Highlights

- Analysis of the streaming marketplace by numerous criteria shows that Netflix is already the dominant competitor in terms of paid subscribers (more than double Disney+), attention share (about double its nearest competitor), and profitability (only long-term profitable company).

- In comparing the two most likely scenarios, a Warner Bros. merger with already dominant Netflix would likely run afoul of standard antitrust considerations, while a combination with Paramount (or another smaller streaming service) could allow for the creation of a more substantial competitor for Netflix.

- A Netflix-Warner Bros. merger would probably harm the already struggling theatrical exhibition market, resulting in job losses, reduced revenue for restaurants and shops, among other hardships.

- Netflix’s history of price increases indicates it is already leveraging its market dominance, and it is reasonable to conclude that, following its acquisition of Warner Bros., it could set rates across the entire sector.

Introduction

Even though the video streaming marketplace is relatively new, it is widely understood that some market consolidation is inevitable and necessary.[i]

In the current market, consumers are frustrated and Wall Street is impatient.[ii] There are so many streaming platforms offering an abundance of content, some consumers end up using spreadsheets just to keep track of which service their favorite shows are on, or have begun using apps like JustWatch to keep track of which shows are available on which services.

Consumers aren’t frustrated because the market has failed—the market has delivered spectacularly. Content owners promised to make their catalogs easily available to consumers if they were permitted to protect their valuable copyright interests, and broadband providers promised abundant bandwidth with low latency if they were permitted to profit from their enormous investment in infrastructure. And both delivered. Thus far, policymakers have gotten the big decisions largely correct, and the result is incredible choice and availability for consumers.

The result is a “crisis of abundance” for consumers. This isn’t a terrible problem, as problems go, but there are other players in the market besides consumers. Most streamers aren’t profitable,[iii] and that’s a problem for Wall Street in the short term and for the companies themselves in the long term. It’s clear that some consolidation is necessary. Streaming disrupted the formerly stable cable model, and it is normal for a period of consolidation to follow a period of disruption.

Already there has been a spate of mergers—including Disney+, Hulu and ESPN+, Amazon’s acquisition of MGM Studios, and Warner Bros.’ merger with Discovery Inc.

But consolidation in the streaming industry clearly isn’t finished yet.

Warner Bros. on the Block (again)

Last October, Warner Bros. Discovery, itself the product of a merger, started exploring merger and sale options, setting the stage for a seismic shift in the media and entertainment landscape. While many potential suitors seemed interested, Paramount Skydance made an offer for the entire company. In reaction, Netflix made an offer for only certain Warner Bros. properties. Weeks later, Warner Bros. accepted Netflix’s offer.

The announcement immediately drew scrutiny from policymakers in Washington, as Netflix is already the largest subscription video on demand (SVOD) provider in the world. Warner Bros.’ vast content library, sizeable production capabilities, and the third-largest streaming platform (HBO Max), combined with Netflix’s scale, could easily preclude competition in this quickly evolving sector.

But Paramount Skydance hasn’t thrown in the towel and is attempting to persuade Warner Bros. Discovery shareholders that theirs is the superior offer. It would not be unusual for both suitors to continue to modify and enhance their bids as the process unfolds.

