Taxes directly affect Americans by compelling them to surrender part of their income to the government, and indirectly since the taxing power can positively or negatively affect economic growth.

In the U.S., our tax regimes are in serious need for reform, both at the state and federal level. Our tax code fails to sufficiently incentivize investment, the primary driver of economic growth. And it hobbles U.S. companies as they compete internationally.

IPI believes that the purpose of taxes is to raise the revenue necessary to fund the legitimate functions of government while imposing the least possible impact upon the functioning of the economy. We therefore believe that taxes should be simple, transparent, neutral, territorial and competitive.

Because of its tremendous potential to stimulate real long-term economic growth, tax reform should be a top priority of policymakers.

Biden's New Proposed Wealth Tax

Biden proposes a wealth tax he once opposed, targeting billionaires whose net worth is $100 million.

More Defense Spending, But How?

Most observers realize that the United States is going to have to increase its defense spending. But, with federal debt ballooning, interest rates rising and the return of inflation, we simply must set our fiscal house in order. We must be able to say “no” to more things so that we can “yes” to a stronger defense.

Correcting Biden

In his State of the Union address, President Biden said the 2017 tax reform only benefited the top 1% of income earners. To put it bluntly, he lied.

Did Sen. Rick Scott Propose a Tax Increase?

Sen. Rick Scott's been accused of wanting to raise taxes. He may be talking about a tax principle rather than tax policy. But Republicans have to be careful how they talk about taxes.

Look, C'mon Folks: Joe Biden Doesn't Understand Inflation

There is no solution to inflation other than reining in loose money and enduring whatever temporary economic pain may result.

The State of the Union and the Allure of Price Controls

The left thinks it can plan and control human behavior and the economy, yet Biden's State of the Union address will likely reveal that the economy is not going as planned.

Tax Competition Between States: How Low Will Tax Rates Go?

Several states are eagerly competing to attract over-taxed people by lowering their income tax rates, in some cases to zero.

The IRS is Already Snooping

You might have thought the Biden administration changed that provision that would allow the IRS to snoop into your finances. Well, think again.

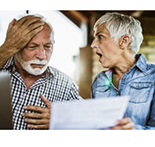

The Other Progressive Income Tax and How It Robs Seniors

It’s unlikely a spend-happy Congress will eliminate the benefits tax anytime soon, even if it does rob seniors of some of the benefits they deserve. Indeed, the bigger threat is Congress making it worse.

Tax Jeopardy!

After an incredible run on the long-running game show, winning nearly $1.4 million, Ms. Schneider is off of TV “Jeopardy!,” but now finds herself in tax jeopardy.