE when an earlier pilot study threatened to undermine the justification for the agency’s existence by demonstrating that nonpayment of child support was not a serious problem.25

Further, our awareness of this alleged problem has come entirely from government sources. No public outcry ever preceded the creation of enforcement machinery; nor has any public discussion ever been held in the media. In fact, no public perception of such a problem even existed until public officials began saying it did.

In light of the facts above, it is difficult to escape the conclusion that the public has been seriously misled by a kind of optical illusion. What we have been told is an epidemic of irresponsible fathers is in reality a serious abuse of power by the government.

Footnotes

1.Lary Holland and Jason Bottomley, “How Federal Welfare Funding Drives Judicial Discretion in Child-Custody Determinations and Domestic Relations Matters,” North Country Gazette, 28 February 2006 (http://www.northcountrygazette.org/articles/022806SSAndCustody.html).

2. Child Support Enforcement (CSE) FY 2002 Preliminary Data Report, 29 April 2003 (http://www.acf.hhs.gov/programs/cse/pubs/2003/reports/prelim_datareport/), figures 1 and 2.

3. 2003 Green Book, House of Representatives, Ways and Means Committee, WMCP: 108-6,section 8, p. 8-69 and table 8-5 (http://waysandmeans.house.gov/media/pdf/greenbook2003/Section8.pdf).

4. 1998 Green Book, House of Representatives, Ways and Means Committee Print, WMCP:105-7, U.S. Government Printing Office Online via GPO Access, section 8: Child Support Enforcement Program (http://frwebgate.access.gpo.gov/cgi-bin/useftp.cgi?IPaddress=162.140.64.21&filename=wm007_08.105&directory=/disk2/wais/data/105_green_book;

5. Report to the House Of Representatives Committee on Ways And Means and the Senate Committee on Finance: Child Support Enforcement Incentive Funding (Washington, DC: Department of Health and Human Services, February 1997).

6. 2003 Green Book, table 8-4.

7. C. Jesse Green, interview with Michael E. Tindall, Michigan Lawyers Weekly (http://www.michiganlawyersweekly.com/loty2000/tindall.htm; no date, accessed 1 May 2002).

8. HHS press release, 27 January 2000.

9. Child Support Enforcement: Clear Guidance Would Help Ensure Proper Access to Information and Use of Wage Withholding by Private Firms (Washington, DC: General Accounting Office, GAO-02-349, March 2002), p. 7.

10, FY 1998 Preliminary Data Report (Washington: Office of Child Support Enforcement, May 1999), figure 2, p. 35; Child Support Enforcement: Effects of Declining Welfare Caseloads Are Beginning to Emerge (Washington, DC: General Accounting Office, GAO/HEHS-99-105, 1999), pp. 7-8.

11. At the same time as the Clinton administration was touting its success, the Ways and Means Committee was arriving at a very different conclusion. “In 1978, less than one-fourth of child support payments were collected through the IV-D [welfare] program. This percentage, however, has increased every year since 1978. By 1993, more than two-thirds (67%) of all child support payments were made through the IV-D program. The implication of this trend is that the IV-D program may be recruiting more and more cases from the private sector, bringing them into the public sector, providing them with subsidized services (or substituting Federal spending for State spending), but not greatly improving child support collections. Whatever the explanation, it seems that improved effectiveness of the IV-D program has not led to significant improvement of the nation's child support performance.” 1998 Green Book, section 8.

12. Jane L. Ross, Child Support Enforcement: Opportunity to Reduce Federal and State Costs (Washington, DC: General Accounting Office, Report # GAO/T-HEHS-95-181), 13 June 1995, pp. 5-6.

13.Molly Olson, “Title IV-D: Child Support Collection and Enforcement, Welfare Service Program,” (Roseville, Minnesota: Center for Parental Responsibility, March 2006).

14. “Statement of Leslie L. Frye, Chief, Office of Child Support California Department of Social Services

Testimony Before the Subcommittee on Human Resources of the House Committee on Ways and Means,

Hearing on the Administration's Child Support Enforcement Incentive Payment Proposal, March 20, 1997” (http://waysandmeans.house.gov/legacy/humres/105cong/3-20-97/3-20frye.htm), pp. 1-2.

15. Holland and Bottomley, “How Federal Welfare Funding Drives Judicial Discretion.”

16. “Wedded to Marriage,” National Review Online, 9 August 2005 (http://www.nationalreview.com/comment/horn200508090806.asp).

17.Robert J. Willis, “Child Support and the Problem of Economic Incentives,” p. 42, and Robert A. McNeely and Cynthia A. McNeely, “Hopelessly Defective: An Examination of the Assumptions Underlying Current Child Support Guidelines,” p. 170; both in William S. Comanor (ed.), The Law and Economics of Child Support Payments (Cheltenham: Edward Elgar, 2004).

18.Saul Hoffman and Greg Duncan, "The Effects of Incomes, Wages, and AFDC Benefits on Marital Disruption," Journal of Human Resources 30 (1995), pp. 19–41; Lowell Gallaway and Richard Vedder, Poverty, Income Distribution, the Family and Public Policy (Washington, DC: Government Printing Office, 1986), pp. 84-89.

19. Kimberly Folse and Hugo Varela-Alvarez, "Long-Run Economic Consequences of Child Support Enforcement for the Middle Class," Journal of Socio-Economics, vol. 31, no. 3 (2002), pp. 274, 283, 284.

20. Bryce Christensen, “The Strange Politics of Child Support,” Society, vol. 39, no. 1 (November-December 2001), pp. 67, 63.

21. Jed H. Abraham, From Courtship to Courtroom: What Divorce Law Is Doing to Marriage (New York: Bloch, 1999), p. 151.

22. Christensen, “Strange Politics of Child Support,” p. 65 (original emphasis).

23. William C. Akins, “Why Georgia's Child Support Guidelines Are Unconstitutional,” Georgia Bar Journal, vol. 6, no. 2 (October 2000), pp. 9-10.

24. Robert Seidenberg, The Father’s Emergency Guide to Divorce-Custody Battle (Takoma Park, Maryland: JES, 1997), pp. 107-108; Irwin Garfinkel and Sarah McLanahan, Single Mothers and Their Children, A New American Dilemma (Washington, DC: Urban Institute Press, 1986), pp. 24-25. Christensen also found “windfalls to the custodial parents.” “Strange Politics of Child Support,” p. 66.

25. S.L. Braver, P.J. Fitzpatrick, and R. Bay, “Adaption of the Non-Custodial Parents: Patterns over Time,” paper presented at the conference of the American Psychological Association, Atlanta, Georgia, 1988; F.L. Sonenstein and C.A. Calhoun, “Determinants of Child Support: A Pilot Survey of Absent Parents,” Contemporary Policy Issues 8 (1990); Carmen D. Solomon, The Child Support Enforcement Program: Policy and Practice, Congressional Research Service, 8 December 1989, pp. 1-3.

About the Author

Stephen Baskerville is a fellow at the Howard Center for Family, Religion, and Society and president of the American Coalition for Fathers and Children. His book, Taken Into Custody: The War Against Fathers, Marriage, and the Family will be published in July by Cumberland House Publishing."