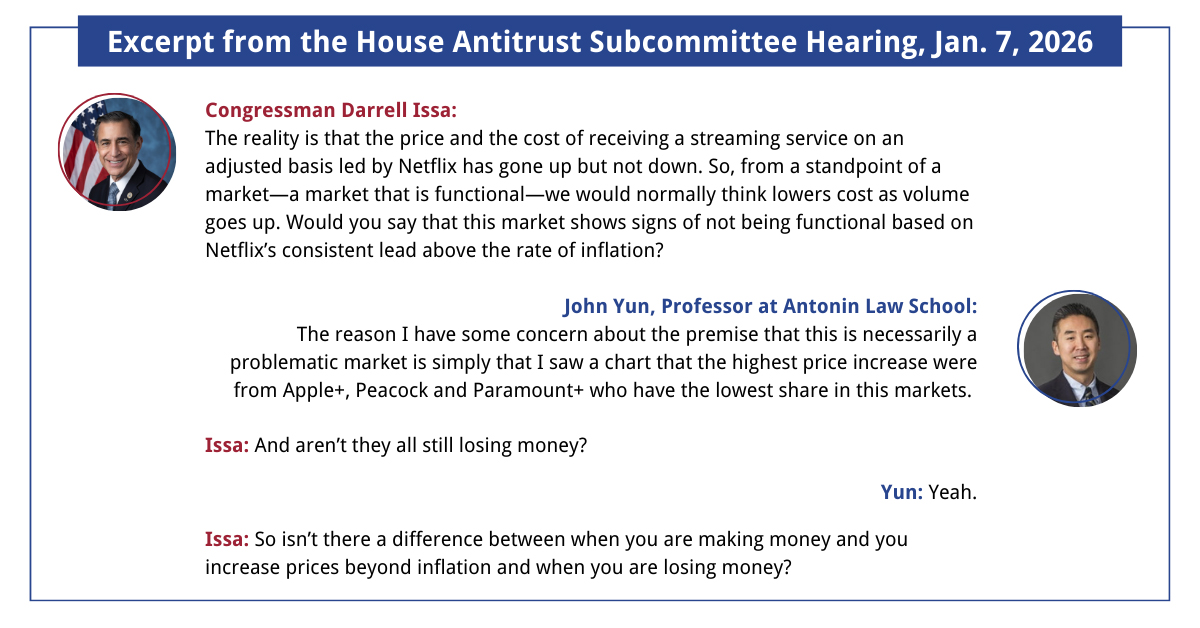

Meanwhile, on January 7, the U.S. House of Representatives subcommittee that oversees antitrust issues held a hearing on the impacts of consolidation in the entertainment sector. Additionally, Senator Mike Lee, Chairman of the Senate Subcommittee on Antitrust, is expected to hold a hearing on Tuesday, February 3, and Netflix CEO Ted Sarandos has reportedly agreed to testify. With Paramount Skydance still vying for contention, a Netflix-Warner Bros. merger will undoubtedly face substantial scrutiny by policymakers.

This paper analyzes key factors that policymakers and antitrust regulators should consider as they review the potential sale and the impact it would have on competition, consumers, innovation, and the economy.

Free Markets and Antitrust

Through competition, innovation, property rights, and rule of law, free markets drive optimal consumer outcomes. Markets are not perfect, but they generally produce value, choice, and novelty for consumers—certainly better than do top-down central control systems.

As a rule of thumb, light-touch regulatory policy allows markets to push forward deals that make sense and best meet consumer demand without distortion caused by government intervention.

Scale is not necessarily harmful to consumers—in fact, depending on the industry and market, scale is sometimes necessary to meet consumer demand. There can be literally thousands of doughnut shops, dry cleaners or restaurants in a city, because such do not require enormous infrastructure investment, but no one imagines that there could be thousands of electric utilities or internet providers in a city.

But scale can be harmful to consumers if scale is leveraged to reduce competition, consumer choice, increase prices and slow innovation.

Antitrust review, oversight and enforcement is part of our legal code, and is sometimes necessary. From a free market perspective, antitrust law is intended to ensure consumer welfare, which includes preventing dominant competitors from taking advantage of their market dominance to harm consumers through limiting choice, competition, and by extracting higher prices.

Antitrust Considerations

There are two important considerations in a market analysis from a free market standpoint.

One is philosophical: The “consumer welfare standard,” formally described by Robert Bork in his book “The Antitrust Paradox.” Bork argued that government shouldn’t attempt to manage competition based on government’s idea of what a market should look like but should rather make judgments based on how a market actually behaves.

The second is U.S. law, regulation and precedent. In a 1963 Supreme Court decision, United States v. Philadelphia National Bank, the Supreme Court determined that a 30 percent market share was a significant threshold for antitrust considerations. That decision established the "structural presumption" that certain mergers—particularly those involving significant market concentration—can be presumed to substantially lessen competition, shifting the burden to the merging parties to prove otherwise.

Policymakers need to take both legal precedent and the consumer welfare standard into account when evaluating streaming consolidation and the mergers under discussion.

And that’s what current Department of Justice guidance demands. The 2010 Horizontal Merger Guidelines (HMG), jointly published by the Department of Justice and the Federal Trade Commission (FTC), included sections alluding to the “consumer welfare standard.”

Section 1 of the HGM reads, “The unifying theme of these Guidelines is that mergers should not be permitted to create, enhance or entrench market power…. A merger enhances market power if it is likely to encourage one or more firms to raise prices, reduce output, diminish innovation, or otherwise harm customers….” Furthermore, Section 10 states “the Agencies will not simply compare the magnitude of cognizable efficiencies with the magnitude of the likely harm to competition absent the efficiencies. The greater the potential for adverse competitive effect of a merger, the greater must be the cognizable efficiencies, and the more they must be passed through to customers….”

The HGM leaves little doubt that the antitrust enforcement agencies are including both the consumer welfare standard and established precedent as the driving factors for merger evaluation and other antitrust litigation.

Trump Administration Antitrust Policy

As in many other policy areas, the Trump administration has not felt bound to prior Republican approaches. President Trump and his agency appointees are far more skeptical of corporate market power, and much more willing to use government power to actualize their preferences, than have been previous Republican administrations.

