Synopsis:

Those pushing for price controls on prescription drugs claim that step is necessary to reign in drug company greed and profiteering. But their arguments reveal both confusion and misinformation about how drugs are priced and distributed. Several factors affect prices, including government regulations, middlemen and the high cost of R&D. Imposing price controls would only reduce innovation and distort the market even more. The better solution is to streamline research and production and seek innovative ways to cover the costs of these medical miracles.

Introduction:

Those pushing to impose price controls on prescription drugs claim that step is necessary to reign in drug company greed and profiteering. While it is not our mission to defend every pricing decision made by a drug manufacturer, there are multiple reasons why some drug prices are high, and government policies are one of those reasons.

Confusing Drug Costs with Drug Spending

Democrats (and some Republicans) think by either directly or indirectly imposing price controls on prescription drugs, they can reduce health care spending. While the two issues are related, controlling prices doesn’t necessarily control spending. Just look at Congress’s effort to use price controls to limit Medicare spending.

Congress imposed price controls on Medicare-covered hospital stays (Part A) in the early 1980s, and on physician services (Part B) in the early 1990s. Neither has had a long-term effect of controlling Medicare spending.

By contrast, Medicare prescription drug benefit (Part D) spending has grown at a much slower pace than predicted, only increasing about 2.3 percent per person annually between 2010 and 2018—even with the addition of the baby boomers retiring in large numbers.1 The Republican drafters of that legislation made voluntary negotiations between private sector companies the key to lower drug prices and wisely rejected Democrats’ demands for explicit or implicit price controls.

If the government were to use its power to arbitrarily lower prices—e.g., House Speaker Nancy Pelosi’s bill “The Lower Drug Costs Act Now”—it would increase demand even as it opened the door for reduced new drug research and development and the supply of existing drugs.

While advocates claim they need that price-control leverage to force drug manufacturers to “negotiate,” their real goal is to dictate politically acceptable prices—and confiscate nearly all of a new drug’s revenue if the manufacturer doesn’t relent to the government’s price.

Why New Drug Prices Are Rising

Historically, innovator drug manufacturers relied almost entirely on simpler, small-molecule drugs that could be put in a pill, and the development costs were spread out across millions of patients. And because these drugs were simpler, it was easier for generic manufacturers to step in with much less expensive copies of a branded drug when it went off patent.

But over the last two decades, innovator companies have increasingly turned to complex injectable drugs known as biologics because they are the only ones effective in treating some of the most deadly and debilitating diseases. These drugs are much more difficult to develop, manufacture, transport and replicate—a fact that helps explain why generic versions, known as biosimilars, haven’t seen quite the price reductions that come with standard generic versions of a drug.

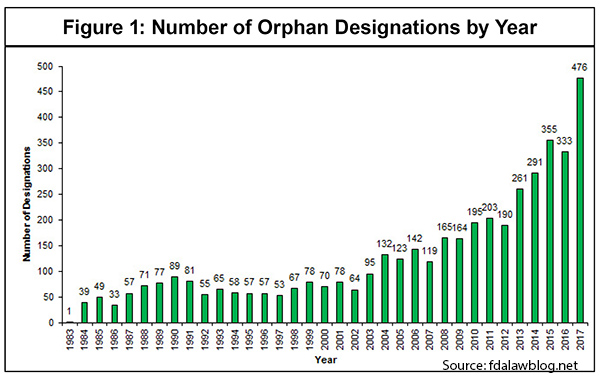

Moreover, these new biologics often target diseases with much smaller patient populations—referred to as “orphan drugs.” [See Figure 1]

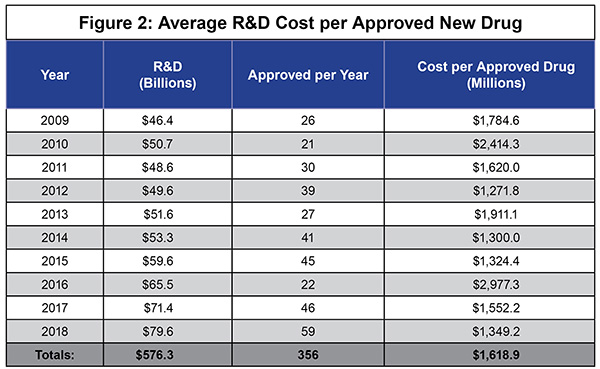

As IPI’s own work has shown, it is very expensive to develop new drugs, especially these more complex biologics, and to move them through the FDA approval process—about $1.6 billion in direct out-of-pocket costs per approved new drug. [See Figure 2] And that estimate does not include the opportunity costs that some analysts reasonably factor in.

