Introduction: Why a Comprehensive Regulatory Review Matters

The Secretary of the Treasury has initiated a policy overview of how the United States regulates all financial services, including not just those services traditionally associated with the banking industry, but also embracing all kinds of investment-related services, including risk-management, or “insurance.” As we discuss below, this review necessarily must address the specific issues and problems of U.S. insurance regulation but inevitably in the process also will reveal the extent to which competition among “different” forms of financial service providers and with foreign companies is growing every day.

There are two good reasons to undertake a comprehensive review of the financial services industry at this time. First, financial services increasingly are marketed and purchased on a global basis in a fiercely competitive market. Consequently, it is important that the regulation of financial services occur within an overarching regulatory framework and be guided by a clear philosophy with well defined objectives and purposes. Therefore, it is essential to delineate as carefully as possible the governing principles and objectives underlying the regulatory framework and to compare them with the practices of other nations that, too, are leaders in the financial services sector.

It is important, of course, for the United States to adopt policies that allow the American financial services industry and its workers to be as efficient and productive as possible in order to compete in international markets. It is equally important, however that any approach to sweeping revision or reform of U.S. regulation be anchored in political traditions characteristic of the nation’s history. Those traditions include what we call “regulatory skepticism” (i.e., regulate only when absolutely necessary to the public good), and federalism, with principle reliance on market forces to achieve regulatory objectives.

The second salient reason for a comprehensive review is that within the borders of the United States itself, the lines of demarcation between “different” industries and lines of business are increasingly blurred. This is particularly noticeable in the telecom sector, where telephone, cable, and wireless providers are seeking the same customers, to a considerable extent, and offering comparable service bundles. But it is also true of the banking-and-finance sector, thanks in part to legislative and regulatory changes in recent decades that have enabled banking firms (directly, or indirectly through an affiliate) to offer comprehensive investment, real-estate, and risk-management products; and also in part to the increasing mobility of the U.S. population, and the tighter integration of financial service markets irrespective of state boundaries, driven in large part by the telecom revolution.

Some First Principles

With regard to insurance products in particular, in developing policy recommendations the Treasury should observe a few basic principles (hopefully self-evident ones). With a few notable exceptions (i.e. the McCarran-Ferguson Act), the regulation and oversight of the insurance industry has evolved over time in a stop-and-go process, with major changes driven to a significant degree by judicial decisions (particularly as to whether insurance regulation is principally a state-level concern or a national one). Given these realities, reform designed to rationalize and simplify regulation should give due regard to the role of the states vis-à-vis the national government.

This principle emphatically does not mean embracing the status quo (far from it), but approaching with a degree of skepticism the notion that a stronger national policy role can override all of the drawbacks of having 50 different state regulators. For this reason alone, the notion of inverting the regulatory framework from one that is completely decentralized in the 50 states to a “single regulator” in Washington, D.C. for all providers of financial services seems an unintuitive and almost certainly a counterproductive idea.

Instead of transforming the regulation of insurance from a system of 50 state regulatory cartels into one national regulatory monopoly, we should look to a competitive framework, both encouraging more reliance on market forces to spur competition among insurance companies and better-serve financial services consumers and also to stimulate competition among regulatory bodies to deliver a better quality of regulatory response to the challenges facing insurance (and other financial services) in the years ahead.

At the same time, we must keep in mind that Washington already has quite a lot to say about insurance and financial services in general. The U.S. government:

- represents the American financial services sector in trade negotiations aimed at securing market access abroad;

- determines the tax-treatment of insurance providers and their products; and

- has a major impact on the marketing and trading of insurance products in its general, and substantial, powers over interstate commerce.

To take just one concrete example of federal regulatory involvement in insurance, the SEC has just announced an initiative to compel public disclosure and (of course) calculation of insurance company exposure to risks associated with climate change. Whatever one’s view of the state of climate science, those risks remain highly speculative, controversial and subject to major errors in calculation and subsequent revision.

This SEC action will, without a doubt, pose major challenges to insurers and to other industries, and down the road may create significant risks of litigation and enforcement action against individual companies. The point is, the image of a hallowed tradition of state-only regulation of insurance is a myth and has been for some time.

Goals of a Comprehensive Review of Financial Services

The goals of the Treasury’s review of financial services regulation should be forward-looking yet constrained. To move comprehensively from “functional” regulation to so-called “principled” regulation (the latter phrase is a misnomer typically used to characterize the approach taken by members of the European Union) is not really a goal, but it could be a useful guideline. However, it may be a false, if convenient, way of characterizing differences in regulatory philosophy. Deferring to the states on insurance regulation, as the U.S. does, is certainly a type of “principled” approach. Yet it may not be all that “functional” in the 21st century.