While the Trump administration revoked Biden’s executive order radically expanding U.S. antitrust enforcement, it left in place Biden’s 2023 merger guidelines, and new Hart-Scott-Rodino Act rules were finalized by the Trump administration on February 10, 2025.[iv] The net result is that the Trump administration does not begin with a “hands off” approach to antitrust review. This makes it more likely that any merger, especially one where there seem to be genuine competition concerns, will be subject to more scrutiny.

Analysis of the Streaming Marketplace

The streaming marketplace saw a surge of new entrants in the late 2010s as subscription video disrupted traditional cable model. The result has been a “disaster of abundance,”[v] in which users increasingly reported “subscription fatigue.” In 2024 nearly a quarter[vi] of U.S. streaming users reported canceling three or more subscriptions over the prior two years, and almost one third[vii] of Americans canceled at least one service last year.

While much of this industry restructuring was, and is probably still, necessary—many services remain unprofitable, and for them, a merger may be the only option to continue operating. Thus, competition and antitrust concerns will likely follow the streaming market for the foreseeable future.

The Current Streaming Marketplace

For purposes of this paper, platforms that consist of almost entirely user-generated content, such as YouTube, are excluded from the market definition. We consider YouTube to be a video-sharing platform, as opposed to an on-demand video streaming service. While YouTube garners a significant share of consumer attention, user-generated content is dissimilar to studio and network generated content as provided by Netflix, Amazon Prime, Disney, Paramount, Peacock, Warner Bros. Discovery, Tubi and Roku. Consumers often go to YouTube, but they don’t go to YouTube for the same reason they go to other streaming services.

Netflix maintains otherwise; insisting that YouTube should be included in the market definition, because it would appear to lessen Netflix’s market dominance. But this assertion does not stand up to scrutiny when considering how consumers use these services. User generated content can be surprisingly creative and entertaining, but it doesn’t substitute for studio-created content.

We define the streaming video marketplace as on‑demand catalog services under the editorial responsibility of the provider (i.e., services offering programs from a catalog selected by the provider). User-upload video-sharing platforms such as YouTube are excluded because they operate primarily as video-sharing platforms without editorial responsibility for user-generated uploads, and their content offering and competitive constraints differ materially from curated on‑demand program catalogs.

Importantly, both EU regulators[viii] and the UK regulator Ofcom[ix] make this same distinction.

We will examine the streaming marketplace by several different criteria.

Note: Shortly before publication, on January 21, 2025, Netflix reported its full-year earnings for the 2025 fiscal year, reporting $45.2 billion in revenue for the full year (up 16 percent year-over-year), and with ad revenue rising over 2.5x to over $1.5 billion. Viewing hours were up 2 percent year-over-year, and total subscribers increased to 325 million.[x]

Because comparing Netflix’s 4Q 2025 numbers with its competitors’ 2024 numbers would be invalid, we note the new numbers here prior to our comparisons. What is clear is that Netflix continues to increase its market dominance, while other competitors continue to struggle.

