Have Minimum Wage Increases Killed "Reshoring"?

Many lower income jobs were returning to the U.S., but that trend appears to have stopped, and workers can thank liberals for it.

Ooops! Apparently CBO Made a $136 Billion Obamacare 'Boo-Boo'

Surprise! The Congressional Budget Office now says that Obamacare will cost a whole lot more than the government and our president predicted.

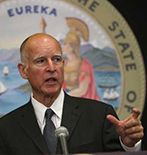

The California Governor's Plan to Create More Jobs in Texas

The governor doing more than anyone to create Texas jobs is Jerry Brown.

GMO Foods and the Anti-Science Left

You wouldn't know it from the media, but those on the political left, not conservatives, are the real anti-science hardliners. Just look at genetically modified foods.

Puerto Rico Already Has SandersCare and It's Broke

We don’t have to wait until he is elected to see Sanders’s ideal health care system; we can look at Puerto Rico.

Donald Trump on (Prescription) Drugs

Donald Trump, the businessman who claims to know how to close a deal, has a way to lower the price of prescription drugs: allow the government to "negotiate: (i.e., dictate) the price.

When Will Republican Candidates Start Identifying Proposed Spending Cuts?

Tax cuts are nice but they are not enough. The government doesn’t just take too much money, it also spends too much.

When Democrats Supported Free Trade--100 Years Ago

Democrats were once the principled voices in support of free trade; now they support protectionism and trade barriers that only lead to trade wars.

Why Losing Welfare Benefits Helps Welfare Recipients

As an Oregon welfare reform pilot program demonstrated in the 1990s, when people looking for welfare benefits were told they would have to work for their benefits, about a third walked out saying if they had to work they’d find their own job.

Economics in Action: Wal-Mart Raises Wages Then Closes Stores

Higher wages are nice, but not when it costs you your job.