With biologics, those development costs are borne by much smaller patient populations—perhaps only 25,000 or fewer cases nationwide.

If we want innovator drug manufacturers to continue searching for cures for cancer, Alzheimer’s, arthritis, and other such diseases—and we do—R&D costs, and thus prices, are likely to continue climbing. The more complicated it is to make a drug, and the fewer patients to pay for it, the more expensive each drug will likely be. It’s not profiteering; it’s math.

However, just because some of the newest and most innovative biologics can be very expensive doesn’t necessarily mean that prescription drug spending is rising quickly, because, as mentioned earlier, price is not the same as spending.

As the Manhattan Institute’s Chris Pope recently explained, “From 2014 to 2018, price changes accounted for $22 billion in extra drug spending, which was more than offset by a $51 billion reduction in spending resulting from the loss of exclusivity that allowed generic drugs to enter the market. Spending increased slightly overall but not because of price increases. Increased usage of existing drugs led to $35 billion of additional spending while the introduction of new drugs accounted for another $75 billion.”2

The real public policy challenge isn’t to find some way to make price controls work without the collateral damage of stifling innovation, limiting supplies and rationing care. It’s to find innovative ways to pay for those new drugs that will allow, even encourage, pharmaceutical companies to continue looking for cures.

Drug Manufacturers Set Their Prices, but…

Drug company critics complain that drug manufacturers are free to set whatever price they choose for a new or existing drug, and so critics conclude the only way to limit or reduce prices is for the government to dictate them.

While drug manufacturers are generally free to set their initial price—indeed, that’s true for almost all manufactured products sold in the U.S.—that complaint ignores factors that put downward pressure on prices.

What Drug Companies Charge ≠ What They Get

Yes, many of the newest drugs can be very expensive. But the asking price is not the same as the sales price.

A small number of private companies, generally referred to as “pharmacy benefit managers” (PBMs), distribute the vast majority of prescription drugs around the country. Some 266 million Americans are in PBM-administered drug plans.3

PBMs negotiate steep discounts or hefty rebates, or both, from the drug manufacturers, which could result in significant savings for consumers—if those savings were passed along to consumers.

How big are those discounts and rebates? The actuarial firm Milliman, Inc., says that discounts and rebates “contribute to the growing spread between pharmaceutical manufacturer’s pre-rebate ‘gross’ and post-rebate ‘net’ revenue. In recent years, pharmaceutical manufacturers have reported actual revenue of 50% to 60% of gross sales due to rebates and discounts.”4

The point is that neither consumers nor politicians should pay too much attention to the top-line “list price” for a prescription drug. Patients almost never pay the list price, and the manufacturer is almost certainly receiving far less.

The Hidden Cost of Middlemen

When a company claims it’s removing the middlemen from its distribution system, consumers expect to see lower prices—or at least prices that do not rise as fast. While some middlemen can play a valuable role in distribution chains, many become little more than a costly added expense. Some argue that’s what PBMs have become in the pharmaceutical distribution chain.

The PBM industry points out that the two largest PBMs self-report “that they return up to 98 percent and 95 percent of rebates, respectively, to those they serve in the commercial market.”5

But as a Pew Charitable Trust report points out, “PBMs’ operations are largely hidden from public view and from regulators. Without transparency, some federal and state officials question whether PBMs are pocketing too much of the money rather than passing the savings on to consumers.”6

The largest PBMs have become very profitable—about $23 billion in gross profits, according to one study in the journal Health Affairs.7 And unlike the drug companies, PBMs don’t actually make anything.