Subscribers

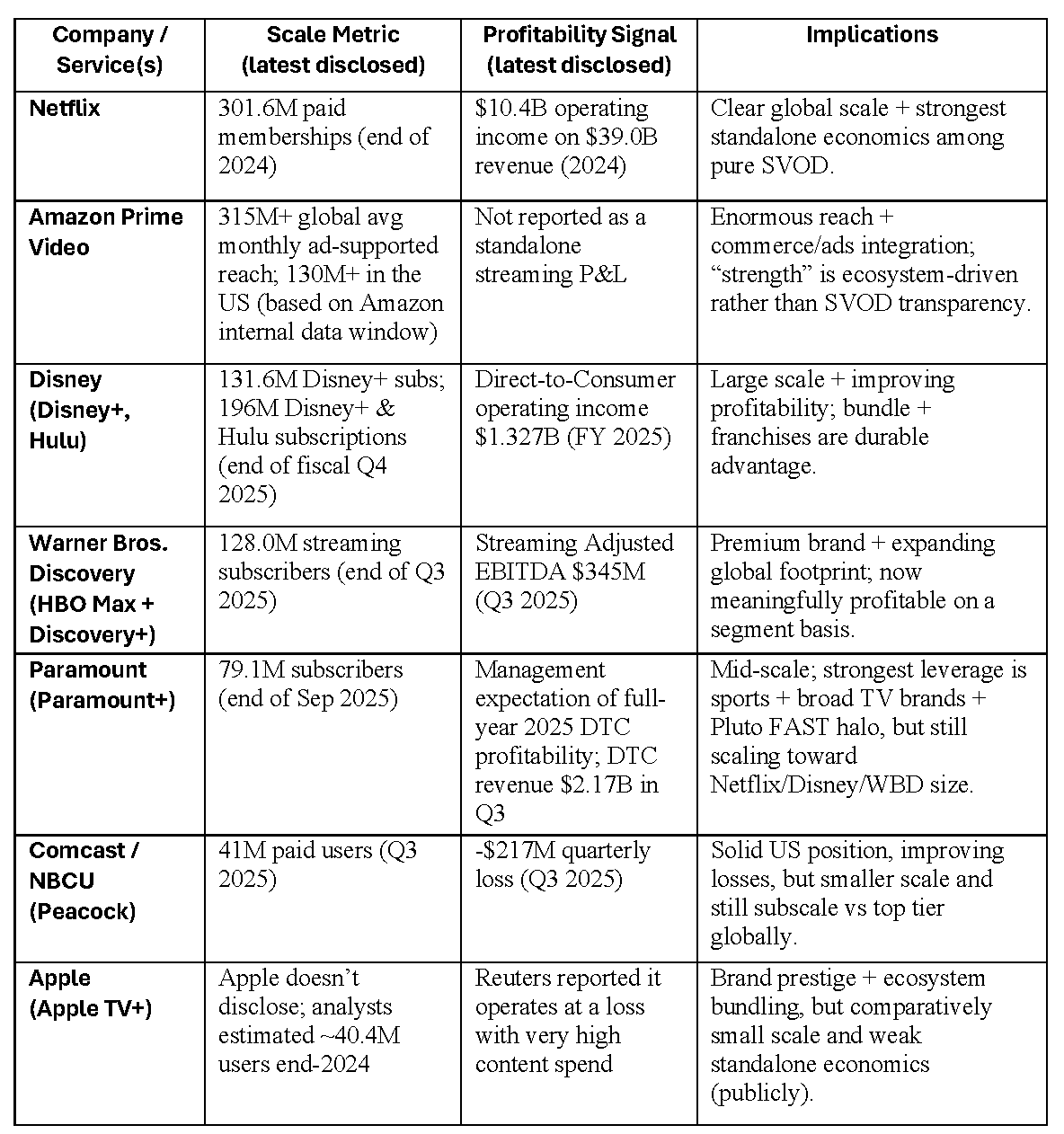

For the most part, streaming services report subscriber numbers as a part of their earnings reports, though not all services do, and not all services break out video streaming from other offerings.

- Netflix: Finished 2024 with 302 million subscribers (and reported “Global Streaming Paid Memberships” of 301.63 million for Q4 2024).[xi]

- Amazon Prime: More than 200 million members; Amazon doesn’t report Prime Video subscribers. Amazon uses its video services as a feature to acquire and retain users in its Prime memberships. A study last year[xii] found 90 percent of Prime users say free shipping is the primary incentive for maintaining their subscription. It is therefore not possible to determine the number of consumers who simply choose to subscribe to Amazon Prime.

- Disney: End of fiscal Q4 2025: 132 million Disney+ subscribers and 196 million Disney+ & Hulu subscriptions.[xiii]

- Warner Bros. Discovery (HBO Max + Discovery+): 128.0 million global streaming subscribers at end of Q3 2025.[xiv]

- Paramount (Paramount+): 79.1 million Paramount+ subscribers at Q3 2025 end.[xv]

- Comcast (Peacock): 41 million paid subscribers as of Sept. 30, 2025.[xvi]

- Apple TV+: While Apple does not release numbers, Reuters cites 40.4 million subscribers per analyst estimates.[xvii]

Conclusion: Netflix is far and away the dominant competitor in terms of paid subscribers, dwarfing all other standalone video streaming providers. Netflix has more than double the number of subscribers as content powerhouse Disney+.

Attention Share

Streaming services don’t report viewing numbers in a standardized or comparable manner, but market analysts have employed several methods to attempt to quantify streaming data.

Nielsen’s “The Gauge” is one of the most cited benchmarks for streaming services because it’s based on TV viewing minutes in the U.S. In November 2025, streaming was 46.7 percent of total TV usage. The Gauge reports[xviii] that, for November 2025, streaming platforms by attention share were:

- Netflix (8.3 percent) (30.41 percent weighted by market definition)

- Disney (4.7 percent) (17.22 percent weighted by market definition)

- Amazon Prime (3.8 percent) (13.92 percent weighted by market definition)

- Roku (2.9 percent) (10.62 percent weighted by market definition)

- Paramount (2.3 percent) (8.42 percent weighted by market definition)

- Tubi (2.1 percent) (7.69 percent weighted by market definition)

- Peacock (1.9 percent) (6.96 percent weighted by market definition)

- Warner Bros. Discovery (1.3 percent) (4.76 percent weighted by market definition)

Conclusion: Netflix is the clearly dominant competitor in terms of attention share, about double that of its nearest competitors.

Profitability

Not all streaming companies report their profits in a way that allows direct comparison. This data is from publicly available filings from corporate earnings reports.