Similarly, the specific idea of One Regulator (to Rule Them All?) governing financial services seems an answer in search of a question. There are huge inefficiencies in the state regulatory structure, to be sure—but what reason is there to believe that concentrating power in one centralized authority is the path to regulatory efficiency? As the Treasury Review proceeds, it should focus laser-like on what are the true objectives of government regulation of the industry and seek to discover the sources of regulatory efficiency. To these ends, the Treasury Department should seek expert testimony on the subject.

Moreover, we hope the Treasury Review examines separately the two distinctly different but related reasons put forward for enlarging the Federal Government’s regulatory role with insurance. First is what might be called the “efficiency” justification for a federal regulator. The insurance industry claims that by centralizing the regulatory function in Moreover, we hope the Treasury Review examines separately the two distinctly different but related reasons put forward for enlarging the Federal Government’s regulatory role with insurance. First is what might be called the “efficiency” justification for a federal regulator. The insurance industry claims that by centralizing the regulatory function in Washington, it will produce greater efficiency and lead to administrative cost savings that will be passed along to consumers in lower insurance premiums. The industry supports an optional federal charter as a means of allowing companies who can take advantage of the efficiency gains from regulatory centralization and uniformity to choose a federal regulator; while allowing companies to choose a state regulator when the efficiency gains are not substantial enough to outweigh the threat of a one-size-fits-all national regulatory structure.

The second reason for considering an expansion in the federal government’s role in regulating insurance—call it the “federalism” rationale—is as a means of creating competition among regulators in which insurance companies may act as “consumers” of regulation in a competitive regulatory marketplace. This rationale for a larger federal role derives from the very structure of the American federalist system, in which power is constrained, channeled and focused by checks and balances, separations of power, divided authorities and overlapping jurisdictions. According to James Madison, the only sure way to create a government both “energetic” enough to pursue the general welfare effectively while simultaneously preserving liberty is through a constitutional arrangement that so contrives “the interior structure of the government as that its several constituent parts may, by their mutual relations, be the means of keeping each other in their proper places” (Federalist No. 51)—“regulatory competition” in today’s parlance.

Critics of regulatory competition, whether accomplished through an optional federal insurance charter or by other means, argue that allowing insurance companies to act as “consumers” of regulation and go shopping in the regulatory marketplace for their regulatory overseer will produce a “rush to the bottom” in regulatory standards and will result in insurance companies running roughshod over consumers. The Treasury Review provides a unique opportunity to examine the pros and cons of this argument.

Based on these authors’ experience with economic regulation in general (in both the executive and legislative branches), we suggest that a light regulatory hand is the best approach, or at least the approach least-likely to do harm. We further suggest that to keep regulation within the bounds of maximizing market efficiency, it is better to err on the side of having a diversity of regulatory authorities, rather than concentrating and centralizing power over one industry or set of industries.

Along these lines, then, we suggest a simple, achievable, yet extremely important goal for the Treasury Review to set, and to achieve: To maximize consumer welfare, which requires above all reforming regulation of insurance (and other financial services) so as to maximize the global competitiveness of U.S.-based companies, while paying due regard to the historical role of the states in regulating such companies. “Due regard” does not mean blind deference, but granting that even as global competition may at times make state-based regulation seem like an anachronism, there remain sound and constitutionally based reasons for the states to continue playing a significant role here.

The Signal Problem of Insurance

Unlike banking, the insurance industry has never had the benefit of the kind of continuous regulatory evolution that produced the dual regulatory option (banks may be both state- and federal-chartered) and the consolidation of multiple financial services in the banking sector, first through the holding company device, then through banks themselves. Without restating history, there is one important practical reason for this difference.

Traditional insurance has focused on objects-in-place (a house, an automobile—admittedly mobile, but tied to its owner—a shop, a factory). Even life and health insurance, although portable in the sense that the individual or family so insured may often carry that insurance from place-to-place, have a physical “anchor” in the person him- or her-self.

Banking-type financial services, on the other hand (safety deposit boxes apart) have long been artifacts of our system of money, payments, and investment, anchored by common belief in, and acceptance of, certain stores of value which need not have much relation to a physical location in one of the states. Indeed, it has been precisely in those instances where banking services have primary regard to objects-in-place (e.g., home mortgages and automobile loans) that local banks and locally regulated banks have remained most salient in the market.

Insurance, then, is in some ways more personal than other financial services (one’s emotional ties to one’s home are a major feature of insurance marketing), and more tied to things in the physical world and, to that degree, less personal. This may be more a matter of psychology than anything else, but it is something the states have used effectively in upholding their primacy in insurance regulation.