A desire to eliminate that middleman cost is leading some large employers to look for ways to bypass the PBMs so they can pass all of the discounts on to their employees. It’s a smart move, and if it’s successful other companies may look for ways to cut the PBM cord.

There Is Competition Even with Monopolies

Another complaint is that when government—i.e., the U.S. Patent and Trademark Office—grants a drug manufacturer one or more patents for a new drug, it creates a monopoly, squelching competition and allowing the manufacturer to charge whatever it wishes.

The complaint ignores the fact that other manufacturers often release their own patented drugs to address the same medical condition shortly after the first drug is released. For example, Gilead Sciences’ Sovaldi, which can actually cure hepatitis C, was released in December 2013. Gilead then released Harvoni in 2014, which works in conjunction with Sovaldi.

However, Drugs.com recently reported, “newer approvals have put pressure on sales of these original oral Hep C agents. Since the approval of Sovaldi and Harvoni, 6 additional oral HCV treatments have been approved.”8

Thus a patent does not necessarily shield a manufacturer from competition, just from another company copying the drug. And more competition is what we want because it can put downward pressure on prices—not to mention save lives.

Regulations Have a Cost

Regulations are a necessary part of a well-functioning economy. But politicians often go overboard imposing them. And regulations also come with a cost, which can at times far exceed their benefits.

The federal government has, over time, created a cumbersome regulatory system for the development and approval of new prescription drugs. Drug manufacturers’ direct out-of-pocket costs to complete the regulatory obstacle course are huge, but so are the indirect costs. For example, patients who might benefit from a new drug may have to wait years before it’s approved—IF it’s approved.

It’s difficult to estimate how many promising molecules have been left on the “cutting-room floor” because of the regulatory costs and the risk of failure, but it’s time to streamline that process. Streamlining and simplifying could reduce the lengthy approval process that limits patients’ ability to benefit from the price-lowering impact of competition from other companies’ new drugs.

Former Food and Drug Administration Commissioner Scott Gottlieb tried to address this bottleneck by expediting the approval process so that competitors would hit the market sooner. His efforts helped, but more needs to be done.

No Shortage of Drug Shortages

Shortages of key drugs, both brand name and generic, have been a growing problem for several years. There are currently some 260 prescription drugs in short supply. And a new report from the U.S. Food and Drug Administration says, “According to a recent study, 56 percent of hospitals reported they had changed patient care or delayed therapy in light of drug shortages: 36.6 percent said they had rescheduled non-urgent or emergent procedures.”9

Given the demand for certain drugs, why aren’t their manufacturers cranking up production? In many cases the answer is government regulations.

While some members of Congress want to impose price controls on prescription drugs, the fact is that various types of price controls have been in place in some programs for years.

Drug manufacturers are required by law to give state Medicaid programs the lowest price for their drugs. That’s a type of price control.

The 340B program requires drug manufacturers to provide discounts to hospitals. And Medicare Part B, which provides injectable medicines for some of the sickest patients, imposes an “average selling price” across all manufacturing.

Yet bureaucrats and politicians keep complaining about the cost of drugs in these programs that incorporate some form of price controls. And they threaten the manufacturers with various fines and penalties if they don’t fix the problems. The result is that some companies pull out of the market, creating shortages, and few if any companies are willing to pick up the slack. To make matters worse, shortages tend to push up the price of a particular drug.

Drug manufacturers are in the business of manufacturing drugs, as long as they can get a reasonable return on their investment. That’s why they exit. So if there are widespread drug shortages, there are reasons why manufacturers haven’t stepped up to fill the gap.

Winners Carry the Load

Drug company critics often complain that a manufacturer may be charging significantly more for a drug than it costs to make it. But with drugs—as well as most creative or innovative products (think of a Hollywood film)—almost all of the costs are in making the first copy. Those costs then have to be spread out over the additional copies. No one wants to pay $1.6 billion for the first pill; everyone wants the second pill.