- Netflix: In 2025, revenue grew 16 percent, operating margin expanded to 27 percent, and operating income exceeded $10 billion for the first time.[xix]

- Amazon Prime: Does not report standalone streaming profit & loss.

- Disney: Q4 fiscal 2025 direct-to-consumer operating income was $352 million.[xx]

- Warner Bros. Discovery: Q3 2025 streaming adjusted EBITDA was $345 million.[xxi]

- Paramount: Q3 2025 materials show Paramount+ management messaging that profitability is a top priority with expectations for direct-to-consumer profitability to be reached in 2025.[xxii]

- Peacock: Comcast reported Peacock EBITDA losses of $217 million in Q3 2025.[xxiii]

Conclusion: Netflix is in the strongest profit position which allows it to self-fund content projects and command a premium for its subscription service. Most other streamers remain unprofitable or are subsidizing their video streaming services from other revenue sources.

Apple-ish to Apple-ish Snapshot

This analysis allows us to construct a “power ranking” of streaming market strength.

Tier 1: Platform Leaders

- Netflix

- Amazon Prime (estimated)

Tier 2: Strong and Improving

- Disney

- Warner Bros. Discovery

Tier 3: Mid-scale Challengers

- Paramount

- Peacock

Tier 4: Small but Strategic

- Apple TV+ (estimated)

Tier 5: Marginal with Ad Strength

- Roku Channel

- Tubi

Two Merger Scenarios

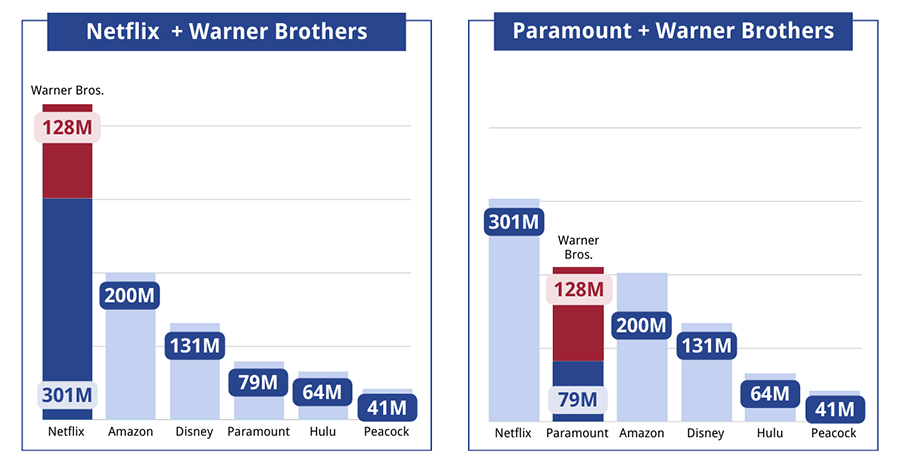

At the time of this writing, both Netflix and Paramount Skydance are vying to acquire Warner Bros. Discovery. Let’s briefly compare the two possible outcomes.

Scenario One: Netflix Acquires Warner Bros. Discovery

By our analysis, this would involve a dominant Tier 1 competitor combining with a strong and improving Tier 2 competitor. In formula terms, 1+2.

Netflix, with 302 million subscribers, would combine with 138 million subscribers, likely pushing its subscriber base to over 400 million, more than twice as many as the next closest competitor, Amazon Prime Video, which has about 200 million subscribers.

And that comparison is skewed by the two streaming services’ different revenue models. Whereas Netflix operates on direct revenue, Amazon uses its video services as a feature to acquire and retain users in its Prime memberships. In other words, many Amazon Prime “subscribers” pay for Prime not for the video component, but for other “perks,” especially free shipping. A study last year[xxiv] found 90 percent of Prime users say free shipping is the primary incentive for maintaining their subscription.

The next closest sole content platform to Netflix is Disney+, which has slightly more than 130 million users. A merger with Warner Bros. would position Netflix with more than three times as many subscribers as Disney+.

According to a recent analysis[xxv] by JustWatch, Netflix’s acquisition of Warner Bros. would push its share of the U.S. SVOD market to 33 percent—12 points higher than Prime Video, the next closest platform in terms of size. JustWatch also estimates that this combination would account for 20 percent of streaming attention share.

By all available evidence, Netflix’s acquisition of Warner Bros. would run afoul of the United States v. Philadelphia National Bank market share threshold. Netflix is already the leading streaming service, both by subscriber volume[xxvi] and viewership.[xxvii] It’s also the obvious leader by market cap, with an equity value of almost $40 billion more[xxviii] than all the other major entertainment producers and theatrical exhibitors combined.

By this market analysis, Netflix already is above the 30 percent market share threshold, even before any further acquisitions.