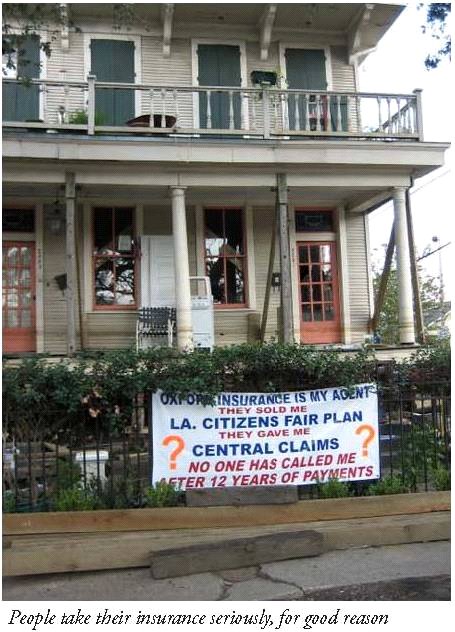

The notion of protecting the unwitting consumer from overreaching sellers of dubious (and complex) products is a mainstay the regulatory ideology. The fact that it is sometimes true is also the primary reason why the regulatory playing field should not be totally upset, too abruptly.

The practical consequences of this state primacy, however, are less attractive. Today insurers have to contend not just with a multitude of regulatory regimes, many of them not just different but self-contradictory, but with a plaintiff’s bar that takes full advantage of the different rights afforded insurance consumers in different states. Settlements compelled at the initiative of the bar may be, and frequently are, perfectly justified (this is why we have courts). At the same time those settlements add to the costs of insurance generally, which in a market-only environment, would be paid in the form of higher policy rates for future customers.

However, where the regulation of insurance premiums is concerned, i.e., insurance rate regulation (either in the form of capping rates, or empowering the state to veto a rate proposed to be charged), which is a vital element of state insurance regulation, the consequences are often different. If costs—whether triggered by court decisions, natural catastrophe or actuarial changes—erase profit margins, then regulatory restraint on rate-setting can result in withdrawal of coverage, or complete elimination of lines of insurance in a particular jurisdiction, or industry withdrawal from an entire state.

A comparable, though different, problem arises when states pre-determine what kinds of coverage packages may be offered in their jurisdiction. If a state demands that a basic homeowners’ policy must include storm, flood, electrical damage and third-party liability coverage, it may appear to be doing the homeowner a favor by thinking of all the things a homeowner should think about. At the same time, the more “basic” elements demanded of an insurance product, the higher the price (rate) will be, or, where rates are strictly controlled, the more precarious the financial position of the insurer will be. At a time of mortgage-industry meltdown, we should learn that regulations that put service providers in a marginal-profit position are not really the best idea.

The bottom line is that with states controlling such basic factors as cost-of-product and contents of service packages (rather than letting market competition work out those details), the insurance industry faces a regulatory dilemma different in kind from that of most other financial service providers. Insurance products are especially prone to political manipulation, and such manipulation is seldom in the interest of industry, consumers, or the nation as a global competitor.

Thoughts on Remedies

A problem or set of problems that faces the insurance industry today will not be solved by any one legislative or regulatory initiative. Just as insurance regulation, under the spur of politics, evolved itself into the present mess, so it will have to evolve itself out. The question is how to remove obstacles to that evolution at a minimum, and ideally to spur it on expeditiously in a positive direction.

Where insurance is concerned, the U.S. Congress is not short on ideas. At this writing, the Congress is considering major legislation on terrorism risk insurance, flood insurance, and federal underwriting of state-based catastrophic insurance regulation. Whatever the merits of these bills, none of them do anything to move toward a more rational, efficient, and competitive American insurance industry. Many of them, in fact, will weaken the industry and make it more difficult to maximize consumer welfare and satisfaction. Motivations for many of these proposals lie elsewhere.

In considering remedies, then, we must keep in mind that Congress, and politics in general, will continue to intrude on the insurance industry, perhaps more so than it does for most other industries. Again, this is because insurance is such a personal matter for many people, not an abstraction like “Wall Street” or “net neutrality” and by its very nature deals with potentially catastrophic events in people’s lives, whether or not the damage and casualty rises to the level of a national or even a state or local catastrophe. We cannot eliminate politics nor should we: but we should look for remedies that minimize the risk that politics will do more harm than good in influencing regulation.

Here are a few ideas in currency that seem to meet that test:

1. The Optional Federal Charter (OFC). The Optional Federal Charter, presently the subject of legislation in both the House and Senate, builds on the experience of the banking industry and would allow insurers voluntarily to seek federal charters, and be subject primarily to federal regulation, just as banks may file with the Comptroller of the Currency. There are several advantages to this approach from the standpoint of the principles and goals we have outlined. The OFC would not override state law and tradition, but complement it. It would not introduce a single national regulator but establish a regulatory marketplace in which competition between and among regulators would produce the most efficient regulatory outcome.