But that’s not all. Prices for the most successful drugs aren’t just paying the cost of inventing that drug, they have to cover the costs of the drugs that never made it to market and for those that won’t be big sellers. Only a relatively small number of newly approved drugs become very profitable. And it’s the profits from those few winners that must carry most of the R&D load that will discover tomorrow’s cures. Maybe critics would view that model more approvingly if we called it “income redistribution.”

Is Cross-Border Care Fair?

Price-control advocates complain that U.S. consumers pay much more for drugs than those in other developed countries. But to the extent that statement is true, it primarily applies to branded drugs. However, generics account for about 90 percent of all U.S. prescription drug purchases, and U.S. generics tend to cost less than generics in other developed economies.

For example, a recent analysis of the “40 most commonly filled generic prescriptions in the United States” by PharmacyChecker found “88 percent of the top prescribed generics [where comparisons could be made] were cheaper in the United States than from Canada.” The reason: “Unlike brand name medications and first-to-market generics, which are granted 180 days of market exclusivity, there is intense price competition among multiple manufacturers for most other generic drugs in the United States.”10

In other words, in the vast majority of purchases—approaching 90 percent—Americans pay less out of pocket for generics than Canadians, even before health insurance has reduced the price. It’s an extremely important point that tends to be lost in political efforts to allow—even encourage—the importation of prescription drugs from other countries.

In addition:

- Virtually all of the 91.5 percent of the U.S. population with “qualified” health coverage has drug coverage included.

- Only 8.5 percent of the population went without health insurance for all of 2018.11 And a portion of those are people who are in the United States illegally and so are not eligible for Medicaid or Obamacare subsidies.

- The drug companies provide billions of dollars worth of their products free or at dramatically discounted prices for low-income individuals without coverage.12

- The most expensive new drugs tend to be biologics, which are often administered by physicians and are not sold to individuals at a pharmacy—including foreign pharmacies. And even if they were, most of them have strict requirements—such as special refrigeration—to ensure they are not compromised. Importing those drugs outside of an FDA-approved “chain of custody” bypasses that chain and greatly increases the risk of receiving mishandled drugs.

In other words, the number of people who would likely benefit from an importation scheme is very small. And the most expensive drugs, primarily biologics, aren’t likely to be available anyway. Do we really want to put a “government approved” imprimatur on drug importation just to address a small problem?

Imported Price Controls Are Still Price Controls

An alternative to importing foreign drugs themselves is to just import their price controls. President Donald Trump and some members of Congress propose setting the U.S. price for certain prescription drugs based on some type of composite index of prices charged in several other developed economies. Of course, this internatiional pricing index model merely substitutes the largely arbitrary prices set by politicians and bureaucrats in other countries for an arbitrary price set by U.S. politicians and bureaucrats.

But why does anyone think that price controls set by foreign governments are any more appropriate than price controls set by U.S. officials? Government-imposed price controls—whether it’s prescription drugs, housing, education or food—are politically determined, and subject to the prevailing social and political forces.

Price controls are imposed to please constituents. But at least voters can hold U.S. politicians accountable if price control legislation, such as Pelosi’s Lower Drug Costs Act Now, undermines the U.S. market for pharmaceutical innovation. If we import price controls, politicians can simply blame other countries when shortages and rationing emerge.

Who Invests When Prices Are Controlled?

Those who invest their money in the search for new drugs, whether it’s existing drug companies or venture capitalists, are hoping for a reasonable return. If politicians, rather than the market, are determining prices and imposing price controls, venture capital will dramatically decline or vanish.

Price-control advocates almost never address this issue. They assume there is plenty of “other people’s money” to invest in new drugs—just as they assume there is plenty of other people’s money to pay for all of their social programs. And to the extent price-control advocates do address the issue of capital, they generally imply that if needed the government could provide the funds.

The great irony is these same people regularly denounce the government for not spending enough on education, welfare, retirement and Medicare and Medicaid. But apparently they assume there will be plenty of money to spend on new drug research and development.