Scenario Two: Paramount Skydance Acquires Warner Bros. Discovery

By our analysis, this would involve a Tier 3 mid-scale competitor combining with a strong and improving Tier 2 competitor. In formula terms, 3+2.

Paramount Skydance, with 79.1 million subscribers, would combine with 138 million subscribers, likely resulting in a net subscribership of about 200 million. This would still be significantly smaller than Netflix’s current subscribership.

A smaller streaming service’s acquisition of Warner Bros. could create greater competition, establishing a company with the content library and user base to be closer to Netflix.

A merger between Warner Bros. and Paramount, or another smaller streaming service, may not unseat Netflix from atop the “streaming wars,” but it could establish the resulting company as a close contender. Such an outcome certainly would not harm consumers, since it would force Netflix (and other providers) to continue to innovate and offer competitive prices.

Other Considerations

The Theatrical Market

Entertainment is a highly integrated industry. Theaters, restaurants, retail and a whole host of businesses largely rely on upstream production decisions. Pandemic lockdowns shifted consumer behaviors—theatrical revenues dropped from $42.3 billion in 2019[xxix] to $12 billion in 2020—creating a structural shift that many vendors are still struggling to climb out from under. Box offices revenues in 2025 remained below pre-pandemic levels.

Since 2023, Netflix films have averaged a theatrical run of only 11 to 17 days,[xxx] compared to major studio features’ average of 46 days in 2024 and 58 days in 2023. And Netflix shows no sign of changing its model. CEO Ted Sarandos has called the theater experience “outdated,”[xxxi] and the company has said it intends to standardize the 17-day theatrical release window if its acquisition of Warner Bros. is approved.

In fact, Netflix only bothers with short theatrical releases for films it believes are Oscar-worthy, since the Oscars require theatrical release. Most Netflix products never make it to a projection booth.

Michael O’Leary, CEO of Cinema United, has said[xxxii] that Netflix’s acquisition of Warner Bros. “poses an unprecedented threat to the global exhibition business.” Acclaimed director James Cameron, likewise, has said the merger is a “disaster”[xxxiii] for the wider industry and called Netflix’s promise to continue to release films in theaters “sucker bait.”

A Netflix-Warner Bros. merger would put even greater pressure on theaters—a scenario that would likely result in job losses, reduced traffic through restaurants and shops, property vacancy, and diminished community vibrancy—especially in rural and small towns, where theaters are often still social anchors.

Last year the movie theater industry employed over 127,000 workers. A 2021 report[xxxiv] found that theaters supported over $36 billion in indirect and induced economic activity and more than $9 billion in movie-night spending. Regulators should consider those jobs and broader economic impacts as they review Netflix’s proposed purchase of one of Hollywood’s top studios.

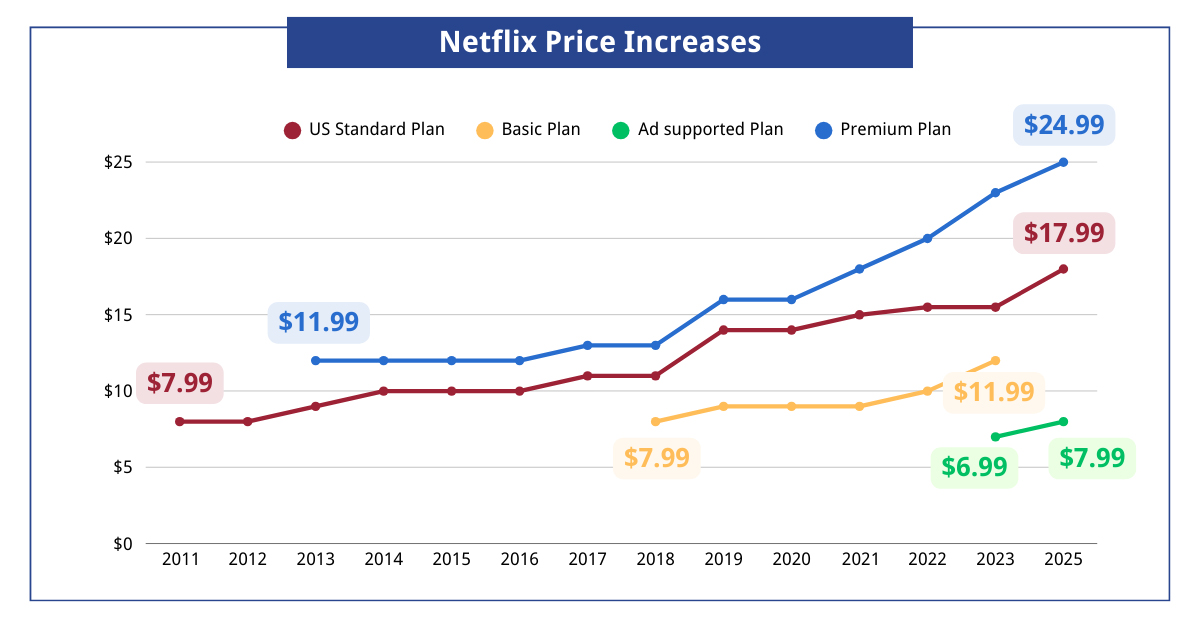

Netflix’s Pricing History

Some proponents may argue that despite Netflix’s disproportionate market share, a merger could allow it to reduce prices and produce better services. But Netflix’s pricing behavior hardly merits such confidence.