True, states would fact the prospect of losing regulatory power over those insurers that shift to federal authority. At the same time, states would be free to compete to win back those insurers’ “business,” principally by adopting a more rational system of regulation. Those who fear a regulatory race-to-the-bottom should consider that the current regulatory structure imposes huge unnecessary costs on the public at large, severely inhibits the marketing of new products and product bundles, and ill-serves the consumer. Indeed the greater fear, given the politics of insurance regulation, is that an overlay of federal regulation could increase the total regulatory burden on the industry rather than merely supplanting the outmoded state structure. Below we suggest a way of minimizing that risk, as well.

2. Insurance Choice. This concept, of allowing individual customers to choose their insurance providers from among providers in any state of the union (rather then just from those operating in, and conceding to regulation by, their home state), is not the subject of current legislation. However, the same general concept underlies legislation be Rep. John Shadegg (R-AZ) in the field of health insurance choice. The idea here is that consumer choice across state lines would lead to greater market competition, in part by recognizing the national market for many lines of insurance, and in part by providing a safety-valve for insurers in badly-regulated states to win business in states with a more favorable climate. While the idea is untested to the best of our knowledge, it has been the subject of significant academic discussion and is a worthwhile topic for the Treasury Review to examine in more detail.

3. State Compacts. States themselves are free to innovate across state lines, by creating formal or informal regulatory compacts in the field of insurance regulation. States that chose to do so could coalesce around a market-based reform similar to that adopted in South Carolina, or create a consortium of states to pool their natural catastrophe reserve funds to back-up insurance where claims may be uninsurable or simply not covered by an unpredictable disaster. This is one way to hedge against the risk that an OFC might itself become an over-regulating competitor to the states and open up nation-wide rent seeking through an inefficient system of actuarially unsound cross-subsidization. Compacts, however, are neither good nor evil in themselves, and we caution that any compact suggested by (or to) the states should be examined rigorously to ensure that it meets the market-efficiency and minimal-regulation standards we have articulated. Further, compacts that require congressional approval under the Compact Clause of the Constitution should receive particularly intense scrutiny, and probably will given the nature of the legislative process.

4. Federalism also provides a range of opportunities to create new organizational structures and power relationships that can allow the natural forces of regulatory evolution to adapt to changing market and environmental conditions. Whether or not the insurance industry is allowed to choose an option federal charter, it is worthwhile to contemplate the creation of an Interstate Advisory/Appeals Commission comprised of both state-level and federal-level appointees. Such a commission would not have original regulatory jurisdiction but would exist to entertain industry appeals and consumer complaints regarding state insurance commissions’ policies and regulations. There are a variety of different ways to configure such a commission, and our purpose here is not to advocate for any particular design but rather to put forward the concept as worthy of consideration. Part of the Treasury’s inquiry should be to consider the benefits and drawbacks of such a board or commission. Among the questions Treasury should consider are: Should such a commission or review board be given limited authority to adjudicate industry appeals and consumer complaints of state regulatory policies by overturning, revising or ordering state commissions to revise their policies and rulings; or should the commission/review board be strictly advisory in nature? Should such a commission/board be established by interstate compact with congressional approval or should it be created legislatively by the Congress?

In sum, the problems of financial services regulation and particularly insurance regulation in an age of increasingly intense global competition do not easily yield to a one-size-fits-all solution. The review of the financial services industry currently underway at the Treasury Department should concentrate on identifying the most critical problems these industries face as a consequence of government action (or inaction), and target a few discrete initiatives that should at a minimum set the political process on a straight road to reducing those problems.

Whatever we do today, these industries will evolve in ways no one can predict, as will the regulatory structures created to oversee them. The one thing that is certain is that if key regulatory barriers to that market revolution can be set aside, the consumer will be much better off. As a corollary, the Treasury Department will be better able to function as key interlocutor for American financial industries in the field of international regulation, trade, and investment.

About the Authors

George A. Pieler and Lawrence A. Hunter are senior research fellows at the Institute for Policy Innovation.

About the Institute for Policy Innovation (IPI)

The Institute for Policy Innovation (IPI) is a nonprofit, non-partisan educational organization founded in 1987. IPI’s purposes are to conduct research, aid development, and widely promote innovative and nonpartisan solutions to today’s public policy problems. IPI is a public foundation, and is supported wholly by contributions from individuals, businesses, and other non-profit foundations. IPI neither solicits nor accepts contributions from any government agency.

IPI’s focus is on developing new approaches to governing that harness the strengths of individual choice, limited government, and free markets. IPI emphasizes getting its studies into the hands of the press and policy makers so that the ideas they contain can be applied to the challenges facing U.S. today.