Taxes directly affect Americans by compelling them to surrender part of their income to the government, and indirectly since the taxing power can positively or negatively affect economic growth.

In the U.S., our tax regimes are in serious need for reform, both at the state and federal level. Our tax code fails to sufficiently incentivize investment, the primary driver of economic growth. And it hobbles U.S. companies as they compete internationally.

IPI believes that the purpose of taxes is to raise the revenue necessary to fund the legitimate functions of government while imposing the least possible impact upon the functioning of the economy. We therefore believe that taxes should be simple, transparent, neutral, territorial and competitive.

Because of its tremendous potential to stimulate real long-term economic growth, tax reform should be a top priority of policymakers.

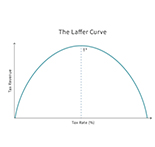

California's Laffer Curve

California proves the Laffer Curve works by demonstrating that the Golden State's high tax policies don't work.

Tax Competition Works

Tax competition works, which is why high-tax states don't like it.

A Tariff Is a Tax

While many taxes have gone up since their inception, tariffs—which are a tax—have gone down.

The Injustice of the Student Debt Bailout

Congrats to everyone who didn't have college debt. Now you do.

The Democrats' Whatever-Tax-That-Can-Pass Approach

Responsible economists ask how a proposed tax increase could distort economic decisions; Democrats ask a different question.

Do Democrats See Us as a Nation of Tax Cheats?

The same people who have repeatedly claimed there is no election fraud think that large swaths of the public, especially high-income Americans and corporations, are not just avoiding taxes but cheating the government out of hundreds of billions of dollars in federal income tax obligations.

Inflation Reduction Act Will Increase Taxes for Most People

President Biden said he wouldn’t raise taxes on people making under $400,000. His revised version to build back better does exactly that.

End the Tax on Phantom Gains

High-inflation times, like now, demonstrate why any capital gains taxes should be based on real gains, not phantom gains.

Taxes Cause Deadweight Loss

Economists know to look under the covers when it comes to taxes, and they often find what's known as "deadweight loss."