Despite being one of few profitable streaming platforms, Netflix has continually raised its prices on consumers. Since 2014, Netflix has increased the cost of its “standard plan” by more than 225 percent[xxxv] and its “premium plan” by over 200 percent, setting the pace[xxxvi] for an industry now plagued by rapidly rising prices.

Netflix’s price increases are notable for two reasons.

First, Netflix is one of the few profitable streaming platforms. In the third quarter of 2025, it posted a $2.5 billion net profit, more than twice the next three profitable streaming services combined. The company has been consistently profitable since 2010. By contrast, most streaming platforms have struggled (and many continue to struggle) to turn a profit, due in large part to start-up costs.

Disney+, for example, only first reported positive earnings in the third quarter of 2024, and the platform reportedly lost three times[xxxvii] more money in its first five years than Disneyland Paris did in three decades. Peacock incurred $101 million and $217 million in losses in Q2 and Q3 of last year, respectively—which were improvements from a year earlier.

And second, as the largest SVOD provider, Netflix is the industry trend setter. When it raises its prices, it creates a benchmark for other services, driving what commentators have dubbed “streamflation.” As one industry publication noted:[xxxviii]

“In recent years, as the streaming TV and movie business has gotten more competitive and companies around Hollywood have thrown billions into building their own platforms and libraries in order to compete with Netflix, participating in the streaming era has gotten steadily more expensive.”

Netflix’s price increases, which have occurred on average every 18 months, are indicative of a market-dominant player leveraging its market power. Due to its sheer superiority in viewership and content, its actions suggest it can hike rates knowing that users will pay up, because there are few other services that offer the same breadth of material.

U.S. Representative Darrell Issa (R-CA) raised this point during the January 7 hearing, when he asked a witness:

“Aren’t we again in situation where if Netflix post-acquisition controls a massive library to the exclusion of others, we have the same situation, where everyone must have access to Netflix in order to have access to not just new production, but a vast library that, in fact, by definition every child grows up watching?”

“I think it’s a relevant concern,” the witness stated.

Netflix’s record profits are not a disqualifier, per se, but its continual rate increases indicate that it is already leveraging its market dominance—which hardly assuages concerns that with a bigger market share, it won’t raise prices faster. And, with fewer competitors, it is reasonable to assume it could manipulate rates across the entire sector.

Conclusion

After a surge of new streaming providers launched only a few years ago, the industry is experiencing much needed consolidation. Several mergers have already taken place, but the most potentially important is the current competition to acquire Warner Bros. Discovery.

In most cases, light-touch regulatory policy generally yields optimal outcomes for consumers. Netflix’s proposed acquisition of Warner Bros., however, deserves additional scrutiny. It’s impossible to predict the future, but it seems very likely that such a transaction would lead to a dominant video streaming behemoth, pursued by minor, ad-supported competitors and boutique services.

As recently as the end of 2024, a Netflix executive dismissed rumors of pursuing mergers and acquisitions, stating that the company is “better builders than buyers.”[xxxix] Its rapid about-face in reaction to Paramount Skydance’s offer for Warner Bros. suggests Netflix saw an opportunity to prevent a transaction that would create a competitor with sufficient scale to challenge Netflix’s dominance.

Netflix has indeed been a successful “builder,” and deserves its success. The question for policymakers is whether a video streaming market dominated by a single, Tier 1 provider is best for consumers, for competition, for choice and for innovation, or whether a transaction that creates a stronger Tier 2 competitor for Netflix would be better.

[i] https://truthonthemarket.com/2021/10/12/why-there-needs-to-be-more-not-less-consolidation-in-video-streaming/

[ii] https://www.hollywoodreporter.com/business/business-news/wall-street-streaming-guidance-2023-1235302958/

[iii] https://insights.som.yale.edu/insights/streaming-seeks-path-to-profitability

[iv] https://www.antitrustlawblog.com/2025/08/articles/merger-control/trump-revokes-biden-administrations-executive-order-on-antitrust-competition-but-other-biden-administration-antitrust-policy-changes-remain-in-place/

[v] https://www.ipi.org/ipi_issues/detail/the-free-market-case-for-a-hollywood-merger

[vi] https://www.businessinsider.com/more-users-cancelling-streaming-subscriptions-prices-increase-netflix-disney-amazon-2024-1#:~:text=As%20content%2Dstreaming%20companies%20continue,from%2015%25%20in%20November%202021.