The Real Challenge

The real challenge to high drug prices isn’t to find government-imposed ways to control them, but to devise fair and equitable ways to pay for them. And to ensure there is robust competition, consistent with intellectual property protections.

One of the newest financing options for some of the more expensive drugs is contingency-pricing, where patients are required to pay a much lower price, or nothing at all, if a drug is unsuccessful.

And IPI has suggested promoting life insurance policies with an accelerated benefit that provides cash for patients if they have a major medical expense. Such policies already exist, but life insurance buyers are typically unaware of that option and its potential benefits.

Conclusion

The United States is the world’s leader in new drug development. And U.S. citizens are the beneficiaries. There are reasons why the newest drugs are expensive—and it isn’t because the government is insufficiently involved. Yet the price of some drugs—including cures that were never dreamed possible—has allowed certain politicians and advocacy groups to flog and inflame the populist perceptions.

What the country needs isn’t old and busted ways to impose price controls, but new, market-oriented ways to promote competition and innovative ways to pay for drugs. Because the most expensive drug is the one that was never invented.

Endnotes

1. “An Overview of the Medicare Part D Prescription Drug Benefit,” Kaiser Family Foundation,” Nov. 13, 2019.

https://www.kff.org/medicare/fact-sheet/an-overview-of-the-medicare-part-d-prescription-drug-benefit/

2. Chris Pope, “Drug Spending Is Reducing Health-Care Costs,” Manhattan Institute Issue Brief, Nov. 6, 2019.

https://www.manhattan-institute.org/issues-2020-drug-prices-account-for-minimal-healthcare-spending

3. “PBMs: Generating Savings for Plan Sponsors and Consumers,” Pharmaceutical Care Management Association, Feb. 4, 2016.

https://www.pcmanet.org/pbms-generating-savings-for-plan-sponsors-and-consumers/

4. Maggie Alston, Gabriela Dieguez, and Samantha Tomicki, “A Primer on Prescription Drug Rebates: Insights Into Why Rebates Are a Target for Reducing Prices,” Milliman, Inc., May 17, 2018.

https://us.milliman.com/en/Insight/A-primer-on-prescription-drug-rebates-Insights-into-why-rebates-are-a-target-for-reducing

5. Matthew Eyles, “On Drug Prices, Pharmacy Benefit Managers Are Not the Problem,” Health Affairs, Oct. 12, 2018.

https://www.healthaffairs.org/do/10.1377/hblog20181009.878948/full/

6. Michael Ollove, “Drug-Price Debate Target Pharmacy Benefit Managers,” Pew Stateline, Feb. 12, 2019.

https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2019/02/12/drug-price-debate-targets-pharmacy-benefit-managers

7. Nancy L. Yu, Preston Atteberry, and Peter B. Bach, “Spending on Prescription Drugs in the U.S.: Where Does All the Money Go?,” Health Affairs, July 31, 2018. https://www.healthaffairs.org/do/10.1377/hblog20180726.670593/full/

8. “Oral Hepatitis C Treatments: The Evolving Landscape,” Drugs.com, Aug. 25, 2019.

https://www.drugs.com/slideshow/hepatitis-c-virus-treatment-options-1068

9. “Drug Shortages: Root Causes and Potential Solutions,” U.S. Food and Drug Administration, 2019, P. 2.

https://www.fda.gov/media/132058/download

10. “Research: Generic Drugs Often Cheaper in US Than From Canada,” Pharmacy Times, June 6, 2019.

https://www.pharmacytimes.com/resource-centers/reimbursement/research-generic-drugs-often-cheaper-in-us-than-from-canada-

11. Phil Galewitz, “Breaking a 10-Year Streak, the Number of Uninsured Americans Rises,” Kaiser Health News,

Sept. 10, 2019.

https://khn.org/news/number-of-americans-without-insurance-rises-in-2018/

12. Sarah Sloat, “After Raising Prices, Drugmakers Can Now Provide Free Drugs to Patients in Need,” Inverse,

Jan. 18, 2018.

https://www.inverse.com/article/40026-pharmaceutical-drugs-caring-voice-coalition