[vii] https://civicscience.com/feelings-of-video-subscription-fatigue-take-hold-driving-streamers-to-switch-churn-and-cancel/

[viii] https://eur-lex.europa.eu/EN/legal-content/summary/audiovisual-media-services-directive-avmsd.html

[ix] https://www.ofcom.org.uk/online-safety/illegal-and-harmful-content/vsp-regulation

[x] https://variety.com/2026/tv/news/netflix-q4-2025-financial-earnings-subscribers-1236635615/

[xi] https://www.sec.gov/Archives/edgar/data/1065280/000106528025000033/ex991_q424.htm

[xii] https://pushpullagency.com/blog/how-many-amazon-prime-members-use-the-platform-worldwide/#:~:text=Key%20Statistics:%20*%20Since%20launching%20globally%20in,incentive%20to%20subscribe%20for%2090%25%20of%20members.

[xiii] https://thewaltdisneycompany.com/press-releases/the-walt-disney-company-reports-fourth-quarter-and-full-year-earnings-for-fiscal-2025/

[xiv]https://www.sec.gov/Archives/edgar/data/1437107/000143710725000213/a991wbd3q25earningsrelea.htm

[xv] https://www.sec.gov/Archives/edgar/data/2041610/000204161025000042/ex99_q325.htm

[xvi] https://www.marketingbrew.com/stories/2025/08/01/peacock-subscribers-live-sports

[xvii] https://www.reuters.com/business/media-telecom/apple-boosts-subscription-price-tv-1299-2025-08-21/

[xviii] https://www.nielsen.com/data-center/the-gauge/

[xix] https://www.sec.gov/Archives/edgar/data/1065280/000106528025000033/ex991_q424.htm

[xx] https://thewaltdisneycompany.com/press-releases/the-walt-disney-company-reports-fourth-quarter-and-full-year-earnings-for-fiscal-2025/

[xxi]https://www.sec.gov/Archives/edgar/data/1437107/000143710725000213/a991wbd3q25earningsrelea.htm

[xxii] https://www.sec.gov/Archives/edgar/data/2041610/000204161025000042/ex99_q325.htm

[xxiii] https://www.hollywoodreporter.com/business/business-news/comcast-q2-2025-earnings-peacock-subscribers-versant-news-1236334135/

[xxiv] https://pushpullagency.com/blog/how-many-amazon-prime-members-use-the-platform-worldwide/#:~:text=Key%20Statistics:%20*%20Since%20launching%20globally%20in,incentive%20to%20subscribe%20for%2090%25%20of%20members.

[xxv] https://www.thewrap.com/wbd-netflix-merger-streaming-market/#:~:text=Based%20on%20insights%20from%20JustWatch's,accounts%20for%204%25%20of%20clickouts.

[xxvi] https://www.parksassociates.com/blogs/in-the-news/parks-netflix-returns-atop-us-svod-services-in-subscribers?page=754

[xxvii] https://luminatedata.com/blog/netflix-vs-everyone-else/

[xxviii] https://x.com/BasedMikeLee/status/1998925325980623313

[xxix] https://www.forbes.com/sites/bradadgate/2021/04/13/the-impact-covid-19-had-on-the-entertainment-industry-in-2020/

[xxx] https://www.businessinsider.com/netflix-explains-how-warner-bros-deal-with-impact-movie-strategy-2025-12

[xxxi] https://www.indiewire.com/news/business/netflix-theatrical-stunts-analysis-1235158036/

[xxxii] https://www.wsj.com/business/media/warner-bros-discovery-and-netflix-enter-exclusive-deal-negotiations-9ea30a85

[xxxiii] https://www.indiewire.com/news/business/james-cameron-netflix-warner-bros-disaster-1235163915/

[xxxiv] https://cinemaunited.org/wp-content/uploads/2021/08/NATO-Econ-Impact-Final-Report-2021-August-16th.pdf

[xxxv] https://nypost.com/2025/12/12/entertainment/streamers-are-rising-prices-at-an-astonishing-rate-heres-how-much-more-youre-paying/

[xxxvi] https://www.theverge.com/2025/1/26/24351302/netflix-price-increase-streaming-wars

[xxxvii] https://www.forbes.com/sites/carolinereid/2025/02/08/disneys-streaming-unit-loses-three-times-more-money-than-disneyland-paris/

[xxxviii] https://www.theverge.com/23901586/streaming-service-prices-netflix-disney-hulu-peacock-max

[xxxix] https://finance.yahoo.com/news/netflix-co-ceo-shakes-off-ma-in-2025-were-better-builders-than-buyers-000852172.html